Perspectives du marché des crypto-monnaies pour juillet : Focus sur l'ETF ETH et Mt.Gox

Original author: Sleeping in the rain

gm frens July Outlook is here~

Let鈥檚 mainly talk about the narrative that may be hyped in July and my personal rating.

1/ Ethereum S-level

The most important things in July are ETH ETF and Mt. Gox. The market always reacts to events before they happen. As events come, their impact on the market will become smaller and smaller. This is why people often say Buy the Rumour, Sell the News. If history rhymes, ETH may perform similarly to BTC after the ETF is passed – of course, we also have to consider the overall macro environment and the impact of the US election on the market.

However, on the issue of Sell the news, I agree with Zhusus point of view.

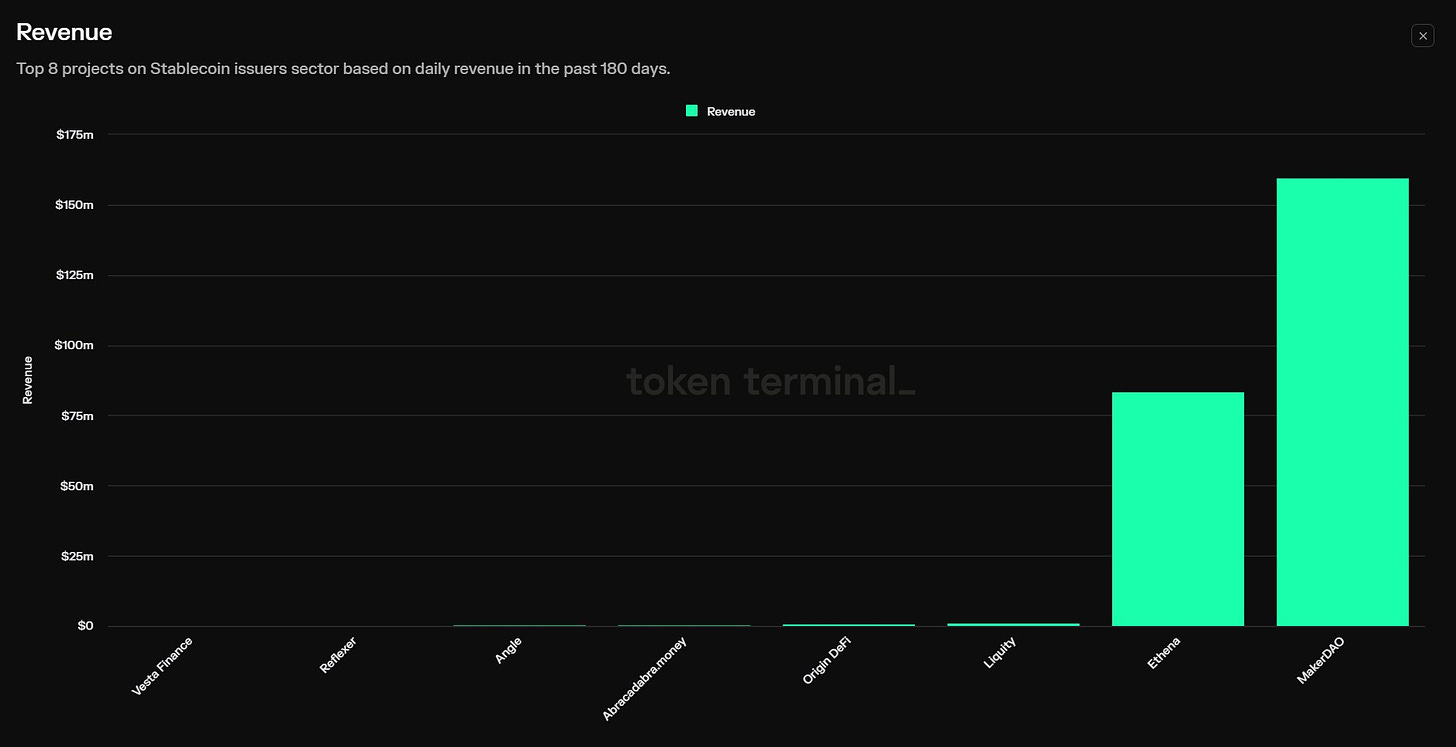

Regarding ETH Beta, I previously selected four coins: $ENS $ETHFI $TURBO $MOG. The price fluctuations of $TURBO and $MOG are large, which are suitable for swing trading, and $ENS performs the best. Regarding $TURBO, I will update my understanding: it is not closely related to ETH, so it will be removed from the list. The current list is: $ENS $LDO $PEPE $MOG $MKR ($MKR is still the same split and renamed narrative, and the protocol revenue/fundamentals are also great)

