Bitget Research Institute : La Banque centrale européenne réduit ses taux d'intérêt comme prévu et IO.NET sera ouvert à la négociation

Au cours des dernières 24 heures, de nombreuses nouvelles devises et sujets chauds sont apparus sur le marché, et il est très probable qu'ils constitueront la prochaine opportunité de gagner de l'argent.

The European Central Bank cut interest rates by 25 basis points, which may start a cycle of interest rate cuts by global central banks. BTC spot ETFs have continued to see net inflows for 18 consecutive days. The altcoin market has performed flatly. The Solana ecosystem meme trading activity remains high. io.net (IO) will be open for trading on June 11.

-

The sectors with the strongest wealth-creating effect are: GameStop concept meme

-

The sector that deserves attention in the future: TON Ecosystem

-

The most searched tokens and topics by users are: Glacier Network, Ultiverse, io.net

-

Potential airdrop opportunities include: UXLINK, Movement

Data statistics time: June 7, 2024 4: 00 (UTC + 0)

1. Environnement du marché

The European Central Bank cut interest rates for the first time since 2019, cutting interest rates by 25 basis points, which may start a cycle of interest rate cuts by global central banks. BTC spot ETFs had a net inflow of US$218 million yesterday, which has been a net inflow for 18 consecutive days. BlackRocks IBIT holdings exceeded 300,000 BTC. After a slight fluctuation, BTC once again broke through US$71,000 today, once again hitting a new high.

Altcoins performed mediocrely, but memecoins on the Solana chain still showed strong trading activity. Keith Gill (Roaring Kitty) scheduled a live broadcast on YouTube on June 8 and disclosed that his GME stock and options positions amounted to $586 million, triggering a surge in GME and KITTY tokens on the Solana chain. In addition, io.net (IO), an AI+DePIN project with a financing of 40 million, announced the token economy and will be open for trading on June 11.

2. Secteur créateur de richesse

1) Sector changes: GameStop concept meme

raison principale:

The king of retail investors Roaring Kitty scheduled a live broadcast on Youtube on June 8, and GME stocks and the Meme token of the same name rose sharply in a short period of time. A screenshot on Reddit showed that the well-known investor Roaring Kitty disclosed that the total value of its GEM stock and option positions has reached approximately US$586 million.

Rising situation:

The GME token on Solana has risen by +120% in the past 24 hours, and KITTY (Roaring Kitty) has risen by +240% in the past 24 hours; GameStop (GME) on the ETH chain has risen by +160% in the past 24 hours;

Facteurs affectant les perspectives du marché :

Whether the live broadcast scheduled by Roaring Kitty can be carried out as scheduled, the content and effect of the live broadcast will greatly affect market sentiment. Previously, the correction after each GameStop concept meme surge was large. Investors need to pay attention to risk control and avoid blindly chasing high prices.

2) Le secteur sur lequel il faudra se concentrer à l’avenir : l’écosystème TON

raison principale:

The popularity of Notcoin has boosted the activity of the entire TON ecosystem, and a large number of similar projects and improved GameFi projects have emerged. TON ecosystem currently has several high-traffic projects that have not issued tokens: TON ecosystem game Hamster Kombat claims that its user base has exceeded 100 million, and Catizens user base has exceeded 15 million… The market is full of expectations for the mass adoption of future TON ecosystem projects, and these projects will bring more users and funds to TON.

Liste spécifique des devises : TON, NOT, STON, GRAM, FISH

3. Recherches rapides des utilisateurs

1) Dapps populaires

Glacier Network:

Glacier Network is building a programmable, modular and scalable blockchain infrastructure for storing, indexing and querying data to enhance AI at scale. Glacier enables verifiable computing through GlacierAI, GlacierDB and GlacierDA. Glacier Network has completed $8 million in angel and seed rounds of financing at a valuation of $100 million, with participation from Foresight X and others.

