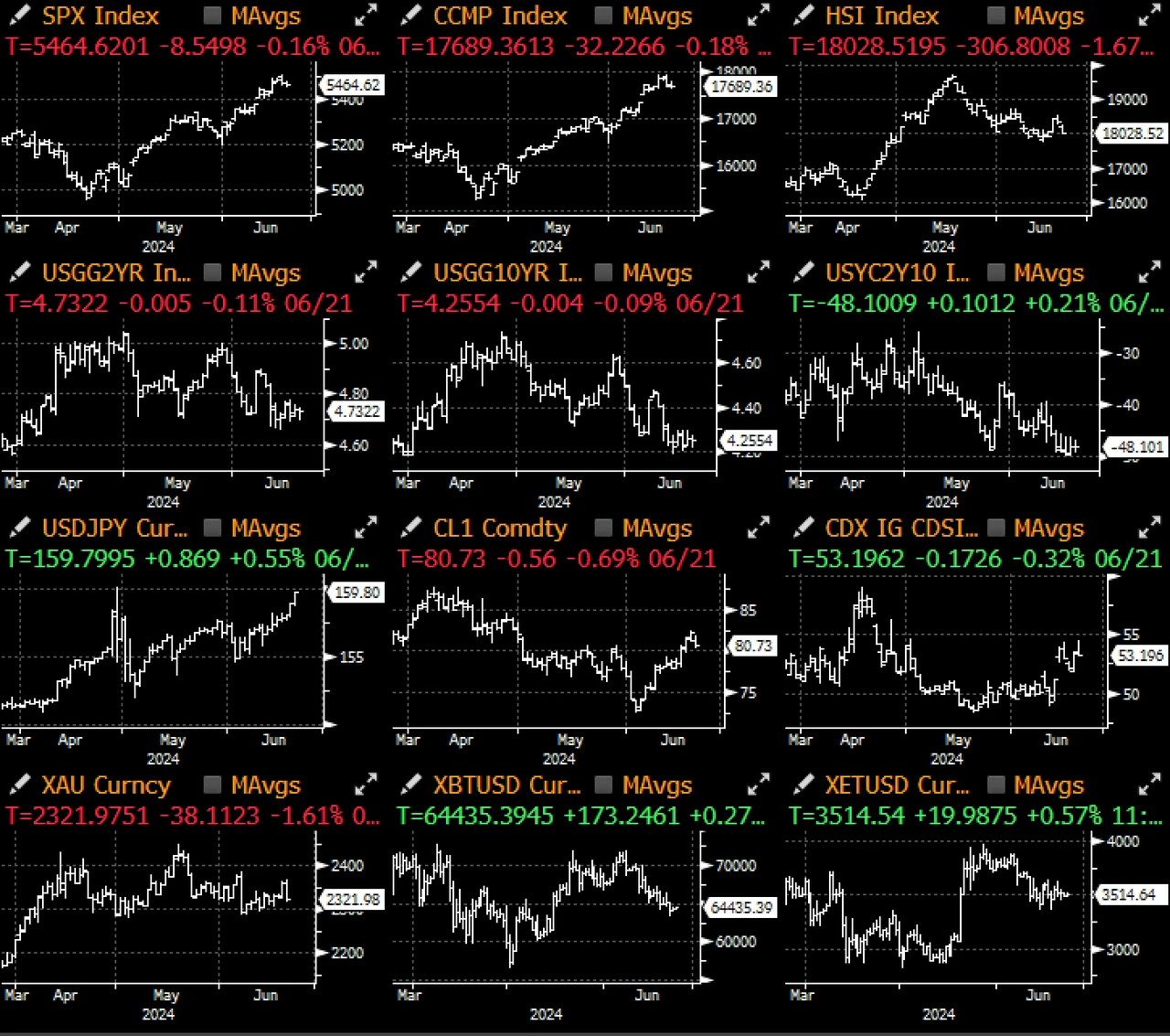

“Quadruple Witching Day” concluded successfully last Friday, with the SPX remaining near all-time highs and Nvidia taking a breather after becoming the world’s most valuable company.

