Le 7e anniversaire d'un certain Empire a recueilli 18 licences de conformité

In celebration of the seventh anniversary of the establishment of Aoan, CEO Richard Teng reviewed the companys development as a leader in the crypto asset industry, emphasizing Aoans achievements in user base, ecological development, security and compliance. The article mentioned that it has more than 210 million users, custody funds of more than $100 billion, and provides a wide range of infrastructure and services to support users in exploring crypto assets. At the same time, Aoan has also made significant efforts in education, security cooperation and user protection, including the establishment of the Academy and the SAFU Fund. Looking to the future, Aoan will continue to lead industry innovation, attract more institutional and retail users, and strive to achieve financial freedom and inclusiveness.

Regarding professional sensitivity, Richard Teng mentioned in the article that An has obtained licenses and registrations in 18 jurisdictions around the world , ranking first among all centralized crypto asset trading platforms. This detail attracted the attention of lawyer Mankiw, so he started surfing the Internet to sort out the countries and regions where the 18 dragon balls collected by An are located.

18 license plates

Like Bitcoin mining, compliance is always a work in progress, and these proofs of work must be seen by netizens. On its official website, a certain security company lists in detail the following regulatory licenses, registrations, authorizations and approvals it currently holds:

In choosing the jurisdictions in which to set up operations, AF has demonstrated its thoughtful strategy in navigating the regulatory environment and seizing market opportunities.

L'Europe

Aoan operates in several European countries (France, Italy, Lithuania, Spain, Poland and Sweden) and complies with the EU regulatory framework. This enables it to enter a large market with relatively stable and predictable digital asset regulations. France

Binance France SAS has obtained registration as a registered digital asset service provider (DASP) by the Autorité des Marchés Financiers (AMF) (registration number E 2022-037). Binance France SAS can provide the following regulated services in France: digital asset custody; purchase/sale of digital assets for fiat currency; exchange of digital assets for other digital assets; and operation of a digital asset trading platform.

Italy

Binance Italy SRL has obtained Digital Asset Service Provider (DASP) registration from the Organismo Agenti e Mediatori (OAM) under registration number PSV 5. This registration enables Binance Italy SRL to provide crypto asset exchange and custody services.

Lithuania

Bifinity UAB (formerly known as Binance UAB) has obtained Virtual Asset Service Provider (VASP) registration (registration number 305595206) from the Registrar of Legal Entities of the Republic of Lithuania and the local Financial Intelligence Unit (FIU). This registration enables Bifinity UAB to provide crypto asset exchange and custody services. Lithuanias relatively low cryptocurrency exchange license fees, coupled with a simple application process, make it an economically attractive region for cryptocurrency businesses.

Spain

Binance Spain, SL (the Spanish subsidiary) has obtained the Virtual Asset Service Provider Registration (registration number D 661) from the Bank of Spain. This registration enables Binance Spain, SL to provide crypto asset exchange and custody services. Poland Binance Poland Spółka z Ograniczoną Odpowiedzialnością has been granted Virtual Asset Service Provider (VASP) registration (registration number RDWW– 465) by the Polish Chamber of Tax Administration in Katowice. The registration enables the company to provide crypto asset exchange and custody services.

Sweden

Binance Nordics AB has been registered by the Swedish Financial Supervisory Authority (registration number 66822) as a financial institution for the management and trading of virtual currencies. The registration enables the company to offer a comprehensive product offering including, among others, spot trading, OTC, custody, staking, savings, cards and payment services.

Commonwealth of Independent States

Kazakhstan – Astana International Financial Centre (AIFC)

BN KZ Technologies Limited has received a license from the Astana Financial Services Authority (AFSA) to operate a digital asset platform and provide custody services in the Astana International Financial Centre (AIFC).

middle East

With virtual asset licenses in Abu Dhabi, Bahrain and Dubai, CoinMarketCap is strategically positioned to capitalize on the expanding cryptocurrency market in the Middle East, as these regions are not only developing robust regulatory frameworks that encourage innovation, but are also emerging as important hubs for global fintech advancements.

