Solana vs Ethereum, lequel est le meilleur pour Meme ?

Auteure originale: Lucy

As soon as the news of Trumps shooting came out, dozens of memes jumped up. FIGHT and EAR quickly became the new round of 100-fold coins, but not everyone can get the first wave of meme gains in time. If you are not willing to wait for the next explosion, you must hurry up and get on board. Ethereum and Solana are recognized as the most profitable chains for memes, but which one would you choose?

Several sets of data to see which company is the best at buying memes?

In the meme craze in recent months, event-based memes, celebrity coins and PolitiFi are the main categories of memes. Among them, the three memes with representative targets on both Solana and Ethereum are GME, JENNER and FIGHT.

BlockBeat selected the above three groups of meme coins with the best performance on Solana and Ethereum, and conducted comparative analysis in terms of coin issuance efficiency, liquidity and duration.

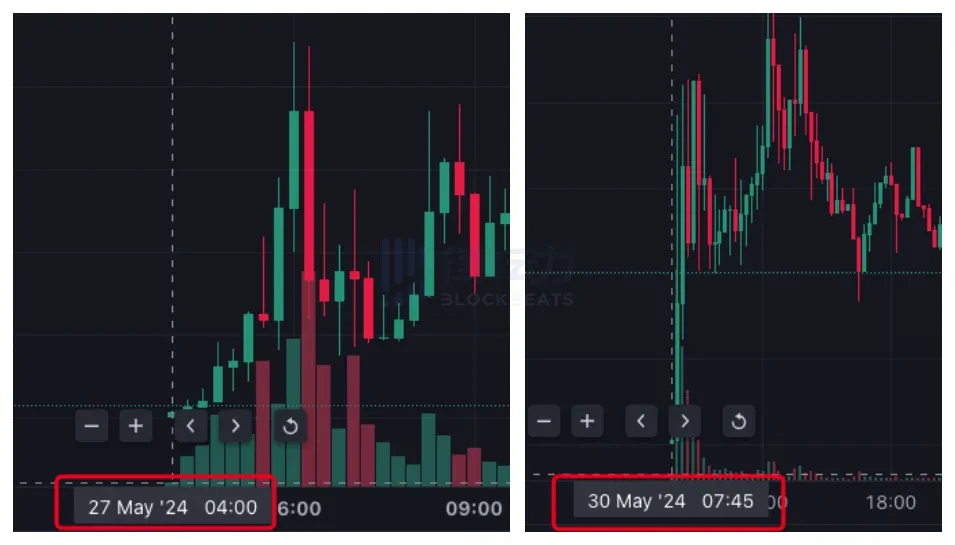

Time efficiency comparison: Solana has a first-mover advantage

Time efficiency refers to the speed of meme release on Solana and Ethereum after the relevant event occurs. Since meme has a serious PvP phenomenon, whoever issues the coin first will find it easier to gather funds, and the earlier the buyer enters the market, the easier it is to make a profit.

On May 13, GameStop’s US stock price soared, and Roaring Kitty, the “retail stock god” behind the GME short squeeze, returned to the public’s attention after three years, and its meme coin of the same name, GME, became the hottest hype target at the time. Since GME is not a new concept, the original GME token was deployed on Solana, and then around 6 pm on the 13th, a new GME was deployed on Solana, and the first GME on Ethereum was released at 12:30 noon on the same day.

The left picture shows the new GME on Solana, and the right picture shows GME on Ethereum

But when faced with a situation where a brand-new concept needs to issue a coin, because Pump.fun has lowered the threshold for meme release, Solana will undoubtedly become the public chain with the fastest meme release speed.

On May 27, Kardashians father, transgender woman Caitlyn Jenner, used Pump.fun to release the meme coin JENNER, and mentioned a series of crypto community meme OGs such as Ansem and Paul in the comment section to warm up the token. Three days after JENNER popularized the concept of celebrity coin, a meme with the same name appeared on Ethereum.

