Édition spéciale d'analyse macro SignalPlus : asymétrique

After three consecutive inflation data exceeded expectations, the CPI data released on Wednesday was roughly in line with expectations. This result is enough to stimulate another round of large-scale rebound in risk markets.

-

SPX hits new high

-

US 1-year 1-year forward rates saw their biggest one-day drop since early January

-

2025 Fed Funds futures pricing in a 25 bps drop from April highs (equivalent to one rate cut)

-

The US dollar index DXY recorded its biggest one-day drop so far this year

-

Cross-asset volatility (FX, equities, rates) retreats to medium-term and/or historic lows

Will the Fed cut interest rates soon? Federal Funds Futures for June show only a 5% chance of a rate cut, and only a 30% chance for July. Even for September, the chance of a rate cut is only about 64%. So what are you all excited about?

Will the Fed cut interest rates soon? Federal Funds Futures for June show only a 5% chance of a rate cut, and only a 30% chance for July. Even for September, the chance of a rate cut is only about 64%. So what are you all excited about?

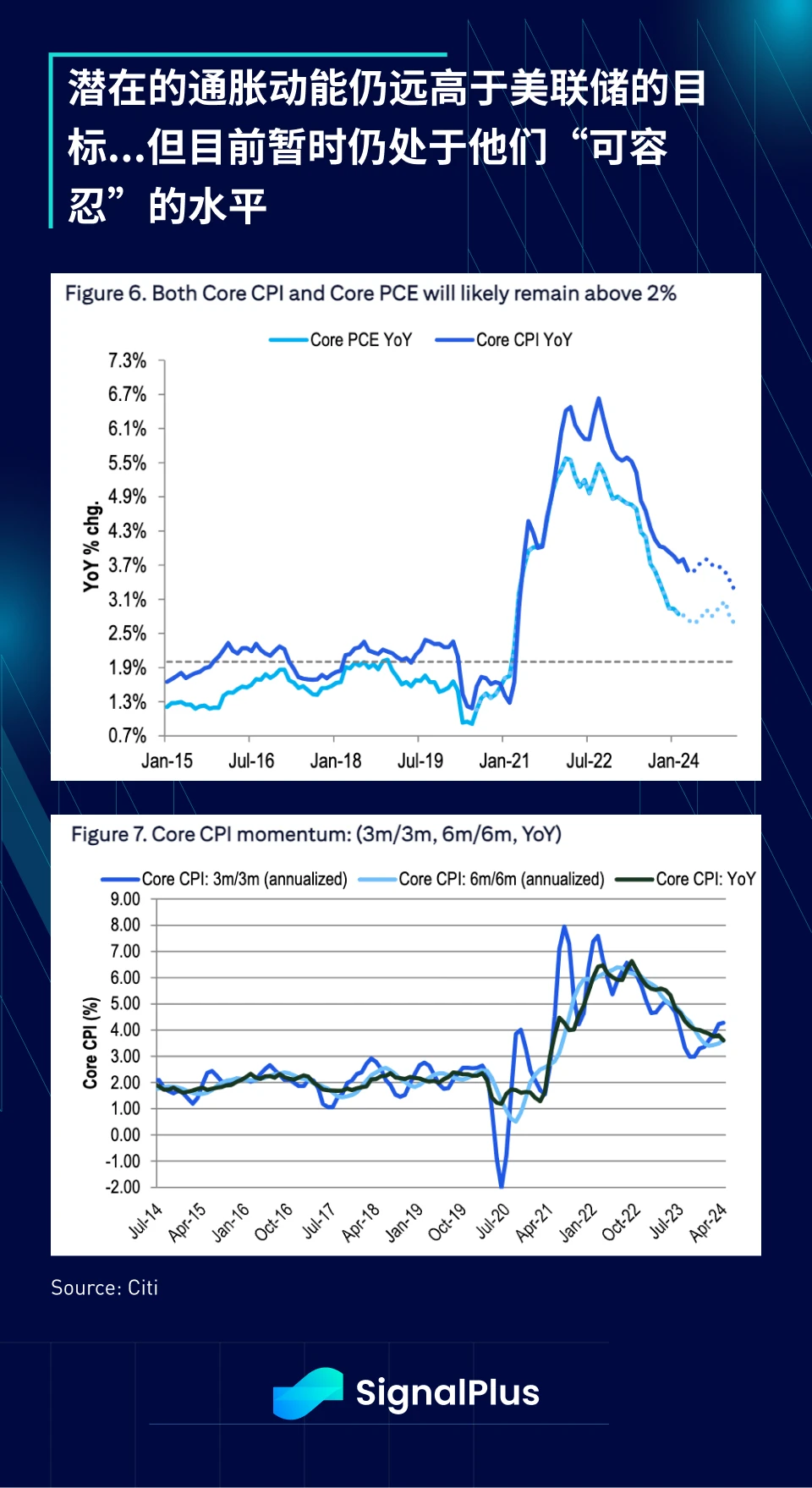

As we have mentioned before, the Fed has moved to a completely unbalanced position, whereby persistent inflationary pressures are tolerated as long as inflation does not re-accelerate, and any signs of weakness in the job market are seen as a driver for policy easing. Therefore, while headline and core inflation remain above the Fed’s 3.6% and 3.4% targets, respectively, the market is concerned about re-acceleration of prices, which did not occur last month, which fits with the Fed’s theme of returning to “watching the timing of easing” as both “slowing job market” and “high but tolerable inflation” are being confirmed one by one.

