Glassnode : Comment déterminer le creux du marché et l'heure d'entrée ?

Titre original : Breakdown Metrics Applied : identifier les creux locaux dans un marché haussier

Auteur original : Ukaria OC, CryptoVizArt, Glassnode

Traduction originale : LadyFinger, BlockBeats

Note de l'éditeur :

Dans l'évolution rapide du marché des actifs numériques, une analyse précise des données est devenue la clé pour que les traders puissent saisir le pouls du marché. Les 28 derniers indicateurs segmentés de Glassnode marquent également une avancée majeure dans le domaine de l'analyse en chaîne. Ces indicateurs fournissent non seulement des informations approfondies sur le comportement des détenteurs à court terme, mais fournissent également aux traders des outils puissants pour identifier les creux du marché et optimiser les stratégies de trading.

Glassnode a récemment lancé une série de 28 nouvelles mesures conçues pour offrir une perspective plus nuancée sur les marchés des actifs numériques, marquant ainsi une avancée majeure dans le domaine de l'analyse on-chain. Vous pouvez lire notre annonce originale ici pour en savoir plus.

Ces indicateurs granulaires changent la donne pour les traders. Ils fournissent des informations très détaillées et intuitives qui peuvent être transformées en signaux d'achat et de vente potentiels. L'une des utilisations les plus efficaces de ces nouveaux indicateurs est d'identifier les niveaux d'épuisement parmi les vendeurs de différentes tranches d'âge parmi les détenteurs à court terme.

En appliquant nos nouveaux indicateurs segmentés, les traders peuvent désormais déterminer plus précisément la gravité des pertes non réalisées et le moment du stop-loss, qui marque souvent les creux du marché et les points d'entrée potentiels pendant les marchés haussiers. Ce rapport explore ce cadre en détail et est résumé ci-dessous, fournissant des informations exploitables pour les traders cherchant à optimiser les stratégies d'entrée sur le marché ou DCA.

Pourquoi se concentrer sur les détenteurs à court terme ?

Dans le contexte de l'analyse on-chain, les détenteurs à long terme (LTH) et les détenteurs à court terme (STH) représentent des groupes ayant des comportements et des impacts différents sur le marché. Les détenteurs à court terme sont généralement de nouveaux entrants ou des traders spéculatifs qui sont plus sensibles aux variations de prix. Pendant les marchés haussiers, ces investisseurs ont tendance à être ceux qui perdent le plus car ils sont plus susceptibles de vendre en raison des fluctuations du marché. Ce phénomène rend l'analyse des détenteurs à court terme particulièrement précieuse lorsqu'elle est utilisée pour identifier les creux du marché.

Avantages de l'application d'indicateurs de segmentation à STH

En segmentant le groupe de détenteurs à court terme par âge, nous aidons les traders à identifier plus efficacement les périodes d'épuisement des vendeurs. Par exemple, nous pouvons observer comment les événements de pression et de capitulation non réalisés se propagent au sein du groupe de détenteurs à court terme, en commençant par la période la plus courte (1 jour) et en s'étendant sur des périodes plus longues (1 semaine à 1 mois, voire plus). Cette progression de l'intérieur vers l'extérieur fournit des signaux plus clairs sur les creux potentiels et les retournements de marché.

Cliquez pour voir le graphique en temps réel

En d’autres termes, grâce aux informations fournies par des indicateurs plus précis, les traders peuvent détecter la confluence d’événements de capitulation sur différentes périodes à court terme, augmentant ainsi considérablement la probabilité d’identifier un creux à court terme.

Un cadre pour identifier les creux locaux dans un marché haussier

Pour identifier les états d'épuisement des vendeurs, nous utilisons une série d'indicateurs clés qui donnent un aperçu des pertes non réalisées et réalisées au sein de la communauté des détenteurs à court terme. Le cadre comprend les indicateurs suivants :

