Bilan complet des opérations d'investissement de la rédaction d'Odaily (21 juin)

Cette nouvelle rubrique est un partage d'expériences d'investissement réelles par les membres de la rédaction d'Odaily. Elle n'accepte aucune publicité commerciale et ne constitue pas un conseil d'investissement (car nos collègues sont très doués pour perdre de l'argent) . Son objectif est d'élargir les perspectives des lecteurs et d'enrichir leurs sources d'information. Vous êtes invités à rejoindre la communauté Odaily (WeChat @Odaily 2018, Groupe d'échange Telegram , Compte officiel X ) pour communiquer et se plaindre.

Recommandateur : Nan Zhi (X : @Assassin_Malvo )

Introduction :Acteur on-chain, analyste de données, joue à tout sauf aux NFT

Partager : The primary market is recovering, and a new Meme token with a market value of tens of millions of dollars is created every day. Focus on two features: the cat and dog market on Solana has recovered, and the top ones are basically animals; the same hot spot often has multiple networks blooming at the same time, but only one of Ethereum and Solana will survive. Solana animals are dominant, and other Ethereum concepts are likely to win. You can focus on the hot spots that appear at the same time.

Recommandé par : Wenser (X: @wenser 2010 )

Introduction : 10 U Ares, the exchange uninstalls players

partager :

-

The market bottomed out amid volatility, and the key nodes thereafter became the options delivery date on the 28th of the month and the Ethereum ETF approval news in early July.

-

Recently I saw a post about being an LP after the emergence of Trump concept coin DJT. Perhaps this will also be an arbitrage opportunity for the popular meme coin in the future. Post link: https://x.com/xxq_jup/status/1803397421961199866?s=46

-

Others feel that the more they try to buy at the bottom, the less they know where the bottom is. Just buy a little and give the market a little reaction, otherwise even fewer people will enter the circle. Remember: you are not buying the bottom, but the hope for the cryptocurrency industry.

Recommandateur : Qin Xiaofeng (X : @QinXiaofeng 888 )

Introduction : Option chien fou, preneur de mème

partager :

-

BTCs lows are constantly moving downwards, and it may drop to the $60,000 mark, but I personally feel that as long as it does not break $64,000, it is still bullish. After all, the average holding cost of institutional spot ETFs is around $60,000, and the average purchase price of MicroStrategy in the past month is also $65,000. In the current market, a big positive line can recover the decline. It is recommended to buy call options on Friday of the week in the future, and to prevent accidents, you can also open a 30% put option for hedging.

-

As for spot, I sold ZRO as soon as I received it last night. I feel that there will be no big market for altcoins in the next period of time, and they may even continue to fall by more than 20%. After all, when institutions are uncertain about the future market, they usually sell altcoins and buy Bitcoin after the altcoins are unlocked.

Recommender: Planet Security (Twitter: @BTC2024ATH )

Introduction : Brainless All-in Level 2, only look at the long side, and hammer the air force dog head