Friends who are interested can look back at this tweet of mine猬囷笍

https://x.com/0xSleepingRain/status/1801638573176930698

2/ Layer 1 (A level), Layer 2 (B level), Layer 3 (C level)

Solana A-Class

I have talked about my point of view before. Solana currently has only one narrative, which is the casino of memecoin. The catalyst of ETF application, Blink, and the previous narratives of Depin and Solana Mobile still need time to verify. In summary, Solana鈥檚 goal is mass adoption, but there is still a long way to go. At present, the market demand for Solana is only hype memecoin.

Avalanche B-Class

Avalanche may launch some new activities similar to the previous Avalanche Rush. Proof of $AVAX Boost

https://x.com/Flowslikeosmo/status/1805643864193351908

Fantom B-Class

Convert to $S, I have already talked about it in the previous tweet 猬囷笍

https://x.com/0xSleepingRain/status/1805875415116136876

I don鈥檛 have much to share about Layer 2, and I mainly focus on the wealth effect of Basechain and the Farming opportunities on Arbitrum. However, there are not many opportunities for Layer 2 tokens such as $ARB $OP to intervene. At the same time, if the ZK narrative explodes, you know which target to choose:)

$ZK is the best meme of ZK.

Let me briefly talk about my views on Layer 3s $XAI.