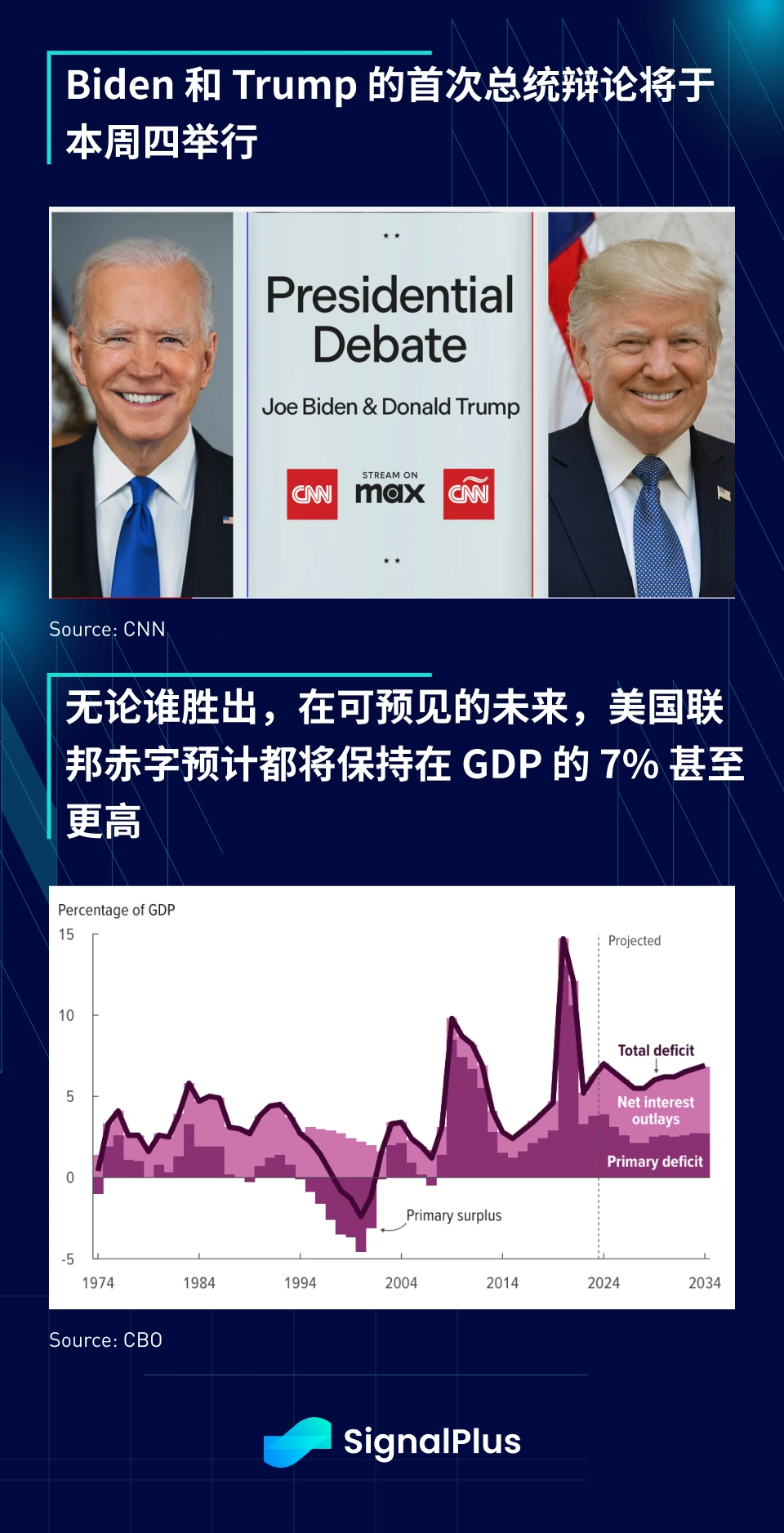

As midsummer approaches, the stock market continues to climb the wall of worry, and the markets attention will gradually turn to politics. Thursdays US presidential debate took place early, and after the court ruling, the market odds have been heavily tilted towards former President Trump, but both candidates are likely to continue the unsustainable US fiscal expansion policy. The US Congressional Budget Office (CBO) raised the deficit to more than 7% of GDP in 2024 and expected it to remain above this level for the foreseeable future.