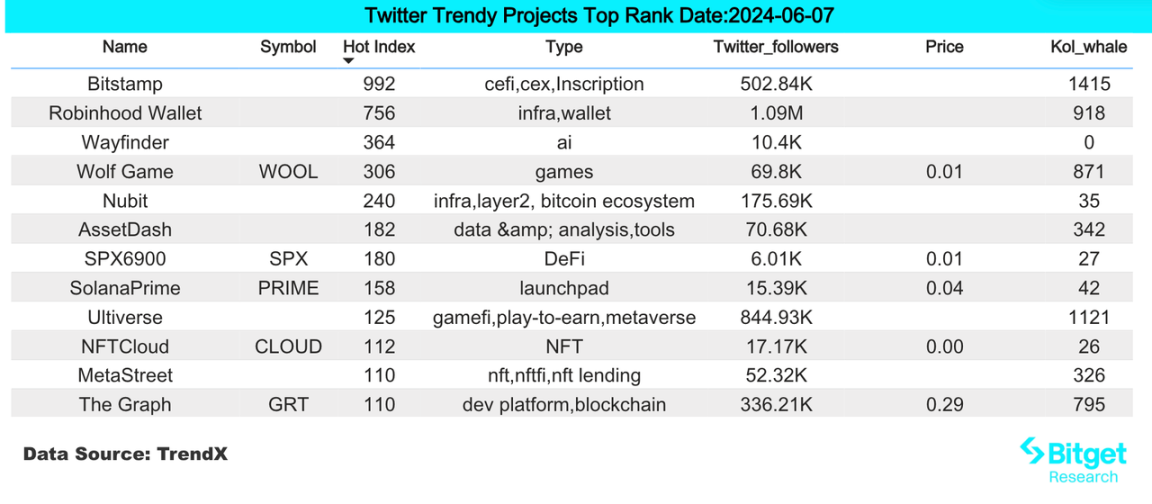

2) Twitter

Ultiverse:

Ultiverse is an AI-driven one-stop platform for Web3 game production and publishing, promoting the mass adoption of AI-enhanced Web3 games. Based on the Bodhi protocol, Ultiverse connects different game worlds in a generative AI way. Ultiverse has completed three rounds of financing, with a luxurious investment lineup, including Binance Labs and other investments, with a total financing of more than 10 million US dollars. Yesterday, Binance Web3 tweeted that the 15 million ULTI rewards of the Binance Web3 Wallet event in cooperation with Ultiverse have been fully distributed, and eligible participants can check their wallets.

3) Région de recherche Google

D'un point de vue global :

IO.Net: Yesterday, Binance Launchpool announced the launch of io.net (IO), where users can mine IO by staking BNB and FDUSD. The mining period is 4 days, starting at 8:00 am on June 7th, Beijing time. It attracted a lot of attention on Twitter and the community, bringing in a lot of traffic. The project is a decentralized computing network that supports the development, execution, and expansion of ML applications on the Solana blockchain, combining 1 million GPUs to form the worlds largest GPU cluster and DePIN.io.net aggregates underutilized resources.

Parmi les recherches les plus fréquentes dans chaque région :

(1) In the hot searches in English-speaking regions, there is a certain amount of attention paid to Bitstamp, mainly because Robinhood announced that it would acquire the cryptocurrency exchange Bitstamp for US$200 million in order to expand outside the United States. The acquisition will be completed in the first half of 2025, which has attracted considerable attention.

(2) In Europe and the United States, people focus on projects with fundamentals, mainly on RWA, DePIN, and POW public chains. Hot search projects include Etherfi, Floki, Boden, etc.

(3) The CIS region paid attention to the TON ecosystem and AI projects. Assets in this field such as NOT Coin and ARKM appeared in the hot searches on Google yesterday.

Potentiel Largage aérien Opportunités

UXLINK

UXLINK is a groundbreaking web3 social system designed for mass adoption, allowing users to build social assets and trade cryptocurrencies. It includes a series of highly modular Dapps, from onboarding to graph formation, group tools to social trading, all seamlessly integrated in Telegram.