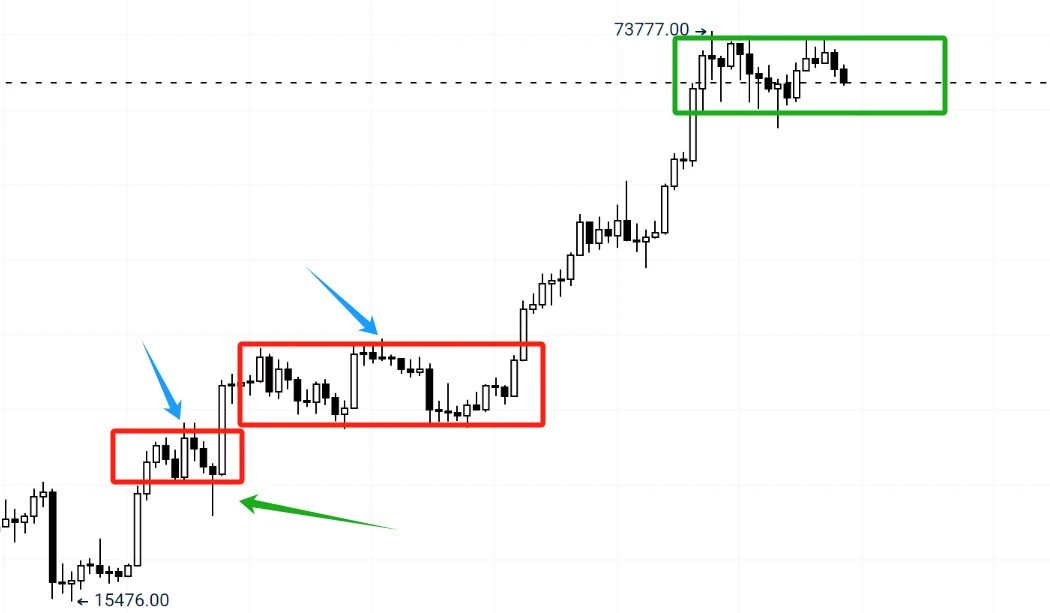

Partager : (Big Pie) Currently, the price has fallen too little. If the price falls less, it needs more sideways movement. This is equivalent to two intervals, 63500-71500, or the wider 60000-72000. The difference between the two intervals is that the large interval means a relatively solid bottom structure, and the small interval requires more testing and trading volume. For the small interval, it is necessary to make corresponding pull-up actions around 65500 and 67100. However, after the large interval is confirmed around 6w, it only needs to observe 71500. The middle can be ignored.

There is also a more useful inventory, especially for large ranges:

However, the current green sideways structure has not reached a new high in the second section, so it looks relatively complicated, without clear signals. Fortunately, the overall outflow has been relatively stably absorbed, and there is obvious intervention of the main force in some positions in the large range fluctuations. The power of the bears is not as strong as imagined, so it gives me the feeling that after the test of 6w here, it is likely to be a bottom area.

However, the current green sideways structure has not reached a new high in the second section, so it looks relatively complicated, without clear signals. Fortunately, the overall outflow has been relatively stably absorbed, and there is obvious intervention of the main force in some positions in the large range fluctuations. The power of the bears is not as strong as imagined, so it gives me the feeling that after the test of 6w here, it is likely to be a bottom area.

Recommandé par : Asher (X: @Asher_0210 )

Introduction :Imitations à faible capitalisation boursière, embuscade à long terme, jeux de blockchain, exploitation de l'or et parasitisme

partager :

-

Money-making: After the announcement of the ZKsync and LayerZero airdrops, the funds of various Ethereum Layer 2 networks were gathered in the exchanges. In the future, we plan to pay attention to money-making opportunities in the BTC ecosystem.

-

The update of the second chapter of Pixels is simply lame. The major changes in materials and resources make people confused for a while. The most important thing is that the token income has not only not increased but has decreased. Although it is better after todays update, the current income cannot effectively attract newcomers. Although Mavia has opened a ruby exchange token mechanism, the income is also pitifully low, and I have abandoned the game.

-

Copycat: BWB finally pulled up, continue to hold, target 1 u.

Records précédents

Lectures recommandées

The cryptocurrency circle is holding a big “618” promotion. Is there any hope for altcoins?

Lorsque le marché est morose, suivez ce guide pour augmenter la valeur des pièces stables

This article is sourced from the internet: Full record of Odaily editorial department investment operations (June 21)

In the past 24 hours, many new popular currencies and topics have appeared in the market, which may be the next opportunity to make money , including: The sectors with relatively strong wealth-creating effects are: ETH ecological blue-chip projects, Curve-related tokens; Hot searched tokens and topics: Renzo, Particle Network, DJT Potential airdrop opportunities include: Skate, Sanctum Data statistics time: June 19, 2024 4: 00 (UTC + 0) 1. Market environment On Tuesday, the crypto market fell across the board. Bitcoin fell below the $65,000 support level in the short term. Several mainstream altcoins fell by double-digit percentages. As of now, the trading price of Bitcoin has rebounded to $65,056, a 24-hour drop of 2.36%. According to Coinglass data, about $372 million of crypto leveraged long positions were liquidated in the…