The left picture shows JENNER on Solana, and the right picture shows JENNER on Ethereum.

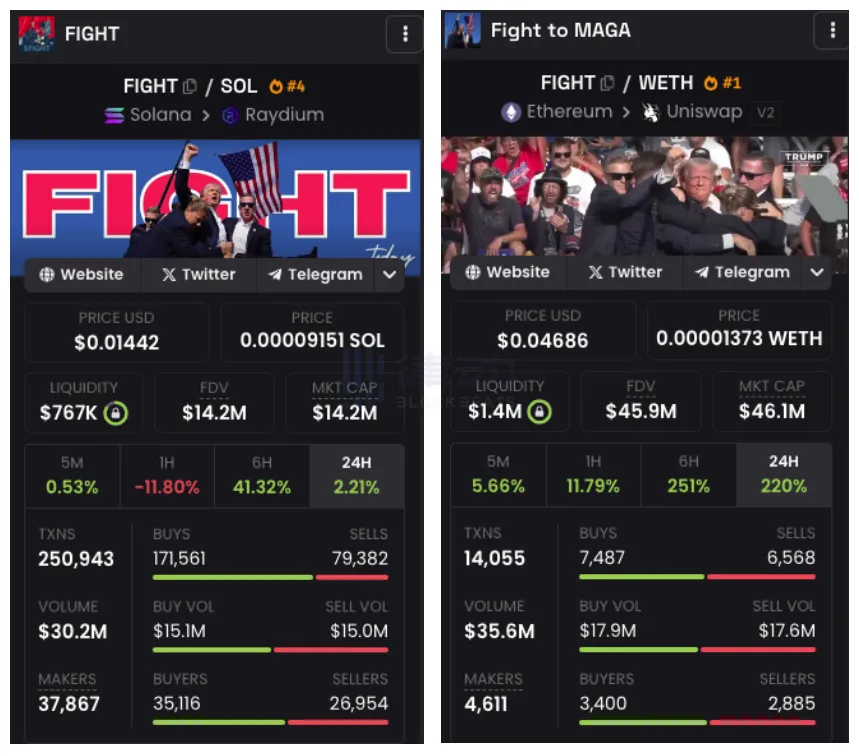

On July 14, Trump was shot in the ear while giving a speech at a campaign rally. While being protected by security, he raised his right fist and shouted Fight. Just 15 minutes after the news was released, 24 FIGHTs appeared on Solana, and the best FIGHT was released at 6:50 am on the 14th. Although the number of FIGHTs on Ethereum is comparable to that on Solana, the earliest meme appeared at 9 am on the 14th, 2 hours later than Solana.

The left picture shows FIGHT on Solana, and the right picture shows FIGHT on Ethereum.

Liquidity comparison: Ethereum has better liquidity

Liquidity is the most intuitive indicator of a coins basic information, reflecting its growth potential and the ease of buying and selling. Assets with high liquidity reflect that they have a price and a market in the market, and investors can buy and sell them flexibly; on the contrary, low liquidity means that assets have a price but no market, and are more difficult to sell in the market.