Back to the CPI data itself, the core CPI rose 0.29% month-on-month in April. After exceeding expectations for three consecutive months, the data results this time were only slightly lower than market expectations. The weakness mainly came from the decline in commodity prices and the controlled growth of housing prices and owners equivalent rents. Core service inflation excluding housing rose 0.42% month-on-month, roughly in line with expectations.

After the release of CPI/PPI, Wall Street expects core PCE to grow by around 0.24% month-on-month in April, moving towards an annualized level of 2% and the Feds comfort zone. Traders remain confident that inflation will continue to fall in the second half of the year.

On the other hand, retail sales data in April weakened significantly, with a general softening in different spending categories. Retail sales were flat month-on-month, lower than the consensus expectation of a month-on-month increase of 0.4%-0.5%, and control group spending fell 0.3% month-on-month, and the previous value was also revised down. General merchandise and even non-store sales saw the largest decline since the first quarter of 2023.

The weaker-than-expected retail sales data continued a recent string of weak consumer data, including rising credit card and auto loan delinquencies, the depletion of accumulated excess savings, and a deteriorating job market. While it is too early to call a significant economic slowdown, we appear to be approaching a turning point in economic growth. Are high interest rates finally starting to erode the U.S. economy?

As always, the market is happy to ignore any risk of a slowdown and focus only on the Feds easing policy for the time being. As a reminder, while the market is very forward-looking and good at incorporating all available information into pricing, please be aware that the market is not that forward-looking. Enjoy the current party for a short while!