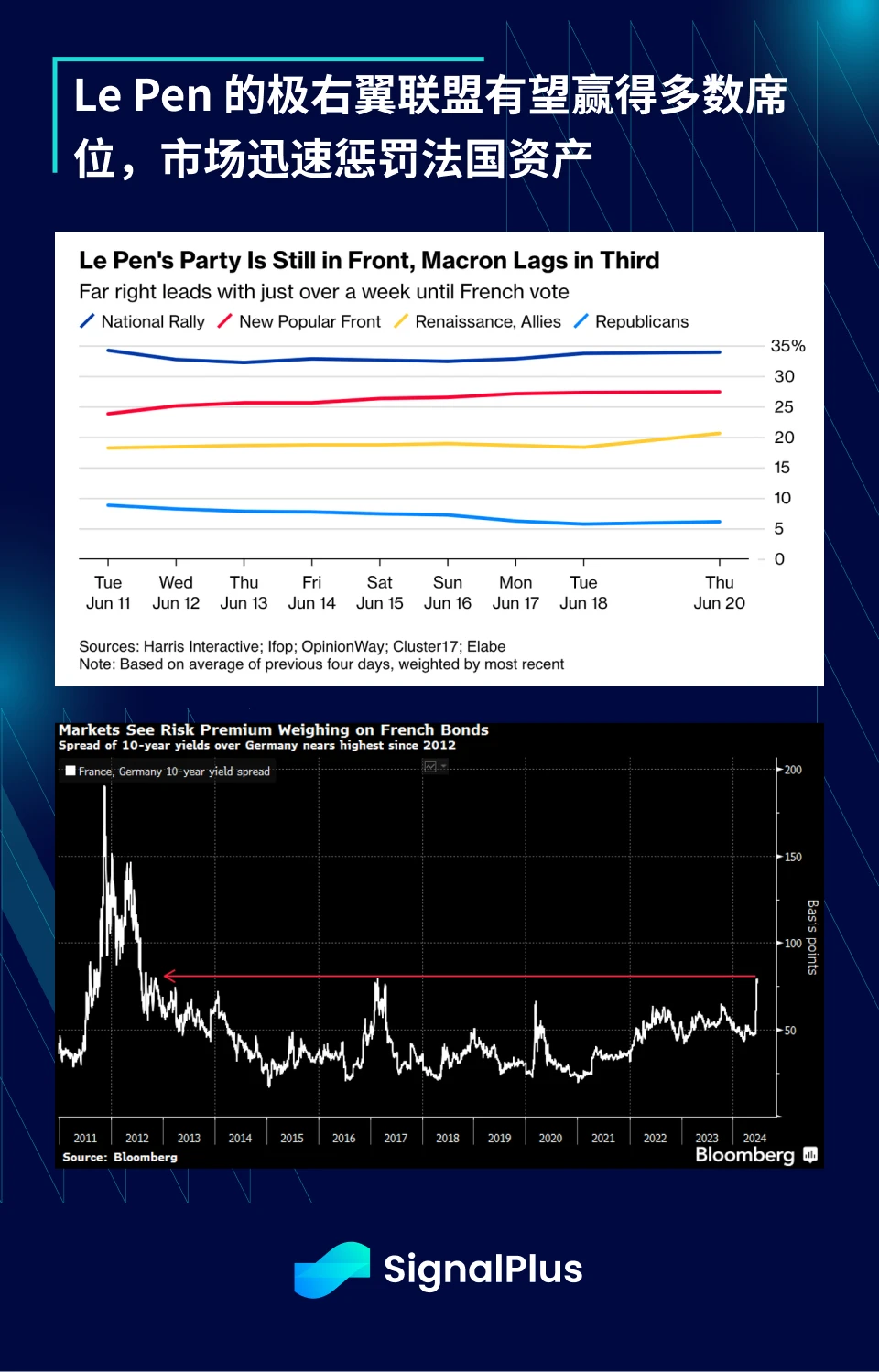

The French election will begin on June 29/30, with the second round to be held on July 6/7. Le Pens National Rally remains in the lead, and the far-right coalition is expected to win an absolute majority. The market has already cast a vote of no confidence in French assets, and the spread between French government bonds and German government bonds has widened to the highest level since 2012.

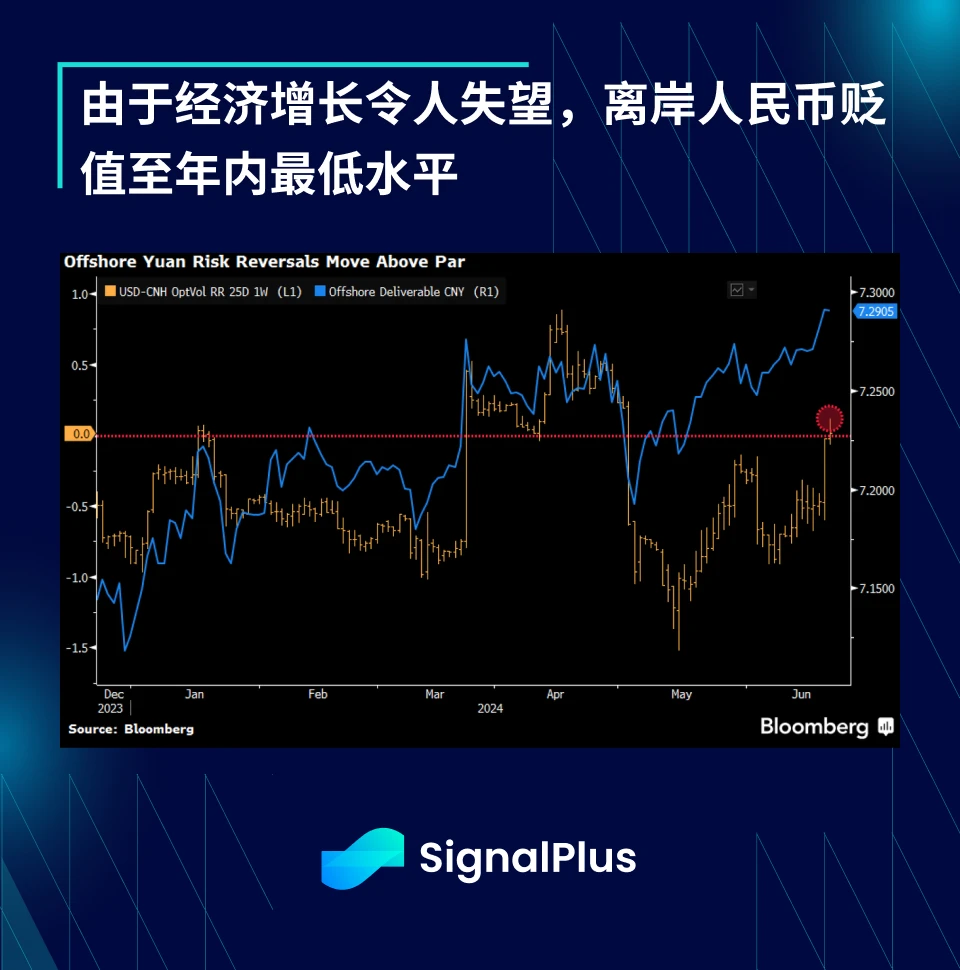

At the same time, foreign exchange-related tensions have also begun to intensify. As Chinas economic growth continues to be sluggish, the offshore yuan exchange rate has fallen to its lowest level this year, and risk reversals also indicate that the market is bracing for further weakness.