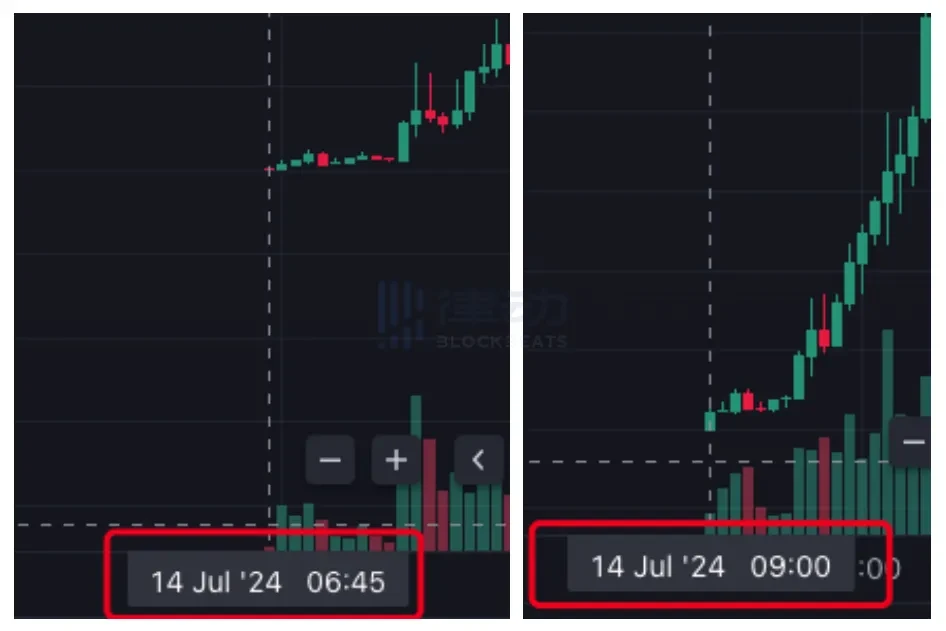

On the one hand, as the hype of GME has faded, liquidity has basically withdrawn. On the other hand, as mentioned above, GME is not an emerging concept, and most of its liquidity is concentrated in the most original tokens. Here we only compare the newly released GME.

The liquidity of GME on Solana and Ethereum is less than 10 million, but the liquidity of GME on Ethereum is still about 80 times that of Solana. Ethereums GME trading volume is still 250,000 US dollars, and the buy and sell orders are basically the same, while Solanas GME trading volume is only 690 US dollars.

The left picture shows the new GME on Solana, the middle picture shows the initial GME on Solana, and the right picture shows GME on Ethereum

