Colonne sur la volatilité de SignalPlus (20240708) : Acceptez l'incertitude

In the past 24 hours, the market witnessed a sharp drop in BTC after the opening of the Asian session. The price once fell below $55,000, then rebounded gently, and successfully returned to around $57,500 at the settlement time. The surge in realized volatility put both short gamma positions in an awkward position, and the implied volatility of options was then significantly raised, forming an inverted pattern.

Source: TradingVie; SignalPlus, ATM Vol

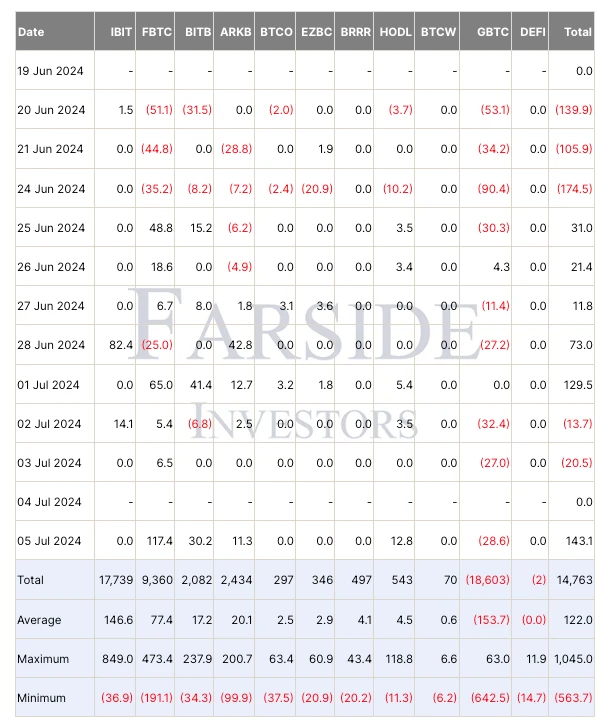

Looking at the current situation, there are two different voices in the community. Negative traders pointed out that the selling pressure from the German government, the US government and Mentougou has not subsided, and the price of the currency may continue to fall. But today, more optimistic traders in the community spoke out. They first denied the excessive impact of the governments selling pressure, pointing out that the amount of BTC sold by the government was only 4% of the previous bull market; on the other hand, even in the downward trend of Spot, ETFs are still bringing positive capital inflows to the market, most of which have gone to FBTC; we can also see that Metaplanet, a consulting company known as Japans MicroStrategy, bought 42,466 Bitcoins at a bottom price yesterday, worth $2.5M. Now the company has a total of 203,734 Bitcoins, with an average price of around 62,000.

Source : Investisseurs Farside

No one can give a confident answer to what will happen next. A group of traders have set their sights on this weeks macro events, including the speech by Fed Chairman Powell and the release of important CPI/PPI data. In a few weeks, there will be a new round of FOMC meetings. When the current situation is still unclear, macro indicators may become an important signpost. Not only that, the market also expects the approval of the Ethereum ETF on November 12 this week, which injects more uncertainty into the market. The second half of the week is expected to be exciting.

Source : SignalPlus, Calendrier économique

Source: Deribit (as of 8 JU L2 4 16: 00 UTC+ 8)

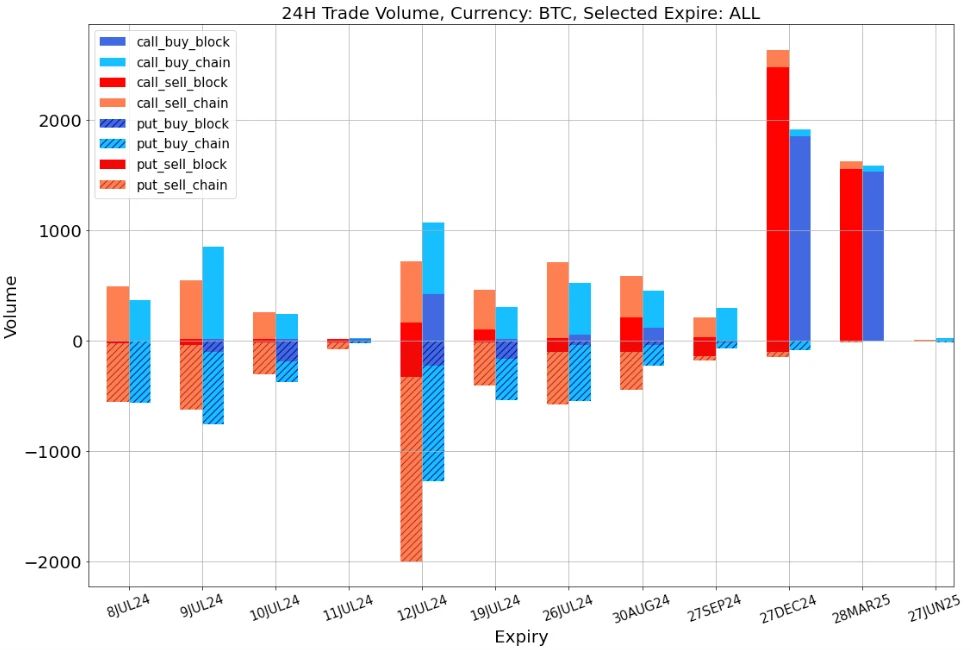

From the perspective of trading, due to the release of important data on November 11-12 and the possibility of ETF approval, traders bought a large number of ETH 12 JUL put options to protect long positions. BTC is the opposite. The price rebound provides traders with confidence to sell 12 JUL put options. At the same time, the volume of long-term call options has skyrocketed, mainly distributed in the purchase of the wing and the sale of the further tail, forming a long call spread flow.

Source de données : Deribit, répartition globale des transactions BTC

Source de données : Deribit, répartition globale des transactions ETH

Source : échange de blocs Deribit

Source : échange de blocs Deribit

Vous pouvez rechercher SignalPlus dans le Plugin Store de ChatGPT 4.0 pour obtenir des informations de cryptage en temps réel. Si vous souhaitez recevoir nos mises à jour immédiatement, veuillez suivre notre compte Twitter @SignalPlus_Web3, ou rejoindre notre groupe WeChat (ajouter l'assistant WeChat : SignalPlus 123), le groupe Telegram et la communauté Discord pour communiquer et interagir avec plus d'amis. Site officiel de SignalPlus : https://www.signalplus.com

This article is sourced from the internet: SignalPlus Volatility Column (20240708): Embrace uncertainty

FrançaisOriginal|Odaily Planet Daily Auteur : jk Le vendredi 28 juin, heure locale aux États-Unis, la Securities and Exchange Commission (SEC) des États-Unis a poursuivi Consensys devant le tribunal fédéral de Brooklyn, New York, accusant la société de s'être livrée à des offres et des ventes de titres et d'agir en tant que courtier non enregistré via son portefeuille d'actifs numériques appelé MetaMask. L'étendue de la répression de la SEC « ConsenSys a violé les lois fédérales sur les valeurs mobilières en ne s'enregistrant pas en tant que courtier-négociant et en n'enregistrant pas les offres et les ventes de certains titres », indique la plainte. « ConsenSys a perçu plus de 110250 millions de livres sterling de frais grâce à sa conduite en tant que courtier-négociant non enregistré. » Selon The Block, la SEC a déclaré que Consensys avait vendu des milliers de titres non enregistrés par l'intermédiaire des fournisseurs de programmes de jalonnement Lido et Rocket Pool, qui ont émis…