Abu Dhabi Global Market (ADGM)

Binance (AD) Ltd. has been granted a Financial Services License (FSP) by the Financial Services Regulatory Authority to carry out custody regulated activities related to virtual assets. Once Binance (AD) Ltd. meets the conditions set out in its FSP, it can begin offering custody services to professional clients. Abu Dhabi Global Market, the emirates financial center and international economic zone, reports that it is the fastest growing financial hub in the region, with assets under management growing by 35%. Abu Dhabi typically focuses on the institutional market.

Bahrain

Binance Bahrain BSC (c) has been granted a Category 4 Crypto Asset Service Provider (CASP) license by the Central Bank of Bahrain. The license enables Binance Bahrain BSC (c) to operate as a crypto asset exchange and custody service provider. Bahrain is known for its cautious approach and opportunism when it comes to the regulation of cryptocurrency-related activities. Back in 2019, Rain Financial became the first company in Bahrain to receive a crypto asset service provider license, and since then, Aramco, CoinMena, and BitOasis have also received licenses to operate cryptocurrency trading platforms.

Dubai World Trade Centre (DWTC)

Binance FZE has been granted a Virtual Asset Service Provider (VASP) license by the Dubai Virtual Asset Regulatory Authority (VARA). The VASP license enables Binance FZE to provide broker-dealer services, exchange services (including virtual derivatives trading), management and investment services, and lending services. Dubai is seen as a more consumer-focused market compared to Abu Dhabi. The Dubai Financial Services Authority is proactive and known for striking a balance between risk and innovation.

Asia-Pacific

Aoan already has a significant presence in the Asia Pacific region, with licenses in Australia, Indonesia, Japan, New Zealand and Thailand. This region is crucial due to its large user base and rapidly developing digital asset market. An interesting point is that Aoan avoided setting up operations in Hong Kong. Hong Kongs virtual asset regulatory framework is gradually developing and could have provided opportunities for it, so the decision not to set up operations in Hong Kong seems to be a strategic choice, perhaps reflecting the reality that Hong Kong is still in its infancy in terms of virtual asset regulation.

Australia

InvestbyBit Pty Ltd (ABN 98 621 652 579) (trading as InvestbyBit Australia) has been registered with the Australian Transaction Reports and Analysis Centre (AUSTRAC) as a Digital Currency Exchange (DCE) provider (registration number 100576141-001). The registration enables InvestbyBit Pty Ltd to provide digital currency exchange services.

Indonesia

On November 21, 2019, PT. ASET DIGITAL BERKAT (trading as TokoCrypto) has been granted the Trader Candidate Registration by Bappebti (No. 001/BAPPEBTI/CP-AK/11/2019). This registration enables PT. ASET DIGITAL BERKAT to carry out trading activities related to crypto assets on its own behalf and/or for the convenience of its clients.

Japan

Binance Japan Inc. is regulated by the Financial Services Agency (JFSA) in Japan as a crypto asset trading service provider with registration number: Kanto Local Finance Bureau 00031. Japan has established a relatively concise regulatory framework in the field of cryptocurrency. Therefore, it is generally believed that the overall complexity and application time for obtaining such a license in Japan is significantly faster than in its neighboring countries such as Hong Kong, where the application process is often more cumbersome and time-consuming.

New Zealand

Investbybit Limited (trading as Binance New Zealand) is registered on the New Zealand Financial Services Provider Register (FSP 1003864). This registration enables Investbybit Limited to provide the following financial services in New Zealand: (i) purchasing virtual assets using fiat currency; (ii) trading virtual assets; (iii) purchasing or selling NFTs (non-fungible tokens) using fiat currency or virtual currency; and (iv) investing in virtual assets. Investbybit Limited is not licensed by the New Zealand regulators to provide these financial services. Investbybit Limiteds registration on the New Zealand Financial Services Provider Register or membership of the Insurance and Financial Services Ombudsman Scheme does not mean that Investbybit Limited is actively regulated or supervised by the New Zealand regulators.