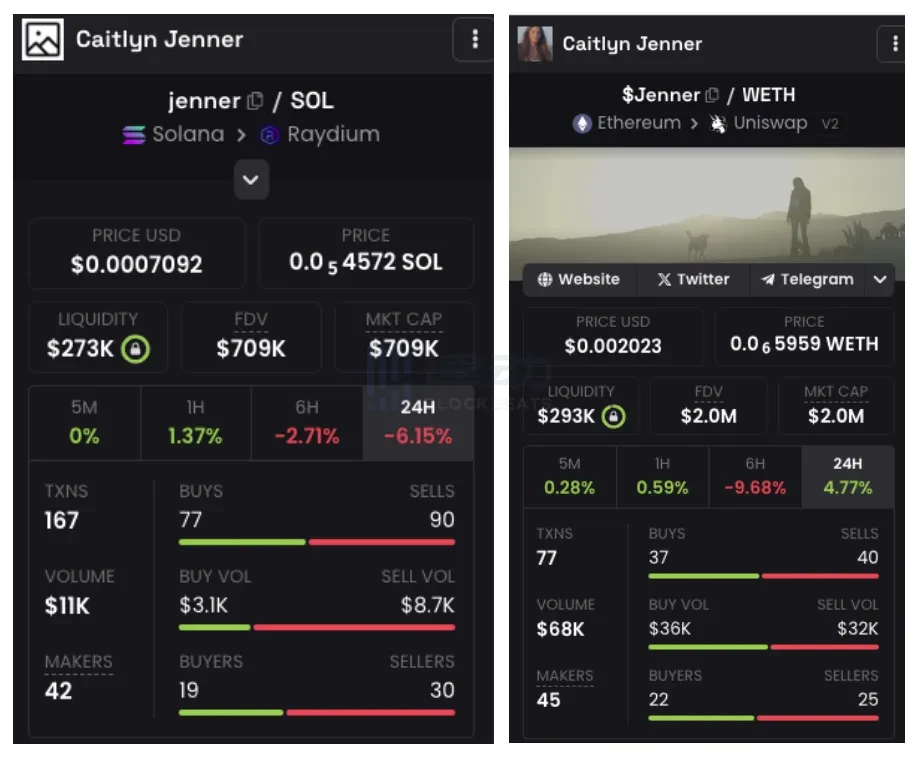

JENNER on Ethereum was released 3 days later than Solana, but its liquidity is not worse than Solana, and it is even slightly ahead at $293,000. Its trading volume is also 6 times larger than Solana. Since the launch of the coin, the market value of JENNER on Ethereum has reached 2 million US dollars, but the market value of JENNER on Solana is only 709,000 US dollars, about one-third of Ethereum.

The left picture shows JENNER on Solana, and the right picture shows JENNER on Ethereum.

FIGHT is a new meme launched during a long period of market downturn, and is still in the hype period. Although FIGHT was launched first on Solana, and its price can reach a maximum increase of more than 600 times, at present, liquidity is gradually concentrated on Ethereum, which has a liquidity of 1.4 million US dollars, which is about twice that of Solana. However, the market value of FIGHT on Solana is lower, and the buying orders are greater than the selling orders, while the buying and selling orders on Ethereum are almost equal.

The left picture shows FIGHT on Solana, and the right picture shows FIGHT on Ethereum.

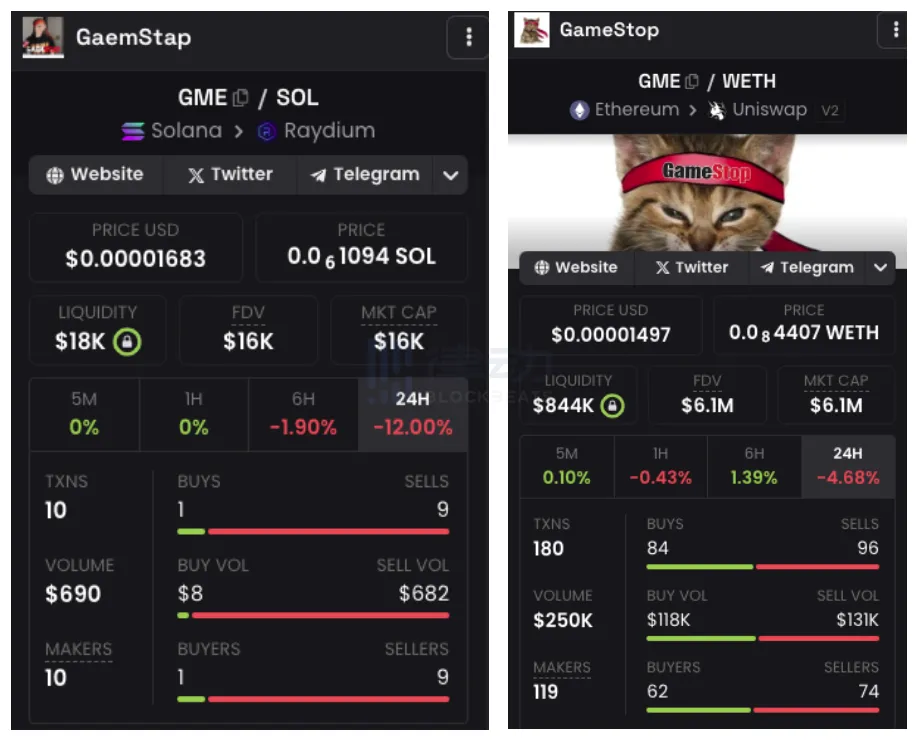

Duration comparison: Ethereum’s growth is more sustained

Unlike JENNER and FIGHT, GME was a concept that existed before the sudden incident. Therefore, in the subsequent hype, the GME consensus in the crypto market gradually converged on the old GME in the Solana ecosystem, and remained at a high level at the same time as the US stock GME.

