Interpretation of Harris Poll Report: Cryptocurrency Becomes an Important Issue in Swing State Ballots?

In the US presidential election, swing states are important targets for the Democratic and Republican parties. Since no particular candidate or party has overwhelming support to obtain electoral votes in these states, winning the electoral votes in these states is very important to winning the election.

Earlier this month, Harris Poll, a well-established polling organization founded in 1963, and Digital Currency Group, a blockchain venture capital entreprise, jointly released a poll called Crypto Attitudes in Swing States. The respondents to the survey were 1,201 registered American voters from politically undecided swing states. At the same time, the recent policy shift of the Democratic Party on cryptocurrencies and the friendly attitude of the Republican Party towards cryptocurrencies also support some of the findings of this report.

The 45-page poll report shows some key results. For example, 40% of voters surveyed want political candidates to talk more about digital currencies; more than half are worried that policymakers will suppress innovation through excessive regulation; nearly half of voters do not trust political candidates who interfere with cryptocurrencies; a quarter of people said that their enthusiasm for cryptocurrencies would make them trust a political candidate more; and 30% said they would be more inclined to support political candidates who are friendly to cryptocurrencies.

The survey was conducted from April 4 to April 16 and took the form of a 10-minute online questionnaire. Eligible voters need to be U.S. residents aged 18 or older and live in swing states, including Michigan, Nevada, Ohio, Montana, Pennsylvania, and Arizona. Participants need to register as voters in the state where they live. Here are more details about the poll.

Finding 1: The current financial system is generally unpopular, with voters generally believing that the system is unfair, with younger generations in particular being disadvantaged.

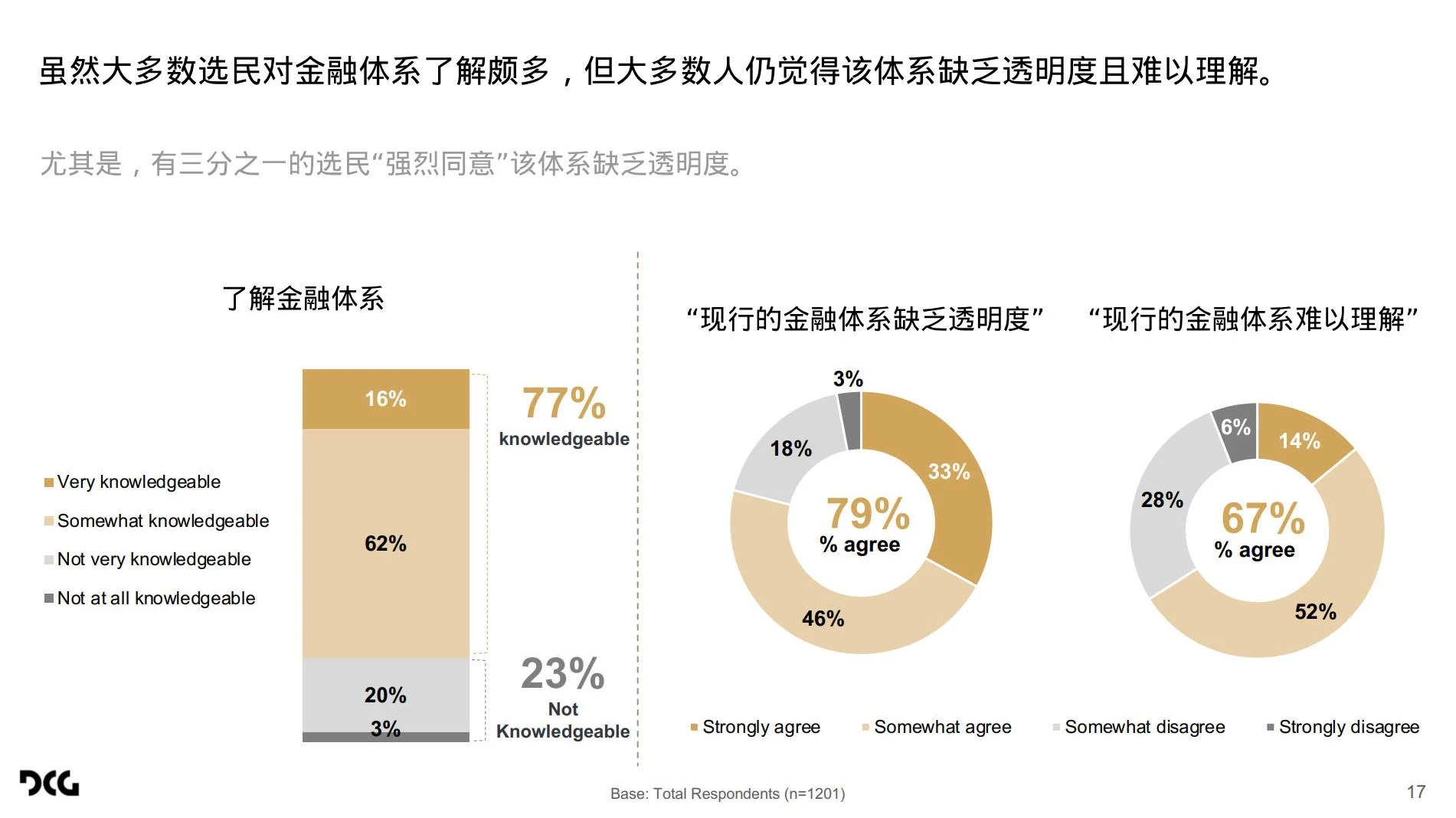

• Specifically, the current financial system evokes negative reactions from voters, with most believing that it favors the elite over ordinary people (80%), lacks transparency (79%), is difficult to understand (67%), and sets up the younger generation for failure (63%).