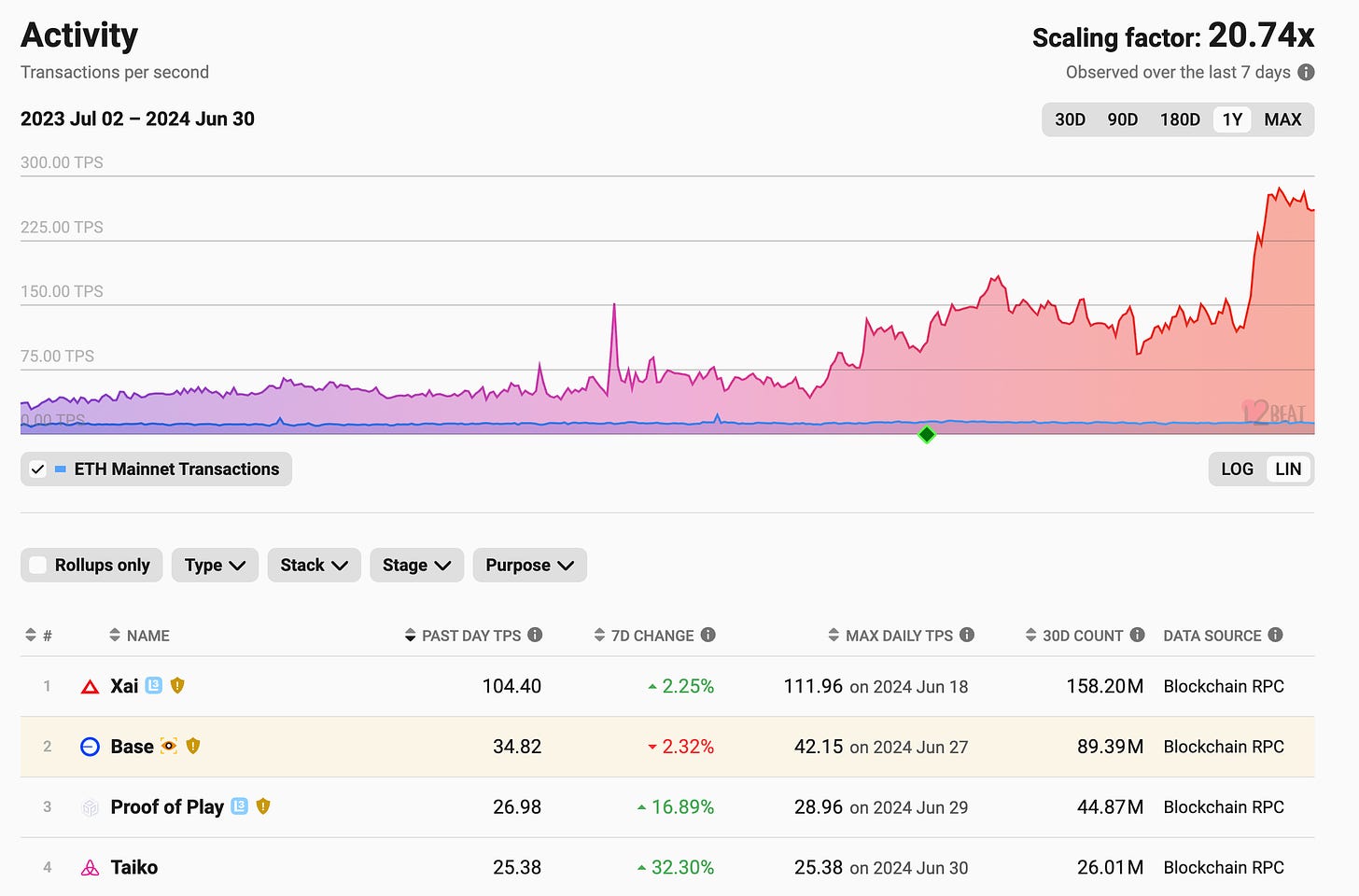

At present, the TPS on the Xai chain has reached 104, ranking first in Ethereum Layer 2 Layer 3. I have explained this phenomenon in my previous tweets. In addition, on July 9, $XAI will unlock about 200 million tokens (accounting for 71% of the current circulation)-this is a super large unlocking event. Conspiratorially, are these two events related? Will Xai use data to make the price growth more reasonable? Everything is unknown. But I have included $XAI in my Watchlist, and once the price changes unusually, I will intervene immediately.

https://x.com/0xSleepingRain/status/1803298199295369417

I have always been optimistic about $DEGEN, but the price performance is very bad. So I won鈥檛 go into details here.

In summary, the price of Layer 3 Tokens mainly depends on catalysts and narratives. There are not many real users (here referring to $DEGEN $DMT and $WINR), and the short-term is greater than the long-term.

3/ RWA A-level

$ONDO is the best target and is closely related to BlackRock鈥檚 stuff. Ondo and Ethereum are the main battlefields for BlackRock to promote tokenization.