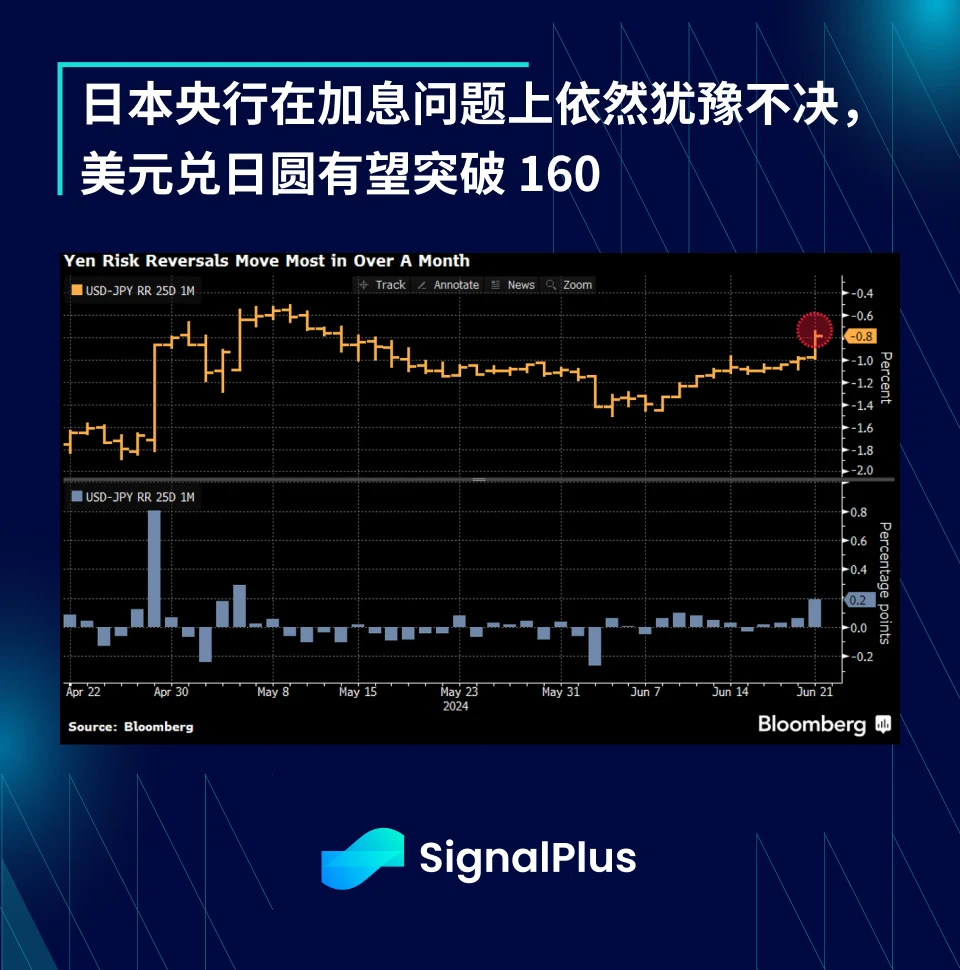

The Japanese yen is also under pressure, with USD/JPY approaching 160. The market expects that the Japanese Ministry of Finance has only about US$200-300 billion in intervention funds left, while Bank of Japan officials are still hesitant about raising interest rates. The market expects that USD/JPY will move towards 165 before the next wave of intervention measures by the Bank of Japan.

While the Nikkei remains near cycle highs, cracks are beginning to show in other areas. Japan’s largest agricultural bank, Norinchukin (“Nochu”), has become the latest victim of the Fed’s prolonged rate hikes. With a balance sheet of $357 billion (56 trillion yen), the bank, known on Wall Street as Japan’s “CLO whale,” could see losses of more than $9.5 billion (1.5 trillion yen) this fiscal year, three times higher than previously expected, due to losses from its massive CLOs.

