La lumière des investisseurs particuliers Roaring Kitty revient et la pièce Meme du même nom s'envole 100 fois en une journée

Auteur original : Joyce

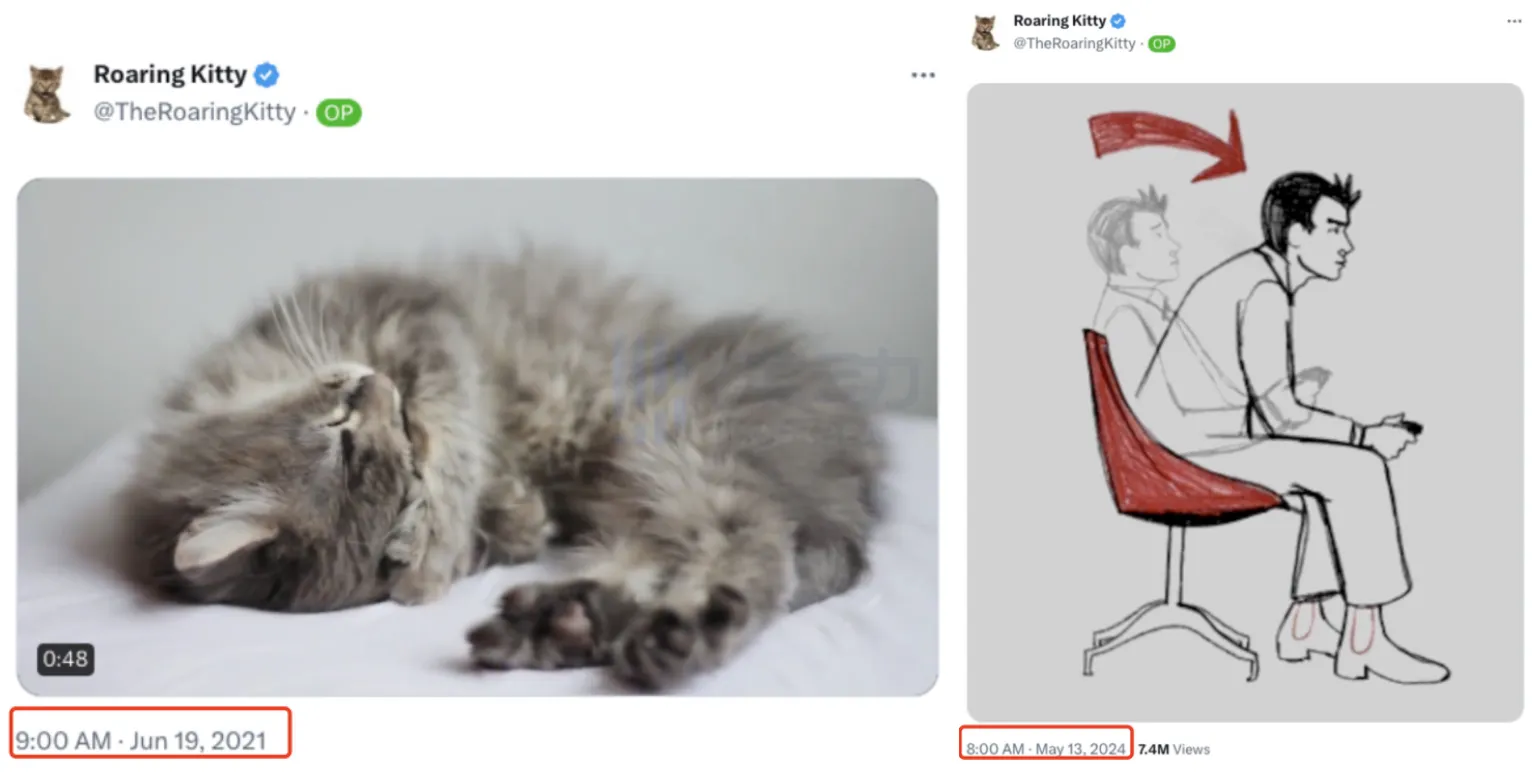

This morning, a tweet went viral in both the U.S. stock trading and crypto communities, with over 6 million views in five hours. This tweet came from Roaring Kitty, a former U.S. stock trader, and it was his first tweet in three years.

Although no one can tell what the tweet means, the entire trading community is excited about the name Roaring Kitty, and many people shouted on Twitter, Roaring Kitty is back. Why does a tweet have such a big impact? Who is Roaring Kitty?

In a sense, it can be said that Roaring Kitty gave birth to the meme section of the crypto community. The originator of meme DOGE was born from the myth of retail investors vs. Wall Street led by Roaring Kitty.

Keith Gill, known as Roaring Kitty, was once a financial analyst. Roaring Kitty is the username he uses on YouTube and Twitter, and he is also a loyal user of Reddit.