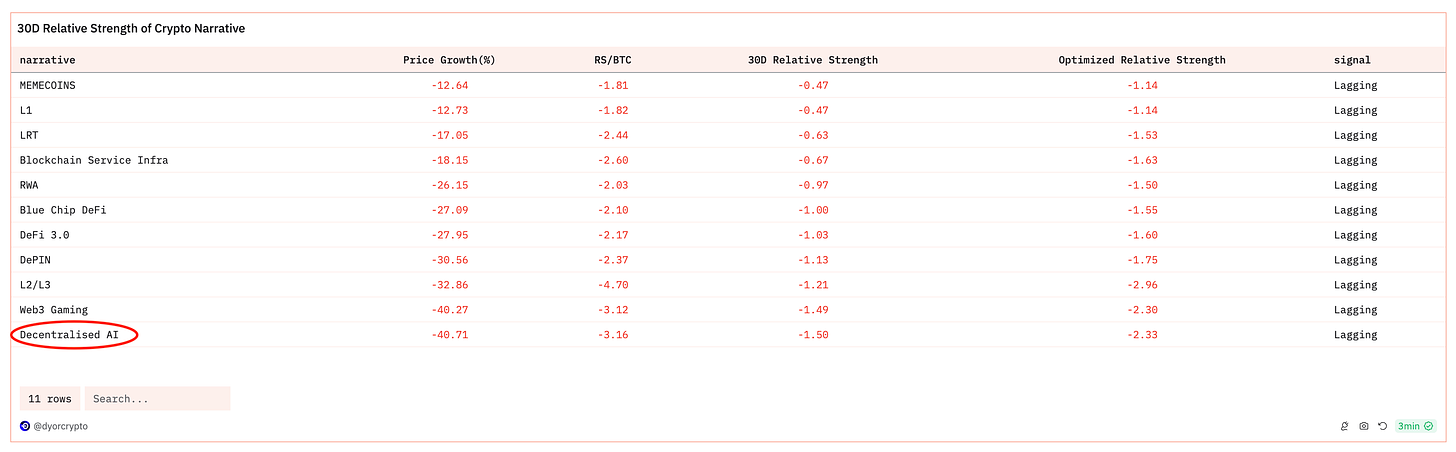

4/ AI Level A

There is not much to talk about. The merger of $FET $OCEAN $AGIX is about to end, and the unlocking of $WLD has begun. If the rise of the sector depends on the release of external products/technology, it is also short-term speculation. Among the 30-day narrative strengths and weaknesses, the price performance of AI Token is the weakest.

https://dune.com/dyorcrypto/relative-strength-crypto-narrative

5/ Socialization is still a false proposition at present, and the current rating is C.

Previously, I thought that Coinbase Smart Wallet would bring a wave of hype about Basechain. In the end, under this market sentiment, the overall performance of Basechain ecosystem was not impressive, and only $BRETT stood out. I failed miserably in this wave of coin selection. In retrospect, the market liquidity and sentiment are not enough to sustain the explosion of Basechain ecosystem. Maybe only one coin or two or three coins will have outstanding performance. It is not good to intervene too much on the left side. You can only monitor the on-chain market at any time and intervene on the right side.

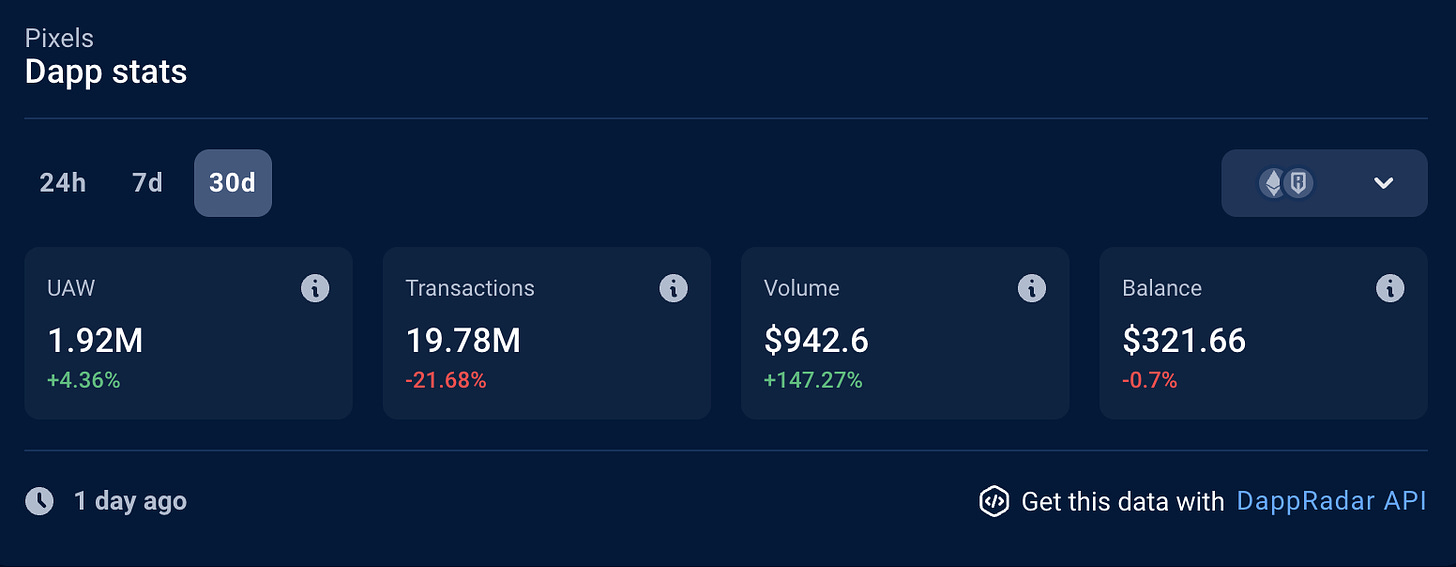

6/ Game, current rating C. False Proposition x 2

Pixels Online is still performing strongly, but the price performance is very poor.

