À l’ère de la commercialisation de l’espace blockchain, les « applications lourdes » finiront-elles par émerger ?

Original author: Mason Nystrom

Traduction originale : Luffy, Foresight News

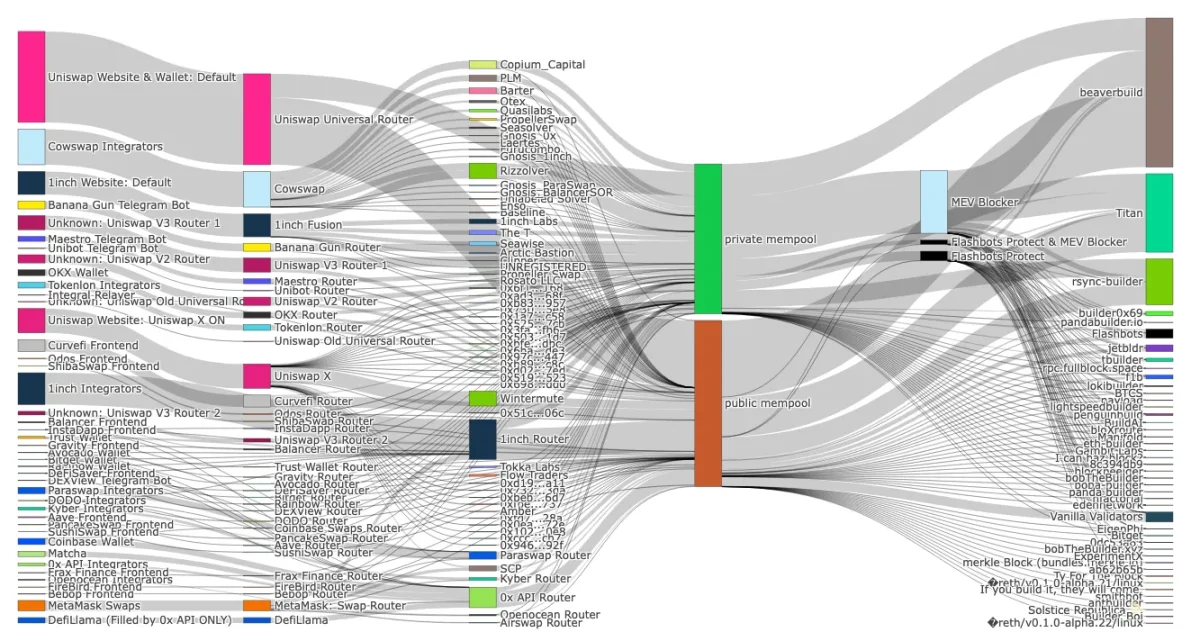

In the past 30 days, Ethereum’s order flow has exceeded $25 billion, and nearly half of that comes from proprietary applications. As the value of block space continues to grow and paves the way for “fat applications”, the privatization of order flow will continue to grow.

Source: Orderflow.art

So how did we get here, and where are we going?

The DeFi summer gave rise to a large number of prosumers and retail trading, which subsequently gave rise to trading aggregators such as 1inch, which provide users with better price execution through private order routing. Wallets (such as MetaMask) quickly followed suit, realizing that they could profit from providing convenience to users by adding in-app exchanges. This proves that there is an extremely valuable business model for any application that controls the attention (and orders) of end users.

