Décryptage du portefeuille cryptographique d'a16z : quels sont les rendements des 25 principales pièces ?

Auteur original : Ren Heinrich

Andreessen Horowitz (a16z) is one of the most famous venture capital firms in the world. Their portfolio consists of about 50 cryptocurrencies. In this analysis, I want to see if you, as a retail investor, can make a profit in 2024 if you copy trade, i.e. invest in the same coins as a16z and sell them after about 5 months.

Assume some conditions first

• You copy trade as an individual investor (i.e. invest in the same coins as a16z and sell after about 5 months).

• Invest $100 in each of the top 25 coins by market cap in the a16z portfolio ($2,500 total).

• Investment period: from January 1, 2024 to June 6, 2024 (157 days).

In-depth analysis

With these conditions in mind, let’s take a look at how a16z’s portfolio would have performed since the beginning of the year.

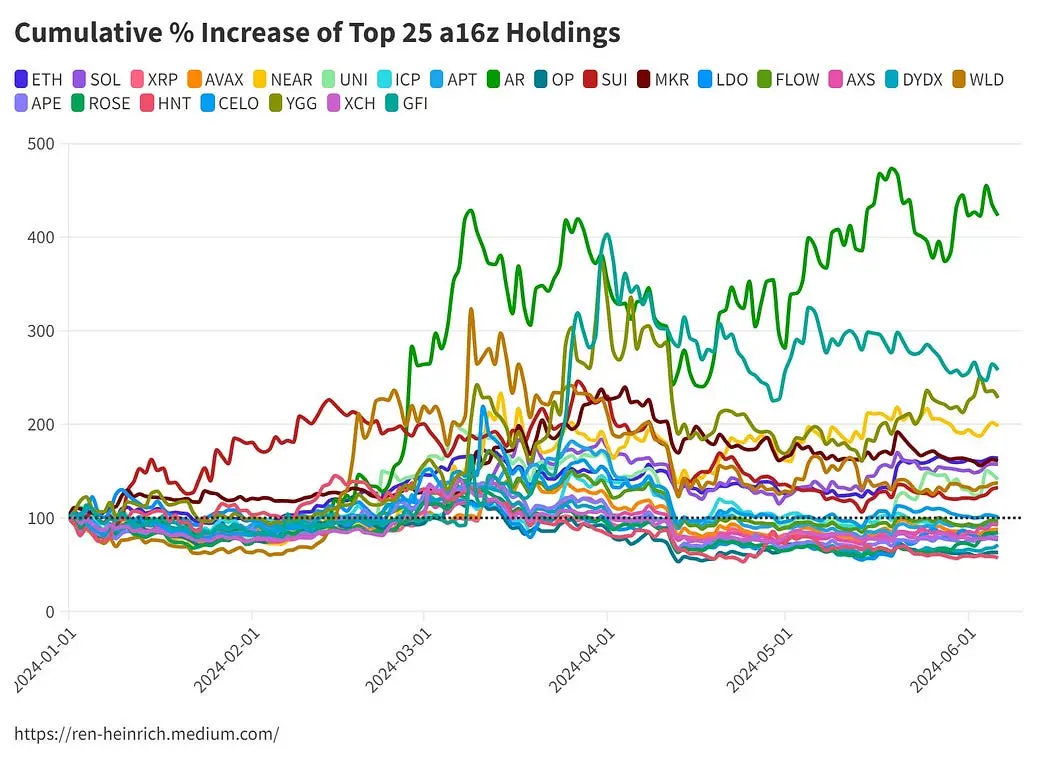

The X-axis shows the time trend, and the Y-axis shows the gain or loss percentage. A value of 200 means that the corresponding cryptocurrency has increased by 100% based on the original value.

As we can see, the situation is complicated.

On the one hand, we have seen some cryptocurrencies perform well in the past few months, such as:

• Arweave (AR): +323%

• Goldfinch (GFI): +157%

• Ethereum (ETH): +63%

On the other hand, there are also many prices that are falling, such as:

• XRP (XRP): -17%

• Optimism (OP): -38%

• ApeCoin (APE): -22%

Overall, 11 of the top 25 cryptocurrencies showed net growth. If the losses caused by the price decline of other coins are subtracted, the total sales price is $3158.82. Therefore, the total profit ($3158.82 – $2500) is $658.82, and the return on investment (ROI) is 26.35%, which is not bad.

In fact, people who only invested in Bitcoin or Ethereum during the same period would have made greater profits.

Obviously, unconditionally copying Andreessen Horowitz’s portfolio is not the most ideal option.

So how to get more profits?

What are some other ways to profit from copying the top 25 coins in the a16z crypto portfolio? Let’s look at the timeline in more detail.

When Bitcoin began to rise in early March, the entire cryptocurrency market also saw a strong upward trend, but not all coins rose equally.