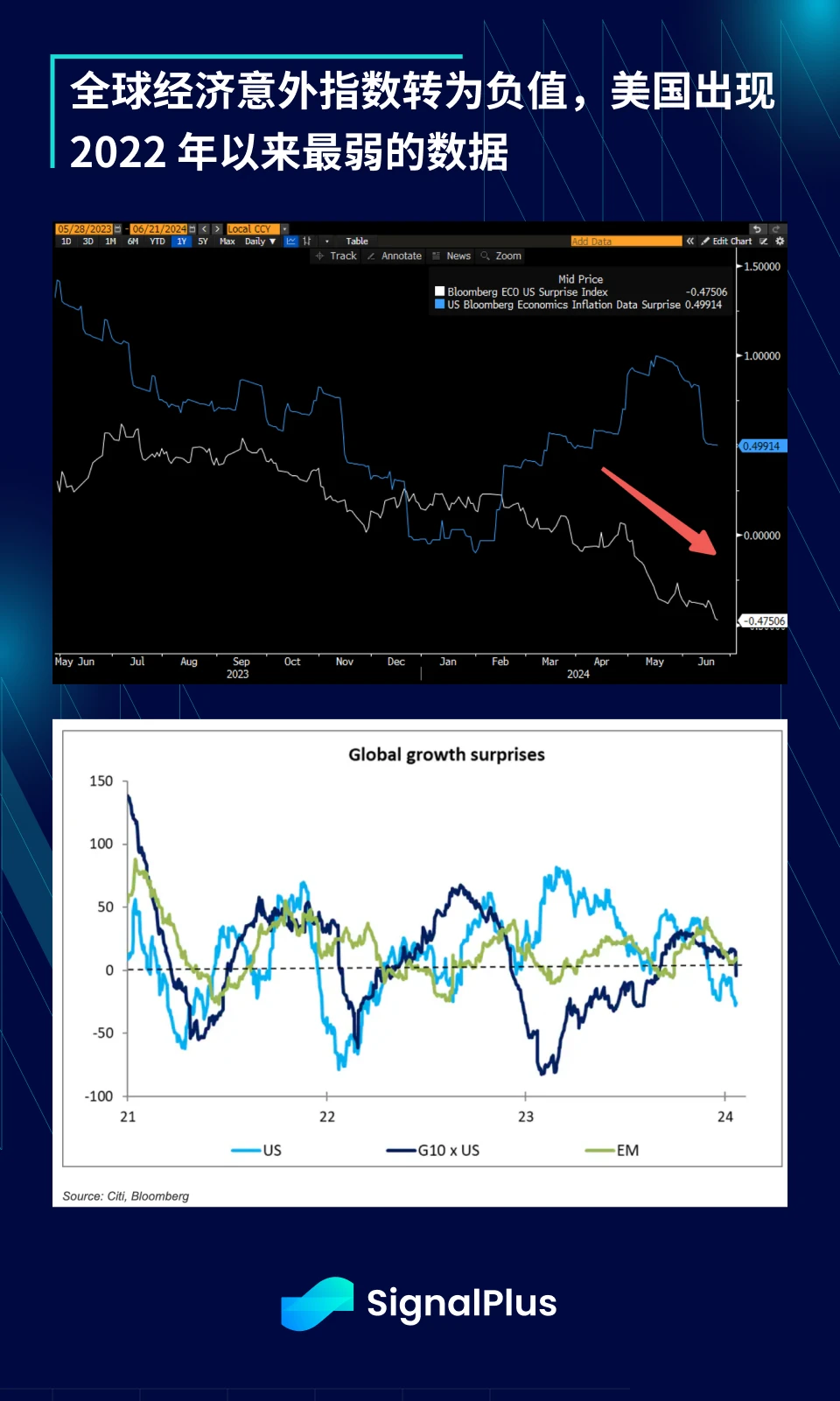

On the economic front, we are seeing more signs that the US economy is finally slowing, with growth surprise indicators falling to their lowest levels since 2022, and the rest of the world joining the US in falling into negative territory.

