Bitget Research Institute : la SEC met fin à son enquête sur ETH 2.0, les devises de l'écosystème ETH rebondissent dans tous les domaines

Au cours des dernières 24 heures, de nombreuses nouvelles devises et sujets populaires sont apparus sur le marché, ce qui peut être la prochaine opportunité de gagner de l'argent , y compris:

-

The sectors with relatively strong wealth-creating effects are: ETH ecological blue-chip projects, Curve-related tokens;

-

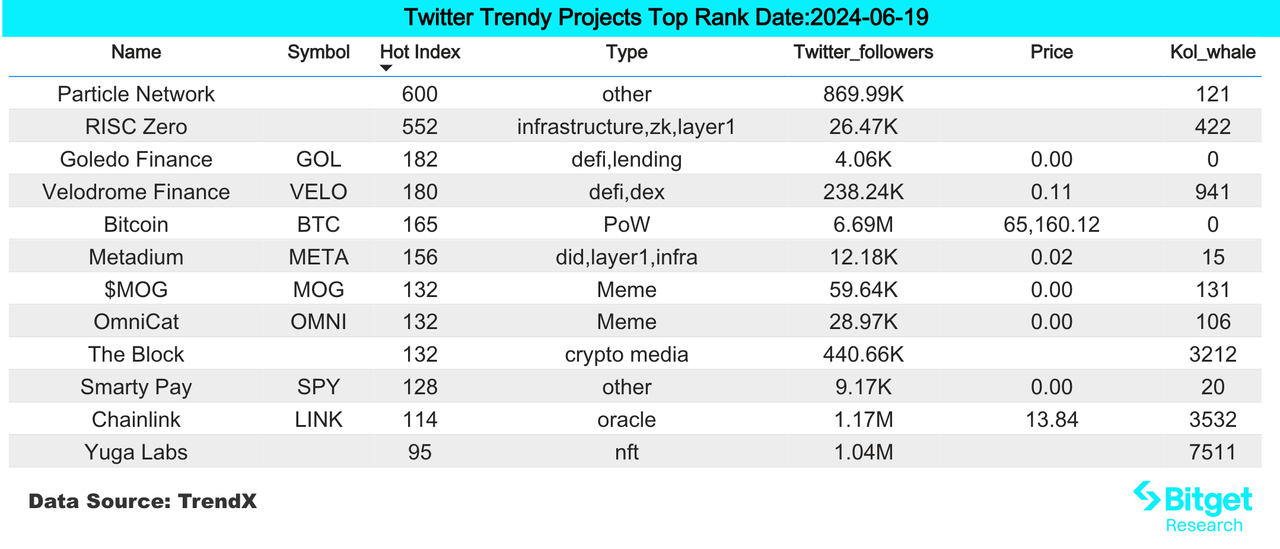

Hot searched tokens and topics: Renzo, Particle Network, DJT

-

Potential airdrop opportunities include: Skate, Sanctum

Data statistics time: June 19, 2024 4: 00 (UTC + 0)

1. Environnement du marché

On Tuesday, the crypto market fell across the board. Bitcoin fell below the $65,000 support level in the short term. Several mainstream altcoins fell by double-digit percentages. As of now, the trading price of Bitcoin has rebounded to $65,056, a 24-hour drop of 2.36%. According to Coinglass data, about $372 million of crypto leveraged long positions were liquidated in the past 24 hours, and the short positions were liquidated at $61.8 million. The market showed a clear spot premium, indicating that market participants speculative activities have decreased. Earlier, the BTC order book showed that the buying volume was concentrated around $65,000. It has now fallen to around $64,000. Bitcoin is still below the 50-day moving average, which puts pressure on the medium-term trend. Investors still need to remain patient.

In the U.S. stock market, Nvidia surpassed Microsoft to become the worlds most valuable listed company. At the close, the SP and Dow Jones indexes rose by 0.25% and 0.15% respectively, and the Nasdaq index was basically flat. We need to continue to pay attention to the correlation between Nasdaq and BTC. If the correlation begins to turn positive, but Nasdaq begins to fall, it will have a greater impact on the crypto market.

2. Secteur créateur de richesse

1) Sector changes: ETH ecosystem blue chip projects

raison principale:

Bitwise has submitted an S-1 revision to the U.S. Securities and Exchange Commission (SEC) for an Ethereum spot ETF, which will include changes after the SECs first round of consultation. It is unclear whether more rounds of consultation are needed, and product fees have not yet been disclosed. According to this document, overall, the SECs end of its investigation into ETH 2.0 has led to a substantial rebound in the blue-chip tokens in the ETH ecosystem that had an eye-catching performance in the last bull market cycle. In the future, this sector will be stronger than other sectors, but it also depends on the overall market situation. The market is relatively weak now, and trading still needs to be cautious.