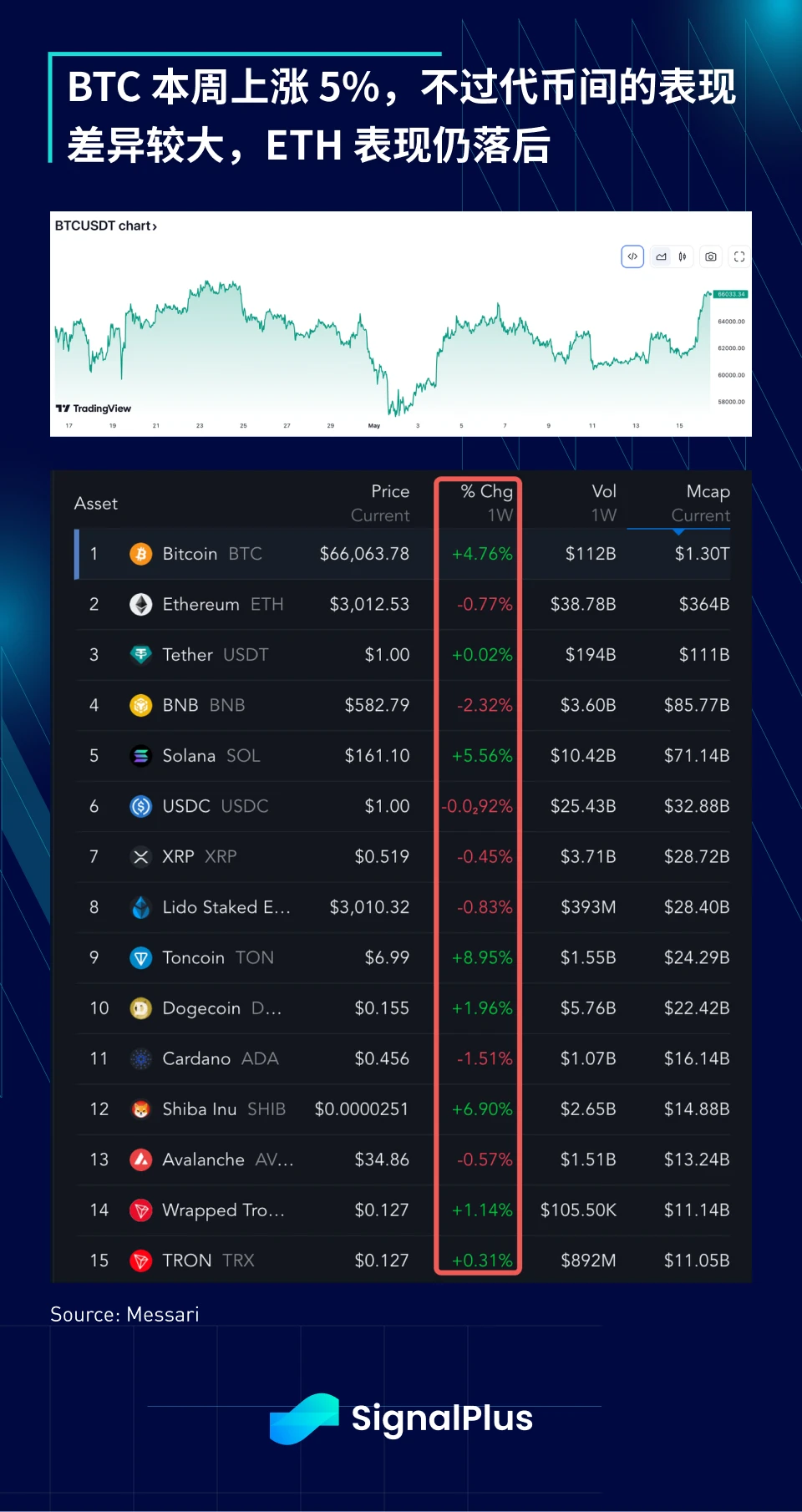

On the crypto side, BTC prices continue to be influenced by overall stock sentiment, with prices breaking through this month’s highs and returning to the April peak of around $67,000. ETF inflows have also been very healthy, with an additional $300 million in inflows following yesterday’s CPI announcement, and even GBTC seeing net inflows. However, the performance of individual tokens remains highly variable, with ETH and some of the top 20 tokens still struggling to recover losses, and market gains increasingly concentrated in a small number of tokens (BTC, SOL, TON, DOGE) rather than overall market gains.

Expect this to continue, with the focus remaining on BTC, the main beneficiary of TradFi inflows (13 F filings show some large hedge funds have increasing exposure to BTC ETFs), and relatively less FOMO on native or degen tokens in this cycle. Good luck everyone!

Vous pouvez rechercher SignalPlus dans le Plugin Store de ChatGPT 4.0 pour obtenir des informations de cryptage en temps réel. Si vous souhaitez recevoir nos mises à jour immédiatement, veuillez suivre notre compte Twitter @SignalPlus_Web3, ou rejoindre notre groupe WeChat (ajouter l'assistant WeChat : SignalPlus 123), le groupe Telegram et la communauté Discord pour communiquer et interagir avec plus d'amis. Site officiel de SignalPlus : https://www.signalplus.com

This article is sourced from the internet: SignalPlus Macro Analysis Special Edition: Asymmetric

En lien : Ethena (ENA) surveille la résistance $1 : la fin de la consolidation en vue

En bref Ethena (ENA) suscite l'intérêt des traders et des analystes avec un mouvement potentiel vers $1. Les mentions sur les réseaux sociaux augmentent, avec une emphase récente des leaders d'opinion clés. Malgré une dynamique à la hausse, la stabilité du sentiment à long terme dépend d'un engagement soutenu. Ethena (ENA) attire une attention notable, suscitant des discussions parmi les traders et les analystes avec sa trajectoire de prix potentielle visant à renverser la marque $1. La crypto-monnaie conserve sa pertinence sans le battage médiatique entourant l'IA ou les jetons meme, qui sont actuellement les principaux secteurs de tendance du moment. Sur la base du sentiment récent et des tendances du marché, ENA montre des signes d'une cassure haussière. Les mentions d'Ethena sur les plateformes sociales sont en hausse Au cours du mois dernier, des comptes influents clés au sein de la communauté crypto ont régulièrement mentionné ENA, indiquant un intérêt croissant. L'analyse révèle que 32 utilisateurs X significatifs ont discuté d'ENA…