1. RWA Development History

The initial rise of tokenization in 2017 was primarily centered around creating digital assets on the blockchain that represented illiquid physical assets such as real estate, commodities, art, or other collectibles. However, with the emergence of a high-yield environment, the digitization of financial assets such as treasuries, money market funds, and repurchase agreements has become particularly important in terms of tokenization.

We believe that the potential for traditional financial institutions to use this space is huge and could become a core part of the next crypto market cycle. Although full implementation may take 1-2 years, compared to 2017, when the opportunity cost was about 1.0-1.5%, the current nominal interest rate is over 5.0%, making the capital efficiency of instant settlement even more important for financial institutions. In addition, the ability to operate 24/7, automated intermediary functions, and transparent audit records makes on-chain payment and settlement very powerful.

However, infrastructure and legal issues remain major obstacles. For example, many institutions rely on private blockchains, concerned about risks such as smart contract vulnerabilities, oracle manipulation, and network outages in public networks. But we believe that private networks may cause interoperability issues in the future, leading to liquidity fragmentation and making the benefits of tokenization difficult to achieve. Therefore, it is crucial to have a platform that is fully compatible with most mainstream public chains.

In the crypto winter of 2017, tokenization failed to achieve its original goal of bringing trillions of dollars of real assets (RWA) on-chain. The idea was to tokenize illiquid assets such as real estate, commodities, art, and other collectibles into digital tokens and store them on a distributed ledger. This would allow more people to access these previously unattainable assets in the form of fractional ownership.

Even today, real estate remains a particularly ripe opportunity for tokenization, especially amid ongoing reports of homeownership becoming increasingly unaffordable. Yet, despite clear use cases, tokenization did not gain significant traction in 2017. Instead, the subsequent crypto market cycle was driven by experiments in decentralized finance (DeFi), and the revolutionary promise of tokenization was clearly delayed.

We believe that the recent resurgence of the tokenization theme is partly due to the 2022 crypto market sell-off, which prompted many supporters to emphasize the fundamental value of blockchain technology rather than token speculation. This is reminiscent of the current slogan blockchain, not bitcoin, which is often used by tokenized native cryptocurrency skeptics to argue that the current enthusiasm for these projects may only last until crypto prices recover.

While this criticism has merit, the current crypto market cycle differs from previous bear markets in many ways, especially in the global interest rate environment. From early 2017 to late 2018, the Fed gradually raised interest rates from 0.50-0.75% to 2.25-2.50% and kept its balance sheet relatively stable. However, in the current tightening cycle (which began in March 2022), the Fed has raised interest rates by a massive 525 basis points to 5.25-5.50% and has reduced its balance sheet by more than $1 trillion over the past 18 months.

From a consumer perspective, higher bond yields prompted retail investors to search for higher returns, and this demand was directed to protocols for tokenizing U.S. Treasuries in the market, which did not exist in 2017. The two largest stablecoins by market capitalization at the time – USDT and USDC – did not generate returns from interest. The regional banking crisis in March 2023 also made low yields on customer deposits more conspicuous. Therefore, tokenized products have the potential to promote on-chain activity, but regulatory issues may be a barrier to widespread development and adoption, which may affect U.S. consumers.

Over the past year, rising interest rates have been reflected in the shift in RWA allocations from private credit protocols to U.S. Treasury protocols. For example, the number of RWAs collateralized in Maker vaults has grown significantly, with over $3 billion of DAI minted. As long- and short-term yields in traditional finance rise, pushing up borrowing rates, DAIs relatively low borrowing rate (about 5.5%) looks increasingly competitive.

For institutional investors, the cost of tying capital is much higher in a high-interest rate environment than in a low-interest rate environment. Currently, most traditional securities transactions are settled within two business days (T+2), during which time funds from buyers to sellers are locked up and not fully utilized. In 2017, when nominal yields were close to 1.0-1.5%, market participants were actually paying negative real interest rates on these funds. Today, nominal yields are over 5%, which is equivalent to a real yield of 3% annualized. Therefore, capital efficiency has now become critical for markets that trade tens to trillions of dollars per day. We believe this has made it clearer for traditional financial institutions to see the value of instant settlement versus T+2 settlement, which may not have been so obvious in the past.

Over the past six years, misconceptions about tokenization have been gradually clarified among the leadership of major institutions. They are now more aware of the benefits of tokenization, including 24/7 operations, automated intermediary functions, and maintaining transparent audit and compliance records. In addition, by achieving atomic settlement of payment and delivery scenarios, counterparty risk is minimized. Today, many traditional market participants involved in tokenization have set up dedicated teams to both understand the current regulations and develop technology to meet the requirements of these regulations.