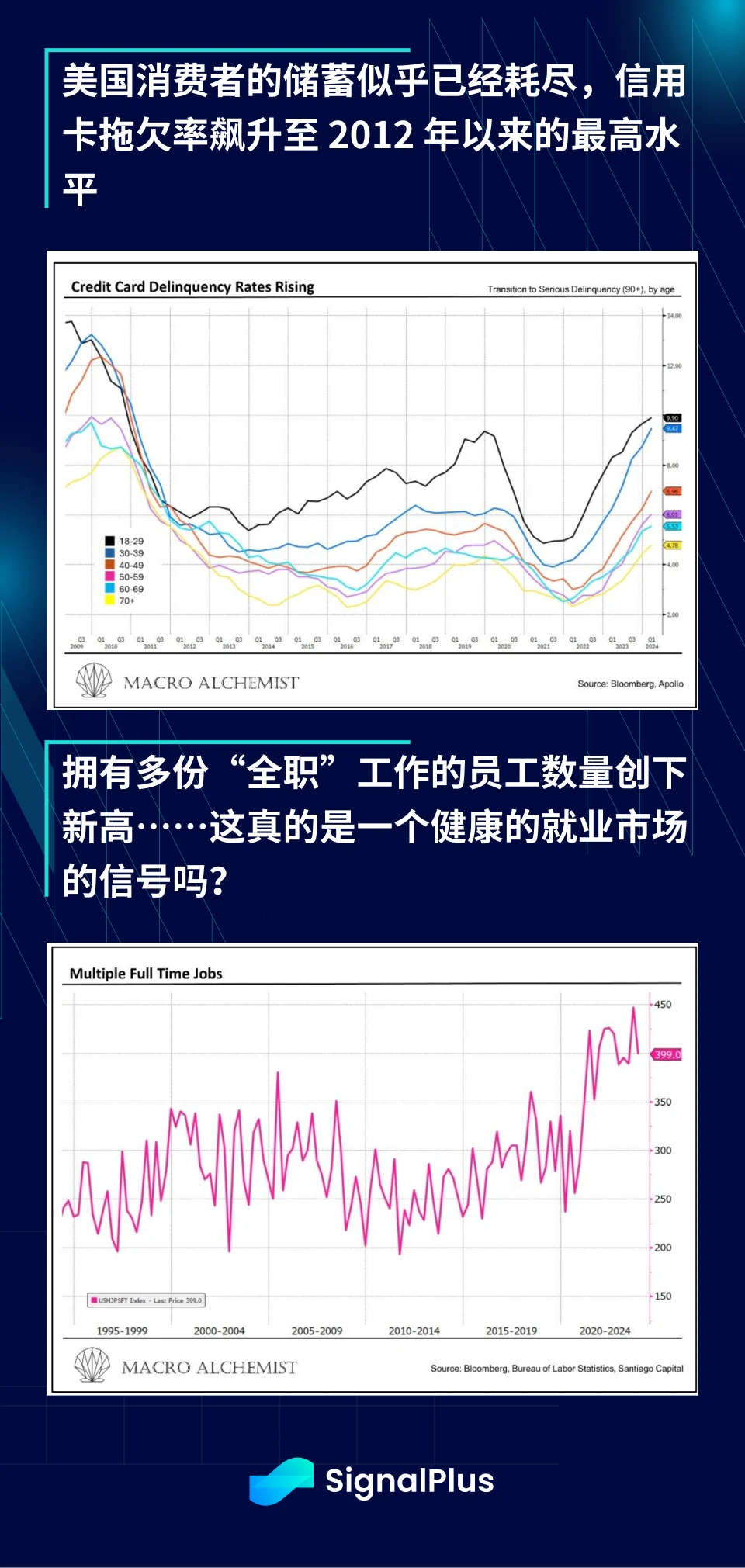

In addition, American consumers are finally showing some early signs of capitulation, with credit card delinquencies rising to their highest level since 2012 as savings from the pandemic are completely depleted. On the job market, despite good overall growth data, data shows that the number of employees with multiple full-time jobs has hit a new high, which can be interpreted as excessive labor demand or individuals needing multiple incomes to maintain the rising cost of living. We prefer the latter.

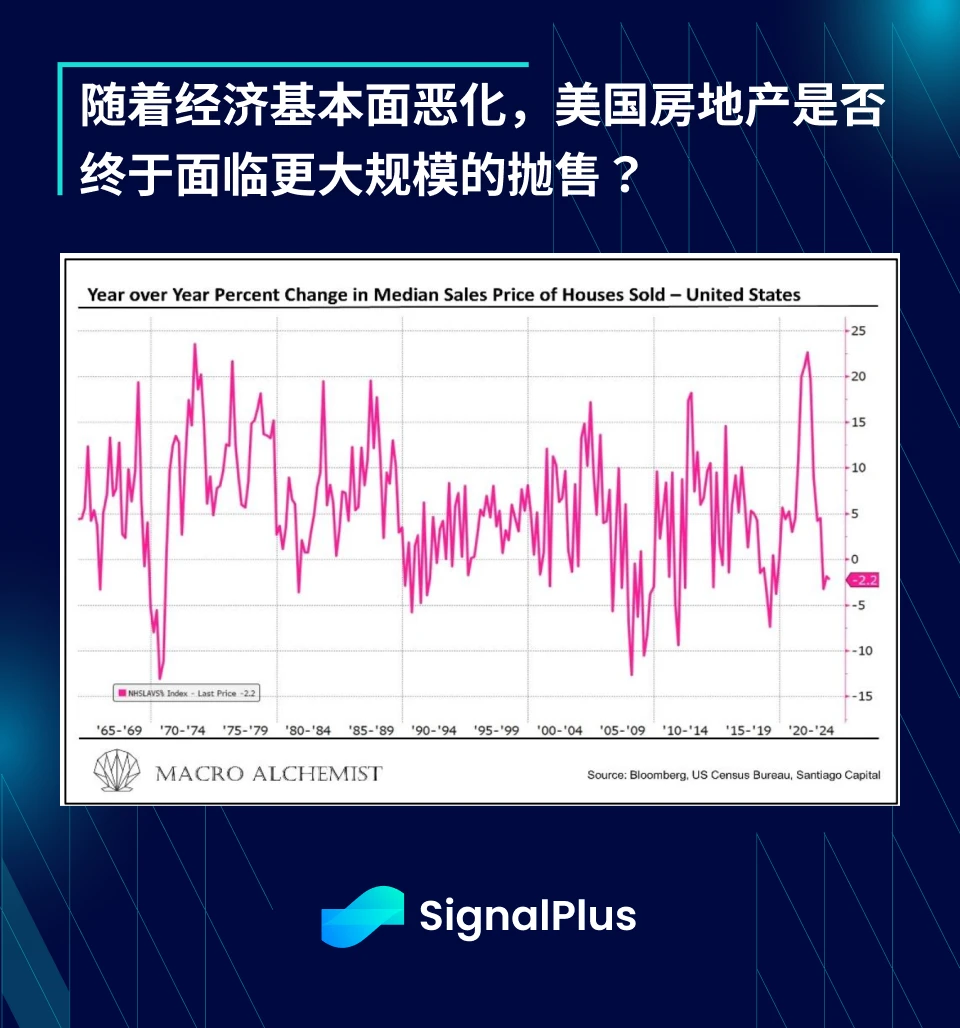

High living costs, a slowing job market and expensive mortgage rates are causing year-over-year declines in U.S. home prices, after earlier price increases were largely due to a lack of supply as sellers were unable to roll over low-rate mortgages to new homes. Will U.S. residential real estate follow the rest of the world and become the next sector to deteriorate?