• In contrast, few believe the current financial system is designed for people like themselves (38%) or fair to everyone (26%).

• Interestingly, the majority of respondents (60-65%) have an overall positive attitude toward their current and future personal financial health (60-65%) and are also positive about their understanding of the financial system (77%). However, this positive attitude does not translate into a positive feeling about the current financial system as a whole.

Finding 2: Cryptocurrencies attract a certain level of interest among a significant number of voters, which forms a pro-cryptocurrency sentiment.

• Current ownership of cryptocurrency among voters is relatively low (14%), and most are unfamiliar with it (69%). About one in five voters plan to own cryptocurrency within the next six months.

• However, nearly a third of voters have a positive attitude toward cryptocurrencies (referred to as “crypto-positive”). Crypto-positive voters are consistently more enthusiastic about cryptocurrencies than voters overall; most associate cryptocurrencies with positive traits such as innovation (62%), promise (50%), and accessibility (45%).

• Most crypto-positive voters agree that cryptocurrency represents a new path to financial security and prosperity (83%), is the future of transacting (79%), levels the playing field for financial health (77%), and is designed for people like themselves (70%).

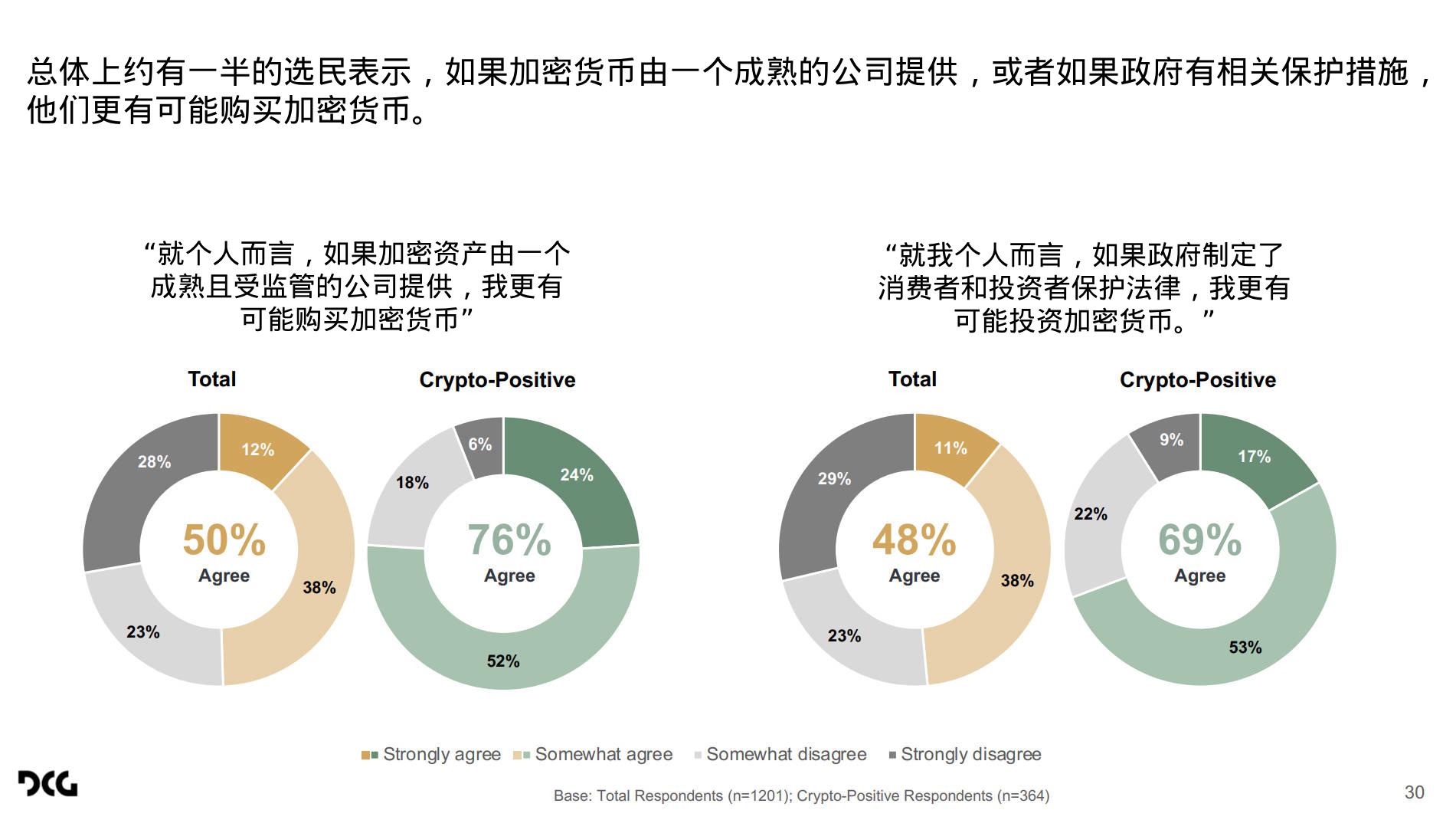

• While skepticism about crypto exists, about half of voters overall, and a majority of crypto-active voters, say they would be more likely to buy crypto if the asset was offered by an established or regulated company (50% overall, 76% for crypto-active voters) or if the government had consumer and investor protection laws in place (48% overall, 69% for crypto-active voters).

Finding 3: Raising cryptocurrency as an election issue may provide critical opportunities for political candidates.

Overall, the vast majority of voters and crypto-active voters plan to participate in the upcoming 2024 elections (90%+), with support for Republicans and Democrats close.

• A significant number of voters (40%) want political candidates to talk more about digital currencies.

• Most voters do not trust elected officials to understand innovative technologies like cryptocurrency, and more than half worry that policymakers are stifling innovation through excessive regulation. The vast majority want policymakers to make sure they understand cryptocurrency before regulating.

• Nearly half of voters distrust political candidates who would interfere with cryptocurrency. A quarter said enthusiasm for cryptocurrency would make them trust a political candidate more. 30% said they would be more inclined to support a political candidate who was crypto-friendly.

• Crypto-active voters are more strongly supportive of the pro-cryptocurrency stance than voters overall.

• Notably, there is broad support for cryptocurrency regulation. An overwhelming majority of voters and nearly half of pro-crypto voters support sweeping reforms to cryptocurrencies. Likewise, about 20-25% of voters and a third of pro-crypto voters want elected officials to focus on cryptocurrency regulation or protections for cryptocurrency investors.

Finding 4: Some notable groups are more open to cryptocurrencies.

• Crypto-active voters are more likely to be male, young, black or Hispanic, and less likely to have a four-year college degree than voters overall.