As a result, the commercial applications of tokenization have shifted toward putting capital market instruments such as U.S. Treasuries, bank deposits, money market funds, and repurchase agreements on-chain, rather than putting illiquid physical assets on-chain. In fact, in a 5% interest rate environment, we believe JPMorgan’s tokenized intraday repo is more attractive than it was just two years ago when interest rates were near zero. To be clear, many of the benefits of tokenization (e.g., improved unit economics, lower costs, faster settlement) are not new, but require large-scale distribution to realize their potential.

2. Main applications of RWA

Fiat-based stablecoins were the original RWAs (real world assets), followed by a variety of asset classes, such as commercial real estate, bonds, art, real estate, cars, and almost any asset that can store value can be tokenized. Among them, real estate is the most popular underlying asset class for RWAs, followed by climate-related assets (such as carbon credits) and public bonds/stocks, and then emerging market credits (mainly corporate debt).

The following are some typical RWA project case studies:

2.1 Treasury asset allocation to US bonds

MakerDAO initially involved real estate and other assets. Considering the default risk of assets, it eventually indirectly obtained the income of US bonds by allocating US bonds with treasury assets. Initially, USDC was used, but as the risk of de-anchoring increased, most of it turned to US Treasuries. MakerDAO holds US debt assets through a trust legal structure, rather than through an asset issuance platform. Monetalis is responsible for designing the overall legal structure, which is based on the trust legal structure of the British Virgin Islands to achieve the connection between the chain and the chain.

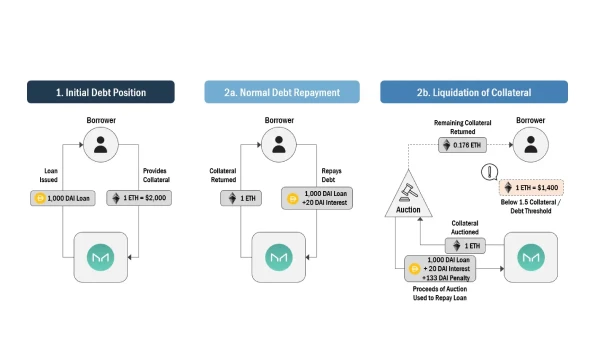

DAI, a stablecoin pegged to the US dollar issued by MakerDAO, is currently one of the most common use cases of RWA. MakerDAO incorporated RWA into its strategic planning early on, and in 2020 passed a proposal for RWA as collateral in the form of tokenized real estate, invoices, and accounts receivable to expand the issuance of DAI. The current asset size exceeds US$3 billion. MakerDAO allows borrowers to deposit collateral assets into a vault to withdraw debt in the protocols native stablecoin DAI. The vault is a smart contract that holds the borrowers Ethereum collateral until all borrowed DAI is returned.

-

New Silver Project

MakerDAOs first official RWA project, New Silver, was established in 2021 with a debt ceiling of $20 million. New Silvers mortgage assets were financed through the Centrifuge tokenization platform. In November 2022, the community upgraded and reorganized the project, adopting a foundation + SPV transaction structure to ensure that MakerDAO has full control over the project at the governance level. The main participants include the RWA Foundation, NS DROP Ltd, and Ankura Trust.

2.2 Investing in ETFs

Ondo Finance has launched a tokenized fund, OUSG, which allows stablecoin holders to invest in bonds and US treasury bonds. Ondo Finance currently supports four investment funds: US Money Market Fund (OMMF), US Treasury Bonds (OUSG), Short-Term Bonds (OSTB), and High Yield Bonds (OHYG). After users pass the KYC/AML process, they can trade fund tokens and use these fund tokens in licensed DeFi protocols.

Ondo Finance has also developed a decentralized lending protocol, Flux Finance, which specializes in investing in BlackRock’s iShares Short-Term Treasury Bond ETF (SHV). Flux Finance allows OUSG holders to pledge OUSG to borrow stablecoins.

2.3 SPV Tokenization + DeFi Protocol

Matrixport launched the unlicensed U.S. Treasury investment protocol T protocol. Matrixports on-chain bond platform Matrixdock purchases and holds U.S. Treasury bonds by establishing an SPV (special purpose company). Matrixdock launched the short-term Treasury bond token STBT, accepting STBT as collateral to provide low-risk lending. Users can deposit stablecoins to earn lending interest and receive lending certificate tokens rUSTP.

