Le compte-rendu de la réunion du FOMC suggère qu'il n'y a pas d'urgence à réduire les taux d'intérêt, le BTC teste $59,500

Auteur original : Mary Liu, BitpushNews

The minutes of the June 11-12 FOMC meeting showed that policymakers were in agreement on price stability, but there was no consensus among Fed officials on how many months of good inflation data were needed to start cutting interest rates. Some officials believed in being patient before taking action, while some officials said that a rate hike was still under discussion.

According to Bitpush data, Bitcoin lost the $62,000 support level in the early hours of Wednesday morning, hitting a low of $59,515, before bullish forces pushed it back above $60,000. However, bears continued to exert downward pressure, and as of press time, BTC was trading at $59,691, down more than 3.5% in 24 hours.

As Bitcoin fell below $60,000, altcoins’ decline intensified, with all but five of the top 200 tokens by market cap falling on Wednesday. Blast (BLAST) was hit the hardest, falling 20.3%, followed by Ethereum Name Service (ENS) and dogwifhat (WIF), which fell 16.2% and 15.8%, respectively.

BinaryX (BNX) led the gains, up 9%, while Worldcoin (WLD) rose 3.5% and aelf (ELF) rose 1.6%.

The current overall market value of cryptocurrencies is $2.21 trillion, and Bitcoin’s market share is 53.4%.

U.S. stocks continued to rise. At the close of the day, the SP 500 and Nasdaq 500 rose 0.51% and 0.88% respectively, closing at record highs for the second consecutive day. The Dow Jones fell 0.06%.

Need more evidence, Fed officials hint at no rush to cut rates

Regarding the outlook for monetary policy, the latest minutes said: Participants noted that progress in reducing inflation this year has been slower than expected in December. They emphasized that it would be inappropriate to lower the target range for the federal funds rate unless more information emerged that gave them more confidence that inflation was moving toward the 2% target in a sustained manner.

The minutes also said that some participants noted that the target range for the federal funds rate might need to be raised if inflation remained persistently high or increased further, while some participants said that monetary policy should stand ready to respond to unexpected economic weakness.

Nick Timiraos, the Federal Reserve Voice, wrote that as rising inflation has made Fed officials lack sufficient confidence in cutting interest rates, some policymakers called at last months meeting to pay close attention to signs that the job market may weaken faster than expected. Combined with recent public statements by Fed officials, the minutes of the meeting suggested that they are unlikely to cut interest rates at their meeting later this month.

Institutional analyst Cameron Crise said in a report that the minutes of the Federal Reserves June meeting showed that the committee was moving toward easing policy but had not yet overcome the difficulties to make a decision.

「Normal FUD cycle」

As BTC once again retests the lower bound of the range it has been trading in since late February, some analysts are warning that Bitcoin could drop to the $40,000 range as momentum appears to be turning in favor of the bears, but most analysts believe that these concerns are overblown and are simply exacerbating a normal FUD cycle.

Market analyst Horn Hairs said on the X platform: If the BTC price stays below $56,000 for a long time and rebounds sharply to above $60,000, then I would feel it is safe to go long again.

Market analyst Rekt Capital said Monday’s breakout “was delayed by a failure to retest the June downtrend as new support,” posting the following chart, saying: “Nevertheless, this is still a trendline that is worth watching for a future trend shift.”

Benjamin Cowen mentioned some macro factors. He said in his podcast that based on the historical correlation between Bitcoin and the 10-year bond yield (US 10 Y), Bitcoin may fall.

Cowen said: “Typically, one of the reasons you see Bitcoin fall might be that the long-term yield curve starts to rise… But if you look at the 10-year yield, youll notice that when the 10-year yield really spikes, starting in July 2023 until October, thats when Bitcoin fell. So if the 10-year Treasury yield starts to spike again in October, that could correspond to Bitcoin showing some seasonal weakness.”

Market analyst Moustache said he believes Bitcoin has bottomed out and BTC is just retesting its recent downward trend line before continuing to move higher.

