Colonne de volatilité SignalPlus (20240626) : La panique s'apaise

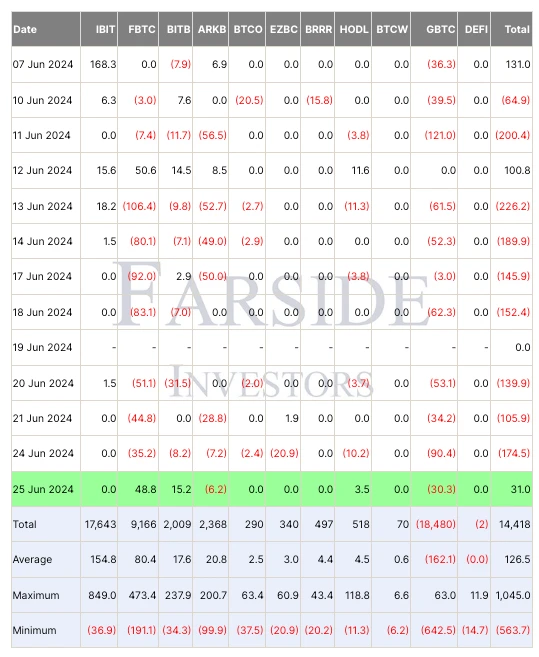

Yesterday (JUN 25), Bitcoin spot ETFs finally stopped outflows, and the uncertainty reflected in the options market also basically fell. Since the Mentougou Compensation Trustee announced on June 24 that repayments would be initiated in early July, the price of Bitcoin has fallen for a short time due to market panic. Alex Thorn, head of Galaxy Research, said in a post that the number of tokens ultimately allocated to individual creditors in the bankruptcy case was less than people thought, about 65,000 BTC (far lower than the 140,000 previously announced by the media), and the resulting Bitcoin selling pressure will be less than expected. This is mainly because some creditors chose debt acceptance (similar to FTXs packaged sale of debt) and received early payment, and the money eventually flowed to large institutions. In addition, the letter did not mention the specific repayment period, but it should not be too short, and these Mentougou creditors themselves are all early digital currency users who are proficient in technology. There is reason to believe that creditors clearly prefer long-term Bitcoin holders, so the maximum daily selling pressure is not exaggerated.

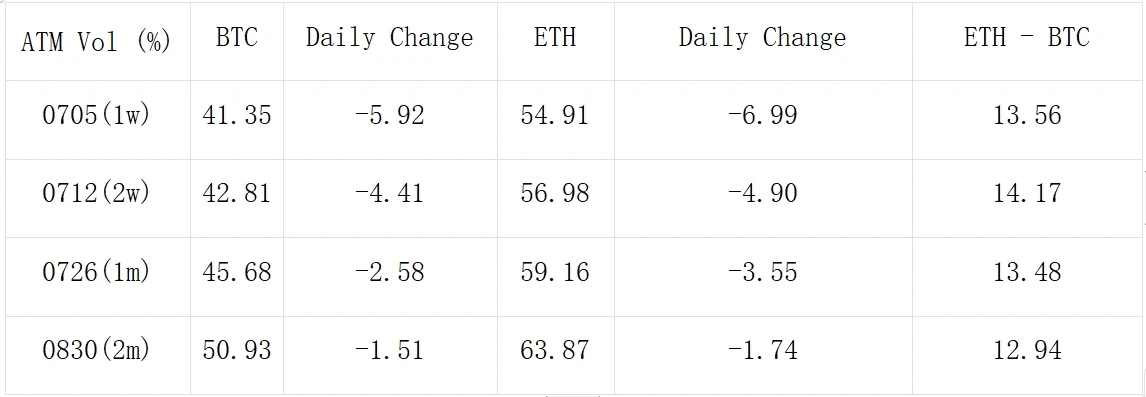

Source: Farside Investors; SignalPlus, ATM Vol.