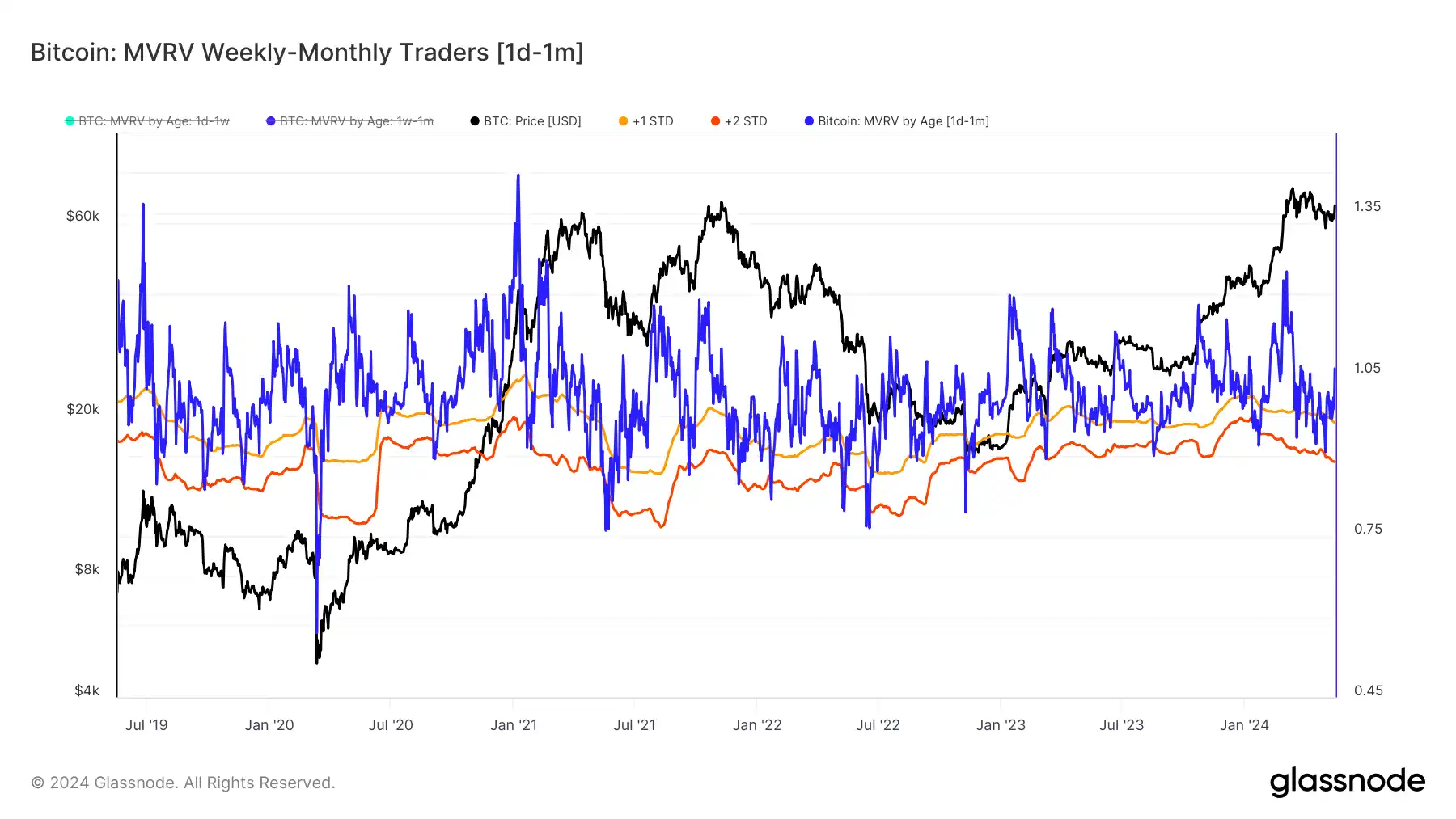

STH MVRV par âge : le rapport valeur de marché/valeur réalisée (MVRV) mesure les profits ou pertes non réalisés d'un actif. Lorsque la MVRV est nettement inférieure à la moyenne, cela indique un niveau élevé de pertes non réalisées parmi ses détenteurs. Cela permet de détecter les premiers signes de pression des vendeurs, car des pertes non réalisées importantes précèdent souvent l'activité de vente réelle des détenteurs à court terme.