The Beacon performed poorly – although related activities promoted the return of old players and the joining of new players, the sustainability was not good.

Mavia launched Phase 2, please refer to this tweet for details, but the market is not buying it猬囷笍

https://x.com/MaviaGame/status/1801857117797892497

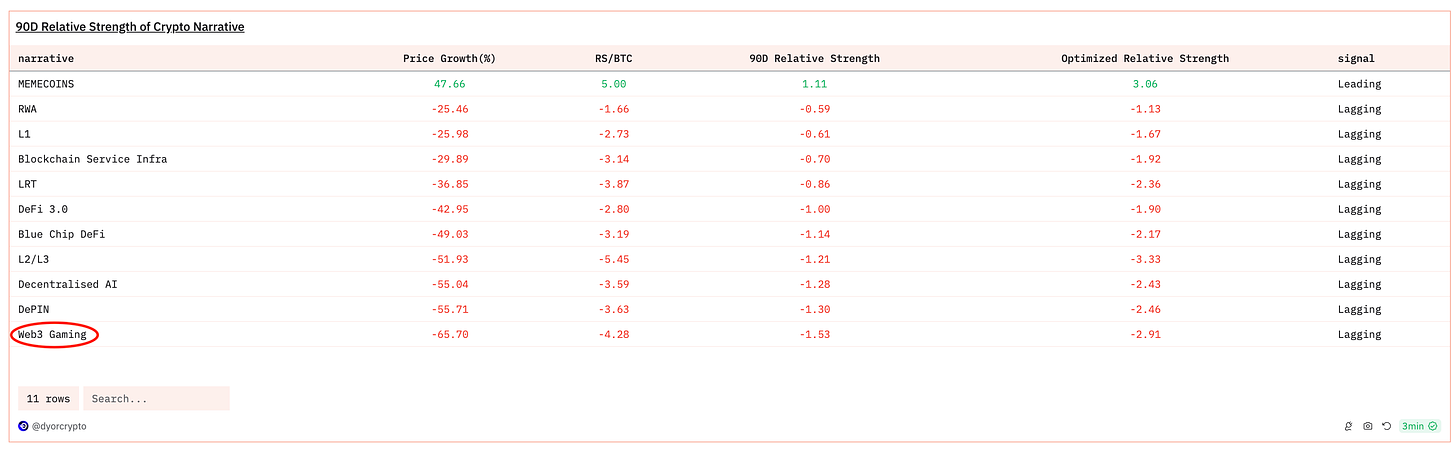

From the comparison of the strength and weakness of narrative tokens in the past 90 days, we can clearly see that the performance of game narratives in the last quarter was not impressive (low EQ: the worst). I look forward to a reversal, but I will not intervene at this time.