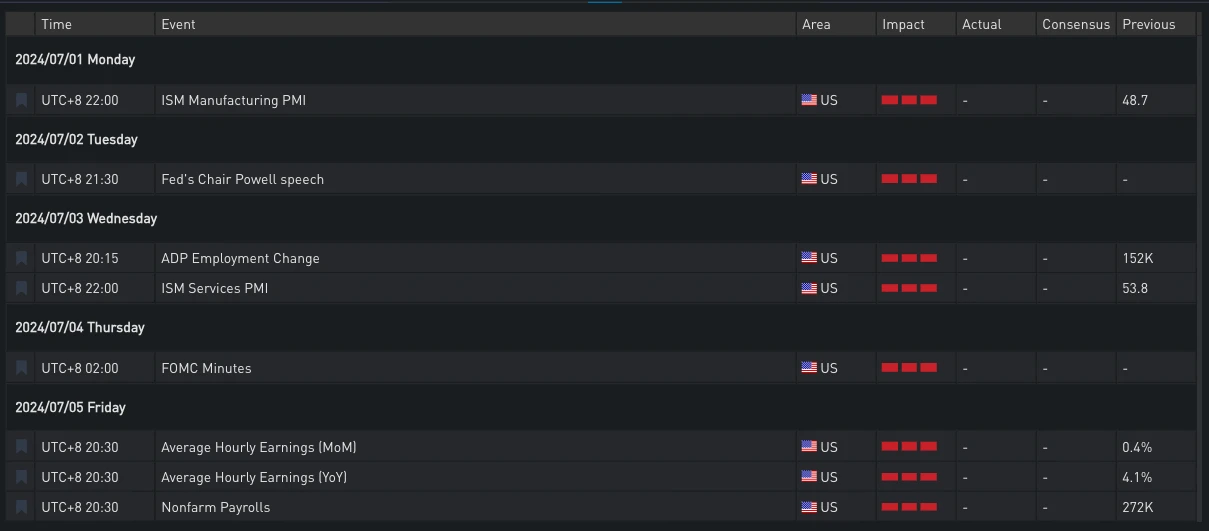

Judging from the price trend of the currency yesterday, although the price rebounded to around 62,000 and the ETF temporarily ended the outflow of funds, it still cannot change the current negative sentiment and poor liquidity. Therefore, the next macro trend should be paid attention to, such as PCE this Friday, the speech of Fed Chairman Powell next Tuesday, and the hourly wage and non-agricultural data next Friday, which will affect the market repricing and capital flow.

Source: SignalPlus Economic Calendar, Important US economic events this week

Source: SignalPlus Economic Calendar, important US economic events next week

Source: Deribit (as of 26 JUN 16: 00 UTC+ 8)

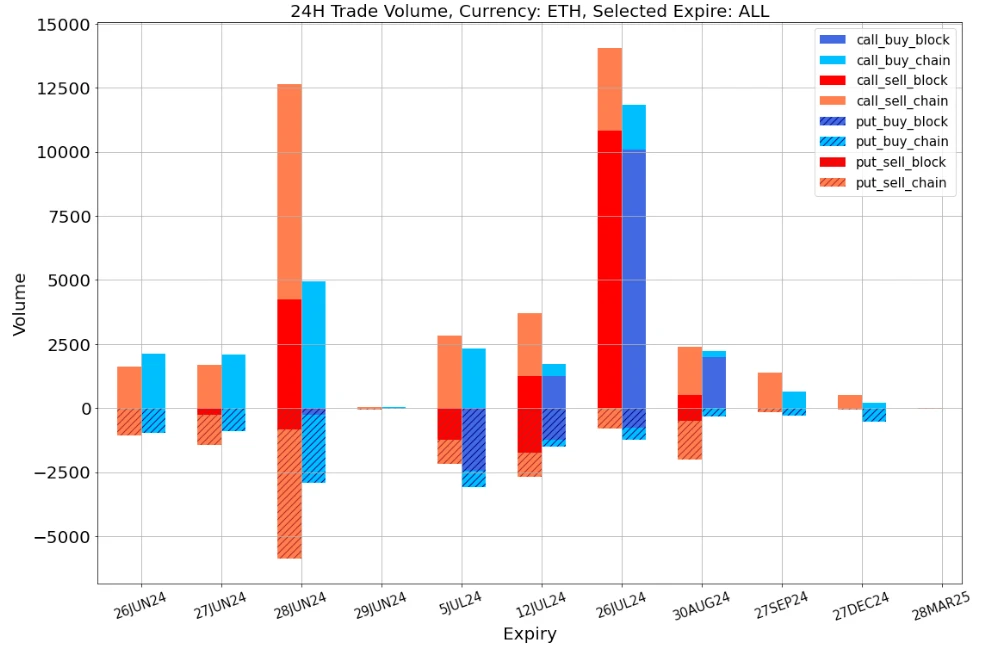

In terms of trading, after the panic subsided, BTC saw bargain-hunting of call options in late June and July. In addition, a large transaction at the end of September was also particularly eye-catching. This strategy protected the remote positions by selling 190 ATM Calls worth 62,000 in exchange for 1,140 Puts worth 48,000 at almost zero cost.