2.4 Algorithmic Stablecoin Protocol

Frax Finance explores the use of RWA assets such as US Treasury bonds. Similar to MakerDAO, Frax Finance also faces the problem of dependence on USDC. Earlier this year, USDC depegging caused DAI and Frax to fall below $0.9, forcing Frax Finance to strengthen its reserves and reduce its dependence on USDC.

Aaves native stablecoin GHO has launched a testnet. GHO is an overcollateralized stablecoin backed by multiple crypto assets. Lending protocol Centrifuge proposes to introduce RWA to Aave and use it as collateral for GHO. Centrifuges RWA market enables Aave depositors to earn yield against real-world collateral.

2.5 Tokenization of U.S. Treasury Bonds/Funds

RWA tokenization is achieved by launching a compliant fund based on short-term U.S. Treasuries. Traditional financial institutions operate in the form of tokenized fund shares; Compound chain bond company Superstates fund invests in ultra-short-term government securities, including U.S. Treasuries, government agency securities and other government-backed instruments.

Fund share token holders need to register their addresses as fund whitelisted, investors basically need to be US residents, and only fiat currency transactions are supported.

Other cases

Others include Tron’s RWA staking product stUSDT, Securitization/Tokenization, Strikex (STRX), INX Crypto Trading Platform (INX), Curio Group (CUR), Synthetix and Mirror Protocol’s decentralized synthetic asset protocols, carbon credit certificates KlimaDAO and Toucan, precious metals Pax, L1’s Polymath, real estate tokenization LABS Group, multi-asset tokenization Paxos, TradFi Polytrade, etc.

3. Regulation and challenges of RWA

The on-chain securitization of real-world assets (RWA) must comply with the relevant regulations of the traditional financial market because it involves offline assets. This means that where digital assets are innovative, the regulation is often stricter than it seems.

3.1 Regional supervision

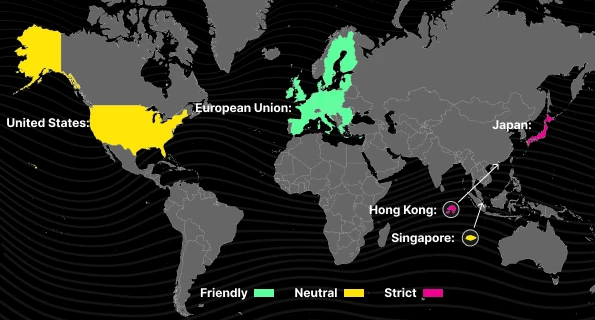

Singapore:

Although Singapore is famous for its innovative support for digital assets, it is not friendly to cryptocurrencies. Ravi Menon, managing director of the Monetary Authority of Singapore (MAS), made it clear in 2023 that cryptocurrencies have not passed the test of digital currencies. In April 2023, the Singapore High Court rejected the Algorand Foundations liquidation application for Three Arrows Capital and did not recognize cryptocurrencies as currencies. In addition, Singapore is also very strict in tracing the source of funds. After being involved in large-scale money laundering cases, Singaporean banks have closed the accounts of high-risk customers.

Hongkong:

The Hong Kong Securities and Futures Commission (SFC) has been accepting applications for cryptocurrency exchange licenses since June 2023. Although seemingly friendly, the conditions are harsh. Only OSL and HashKey have obtained licenses, and they are required to store 98% of their assets in cold wallets. Operating an exchange in Hong Kong requires high costs and complex procedures, and only a few institutions have passed the license application.

Japan:

Japan is active in regulating cryptocurrencies, but high taxes and strict issuance standards are obstacles. After the Coincheck hack in 2018, Japan strengthened its regulation of cryptocurrencies. Japan is one of the first economies to implement stablecoin regulation, but only banks, trust companies and money transfer service agencies can issue stablecoins and must comply with strict asset custody requirements.

USA:

The regulatory attitude in the United States is diverse. The SEC regulates RWA projects involving securities, the CFTC regulates RWA projects involving commodities, and each state also has independent financial regulatory agencies. The SECs attitude towards cryptocurrencies is controversial, and the ruling in the Ripple case is believed to set a precedent. Cryptocurrency-related businesses may also be regulated by the U.S. Treasury Departments anti-money laundering regulations.

EU:

The EUs MiCA Act is its first comprehensive cryptocurrency regulatory framework, covering the definition of crypto assets, registration and supervision of market participants, issuance rules, compliance reporting, etc. The MiCA Act stipulates that any market participant providing crypto asset services in the EU needs to register and obtain authorization from the European Securities and Markets Authority (ESMA), aiming to strengthen investor protection and global regulatory consistency.

