SignalPlus Macro Analysis Special Edition : Et toi, ETH ?

Au cours des dernières 48 heures, le marché des cryptomonnaies et le groupe de pression TradFi ont été pris au dépourvu par ce changement soudain. La SEC américaine a soudainement changé sa position sur l'approbation de l'ETF ETH, exigeant soudainement que divers émetteurs d'ETF mettent à jour leurs derniers dépôts 19 b-4 et informent le NYSE et le CBOE que ces fonds seront cotés en bourse, ce qui indique que la possibilité que l'ETF ETH soit approuvé est assez élevée.

En réponse, cinq institutions qui ont demandé à émettre des ETF (Ark 21, Fidelity, Franklin Templeton, Invesco/Galaxy et VanEck) ont mis à jour leurs dépôts 19 b-4 au cours des dernières 24 heures. Le produit de VanEck a même été répertorié sur DTCC sous le nom $ETHV. Cette progression est vraiment trop rapide !

Alors, qu'est-ce qui a changé dans le document mis à jour ? ETF Analyst rapporte que, sans surprise, la SEC a demandé à tous les émetteurs de supprimer toutes les références au jalonnement d'ETH, car il s'agit du principal argument de l'agence pour que l'ETH soit un titre, de sorte que les actifs sous-jacents de l'ETF ETH final ne sont peut-être pas « jalonnement à but lucratif », mais qu'en est-il s'il est conditionné par un échange centralisé ou effectué par une plateforme tierce prête à payer des intérêts de dépôt ? Comment le document S-1 final le décrira-t-il ? Ce secteur est en effet toujours le plus avantageux pour les avocats !