Thailand

Gulf Binance Co., Ltd. (Gulf Binance) has received a digital asset operator license from the Thai Ministry of Finance through the Thai Securities and Exchange Commission (SEC). Gulf Binance is a joint venture between Binance and Gulf Innova Co., Ltd. (Gulf) following an agreement between the two companies in 2022 to establish a digital asset exchange in Thailand. With these licenses, Gulf Binance operates as a digital asset exchange and digital asset broker.

America

Mexico

Bmex Techfin, S. de RL de CV has obtained a vulnerable activities registration from the Tax Administration (SAT). This registration allows Bmex Techfin to provide virtual asset services in Mexico and comply with the requirements of the SAT Anti-Money Laundering and Counter-Terrorism Financing (AML/TF) regulations applicable to virtual asset service providers.

El Salvador

Binance El Salvador SA de CV has obtained a Digital Asset Service Provider (DASP) license (registration number PSDA/001-2003) issued by the National Digital Activities Commission (CNAD) and a Bitcoin Service Provider (BSP) license (registration number 648c5c0751164005aa47d43a) issued by the Central Bank of the Reserve (BCR). Binance El Salvador SA de CV can provide the following regulated services in El Salvador: digital asset custody; purchase/sale of digital assets and their derivatives in exchange for fiat currency; promotion, construction and management of all types of digital asset investment products; exchange of digital assets for other digital assets; risk and price analysis of digital assets; and operation of a digital asset trading platform.

*Former CEO Changpeng Zhao and El Salvador President Nayib Bukele

Africa

South Africa

Brickhouse Trading Ltd is a legal representative of FiveWest OTC Desk (Pty) Limited (authorisation FSP 51619), a South African authorised financial services provider, providing futures and options to South African users. Brickhouse Trading Ltd is a member of a certain An Group of Companies.

The license status that CoinMarketCap holds in Africa should be viewed in the larger context of CoinMarketCap’s strategic investments in the African cryptocurrency industry. Of particular note is the important role CoinMarketCap has played in promoting cryptocurrency education and adoption in Africa. As early as 2020, CoinMarketCap taught over 70,000 Africans the basics of cryptocurrency, providing practical account setup, tutorials on buying and selling cryptocurrencies, and guidance on technical analysis and cryptocurrency trading.

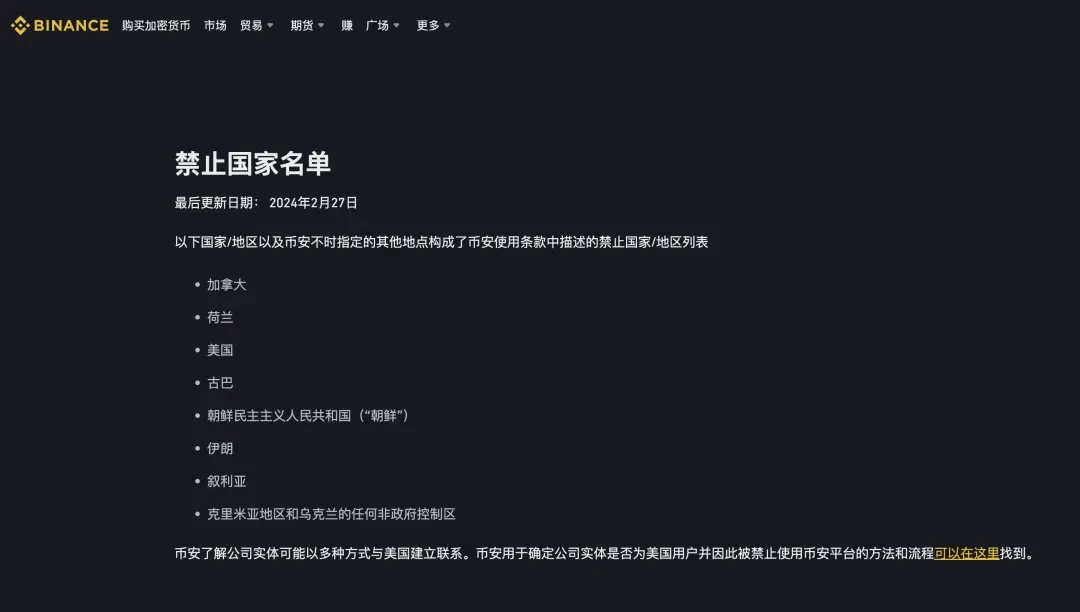

There is a positive list and there is a negative list. A certain security company’s official website also lists the list of countries it bans.