Rising situation:

ENS, LDO, and RPL have risen by 16%, 20%, and 17% respectively in the past 24 hours;

Facteurs affectant les perspectives du marché :

At present, the ETH spot ETF is likely to be approved and start trading in a few weeks to months. Before and after the ETH spot ETF is approved, the ETH/BTC exchange rate may continue to rise, and ETH is expected to break new highs in the next few months. The breakthrough of ETH will drive the market value of the entire altcoin to rise sharply. Traders on ETH will begin to have greater demand for leverage and trading. Blue chip projects, especially blue chip DeFi projects with actual returns, will continue to rise, ushering in the altcoin season.

2) Sector changes: Curve-related tokens (CRV, CVX)

raison principale:

Influenced by yesterdays news, Bitwise submitted an S-1 revision for Ethereum spot ETF, and the SEC will end its investigation into Ethereum 2.0, which means that ETH is not a security. ETH ecosystem assets CRV and CVX also rose sharply.

Rising situation:

CRV and CVX have risen 17% and 36% respectively in the past 24 hours;

Facteurs affectant les perspectives du marché :

Curve is still one of the best places for stablecoin bulk transactions, and it still maintains a good real profit. Its biggest problem is that its narrative is too old, and there are no new products or operations that excite the market. At the same time, previous accidents and this liquidation decline inevitably make the market full of concerns. However, the price of CRV bought by many whales in OTC before was higher than 0.3 US dollars, so the current price of CRV is still attractive.

3) Sectors that need to be focused on in the future: AI sector

raison principale:

-

Binance a récemment annoncé son soutien à la fusion de FET, AGIX et OCEAN dans ASI, ce qui a suscité de vives discussions en Europe et aux États-Unis et a attiré une grande attention de la communauté ;

-

Arweave AO announced that it has launched AO token minting. Users holding AR can obtain AO. AO issuance is relatively fair and is used for data layer business.

Liste de devises spécifique :

-

TAO : Bittensor est un protocole open source qui alimente les réseaux d'apprentissage automatique basés sur la blockchain. Les modèles d'apprentissage automatique sont formés de manière collaborative et sont récompensés dans TAO en fonction de la valeur des informations qu'ils fournissent au collectif.

-

NEAR : Récemment, de nombreux projets d’IA dans l’écosystème NEAR sont en phase de construction/financement. NEAR devrait devenir le pôle d’IA du futur.

-

ASI : Les jetons de FET, AGIX et OCEAN après la fusion pourraient avoir une volatilité plus élevée et pourraient offrir des opportunités de spéculation ;

-

AR: Arweave’s new token AO is about to be issued, backed by technical fundamentals and has a good track record.

3. Recherches rapides des utilisateurs

1) Dapps populaires

Renzo: Liquidity re-pledge protocol Renzo announced the completion of $17 million in financing, which was divided into two rounds, the first round was led by Galaxy Ventures, and the second round was led by Abu Dhabi-based Nova Fund – BH Digital. Due to the good news, the REZ token rose by 3.74% in a short period of time. Although the token price fell sharply, Renzo still has $3.8 billion in TVL, and user loss is not serious.

2) Twitter

Particle Network: Positioned as a modular L1 that empowers chain abstraction. In the test network Phase 1, Particle Networks Universal Account is based on Particle L1s unique high-performance EVM execution environment, linking various mainstream L1/L2s such as Ethereum, BNB Chain, Polygon, and BTC L2s. Currently, the number of accounts on its chain has exceeded 1 million, and there may be airdrops in the future. It is popular and users are recommended to participate.

3) Région de recherche Google

D'un point de vue global :

DJT: Pirate Wires, an American media outlet, published a tweet on the X platform, saying, Rumor has it that Trump is launching an official token on Solana — $DJT. This move has led to a surge in attention to the DJT token, and the on-chain data analysis platform Arkham officially stated that Arkham Intelligence will offer a $150,000 bounty to any user who can clearly prove the identity of the issuer of the Trump-themed Solana on-chain token DJT. But then the price began to fall back, and has fallen by more than 57% in the past 24 hours. The token price fluctuates greatly and is highly uncertain, so users are not recommended to continue paying attention.

Parmi les recherches les plus fréquentes dans chaque région :

(1) There is a lack of attention on a unified theme in Asia. Each country has its own focus, and there is little attention paid to projects and hot issues.