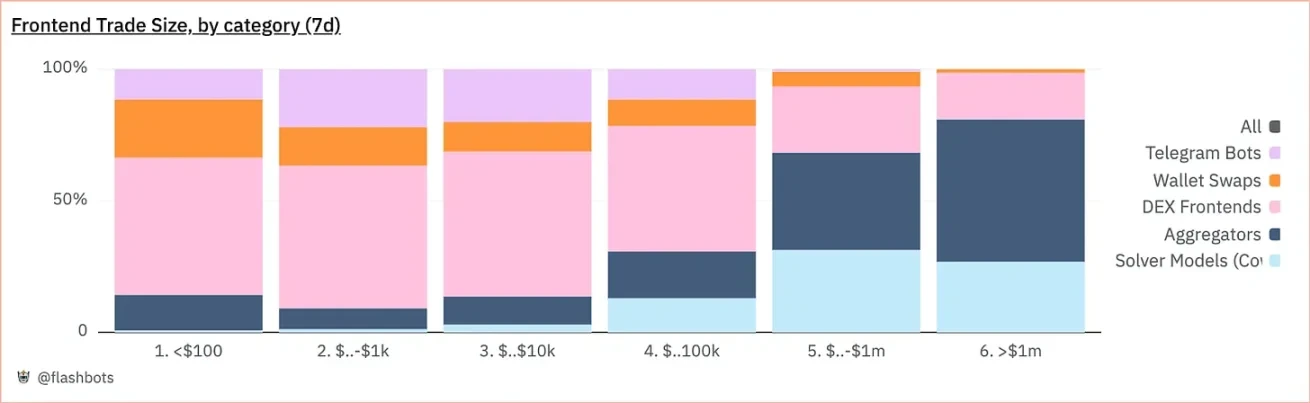

Over the past two years, we have seen two additional types of participants enter the private order flow space: Telegram bots and solver networks. Telegram bots provide users with a convenient way to trade long-tail assets in group chats. As of June, Telegram bots accounted for approximately 21% of trades by number and 11% of trades by volume, most of which were conducted through private memory pools.

Source: Dune

On the other hand, solver networks (i.e. Cowswap, UniswapX) have also become the core venue for trading high-liquidity trading pairs (such as stablecoins and ETH/BTC). Solver networks have changed the order flow market structure by outsourcing the work of finding the best path for transactions to solvers (market makers).

As a result, trading venues have bifurcated, with convenient frontends (including TG Bots, wallet exchanges, and Uniswap frontends) primarily used for long-tail, low-value (less than $100k) trades, while aggregators and solver networks are the preferred venues for larger trades.

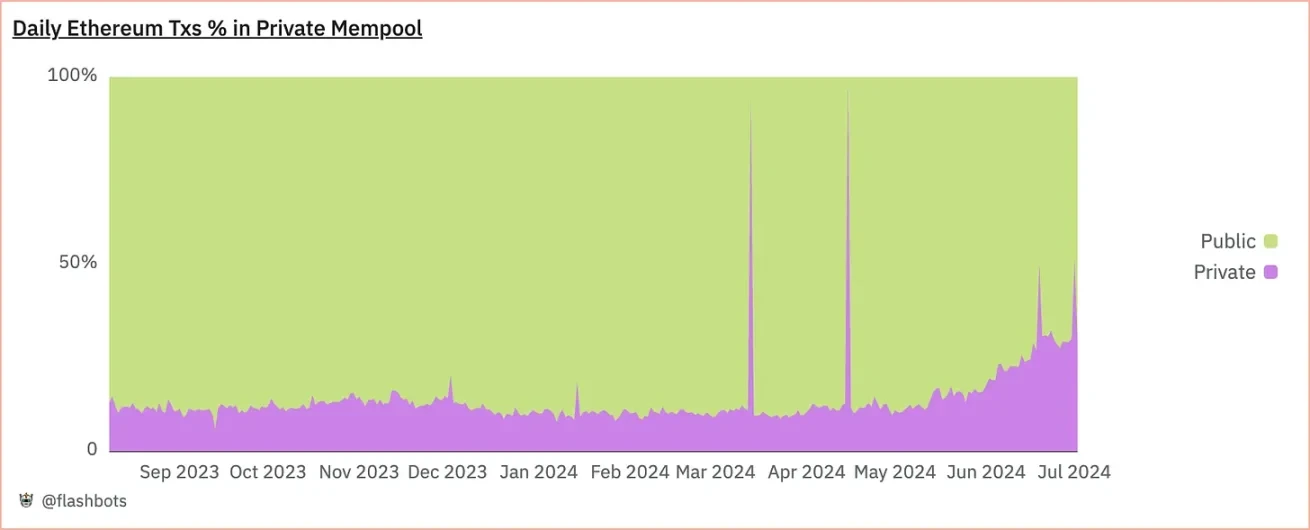

If you look more closely, you’ll notice that most of the private order flow comes from the frontend (TG bots, wallets, and frontends).