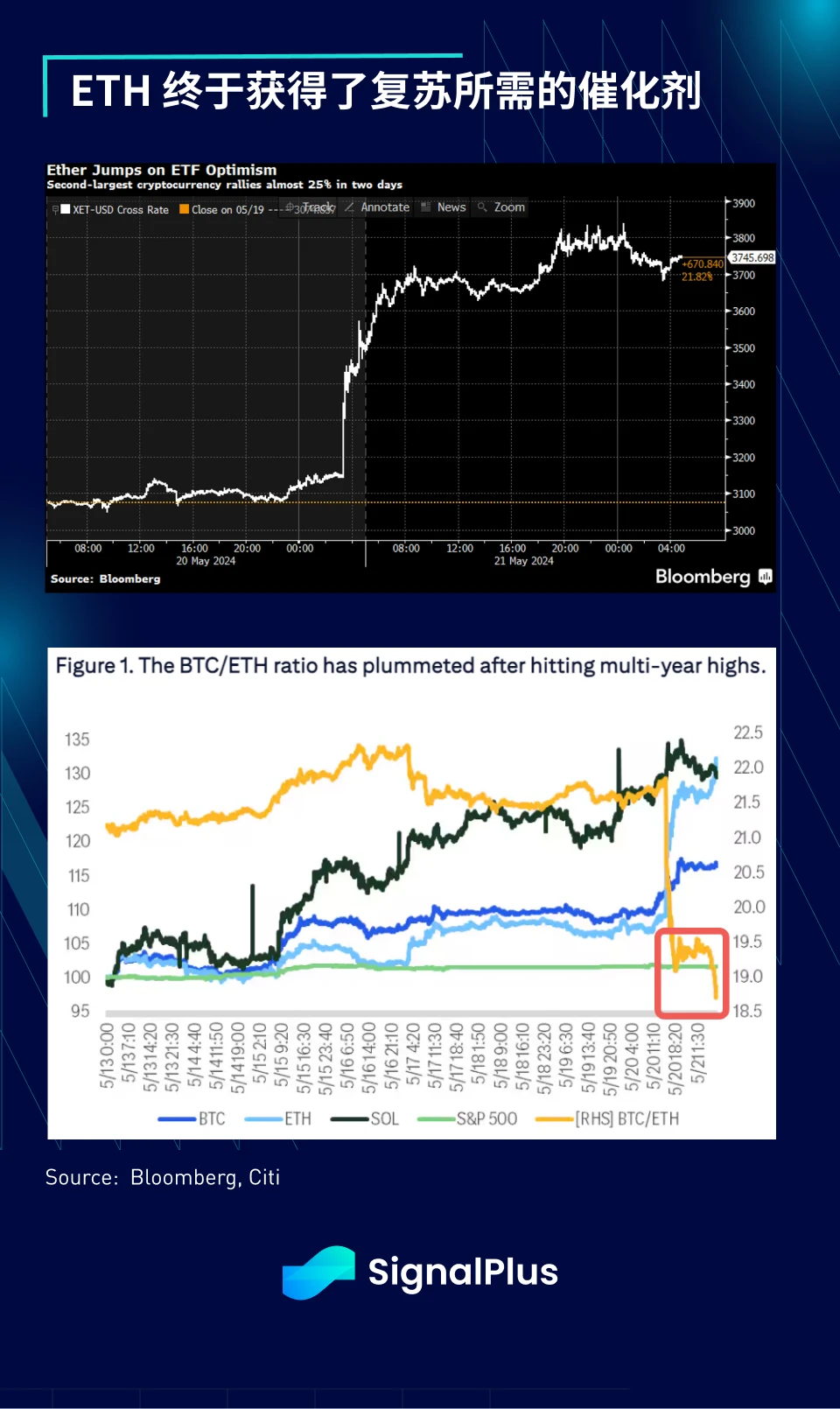

L'ETH a bien sûr bondi à la nouvelle, passant de $3 100 à $3 750 en moins de 2 jours. L'ETH a enregistré des performances relativement médiocres au cours des 2 dernières années et a été considérablement à la traîne par rapport au BTC au cours de l'année écoulée, confronté à une baisse des frais, à la concurrence de L1-EVM et à une focalisation excessive sur le jalonnement et le re-staking de liquidités complexes, supprimant le récit original de l'argent sain d'Ethereum avant POS. Aujourd'hui, à l'instar de l'approbation de l'ETF BTC, l'entrée des gros bonnets de TradFi devrait une fois de plus être le catalyseur dont Ethereum a besoin pour sortir de son creux.

Contrairement à janvier, le marché dispose désormais d'un plan d'action sur le fonctionnement de ces lancements d'ETF, ou du moins d'un précédent sur lequel s'appuyer :

-

Depuis l'approbation de l'ETF BTC en janvier, le prix du Bitcoin est de plus en plus déterminé par la vitesse des flux entrants dans l'ETF TradFi.

-

La corrélation du BTC avec les facteurs macroéconomiques et même le Nasdaq est beaucoup plus élevée que lors des cycles précédents

-

Le BTC a connu une hausse rapide en janvier, passant d'environ $57 000 à environ $50 000, puis les entrées de capitaux accumulées ont rapidement poussé le prix vers un nouveau sommet de plus de $72 000. Les acteurs du marché se comporteront-ils de la même manière cette fois-ci ?

-

Étant donné que l'ETH est si impopulaire, les utilisateurs natifs ont-ils accumulé suffisamment d'ETH ? Contrairement au cas de l'ETF BTC, la possibilité que l'ETF ETH original soit approuvé est depuis longtemps très faible.

-

Quel impact la combinaison du carnet de ventes de Grayscales et des entrées d'ETF aura-t-elle finalement sur les prix ?

-

La circulation de l'ETH est bien plus faible que celle du BTC. Devons-nous nous attendre à ce que les entrées/sorties nettes d'ETH à venir provoquent des fluctuations de prix plus importantes ?

-

Avec quelle agressivité Larry Fink et Wall Street vont-ils promouvoir l’ETH cette fois-ci ?

-

Alors que les volumes d’échanges continuent de se déplacer vers le fuseau horaire américain, l’influence du marché américain (qui est à un niveau record depuis le début de l’année) continuera-t-elle de croître ?

-

D’un point de vue temporel, il reste encore un long chemin à parcourir avant la date d’approbation finale du S-1. D’ici le lancement de l’ETF, l’environnement macroéconomique (économie et taux d’intérêt) aura-t-il changé de manière significative ?

En parlant de l'évolution des facteurs macroéconomiques, alors que le marché attend aujourd'hui la publication des résultats de Nvidia, une série d'intervenants de la Fed ont discrètement mais fermement modifié leur discours sur les taux, cette fois-ci en revenant à une position agressive. Cette semaine et la semaine dernière seulement :

-

Le gouverneur de la Fed Waller : En l’absence de faiblesse significative du marché du travail, j’ai besoin de voir quelques mois supplémentaires de bonnes données sur l’inflation avant de pouvoir me sentir à l’aise pour soutenir un assouplissement de la politique monétaire.

-

Vice-président Jefferson : Il est trop tôt pour dire si la récente décélération de l'inflation va se poursuivre

-

Michael Barr, vice-président : Les données sur l'inflation au premier trimestre de cette année ont été décevantes. Ces résultats ne me donnent pas la confiance nécessaire pour soutenir un assouplissement de la politique monétaire

-

Bostic, directeur de la Fed d'Atlanta : « Je ne suis pas pressé de baisser les taux… Je prévois que l'inflation continuera de baisser cette année jusqu'en 2025 », a-t-il déclaré, ajoutant toutefois que les prix baisseront plus lentement que beaucoup ne le pensent.