In September 2019, Gill bought GME, the stock of GameStop, a long-established American gaming retailer that had been losing money for many years, and posted a screenshot of his transaction on the r/wallstreetbets sub-forum of Reddit – a long position of about $53,000. Since then, Gill has frequently posted bullish views on GME on Reddit.

In addition to text output, he also posted videos and live broadcasts on Youtube to talk about the fundamentals and potential space of GME. For a long time, many retail traders were influenced by him to buy GME, and then went to the comment area of his Youtube channel to keep warm and firmly hold their confidence.

Roaring Kitty in the Youtube channel

In 2020, GME did surge, and Gills assets increased several times. However, GMEs upward trend attracted the attention of Wall Street institutions, and capital was not optimistic about GME. In January 2021, Melvin Capital hedge fund and well-known short-selling institution Citron Research announced on Twitter that they were short GME, believing that its price should be halved from the closing price.

This news sparked the anger of many retail investors. That month, the Reddit retail social forum group Wall Street Bets launched a large-scale short squeeze campaign on major social media, pushing the GME stock price from $17 at the beginning of the month to a maximum of $347, an increase of nearly 19 times. In this process, Roaring Kitty played an indispensable role. He said on Reddit that he would not sell even 1 cent of GME, and broadcast the GME stock price live on Youtube for 7 hours.

It is worth mentioning that GME once plummeted by nearly two-thirds due to the suspension of trading by brokers, and Roaring Kittys earnings fell by more than 15 million US dollars. However, he still held it firmly and continued to post updates in the community, and finally waited for GME to rise again.

The $53,000 GME that Roaring Kitty bought in 2019 turned into more than $30 million more than a year later, reaching a peak of $48 million. Roaring Kitty became famous overnight, and Netflix made a documentary called Eating the Rich: The GameStop Saga based on this incident. The movie Dumb Money released last year was also based on Roaring Kitty, telling the story of his journey from the first purchase of GameStop stock to the stock peak and the collapse of hedge funds.

Since a large number of retail investors were trading on Robinhood at the time, and Robinhood had suspended GME trading during this bull-short war, the intense emotions of investors on Robinhood overflowed to other targets, including DOGE, which had no substantive significance. Shortly after the GME incident, Elon Musk began to post a large number of tweets on Twitter to spread the Doge Meme. DOGE peaked three months later, with a market value of $90 billion. The MEME bull market in the crypto community has begun since then.

Looking back, although Roaring Kitty has never purchased cryptocurrency, the rebellious culture he led and the low-threshold trading role played by Robinhood in the entire incident echo the culture of the crypto community.

Chamath Palihapitiya, a venture capitalist who became famous on Wall Street for buying a large amount of Bitcoin at $80, commented on Roaing Kittys achievements at the time and said that retail investors are as good as Wall Street professionals. They were only unable to use more financial tools because of insufficient funds in the past, so they were cut by institutions. Now retail investors are united to beat up institutions, which shows that the era of retail investors has arrived.

As the Battle of Wall Street gradually came to an end, the price of GME gradually fell, and Roaring Kitty also disappeared from the Internet. His Youtube channel and Twitter were no longer updated, and the last update was in 2021.

Three years later, Roaring Kitty tweeted again. This legendary figure who is a light of retail investors and has crypto culture naturally aroused the excitement of the community. Prior to this, GME had experienced a week of growth. With the help of Roaring Kitty, GMEs weekly increase was as high as 80%. The last time it achieved such an increase was in 2022.

The impact of Roaring Kitty on the GME stock price is not particularly significant. Its comment section is full of calls for orders for various meme coins. The luckiest one belongs to the meme KITTY of the same name as Roaring Kitty, which was born on March 31. It fell by more than 90% the day after its launch and was on the road to zero, but unexpectedly rose sharply due to the return of Roaring Kitty.

One month after returning to zero, KITTY has risen more than 100 times in the past 7 hours. Some traders have also been lucky. One trader spent about $3,000 to buy 17.4 million KITTY yesterday before Roaring Kitty tweeted. Now he has made a profit of more than $100,000 because of this tweet.

This article is sourced from the internet: The Light of Retail Investors Roaring Kitty returns, and the Meme coin of the same name soars 100 times in one day

Connexes : 158 milliards de jetons PEPE retirés de Binance : impact sur les prix

In Brief Wintermute withdrew 158 billion PEPE tokens from Binance, impacting liquidity. The transaction worth about $1.19 million could lead to a price correction for PEPE. Crypto market volatility may reverse the trend if PEPE sustains above the risk line. Wintermute, a global algorithmic market maker, has withdrawn an astonishing 158 billion PEPE tokens from Binance. This transaction, valued at approximately $1.19 million, signifies a remarkable shift in the meme coin’s liquidity. Billions of PEPE Tokens on the Move Wintermute’s recent transaction reflects its strategic positioning within the crypto market. Especially when understanding that the firm embodies high-frequency market-making in the industry. Its algorithms and business models, distinct from traditional OTC or dark pool market makers, aim to enhance market efficiency and liquidity. The substantial withdrawal of PEPE tokens by…