The privatization of order flow is even more pronounced when we consider that only 15-30% of Ethereum transactions go through private mempools, meaning that a large portion of private order flow volume is contributed by a small number of exchanges.

Source: Dune

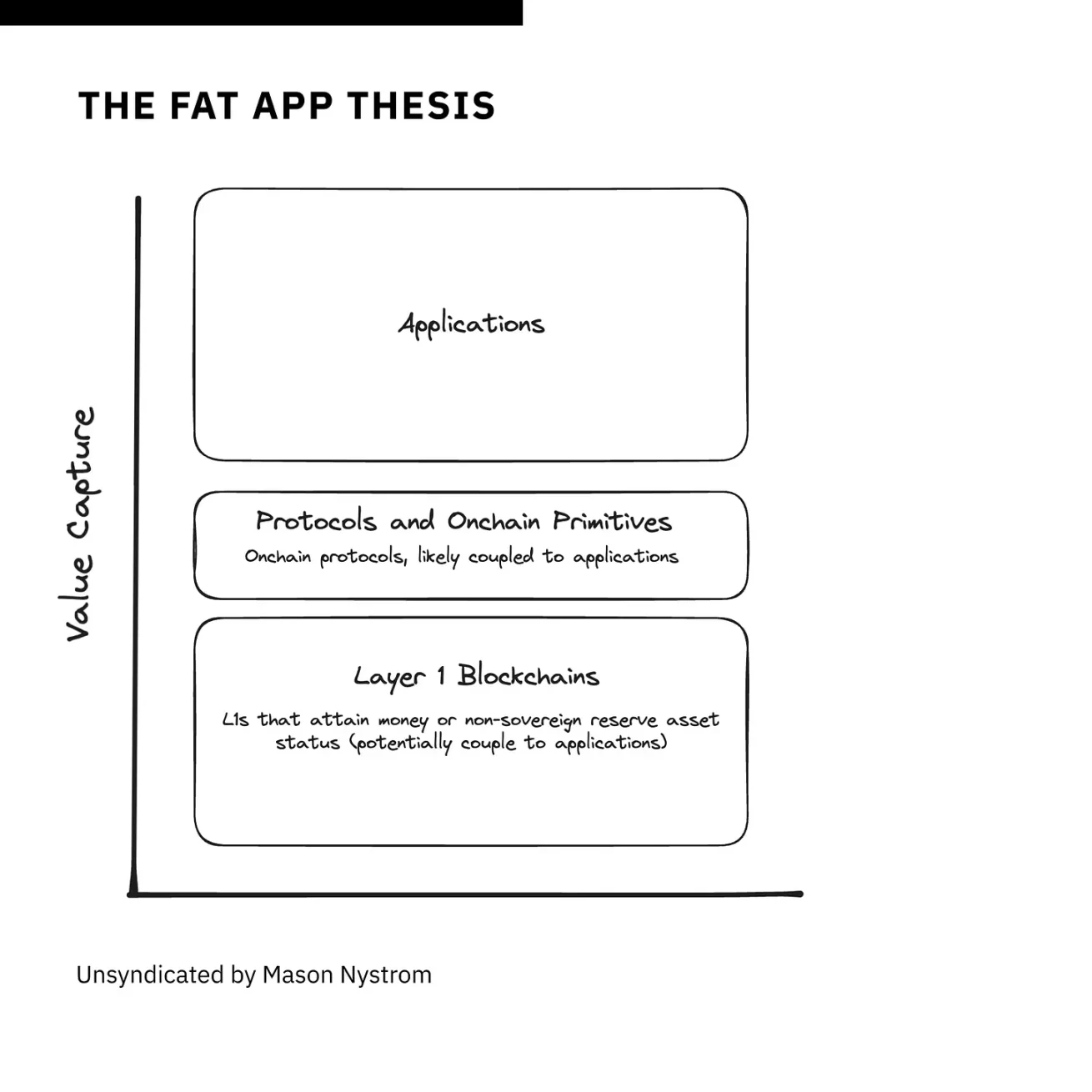

In other words, valuable order flow is more important than the amount of order flow. The power-law distribution of users and order flow leads to an inevitable conclusion: applications will account for the largest proportion of total value. In other words, the fat app theory is still valid.