Cliquez pour voir le graphique en temps réel

STH SOPR par âge : Le ratio de rendement dépensé et de profit (SOPR) permet de savoir si la pression financière non réalisée observée dans le MVRV est prise en compte. Un score Z SOPR négatif indique que les détenteurs à court terme capitulent, vendent leurs actifs à perte et exacerbent la pression des vendeurs.

Cliquez pour voir le graphique en temps réel

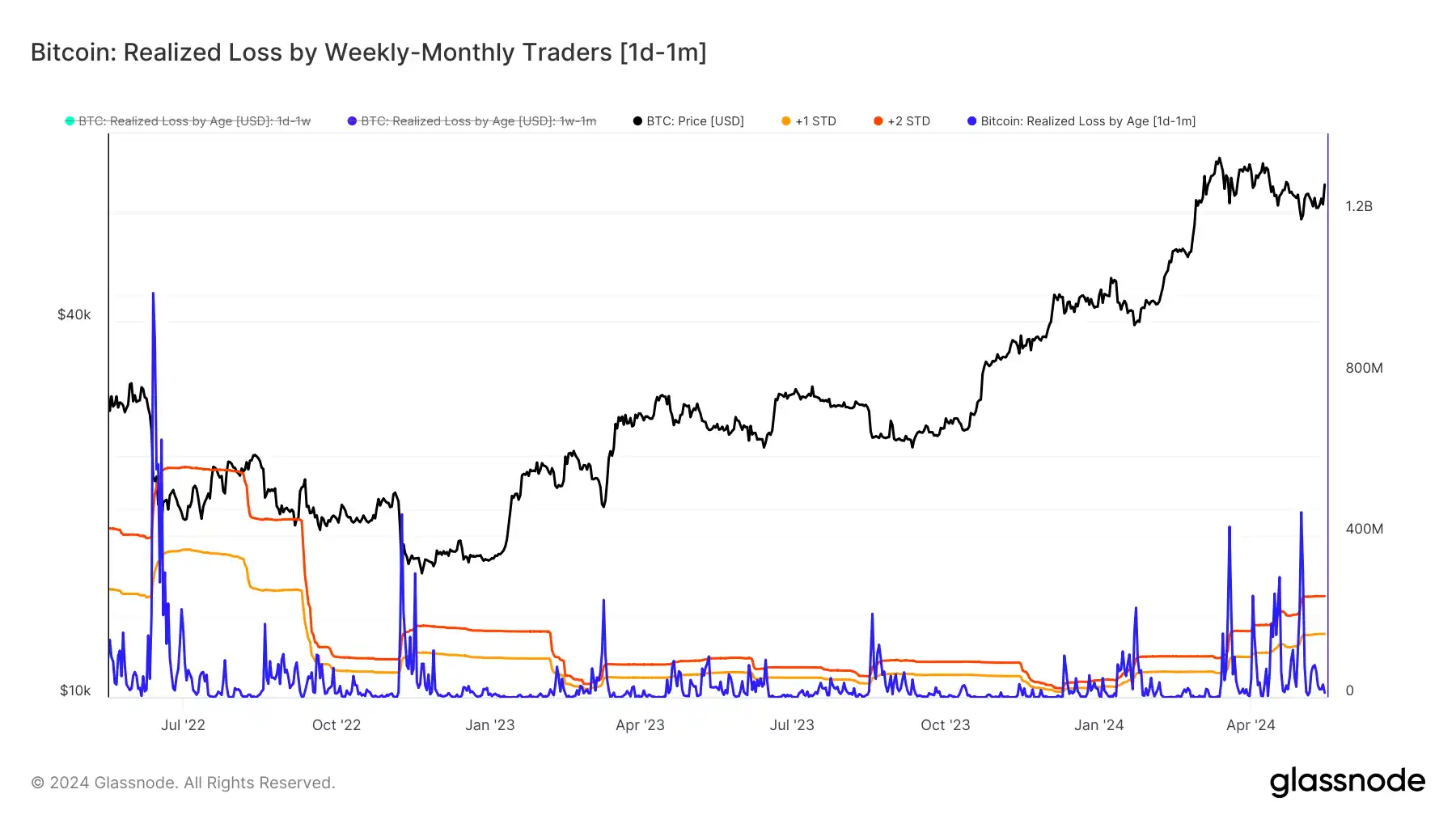

Perte réalisée STH par âge : cet indicateur évalue l'ampleur des pertes réalisées par les détenteurs à court terme. Les valeurs élevées des pertes réalisées confirment que la pression de vente identifiée par les indicateurs MVRV et SOPR est apparue, validant les périodes d'épuisement des vendeurs en quantifiant l'ampleur des pertes réalisées.