(2) There is a significant difference between the hot searches in Europe and the United States and those in Asia: English-speaking countries have shown a concentrated focus on meme tokens. For example, meme tokens such as boden, pepe, trump, and floki have a high level of attention in the United States. The United Kingdom pays more attention to public chain projects, and monad, icp, and hedra have always remained on the hot search list.

Potentiel Largage aérien Opportunités

Patin

Skate vise à briser le cloisonnement des applications DApp avec la couche d'application complète Skate. Autrement dit, les Dapps peuvent fonctionner sur plusieurs chaînes avec un seul état, et de nouvelles blockchains peuvent également être connectées à Skate. Les utilisateurs et les développeurs n'ont besoin d'interagir qu'avec Skate seul pour accéder instantanément à divers réseaux et bénéficier d'une liquidité unifiée. Le projet lancera 8% de jetons par airdrop.

Le prédécesseur de Skates était le protocole de gestion d'actifs en chaîne Range Protocol, qui a bouclé un tour de financement d'amorçage de 1 TP10T3,75 millions en septembre de l'année dernière, dirigé par HashKey Capital et Nomad Capital.

Méthode de fonctionnement spécifique : Actuellement, vous pouvez obtenir 600 points Ollies et un NFT Early Bird en accomplissant des tâches simples. Associez votre portefeuille et accomplissez des tâches simples sur les réseaux sociaux, comme le transfert de tweets. Vous pouvez créer un NFT Early Bird sans frais de gaz. Vous pouvez obtenir plus de points en invitant.

Sanctuaire

Le protocole LST de l'écosystème Solana Sanctum a officiellement annoncé le lancement du programme de fidélité Sanctum Wonderland. Selon les rapports, Sanctum Wonderland vise à exploiter pleinement SOL pour obtenir des avantages grâce à une expérience ludique. Les utilisateurs peuvent collecter des animaux de compagnie et gagner des points d'expérience pour les améliorer en jalonnant SOL, et gagner de l'EXP grâce aux animaux de compagnie.

Auparavant, le protocole de service de jalonnement de liquidités de l'écosystème Solana, Sanctum, avait terminé son tour de financement d'extension de tour d'amorçage, dirigé par Dragonfly, avec la participation de Solana Ventures, CMS Holdings, DeFiance Capital, Genblock Capital, Jump Capital, Marin Digital Ventures et d'autres. Le financement total a désormais atteint 10,61 millions de dollars américains.

Méthode de participation spécifique : ouvrez le lien, connectez le portefeuille, remplissez le code d'invitation, ② échangez Sol contre Infinity, déposez au moins 0,122 SOL + 0,05. Le portefeuille de dépôt doit préparer au moins 0,172 SOL et déposer au moins 0,11 SOL. L'animal grandira automatiquement et gagnera de l'EXP. Une fois que le solde LST est inférieur à 0,1 SOL, l'animal entrera en hibernation et cessera de gagner de l'EXP. Il est recommandé à ceux qui en sont capables de déposer plus de 1 SOL. 1 SOL rapportera 10 EXP par minute, qui peuvent être retirés à tout moment, et les frais de GAS sont extrêmement bas.

Lien d'origine : https://www.bitget.com/zh-CN/research/articles/12560603811433

【Avertissement】 Le marché est risqué, alors soyez prudent lorsque vous investissez. Cet article ne constitue pas un conseil en investissement et les utilisateurs doivent se demander si les opinions, points de vue ou conclusions contenus dans cet article sont adaptés à leur situation spécifique. Investir sur la base de ces informations est à vos propres risques.

This article is sourced from the internet: Bitget Research Institute: SEC ends investigation into ETH 2.0, ETH ecosystem currencies rebound across the board

Original author: Nina Bambysheva, Forbes reporter Original translation: Luffy, Foresight News When FTX filed for bankruptcy, savvy crypto traders smelled a lucrative opportunity. Sam Bankman-Fried’s (SBF) crypto empire was wiped out of billions of dollars in customer funds, but still held $3.4 billion worth of various cryptocurrencies, an estate that had to be sold to satisfy creditors, likely at well below market prices. Most of the companies responsible for managing bankrupt assets had little experience with cryptocurrencies, and early attempts to integrate funds sometimes resulted in embarrassing losses of tens of thousands of dollars. In September 2023, bankrupt FTX tapped the asset management arm of billionaire Michael Novogratzs Galaxy Digital Holdings to help manage its massive cryptocurrency reserves, including selling, hedging, and staking cryptocurrencies. This process allows token holders to…