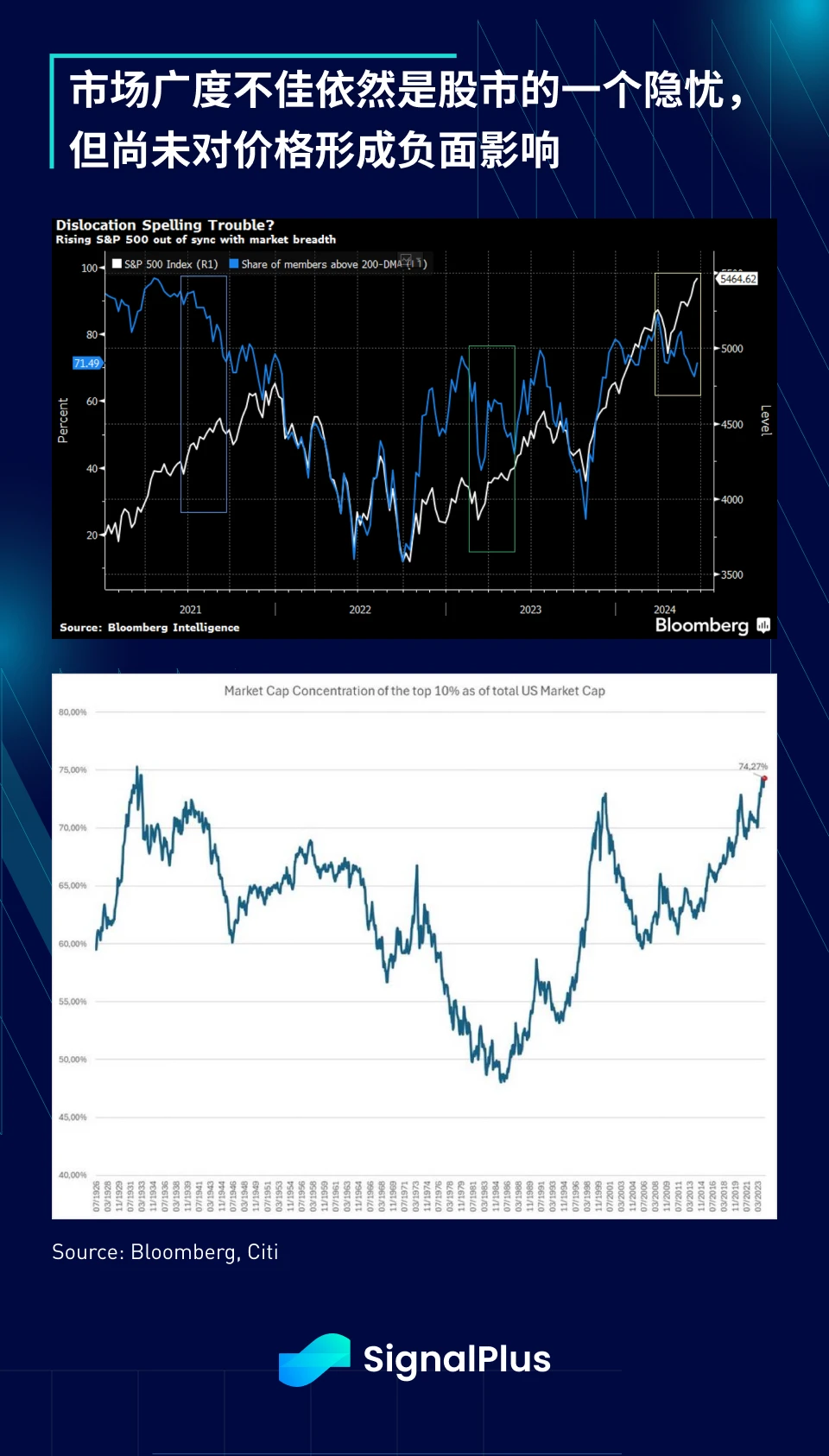

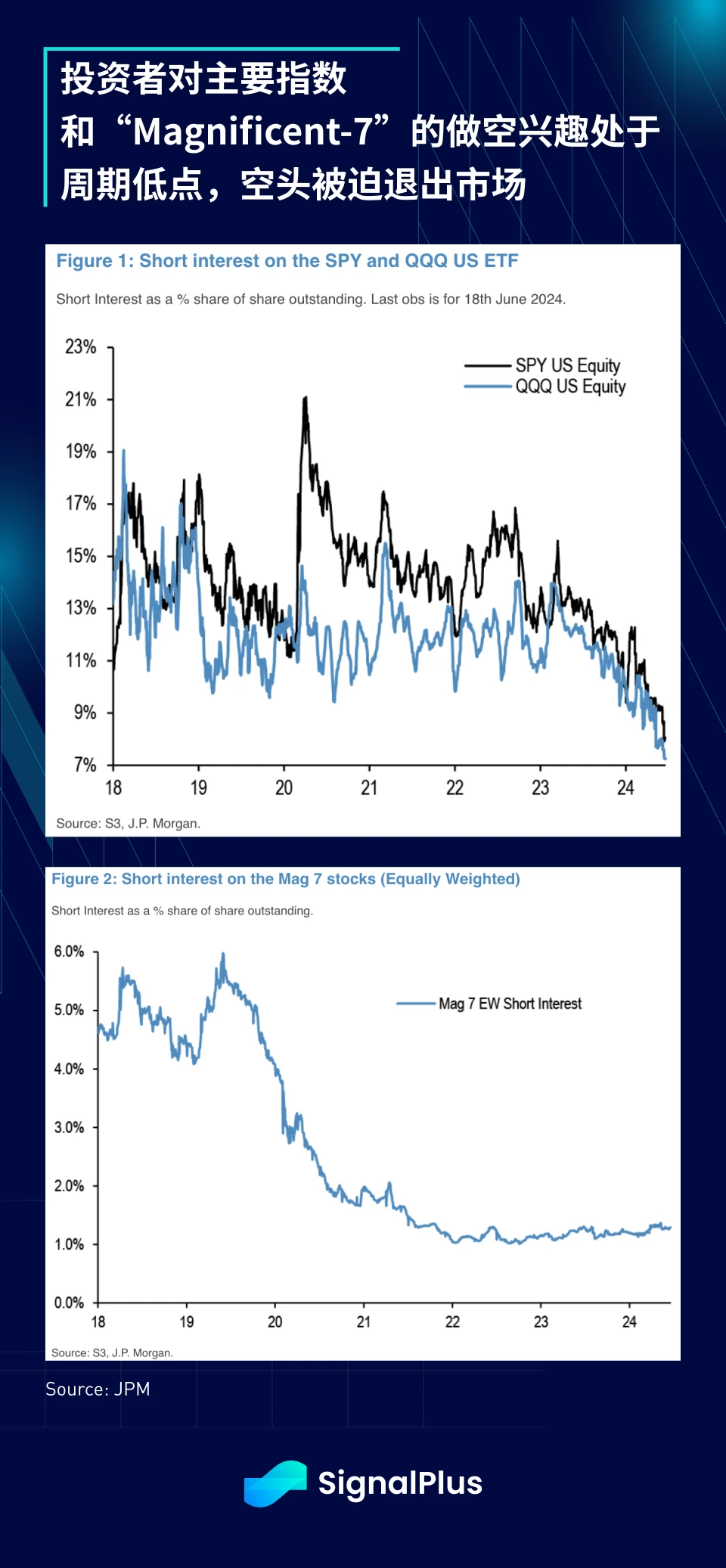

The stock market closed last Friday, and the major indexes still performed strongly. Brokerages reported that as the major indexes remained firm and short covering continued throughout the week, Fridays PCE will be the most important data release of the week. Narrow market breadth and shrinking leading groups remain concerns for the stock market, but have not yet translated into substantial weakness, short sellers continue to be eliminated, and the markets short interest in SPX, Nasdaq and Magnificent-7 is at multi-year lows.

The only asset class to suffer last week was cryptocurrencies, with the majors (BTC/ETH) down 3% and altcoins seeing a massive sell-off, with many prominent tokens down 10-15% in a week and down nearly 70% from their recent highs, while the massive net outflows from BTC ETFs obviously didn’t help.

One difference in this cycle is that the rebound in major currencies is unlikely to lead to a positive spillover effect for altcoins/NFTs, but crypto native users were hit particularly hard last week due to various airdrop conspiracies in well-known DeFi projects. Many native users have been working hard on airdrops in the past year as new alphas, but the actual rewards of projects such as zkSync, Layer Zero, and Eigenlayer were significantly lower than expected, shaking user confidence and even sparking many discussions about the end of the airdrop era. With NFT, memecoin and Ethereum L1 fees continuing to fall, will the native ecosystem usher in another huge change? It is indeed a very interesting year.