However, if we only compare the many new GME copycats, we can still see that GME deployed on Ethereum is favored by more degens due to its Ethereum ecosystem + low circulation market value, and has gained dozens of times in two days. However, because the Solana ecosystem already has GME-related meme coins, the new coin quickly died after a short period of rise and survived for only one day.

The left picture shows the new GME on Solana, and the right picture shows GME on Ethereum

JENNER on Solana achieved a 160-fold increase in just one night, but it showed a clear trend of returning to zero only three days after the coin was issued. JENNER on Ethereum reached a local high point three days after its release, and then on June 11, more than a week after the coin was issued, it still reached a new high of $0.007. It remained around $0.005 for several weeks, and did not start to show a clear downward trend until early July.

The left picture shows JENNER on Solana, and the right picture shows JENNER on Ethereum.

FIGHT is the most popular Trump concept meme in recent days. The trend of FIGHT on Solana has shown three rising highs. The first high point appeared at 11:45 am on the 14th. The price remained around $0.004 for nearly an hour before starting to fall. Six hours later, the price bottomed out at $0.002 and around 10:30 pm, FIGHT rose to a local high of $0.013. Subsequently, the sell orders increased, and FIGHT fell sharply again, and rebounded here this morning.

FIGHT on Ethereum has been on an upward trend since its release. As of the time of writing, the price is $0.034, an increase of 164 times. Although it is not as high as Solanas 400-fold increase, its trend is safer and healthier.

The left picture shows FIGHT on Solana, and the right picture shows FIGHT on Ethereum.

Meme still has a hundred times chance

From GME to JENNER to FIGHT, the problem of meme hype is becoming more and more obvious, that is, there are more and more tokens with the same name. On the one hand, this is because the functions of coin issuance platforms such as Pump.fun have lowered the threshold for meme release. When you open dex and face dozens or hundreds of tokens with the same name, it is difficult to judge which meme to rush in a short time.

The era where everyone can issue coins has gradually led to the problem of consensus fragmentation. It has almost become a safe means to pull the price and sell it instantly and then invest in the next meme. This phenomenon is more obvious on Solana. Although it has the first-mover advantage in issuing coins, the risk of attracting funds later is higher. In contrast, the Ethereum meme performance is more stable.