UXLINK recently announced financing, led by SevenX Ventures, Ince Capital, and HashKey Capital, with a total financing of US$15 million.

Specific participation method: Web3 social infrastructure project UXLINK issues IN UXLINK WE TRUST series NFT as airdrop vouchers. According to the users community contribution, on-chain interaction and asset status, it is divided into four levels: MOON, TRUST, FRENS, and LINK, corresponding to different rights and interests and the number of UXLINK token airdrops.

Mouvement

L'équipe de développement de blockchain Movement Labs a été fondée en 2022 et a déjà réalisé un tour de table de $3,4 millions en septembre 2023. En plus de son produit phare Movement L2, Movement Labs lancera également Move Stack, un framework de couche d'exécution compatible avec les frameworks de rollup. tels que l'Optimisme, le Polygone et l'Arbitrum.

L'équipe de développement de blockchain Movement Labs a été fondée en 2022 et a déjà réalisé un tour de table de $3,4 millions en septembre 2023. En plus de son produit phare Movement L2, Movement Labs lancera également Move Stack, un framework de couche d'exécution compatible avec les frameworks de rollup. tels que l'Optimisme, le Polygone et l'Arbitrum.

Récemment, Movement Labs a finalisé un cycle de financement de série A de $38 millions de dollars, dirigé par Polychain Capital, avec la participation de nombreuses institutions bien connues telles que Hack VC, Foresight Ventures et Placeholder.

Méthode de participation spécifique : entrez dans l'interface des tâches zélées du Mouvement (remarque : les tâches sociales ont des périodes de temps et des tâches qui sont en ligne en permanence), vous pouvez interagir avec DEX, interagir avec quelques tests à volonté et attendre les actions ultérieures du site officiel.

Plus d'informations sur Bitget Research Institute : https://www.bitget.fit/zh-CN/research

Le Bitget Research Institute se concentre sur les données en chaîne et l'exploitation d'actifs précieux. Il exploite des investissements de valeur de pointe grâce à la surveillance en temps réel des données en chaîne et aux recherches régionales à chaud, et fournit des informations au niveau institutionnel aux passionnés de cryptographie. Jusqu'à présent, il a fourni aux utilisateurs mondiaux de Bitgets des actifs précieux à un stade précoce dans plusieurs secteurs populaires tels que [Arbitrum Ecosystem], [AI Ecosystem] et [SHIB Ecosystem]. Grâce à des recherches approfondies basées sur des données, il crée un meilleur effet de richesse pour les utilisateurs mondiaux de Bitgets.

« Clause de non-responsabilité » : le marché est risqué, alors soyez prudent lorsque vous investissez. Cet article ne constitue pas un conseil en investissement et les utilisateurs doivent se demander si les opinions, points de vue ou conclusions contenus dans cet article sont adaptés à leur situation spécifique. Investir sur la base de ces informations est à vos propres risques.

This article is sourced from the internet: Bitget Research Institute: The European Central Bank cuts interest rates as expected, and IO.NET will be open for trading on June 11

Related: V Gods new article: Multi-dimensional Gas Pricing to Improve Ethereum Scalability

Original article: Multidimensional gas pricing Compiled by: Odaily Planet Daily Asher In the Ethereum network, resources are limited and priced through a single resource called Gas. Gas is a measure of the computational effort required to process a particular transaction or block. Gas combines multiple types of effort, the most important of which are: Primitive calculations (such as ADD, MULTIPLY ) Read and write Ethereum storage (such as SSTORE, SLOAD, ETH transfers) Data bandwidth Cost of generating a block ZK-SNARK proof For example, this transaction cost a total of 47085 Gas. This includes: (i) 21000 Gas for the base fee; (ii) 1556 Gas for the calldata bytes that are part of the transaction; (iii) 16500 Gas for reading and writing storage; (iv) 2149 Gas for log generation; and the rest…