Original author: Dacong Fred (X: @Dacongfred)

1. Project division: financial vs. Web2 integration

After the ETH ETF was approved, the entire market fell sharply as expected, which was exactly the same as the trend after the BTC ETF was approved.

Based on the impact of ETFs on the market, we can summarize the US ETF model: expectations are fully raised before going online, resulting in a big surge; after going online, all the positive factors are exhausted, and there is a decline; then, due to the final positive factors after the ETF is approved, it gradually rises slowly again.

However, looking back at this cycle, although there are narratives about AI, DePIN, and Restaking, there have never been hot tracks and projects like Uniswap leading the Defi summer, the NFT craze where everyone changes their avatars, and StepN causing a nationwide movement to participate, as in the previous cycles. This has also made many investors and builders confused about this cycle. What will the bull market of this cycle look like to greet us?

Everyone has made different choices, whether choosing to build the BTC ecosystem, build on the DePIN/AI track, or devote themselves to meme trading full-time, everyone has made bets based on their own beliefs.

In general, the current project exploration can be roughly divided into two schools. One is the financial school, which believes that the development of Web3 must be closely related to finance. Whether it is Defi, NFT or BTC ecology, the essence is still to make a fuss around financial gameplay and asset attributes; the other school is the web2 combination school, which includes social, games, infrastructure (DePIN), AI, etc., hoping to combine the web2 track with blockchain/cryptocurrency to explore new scenarios.

In several previous research reports and analysis articles, I have discussed the development status and challenges of the combination of AI+Web3, as well as the development status of the BTC ecosystem. Today, let’s talk about Defi, a representative track in the financial sector.

2. Why DeFi exploded — Pioneers’ exploration

Defi is a track that has been talked about for a long time. Whether it is Uniswap, the most representative in Dex, or dYdX in the derivatives track, Defi plays a very important role in a public chain and even the entire web3 industry.

Before the birth of Dex, people traded cryptocurrencies through centralized exchanges. The advantages of centralized exchanges are the same as web2, fast speed and simple operation; however, the disadvantages are also obvious, low transparency and poor security. The subsequent collapse of a CEX giant also broke the hearts of many people, especially for web3 users, asset ownership, security and transparency are placed in a very important position.

In 2018, Uniswap V1 realized a decentralized exchange by adopting an automated market maker model (AMM), allowing users to trade directly with smart contracts instead of the traditional order book model of buyers and sellers, thus emerging and leading a new track; later V2 and V3 had new features such as built-in price oracles, support for centralized liquidity and multi-layer fees, and continuously optimized the user experience of using Dex. Uniswap has firmly occupied the leading position in the Dex track since its inception.

On the other hand, as a pioneer of Defi derivatives, dYdX chose to use the order book model to provide leverage and contract trading services, which is closer to the traditional financial model in terms of operation. With relatively high liquidity and a large number of trading pairs, it once occupied a high market share in the derivatives track and led the Defi Summer together with Uniswap.

3. Challengers and the future of Defi

Later, in the development of Defi, the development of Dex and derivatives showed two clearly different paths.

1) Dex binding chain mode: From the perspective of Dex’s TVL, the development of Dex is basically inseparable from binding with a certain chain. Whether it is the take-off of Uniswap and Ethereum, or Pancake binding to BSC, Raydium binding to Solana, and then to Velodrome on Optimism and Aerodrome on Base chain, Dex is a necessity for public chains. Each Dex is essentially the same. Whether it takes off or not, it actually needs to be bound to a chain, and its TVL performance is often highly correlated with the position of the chain.

2) Derivatives innovation model: On the other hand, the generational change of derivatives is more about innovation in gameplay. For example, GMX was only launched in 2021, but it defeated the previous leader dYdX.

Next, let’s further analyze why GMX has emerged as a dark horse before. Compared with dYdX, what are the innovations of GMX? I think there are two core innovations:

1. The model of LP providing a capital pool is used: GMX uses the model of LP providing a capital pool, combined with oracle quotes, so that users can maintain low slippage while trading quickly; – Good for users

2. Innovation in profit-sharing mechanism: 70% of the profits are distributed to liquidity providers (GLP holders), and 30% are distributed to GMX operating token holders. – Good for liquidity providers

These two innovations accurately grasp the two ends of the transaction: users and liquidity providers, allowing them to come from behind and become the new leader in derivatives.