• Compared to the overall voting population, there are no significant differences in household income and political inclination among crypto-active voters.

• Positive attitudes toward cryptocurrencies are not limited to crypto holders – around 40% of voters who have a positive attitude toward cryptocurrencies have never owned cryptocurrency.

• Among the states surveyed, voters in Ohio have the most negative attitudes toward cryptocurrencies.

What impact will these findings have?

Cryptocurrency’s image among voters could improve with further education

• Most voters feel they don’t understand cryptocurrencies, and even most crypto-positive voters find cryptocurrencies difficult to understand.

• When asked why they had a negative view of cryptocurrencies, some said they were unfamiliar or inexperienced with cryptocurrencies, suggesting that it is possible to change their views with more information or experience.

Voters Positive About Cryptocurrency Represent an Opportunity in the Upcoming Election

• In a highly polarized political environment, cryptocurrency could be a relatively non-partisan issue that could gain support among some voters.

• The demographics of voters who are positive about cryptocurrency (young people and people of color) are particularly attractive to Democratic candidates.

Talking about cryptocurrencies in an informed way may help candidates stand out

• People show considerable interest in candidates talking about digital currencies, but less trust in candidates actually understanding cryptocurrencies. A politician who demonstrates knowledge of cryptocurrencies may stand out.

• Voters who support a pro-crypto candidate say they would view that candidate as forward-looking and open-minded, suggesting a possible halo effect.

In addition to supporting cryptocurrencies, candidates can also win favor by supporting reasonable regulation.

• Support for radical reforms to cryptocurrencies is high among voters overall and crypto-positive voters. More people would buy cryptocurrencies if they were backed by protective government laws, suggesting that hesitancy about cryptocurrencies could potentially be alleviated by trusted authority.

• Suggestions for reasonable regulation of cryptocurrencies within an overall pro-cryptocurrency message could ease the concerns of voters who are skeptical of cryptocurrencies while attracting crypto-positive voters.

This article is sourced from the internet: Interpretation of Harris Poll Report: Cryptocurrency Becomes an Important Issue in Swing State Ballots?

Related: SignalPlus Macro Analysis (20240417): The market restarts the soft landing narrative

Over the past week, slowing economic growth and falling inflation expectations have once again triggered the narrative of a soft landing. This is not the first time we have seen this happen. The most natural reaction of the market at this time is the FOMO sentiment of stocks, buying credit instruments, collecting fixed interest rates, shorting volatility, and earning arbitrage returns. This is almost the standard script since the last FOMC meeting, and in the absence of any significant variables, this trend shows no signs of slowing down. Stocks hit new highs last week, with the SPX up 1.5% to break 5,300, with automakers (+4.4%), technology (+2.9%) and real estate (+2.5%) performing particularly well in a friendly financial environment. The 10-year Treasury yield fell 8 basis points and is now…