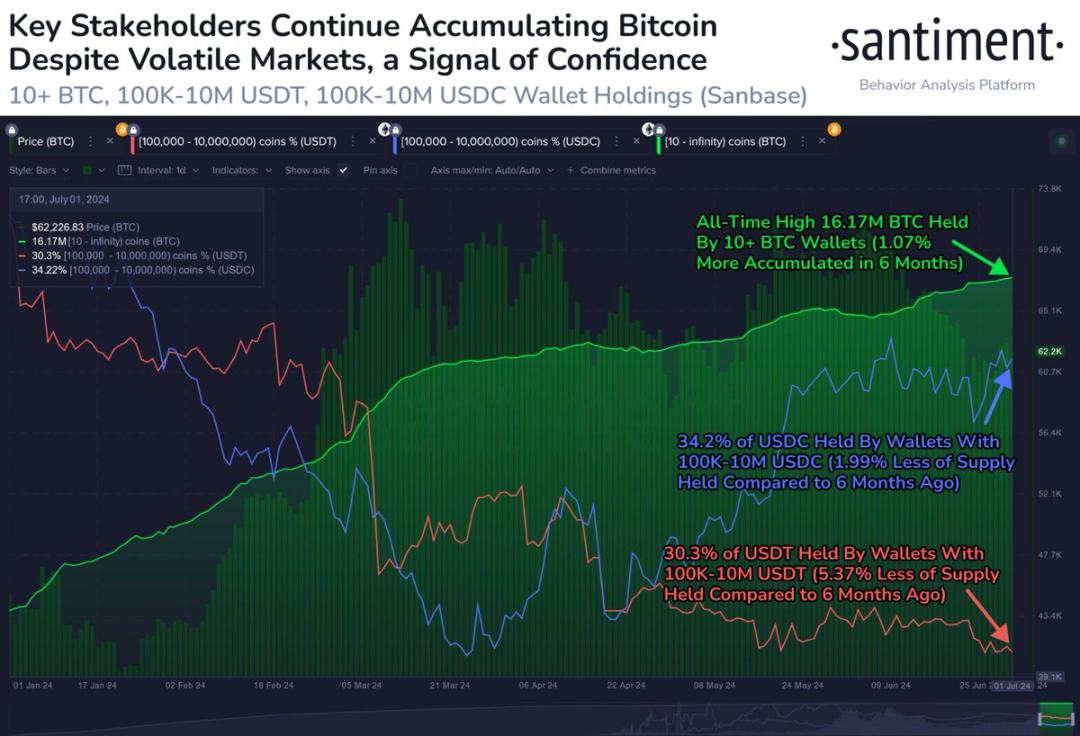

On-chain data platform Santiment emphasized that while retail traders have been selling tokens amid FUD-induced weakness, whales are more optimistic than ever, with more than 10 whale wallets now accumulating 16.17 million BTC, a record high. Santiment said on the X platform: We are seeing an increase in the purchasing power of Tether and USD Coin holders, which will truly open the floodgates for a crypto bull run.

This article is sourced from the internet: FOMC meeting minutes suggest no rush to cut interest rates, BTC tests $59,500

Related: Decrypting Airdrops: How Do FDV and Token Economics Affect Token Prices?

Original article by: Victor Ramirez, Matías Andrade, Tanay Ved Original translation: Lynn, MarsBit Key Takeaways FDV launches have varied in recent years: a median of $140 million in 2020 (DeFi protocols), a surge to $1.4 billion in 2021 (NFTs, games), a decline in 2022 ($800 million for L2), and a rebound in 2023 and 2024 ($2.4 billion and $1 billion), featuring alt L1 and Solana projects. FDV ignores short-term market shocks; therefore, circulation (public supply) is important. High FDV, low circulation tokens like World Coin ($800 million vs. $34 billion FDV) may distort true valuations. Airdrops distribute tokens to promote protocol adoption and are usually quickly cashed out by recipients. While initially lucrative, most airdropped tokens lose value over the long term, with exceptions such as BONK (which saw a…