Cliquez pour voir le graphique en temps réel

En utilisant les Z-Scores, nous normalisons ces indicateurs, ce qui facilite la comparaison et l'identification des écarts significatifs par rapport à la moyenne. Les Z-Scores mettent en évidence les périodes de comportement extrême, ce qui permet de détecter plus facilement les moments où les pertes non réalisées et réalisées sont inhabituellement élevées. Cette normalisation permet d'identifier les périodes de véritable épuisement des vendeurs, fournissant aux traders des signaux plus clairs en filtrant le bruit et en se concentrant sur les événements statistiquement significatifs.

Applications pratiques pour les commerçants

L'utilisation du nouvel indicateur de rupture de Glassnode pour identifier les points d'épuisement des vendeurs dans un marché haussier peut offrir de nombreux avantages aux traders. Voici les principaux avantages :

Détection précoce des creux locaux : en repérant les moments de pertes importantes non réalisées et de capitulation parmi les détenteurs à court terme, les traders peuvent identifier les creux du marché avant qu'ils ne deviennent apparents, offrant ainsi des opportunités de points d'entrée précoces.

Stratégie optimisée de moyenne d'achat en dollars (DCA) : comprendre les périodes d'épuisement des vendeurs permet aux traders de mettre en œuvre des stratégies DCA plus efficacement, en achetant des actifs à des prix inférieurs aux plus bas du marché pour réduire les coûts d'achat moyens.

Synchronisation améliorée du marché : en observant comment la pression de vente se propage des délais les plus courts aux délais les plus longs au sein de la communauté des détenteurs à court terme, les traders peuvent mieux chronométrer les entrées et les sorties du marché pour maximiser les profits et minimiser les pertes.

Flexibilité stratégique : la segmentation des détenteurs à court terme par groupe d'âge permet aux traders d'appliquer ce cadre à une variété de stratégies de trading, du day trading au swing trading, afin de s'assurer qu'ils peuvent ajuster leur approche en fonction des conditions spécifiques du marché. En tirant parti des informations fournies par nos nouveaux indicateurs segmentés, les traders peuvent obtenir un avantage concurrentiel sur le marché et prendre des décisions plus stratégiques et plus rentables.

Commencez à trader avec l'indicateur de rupture de Glassnodes dès aujourd'hui

Actuellement, ces puissantes mesures de segmentation ne sont disponibles que dans le plan Glassnode Enterprise. Un aperçu complet des nouvelles mesures, tableaux de bord et documentation est disponible ici .

Si vous êtes un trader ou un investisseur institutionnel et que vous souhaitez utiliser ces indicateurs pour obtenir un avantage plus important lors de la négociation sur les marchés Bitcoin et Ethereum, veuillez Contactez notre équipe commerciale institutionnelle aujourd'hui.

Cet article provient d'Internet : Glassnode : Comment déterminer le creux du marché et l'heure d'entrée ?

Auteur original : James Wo, PDG fondateur, Digital Finance Group Le 9 mai 2024, Hong Kong a accueilli la première conférence Bitcoin Asia. La précédente conférence Bitcoin s'était essentiellement tenue en Europe et aux États-Unis. Cette initiative a également propulsé l'industrie Web3 en Asie vers de nouveaux sommets. La prospérité actuelle de l'écosystème Bitcoin est indissociable du marché asiatique, qui comprend les développeurs et les parties prenantes de projets asiatiques. C'est peut-être pour cette raison que la conférence Bitcoin a choisi Hong Kong comme première étape cette année. Lors de la conférence, les gens ont surtout parlé de l'état actuel et du développement futur de l'écosystème macro Bitcoin et de la technologie Layer 2. Bien entendu, tout cela est centré sur les attributs financiers et les transactions de Bitcoin. Le site de la conférence a réuni des exposants tels que des parties prenantes de projets, des sociétés minières…