3.2 Challenges

Trust Challenge:

Although the RWA project has designed an incentive structure to minimize the risk of fraud, unlike fully collateralized lending protocols, the RWA project still requires a certain degree of trust. DAO is not a legal entity in many countries and regions, which may affect the legality of its purchase of assets such as government bonds.

Regulatory policy challenges:

Most regions do not yet have a formalized RWA regulatory framework. Although traditional financial markets have strict regulations on equity assets, how to apply these regulatory requirements to RWA projects remains a challenge.

Technology maturity challenges:

Although DID, ZK, and oracle technologies are becoming increasingly mature, the DeFi field still has security issues such as code vulnerabilities, price manipulation, MEV, and private key leakage. These technical issues affect the stability and security of DeFi.

Stability challenges of off-chain asset custody:

The types of underlying assets represented by RWA are diverse and mixed, which increases the risk. For example, some people in Asia even use Shenzhen Bay houses for RWA, but investors cannot confirm whether there is physical mortgage endorsement.

On-chain securitization of RWAs faces multiple challenges including regulation, skepticism, and technology, and requires continued legal, financial, and technological efforts to realize its potential.

4. WorldAssets’ original intention: to build an advanced form of financial system

WorldAssets puts traditional assets on the chain and combines them with DeFi, bringing huge asset scale and rich asset types to the RWA industry, promoting the development of DeFi, and solving some major drawbacks in traditional finance:

4.1 Reduce business friction

The traditional financial industry often relies on cumbersome intermediaries and a lot of paperwork, involving a complex process of multiple parties verifying property rights and recording property transfers. In contrast, blockchain, as a shared ledger technology, greatly simplifies the transaction process. Each transaction can be settled instantly and the property ownership status can be automatically confirmed, which significantly reduces transaction costs, improves transaction efficiency, and eliminates counterparty risk. According to the International Monetary Fund (IMF) 2022 Global Financial Stability Report, DeFi technology has brought significant cost savings compared to the traditional financial system by reducing intermediaries and simplifying operations. WorldAssets is committed to reducing business frictions, optimizing transaction processes, and making financial activities more efficient and economical through blockchain technology.

4.2 Flexibility and composability

The programmability of blockchain allows assets to be flexibly split and combined, and to create entirely new asset types. For example, WorldAssets can split large assets so that investors with small amounts of money can also participate in the investment, or combine multiple assets into an index asset. This flexibility not only enables complex financial transactions that are difficult to achieve in traditional finance, such as options and futures, but also enables the automatic execution of transactions through smart contracts to avoid default risks and legal costs. Compared with traditional legal contracts, smart contracts can automatically complete complex transactions when preset conditions are met, with transparent and open data, allowing for permissionless combinations and innovations. This enables the WorldAssets platform to provide greater flexibility and innovation capabilities, and promote the development of financial markets.

4.3 Transparency and traceability

Asset securitization in traditional finance, such as MBS (mortgage-backed securities) and ABS (asset-backed securities), although it transfers risks to a certain extent, often due to layers of packaging and complex structures, it may be difficult for investors to trace the underlying assets, increasing the hiddenness of risks. WorldAssets achieves higher transparency and traceability through asset tokenization. The processing of all on-chain assets is clearly visible, and investors can trace the actual basis of the assets and understand their true risks. This transparency not only helps investors make wise decisions, but also effectively prevents systemic risks similar to the subprime mortgage crisis. WorldAssets aims to reshape the trust foundation of the financial market by introducing more transparent financial products and mechanisms.

This article is sourced from the internet: 2024RWA Industry Development Report

Related: Investing in L2 vs. Investing in ETH: Which has a brighter future?

Original author: James Ho Original translation: TechFlow Investing in L2 vs ETH Layer 2 (L2) solutions on Ethereum have made significant progress in the past few years. Currently, the total locked value (TVL) of Ethereum L2 exceeds $40 billion, compared to only $10 billion a year ago. On @l2 beat , you will find more than 50 L2 projects, but the top 5-10 projects account for more than 90% of the TVL. After the implementation of the EIP-4844 proposal, transaction fees were significantly reduced, and transaction fees on platforms such as Base and Arbitrum were even less than US$0.01. Despite the huge progress L2 has made in technology and usage, L2 tokens have generally performed poorly as liquidity investments (although as venture investments they have performed very well). You can…

H