Source de données : Deribit, répartition globale des transactions BTC

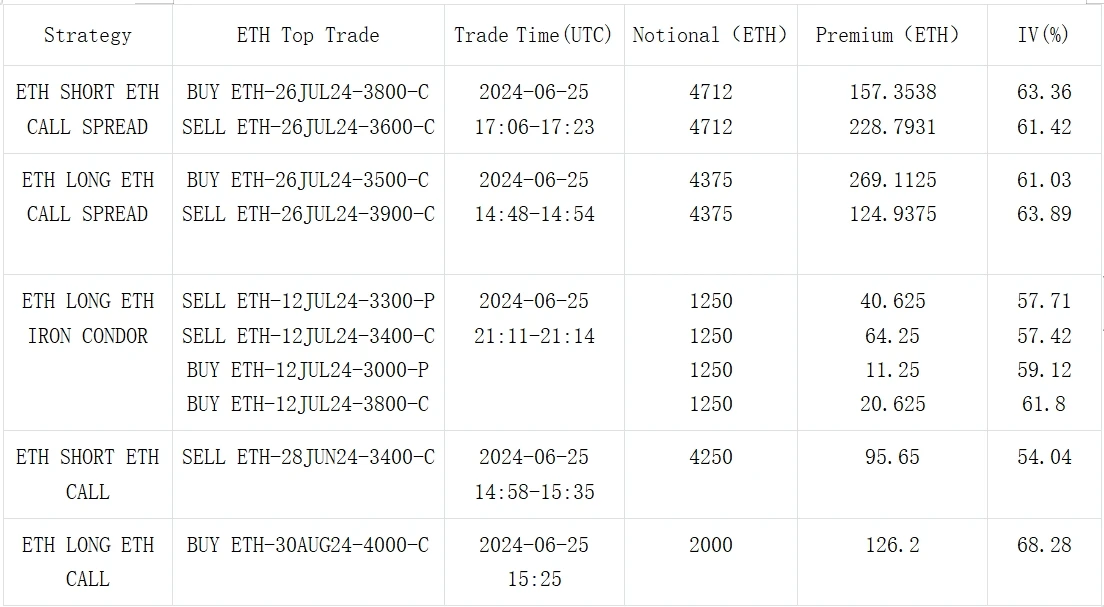

Source de données : Deribit, répartition globale des transactions ETH

Source : échange de blocs Deribit

Source : échange de blocs Deribit

Vous pouvez rechercher SignalPlus dans le Plugin Store de ChatGPT 4.0 pour obtenir des informations de cryptage en temps réel. Si vous souhaitez recevoir nos mises à jour immédiatement, veuillez suivre notre compte Twitter @SignalPlus_Web3, ou rejoindre notre groupe WeChat (ajouter l'assistant WeChat : SignalPlus 123), le groupe Telegram et la communauté Discord pour communiquer et interagir avec plus d'amis. Site officiel de SignalPlus : https://www.signalplus.com

This article is sourced from the internet: SignalPlus Volatility Column (20240626): Panic subsides

Connexes : Un aperçu rapide de 10 jetons prometteurs détenus par a16z, BlackRock et Coinbase

Auteur original : Atlas, Crypto KOL Traduction originale : Felix, PANews Les investisseurs en capital-risque investissent chaque jour des millions de dollars dans divers altcoins, faisant grimper les prix de ces altcoins. Suivre les portefeuilles des principales institutions de capital-risque et des baleines et suivre leurs avoirs peut entraîner des bénéfices excédentaires. Crypto KOL Atlas a analysé plus de 100 portefeuilles de fonds et baleines rentables, analysé leurs portefeuilles et examiné tous les projets, et sélectionné les fonds les plus performants du Web3, notamment a16z, BlackRock et Coinbase. Voici les 10 jetons les plus prometteurs qu’il détient. Remarque PANews : cet article est destiné à fournir des informations sur le marché et ne constitue pas un conseil en investissement, DYOR. Compound Labs (COMP) Un protocole DeFi de prêt qui permet aux utilisateurs de gagner des intérêts sur les crypto-monnaies déposées dans l'un de ses pools. Valeur marchande : $386…