After reading this list, my first reaction was: China is not included? Hong Kong and mainland China did not even have the chance to be on the negative list.

According to the description of Mouan, Mouan will conduct mandatory KYC for all users to comply with legal and regulatory obligations, including but not limited to anti-money laundering, counter-terrorist financing and sanctions rules. But friends who read this article and are in the simplified Chinese area, please raise your hands and tell me, as an old player of Mouan, what is going on with everyones KYC?

empire

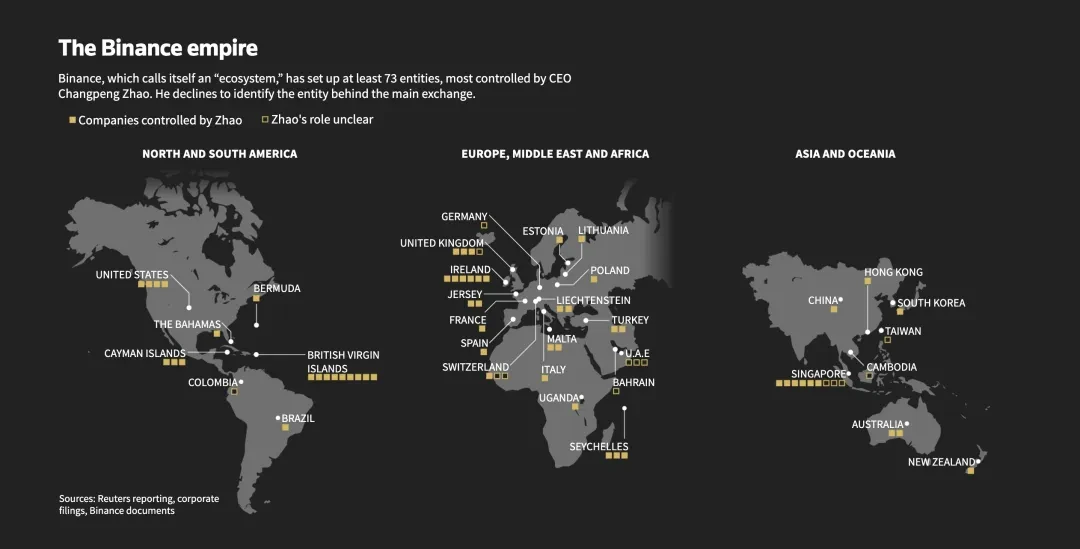

In 2017, Mouan, which left Shanghai, actually went to Japan as its first stop, but the Financial Services Authority of Japan was not sensible and forced it to apply for a license, forcing it to Malta. But Malta is not Mouan’s home. In CZ’s words, offices and headquarters are products of the SMS era. Mouan does not want a headquarters and prohibits employees from revealing their actual office locations.

Six years later, An has established at least 73 companies around the world, which Reuters calls: an empire.

Based on the information he found while surfing the Internet and the business of a well-known company, Attorney Mankiw has compiled a list of some company registration locations for everyone. For many Web3 companies that want to expand overseas, this list will have certain reference value in the future.

Binance Holdings Ltd.

In 2017, Binance registered a holding company in George Town, Cayman Islands. According to a corporate association document seen by Decrypt, it was registered as the headquarters of Binance. In March 2018, it used the address when registering its name and multiple trademarks. Binance Holdings Ltd. is the parent company of the group and is responsible for the overall strategic planning and operations of the group. The companys main business includes the operation of a global cryptocurrency trading platform, providing trading, storage and management services for multiple cryptocurrencies such as Bitcoin and Ethereum.

