Privilégié par Vitalik, qu'est-ce qui rend MegaETH si spécial qu'il est devenu populaire du jour au lendemain ?

Original author: Karen, Foresight News

From being ignored to becoming popular overnight, has MegaETH, which aims to build a real-time blockchain, already stood at the forefront of blockchain? Just yesterday, MegaETH developer MegaLabs announced the completion of a $20 million seed round led by Dragonfly, and received support from Vitalik Buterin, Joseph Lubin, founder of Consensys, Sreeram Kannan, founder of EigenLayer, and others.

What is MegaETH?

The founding of MegaLabs dates back to early 2023, when it was established as a research project to scale blockchain performance without sacrificing security or decentralization. It currently has a live and high-performance devnet and is developing a live blockchain that is only limited by hardware.

MegaETH believes that the current EVM chain has limitations such as low transaction throughput, difficulty in putting complex applications on the chain, and slow block time. High-throughput blockchains have congestion and reliability issues, and Layer 2 is not truly optimized for performance.

MegaETH claims to be the first live blockchain that is fully compatible with Ethereum. This technological breakthrough is due to MegaETHs full use of Ethereum security, the integration of Optimisms fault proof system, and the combined use of its own optimized sorter.

Officials said MegaETH has high transaction throughput, rich computing power, and millisecond response time even under heavy load. The goal is to improve the performance of Ethereum L2 to the hardware limit and narrow the gap between blockchain and traditional cloud computing servers. MegaETH claims to be able to process 100,000 transactions per second with a millisecond response speed.

MegaETH Team and Investment Background

The main team members of MegaETH have strong backgrounds, including academic elites from top American universities with professional backgrounds related to blockchain and computer science, as well as professionals who have held important positions in ConsenSys. Shuyao Kong said that currently, the number of MegaETH team members does not exceed 20.

-

Yilong Li: Co-founder and CEO of MegaETH, holds a Ph.D. in Computer Science from Stanford University and worked as a senior software engineer at software company Runtime Verification Inc.

-

Lei Yang: Co-founder and CEO of MegaETH, received a bachelors degree in computer science from Peking University in 2018, a masters degree from MIT in 2020, and recently received a doctorate in computer science from MIT. He is also a member of the Network and Mobile Systems Group (NMS) at MIT Computer Science and Artificial Intelligence Laboratory (MIT CSAIL), with a thesis on efficient consensus and synchronization of distributed systems. Lei Yangs current research focuses on computer network problems in blockchain settings.

-

Shuyao Kong: Co-founder and CBO of MegaETH, known as Bing Xiong on Twitter. Corporate information shows that he served as the global business development director at ConsenSy from October 2017 to April this year. Shuyao Kongs personal Twitter profile shows that he is a consultant to Consensys.

-

Namik Muduroglu: Founding member and head of growth at MegaETH, formerly worked at Consensys and Hypersphere.

Yesterday, MegaETH developer MegaLabs announced the completion of a $20 million seed round of financing led by Dragonfly, with participation from Figment Capital, Folius Ventures, Robot Ventures, Big Brain Holdings, Tangent and Credible Neutral, as well as support from several top angel investors in the industry, including Vitalik Buterin, Consensys founder Joseph Lubin, EigenLayer founder and CEO Sreeram Kannan, Cobie, ETHGlobal co-founder Kartik Talwar, Hasu, Santiago and Helius Labs co-founder and CEO Mert Mumtaz.

According to The Block, the structure of this round of financing is equity plus token warrants, which makes MegaETHs fully diluted token valuation reach 9 figures, that is, at least $100 million. When asked whether MegaETHs native token will be launched with the mainnet (launched at the end of the year), Kong said that no decision has been made yet.

How does MegaETH work? How is real-time performance achieved?