Vous pouvez rechercher SignalPlus dans le Plugin Store de ChatGPT 4.0 pour obtenir des informations de cryptage en temps réel. Si vous souhaitez recevoir nos mises à jour immédiatement, veuillez suivre notre compte Twitter @SignalPlus_Web3, ou rejoindre notre groupe WeChat (ajouter l'assistant WeChat : SignalPlus 123), le groupe Telegram et la communauté Discord pour communiquer et interagir avec plus d'amis. Site officiel de SignalPlus : https://www.signalplus.com

This article is sourced from the internet: SignalPlus Macro Analysis Special Edition: Round 2

En lien : Opinion : Le marché haussier des altcoins arrive, il est temps d'acheter en cas de baisse

Français : Auteur original : CryptoAmsterdam Traduction originale : TechFlow Le marché haussier des altcoins arrive-t-il ? Cet article exprimera mon point de vue sous les deux aspects suivants. Il existe différentes étapes d'un marché haussier, et je pense que le marché haussier des altcoins n'a pas encore commencé. Pourquoi je pense que beaucoup de gens passent à côté et comment je le fais. cycle Tous les actifs, sur n'importe quelle période, présenteront des structures cycliques similaires. Concentrez-vous sur le cycle hebdomadaire, qui est ce que nous appelons généralement un marché haussier sur les périodes plus longues. Marché haussier Marché baissier Période de consolidation Période de doute (1) Les phases 4 et 5 du marché haussier sont celles où se produit la hausse parabolique. La structure du cycle s'applique au BTC, et vous pouvez trouver la structure du marché dans les fluctuations à chaque étape du cycle. Bull…