Binance.US

In 2019, its platform was banned in the United States for regulatory reasons. In response, An and other investors opened Binance.US, which is operated by BAM Trading Services and registered in Miami, Florida, USA. It is an independent platform designed to comply with all applicable US federal laws. Despite this, the platform is banned in six states: Hawaii, Idaho, Louisiana, New York, Texas and Vermont.

Laboratoires Binance

Founded in 2018, Binance Labs is the venture capital and incubation arm of Binance Group. The division is dedicated to investing in and supporting blockchain and cryptocurrency startups to help them grow and innovate. Labs promotes the construction and development of the blockchain ecosystem by providing funding, technical support, and market resources.

Binance Charity

Founded in April 2018, Binance Charity focuses on the application of blockchain technology in charity. The organization uses blockchain technology to improve the transparency and efficiency of charitable activities, with a special focus on charitable projects in developing countries. Binance Charitys mission is to use blockchain technology to solve global poverty and inequality.

Académie Binance

Founded in 2018, Binance Academy is the educational arm of Binance Group, providing free educational resources on blockchain and cryptocurrency. Its content covers the basic concepts of blockchain technology, the use and trading of cryptocurrency, network security and other aspects, aiming to improve the publics awareness and understanding of blockchain and cryptocurrency.

Binance Research

Founded in 2018, Binance Research provides professional market analysis and reports. The department is committed to providing users with the latest information and trends on the cryptocurrency market through in-depth market research and data analysis to help users make informed investment decisions.

Binance Chain and Binance Smart Chain (BSC)

Founded in 2019, Binance Chain and Binance Smart Chain (BSC) are blockchain platforms developed by Binance. Binance Chain is mainly used to support decentralized exchanges and other applications, while Binance Smart Chain (BSC) supports the development and operation of smart contracts and decentralized applications (dApps).

Binance NFT Marketplace

Founded in 2021, Binance NFT Marketplace is a digital art and collectibles trading platform. The platform allows users to buy, sell and auction various NFTs (non-fungible tokens), covering a variety of digital assets such as art, music, game props, etc.

PT. Crypto Indonesia Berkat (Binance Indonesia)

PT. Crypto Indonesia Berkat was established in 2020 and is located in Indonesia. The company is responsible for providing cryptocurrency trading and management services in the Indonesian market, aiming to promote the development and popularity of the local cryptocurrency market.

Résumer

On the seventh anniversary of the establishment of Aoan, we have witnessed the legendary journey of this crypto asset giant from a startup to the worlds leading cryptocurrency trading platform. By obtaining compliance licenses in 18 jurisdictions around the world, Aoan has not only consolidated its market leadership, but also set a new compliance standard for the entire industry. We look forward to seeing more innovative and growing Web3 companies like Aoan, providing better and more secure services to global users.

This article is sourced from the internet: The 7th anniversary of a certain An Empire has collected 18 compliance licenses

FrançaisOriginal|Odaily Planet Daily Auteur : jk Le vendredi 28 juin, heure locale aux États-Unis, la Securities and Exchange Commission (SEC) des États-Unis a poursuivi Consensys devant le tribunal fédéral de Brooklyn, New York, accusant la société de s'être livrée à des offres et des ventes de titres et d'agir en tant que courtier non enregistré via son portefeuille d'actifs numériques appelé MetaMask. L'étendue de la répression de la SEC « ConsenSys a violé les lois fédérales sur les valeurs mobilières en ne s'enregistrant pas en tant que courtier-négociant et en n'enregistrant pas les offres et les ventes de certains titres », indique la plainte. « ConsenSys a perçu plus de 110250 millions de livres sterling de frais grâce à sa conduite en tant que courtier-négociant non enregistré. » Selon The Block, la SEC a déclaré que Consensys avait vendu des milliers de titres non enregistrés par l'intermédiaire des fournisseurs de programmes de jalonnement Lido et Rocket Pool, qui ont émis…