Vers des applications grasses

Uniswap’s protocol layer is obviously valuable, but the more interesting story happens at the application layer as Uniswap strives to become a consumer application: verticalizing key components of its stack by expanding the functionality of the interface, mobile wallet, and aggregation layers. For example, Uniswap Labs’ application (Uniswap’s frontend, wallet, and aggregator UniswapX) contributed nearly 25% of the $13 billion in private order flow and nearly 40% of total order flow in the past 30 days.

Elsewhere in the cryptocurrency space, applications like Worldcoin account for nearly 50% of Optimism mainnet activity, which has driven Worldcoin to build its own application chain, further highlighting the power of the fat application theory.

Even top NFT projects with strong brands like Pudgy Penguins are building their own chains, with CEO and Chief Penguin Luca explaining that controlling block space is beneficial to the value accumulation of Pudgy’s brand and IP.

À l'avenir, les applications devraient chercher à créer de nouveaux types de flux d'ordres, notamment : la création de nouveaux actifs (par exemple Pump et memecoins), la création d'applications pour de nouveaux cas d'utilisation (par exemple Worldcoin, ENS), la création d'expériences client améliorées et intégrées verticalement et la prise en charge de transactions de valeur, telles que Farcaster et Frames, Solana Blinks, les applications Telegram et TG, ou les jeux en chaîne.

Réflexions finales sur les applications lourdes

Once the application chain theory becomes an industry consensus, fat applications will become the focus of many peoples attention.

My current view of the fat app theory is that we will see the majority of value accrue to the application layer, where control over users and order flow puts applications in a privileged position. These applications will likely be coupled with on-chain protocols and primitives, similar to today’s UniswapX and Uniswap Protocol, Warpcast and Farcaster, Worldcoin and Worldchain. Ultimately, these protocols, especially those most on-chain (e.g. MakerDAO), can still accrue significant value, but applications will likely capture more value given their proximity to users and the off-chain components that provide moats for the applications.

Finally, I still believe that Layer 1 blockchains (e.g. Bitcoin, Ethereum, Solana) can gain significant value as non-sovereign reserve assets. Given enough time, applications may try to build their own L1s, just as they have built their own L2s. But building an L2 blockspace is very different from bootstrapping an L1 and turning governance tokens into commodities and collateral assets, so this may be a relatively distant question.

The core point is that as more and more applications create and have valuable order flows, the crypto world will re-evaluate applications, and fat applications are the general trend.

This article is sourced from the internet: In the era of blockchain space commercialization, will “fat applications” eventually rise?

Nous sommes à un moment important de l'histoire des crypto-monnaies. Ces dernières semaines, nous avons assisté à un virage à 180 degrés dans l'attitude des États-Unis à l'égard des crypto-monnaies. Étonnamment, les huit ETF Ethereum ont été approuvés par la SEC. En outre, la Chambre des représentants américaine a non seulement adopté le projet de loi Crypto FIT 21, mais a également adopté une loi visant à empêcher la création de monnaies numériques de banque centrale. Mais ce qui est encore plus frappant, c'est de voir que les crypto-monnaies commencent même à devenir un enjeu important lors de la prochaine élection présidentielle américaine. Donc, si vous êtes une grande institution financière, le message est clair : les crypto-monnaies ne vont pas disparaître, et vous feriez mieux de vous familiariser avec elles et de commencer à explorer ses différents cas d'utilisation, de peur de…