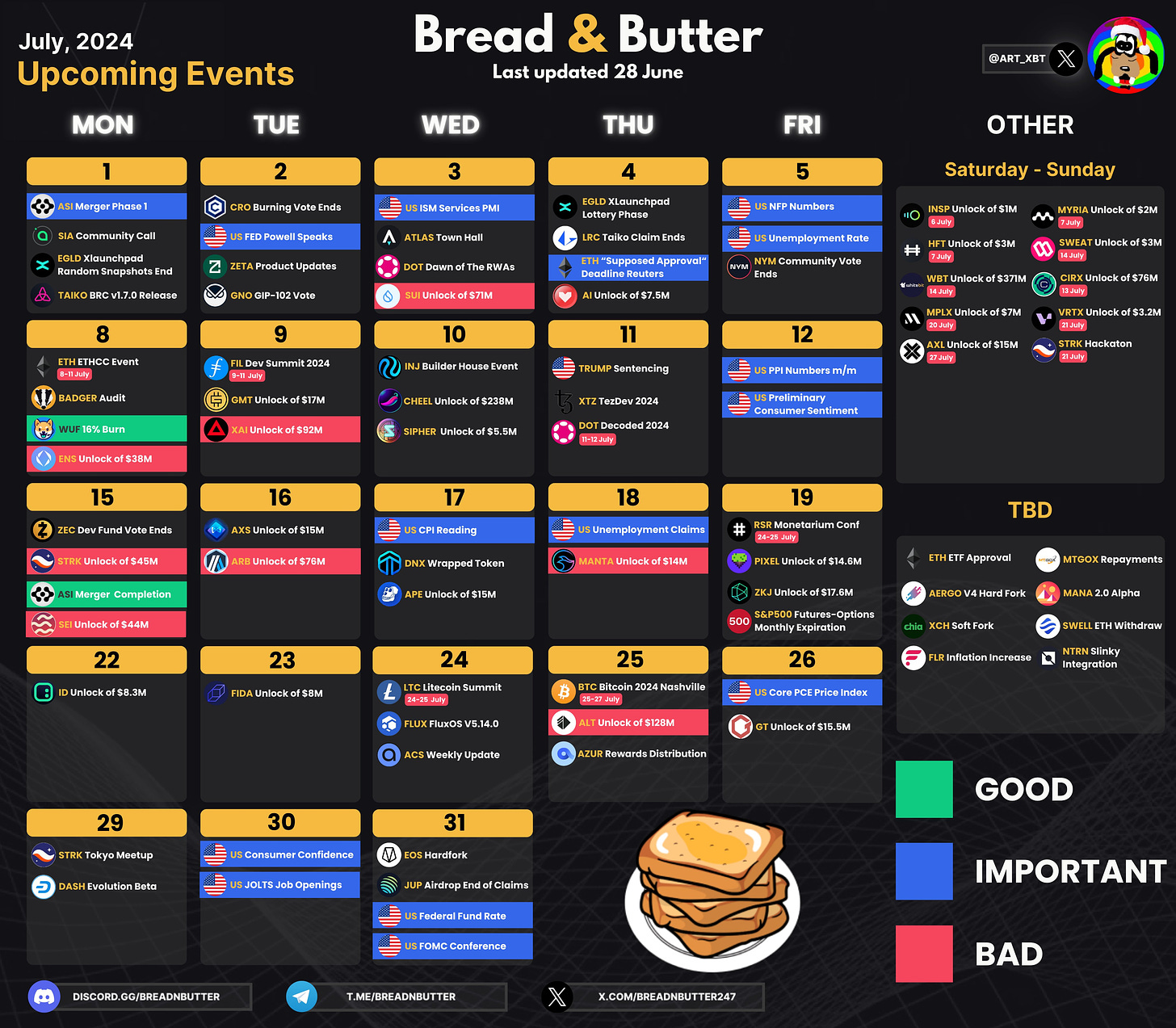

For specific events in July, please check this picture 猬囷笍

Regarding macroeconomic forecasts, I recommend these two articles:

https://x.com/DistilledCrypto/status/1803935278035537931

This article is sourced from the internet: Crypto Market Outlook for July: Focus on ETH ETF and Mt.Gox

Ces derniers mois, la popularité des jetons à valorisation élevée et à faible offre initiale en circulation a fait l’objet de discussions au sein de la communauté crypto. Cela découle de la crainte que cette structure de marché ne laisse peu de marge de progression durable aux traders après l’événement de génération de jetons (TGE). – C’est la phrase d’ouverture de l’article Binance Research : Les jetons à faible circulation et à FDV élevé sont répandus, pourquoi le marché s’est-il développé à ce point ? publié par Binance Research cette semaine. Il semble que tout d’un coup, les raisons et les discussions sur la prévalence des jetons à FDV élevé et à faible circulation soient devenues les gros titres des médias sur les crypto-monnaies et soient fréquemment mentionnées dans les sujets brûlants des membres de la communauté. Le 20 mai, Binance a annoncé qu’elle prendrait la tête de…