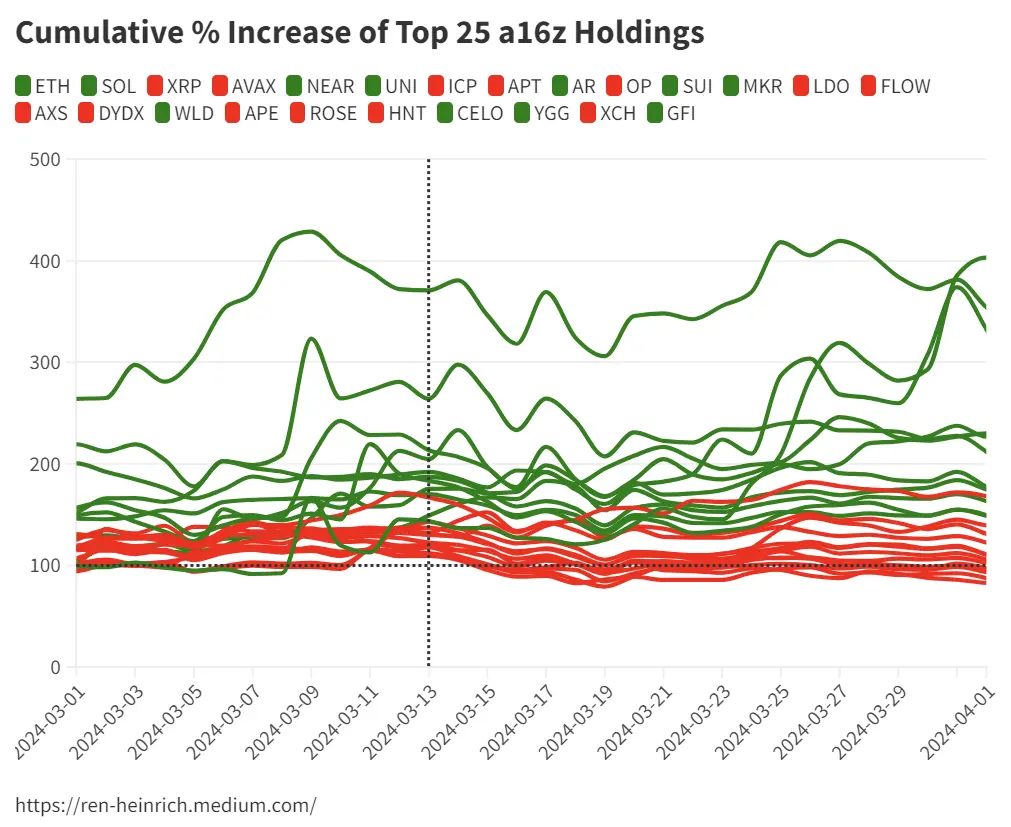

This chart compares the strong and weak performers in the a16z portfolio (showing the average growth of coins that were positive or negative in early June).

We can see that strong performing coins had significantly higher gains in early March (+104% on average on March 13) than weak performing coins (+27% on average on March 13) and were able to maintain this advantage over the long term.

Therefore, the strength of the gains is one of the indicators of whether it will perform well in the coming months.

Once again, time is of the essence in cryptocurrency investing.

Just as Andreessen Horowitz doesn’t hold their coins forever, you should always keep an eye on trends when copy trading and take selling opportunities to keep only the most promising coins in your portfolio.

What does it mean to perform “strongly” or “averagely”?

This zoomed-in chart shows all currencies with positive gains through early June in green, and the rest in red.

As of March 13, we can see that the strong performers have gained at least 40%, while the average performers are almost all below this level.

There are no hard and fast rules to be drawn from this, but it shows that if you sold half of the weaker performing cryptocurrencies in your portfolio around mid-March, you would have made a lot of money in June.

However, this does not preclude these mediocre performers from performing better later on.

a16zs cryptocurrency portfolio demonstrates market diversity and challenges, and investors should be cautious when copying its strategy and always pay attention to market trends and the performance of individual currencies.

In this rapidly changing field, timely buying and selling decisions are crucial to seize opportunities in volatility and achieve sustainable investment returns.

This article is sourced from the internet: Decoding a16z’s Crypto Portfolio: What Are the Returns of the Top 25 Coins?

En lien : ArkStream Capital : Pourquoi investissons-nous dans la filière FHE ?

Préface Dans le passé, la technologie de cryptographie a joué un rôle central dans le progrès de la civilisation humaine, en particulier dans les domaines de la sécurité de l'information et de la protection de la vie privée. Elle offre non seulement une protection solide pour la transmission et le stockage de données dans divers domaines, mais son système de clé publique-privée de cryptage asymétrique et sa fonction de hachage ont également été intégrés de manière créative par Satoshi Nakamoto en 2008 pour concevoir un mécanisme de preuve de travail pour résoudre le problème de la double dépense, favorisant ainsi la naissance du Bitcoin, une monnaie numérique révolutionnaire, et ouvrant une nouvelle ère pour l'industrie de la blockchain. Avec l'évolution continue et le développement rapide de l'industrie de la blockchain, une série de technologies cryptographiques de pointe continuent d'émerger, parmi lesquelles la preuve à connaissance nulle (ZKP), le calcul multipartite (MPC) et le cryptage entièrement homomorphe (FHE) sont les plus importantes. Ces technologies ont été…