-

Cleveland Feds Mester : Ma prévision précédente était de trois (baisses de taux), mais en me basant sur ce que je vois dans l’économie en ce moment, je ne pense pas que ce soit toujours approprié… J’ai besoin de voir quelques mois supplémentaires de données sur l’inflation montrant que l’inflation est en baisse

-

Daly, directeur de la Fed à San Francisco : « Il n’est pas certain que l’inflation soit réellement en baisse, et il n’y a aucune urgence à réduire les taux »

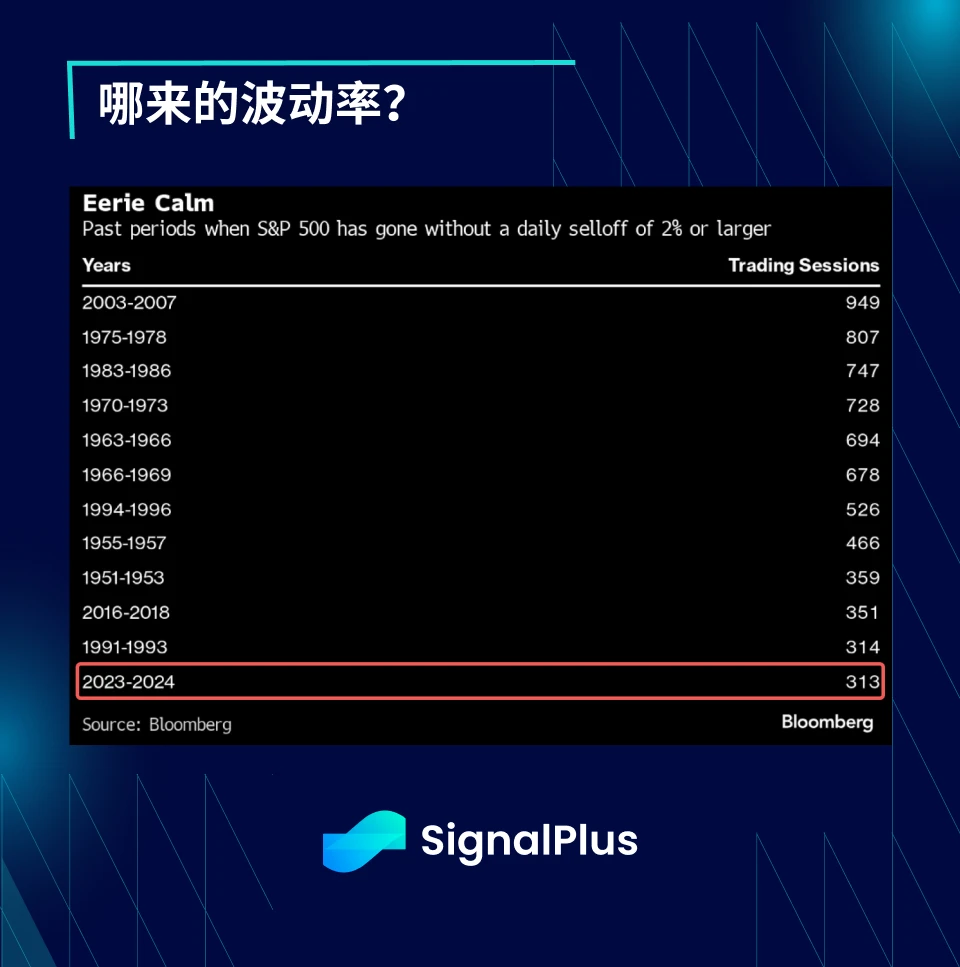

Le SPX n'a pas chuté de plus de 2% en une seule journée depuis 313 jours. La dernière fois que cela s'est produit, c'était entre 2016 et 2018, lorsque le record était de 351 jours consécutifs. Le record le plus long a été de 2003 à 2007, lorsqu'il n'y a pas eu de baisse de plus de 2% pendant environ 3 ans. Il n'est pas étonnant que tout le monde vende de la volatilité.

Vous pouvez rechercher SignalPlus dans le Plugin Store de ChatGPT 4.0 pour obtenir des informations de cryptage en temps réel. Si vous souhaitez recevoir nos mises à jour immédiatement, veuillez suivre notre compte Twitter @SignalPlus_Web3, ou rejoindre notre groupe WeChat (ajouter l'assistant WeChat : SignalPlus 123), le groupe Telegram et la communauté Discord pour communiquer et interagir avec plus d'amis. Site officiel de SignalPlus : https://www.signalplus.com

Cet article provient d'Internet : SignalPlus Macro Analysis Special Edition : Et toi, ETH ?

Originale | Odaily Planet Auteur quotidien | Éditeur Asher | Qin Xiaofeng Au cours de la semaine dernière, le marché global de la cryptographie était relativement lent, mais il y avait encore de nombreux projets populaires dans le secteur GameFi qui ont lancé de grands mouvements. Peut-être qu'à mesure que le marché se redresse, la rotation des altcoins viendra dans le secteur GameFi. Par conséquent, Odaily Planet Daily a résumé et trié les projets de jeux blockchain qui ont été populaires récemment ou qui ont des activités populaires. Performance du marché secondaire du secteur des jeux blockchain Selon les données de Coingecko, le secteur des jeux (GameFi) a chuté de 9,8% la semaine dernière ; la valeur marchande totale actuelle est de $ 19 853 737 045, se classant 22e dans le classement du secteur, en baisse d'une place par rapport au classement sectoriel de la valeur marchande totale la semaine dernière. Au cours de la semaine dernière, le nombre de jetons…