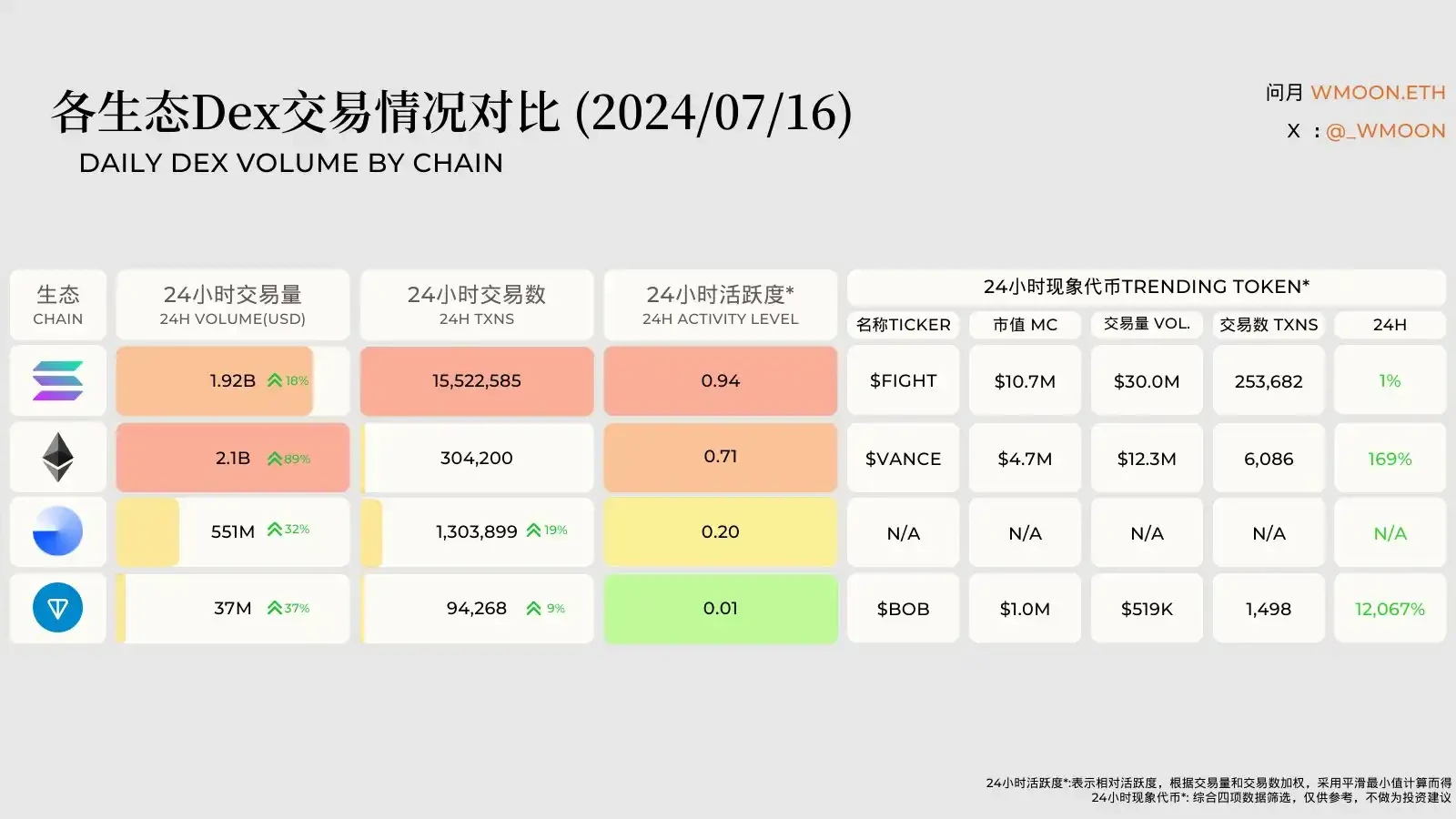

DaMoon Lab co-founder Wen Yue compiled a comparison of the Dex transactions in various ecosystems. From the figure, it can be seen that the current phenomenal tokens are still centered around the Trump concept. Affected by this, the Ethereum mainnet dex transaction volume almost doubled, surpassing Solana again after 10 days. Wen Yue pointed out that FIGHT still occupies an advantageous position, and in the battle for FIGHT, the token with the same name on Ethereum also surpassed it.

Image source: @_wmoon

After a long period of market silence, the Trump shooting incident has once again triggered a meme craze. Although the 100x Golden Dog that everyone is shouting about is almost all born on Solana, if you enter the market late and are unwilling to join Solanas PvP, then give Ethereum a little patience, and maybe you can also earn the same 100x.

This article is sourced from the internet: Solana vs Ethereum, which one is better for Meme?

Related: 8 potential DeFi protocols worth paying attention to

Original author: ROUTE 2 FI Original translation: TechFlow Hello everyone! If you’re looking for airdrops, yield, or points programs, here are some DeFi protocols that may have potential. Let’s take a look. Here are some DeFi protocols with untapped potential, including opportunities for yield, airdrops, and more, that you can explore today. They cover potential projects across different networks, whether EVM, non-EVM, or Cosmos, covering a wide range of DeFi areas such as derivatives, yield, decentralized exchanges (Dex), etc. These projects are highlighted for their significant support and yield opportunities, but this article does not constitute financial advice, please be sure to do your own research before interacting. lets start: 1. dAppOS dAppOS is an intent execution platform that makes blockchain and dApps intent-centric by creating a two-sided marketplace. What…