After GMX, some interesting derivative projects have also emerged. For example, SynFutures on the Blast chain has recently hit record highs in on-chain transaction volume. After a careful look, we found that there are several points worth noting:

1. Wealth effect of Blast chain: From Blur to Blast, Blast chain has brought wealth effect since its birth. SynFutures’ choice to deploy on Blast chain is a very smart choice. – Attract users

2. oAMM centralized liquidity: Similar to Uniswap’s centralized liquidity strategy, SynFutures’ oAMM allows LPs to add liquidity to a specified price range, thereby improving liquidity depth and capital utilization efficiency; – Favorable liquidity provision

3. oAMM does not require permission to list coins: In addition, oAMM, like other spot AMMs, supports permissionless listing of coins, so that anyone can create a perpetual contract for trading pairs, making the range of coins unlimited – good for liquidity providers

In addition, I think the most interesting point of SynFutures is the combination of AMM+order book. Let’s analyze this innovation in detail.

As mentioned in Feature 2 above, oAMM allows LPs to concentrate liquidity in a price range, which can be divided into multiple price orders, so that liquidity providers can provide liquidity in the form of on-chain limit orders on SynFutures.

This order book-like liquidity provision model allows many centralized exchange market makers to participate more familiarly and conveniently. It is essentially not much different from the limit order model of centralized exchanges, thus further improving the liquidity of the pool. After benefiting liquidity providers, deeper pools will also attract more users, thus forming a positive cycle.

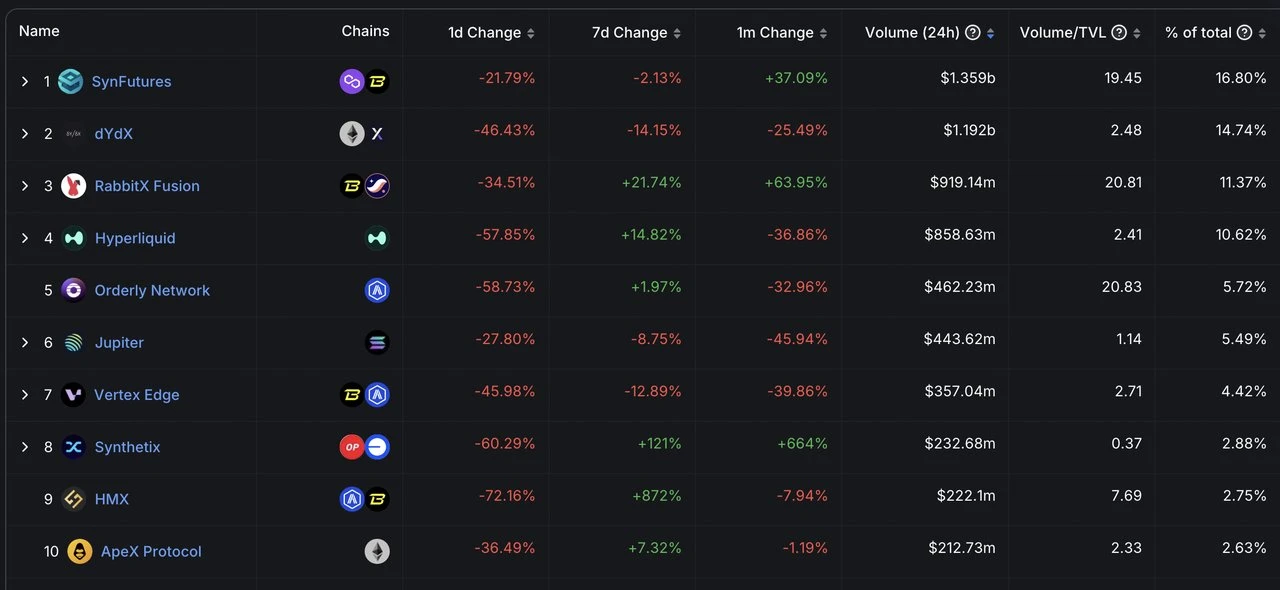

Currently, SynFutures daily trading volume exceeds US$1.3 billion, surpassing the old star projects dYdXs 1.2 billion and GMXs 180 million (not in the top ten). It has performed very strongly in terms of trading volume, bringing new vitality to the derivatives track.

In general, both the financial and web2 integration groups are looking forward to more native and interesting projects emerging, involving more people and money, and finding a sustainable detonation point for the bull market in this cycle in the short term. In the long run, they will penetrate more into the traditional world and create more mass adoption.

This article is sourced from the internet: Talking about the development and future of DeFi

Related: Modular blockchain: The final piece of the Web3 puzzle

I. Introduction Modular blockchain is an innovative blockchain design paradigm that aims to improve the efficiency and scalability of the system through specialization and division of labor. Before the advent of modular blockchain, a single (Monolithic) chain needed to handle all tasks, including the execution layer, data availability layer, consensus layer, and settlement layer. Modular blockchain solves these problems by treating these tasks as freely combinable modules, each focusing on a specific function. Execution layer : responsible for processing and verifying all transactions and managing blockchain state changes. Consensus layer : reach agreement on the order of transactions. Settlement layer : used to complete transactions, verify proofs, and build bridges between different execution layers. Data Availability Layer : Responsible for ensuring that all necessary data is available to participants in…