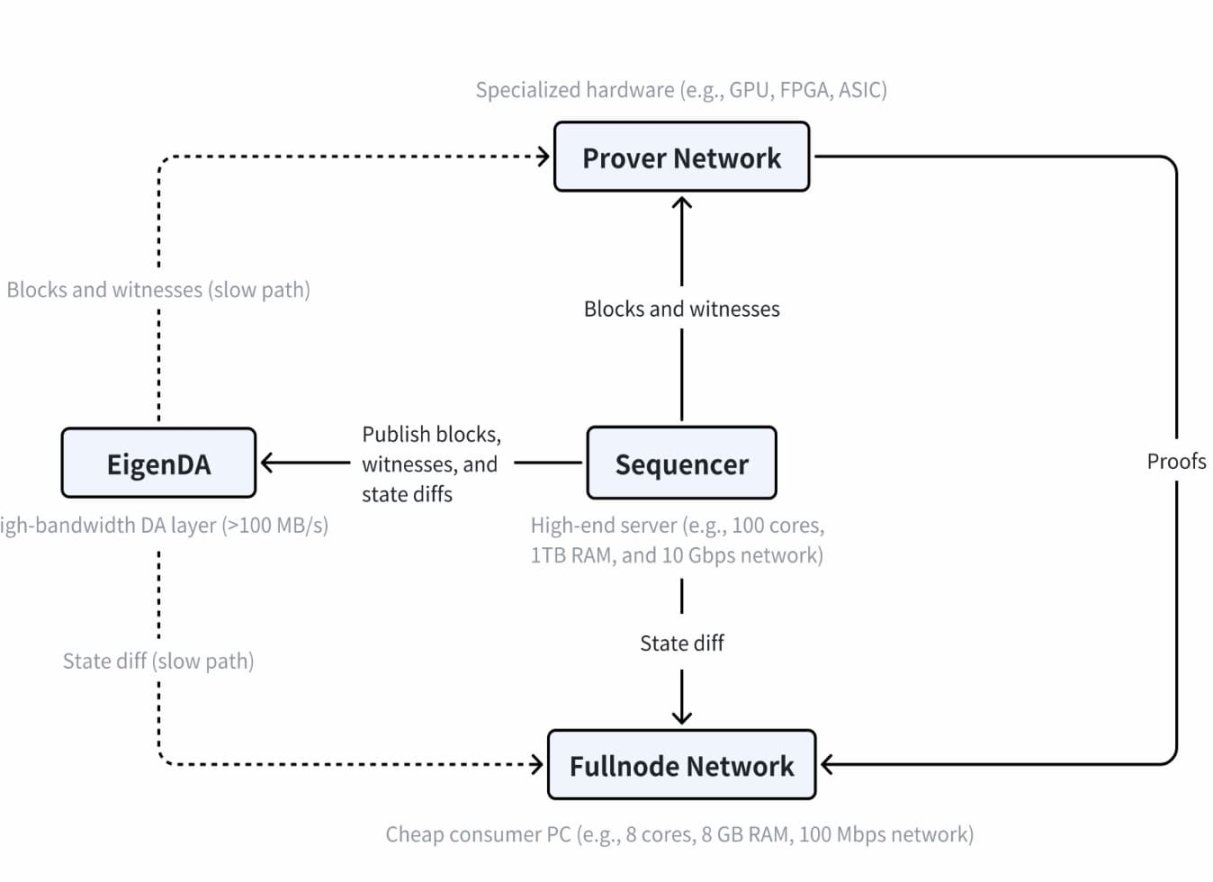

There are three main roles in MegaETH: sorter, prover, and full node. MegaETH achieves node specialization by decoupling transaction execution tasks from full nodes.

Similar to any L2, the sorter is responsible for sorting and executing user transactions. The difference is that MegaETH has only one active sorter at any given time, eliminating consensus overhead during normal execution.

Most full nodes receive state diffs from the sequencer through the p2p network and update their local state directly. They do not re-execute transactions, but instead verify blocks indirectly using the proofs provided by the prover.

The main components of MegaETH and their interactions. Source: MegaETH

MegaETH uses Ethereum security, Optimisms fault proof system and optimized sorter, and achieves real-time performance through two key technologies: heterogeneous blockchain architecture and ultra-optimized EVM execution environment. Among them, the above heterogeneous blockchain architecture improves performance by allowing network nodes with different hardware configurations to focus on specific tasks. Its execution environment can push throughput, latency and resource efficiency to the hardware limits.

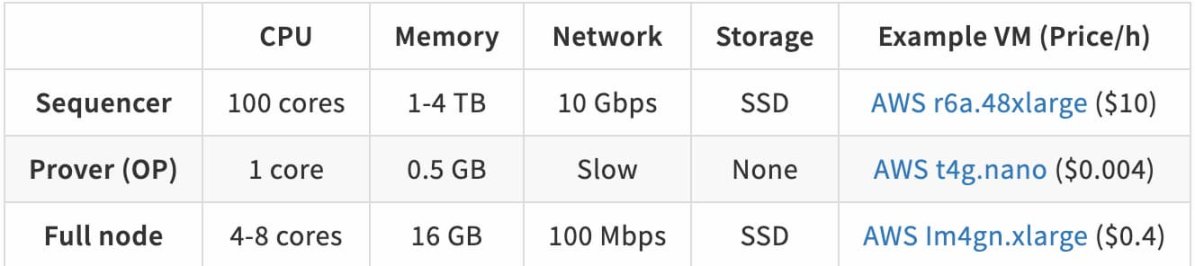

MegaLabs said that MegaETH has higher hardware requirements for sequencer nodes and lower hardware requirements for full nodes, because sequencer nodes handle heavy execution work, while the computational cost of verifying proofs is lower. This node specialization allows MegaETH to have sequencer nodes that are 20 times more expensive (5-10 times more performant) than ordinary Solana validators, while keeping the cost of full nodes comparable to Ethereum L1 nodes.

Estimated hardware requirements for each type of node in MegaETH. Source: MegaETH

MegaETH will launch a public testnet in early autumn and a mainnet by the end of the year. It has recently launched a 10x builder project, MegaMafia.

To help developers and founders build applications with the MegaLabs team and its advisors.

MegaETH real-time blockchain is expected to meet the needs of complex applications for high throughput and low latency. For full-chain games, real-time blockchain means a smoother and more realistic gaming experience. For the DePIN project, a more efficient and reliable data chain process is required. Whether MegaETH can demonstrate a strong driving force for the development of complex applications such as full-chain games and DePIN, provide an ideal operating environment, and transform cutting-edge blockchain technology concepts into a reality within reach, we will continue to pay attention to the progress of MegaETH.

This article is sourced from the internet: Favored by Vitalik, what is so special about MegaETH that became popular overnight?

Headlines Feds Kashkari: No more than 2 rate cuts expected in June economic forecast Kashkari of the Federal Reserve said that no more than 2 rate cuts are expected in the June economic forecast. Inflation seems to be stable for some time, and more patience may be needed. The US economy is in good shape, but if the inflation target of 2% is not achieved, it will damage the credibility of the Federal Reserve. It is more likely than raising interest rates that interest rates will be kept at the current level for longer than the public expects. It is not that monetary policy has no impact, but that the impact is not as large as expected, nor as fast as expected. (Jinshi) Grayscale withdraws 19b-4 filing for Ethereum futures…