Más de 57.000 usuarios participaron en dos días. Explicación detallada del primer proyecto de Binance Megadrops, BounceBit (con opera

Original | Odaily Planeta Diario

Autor | aser

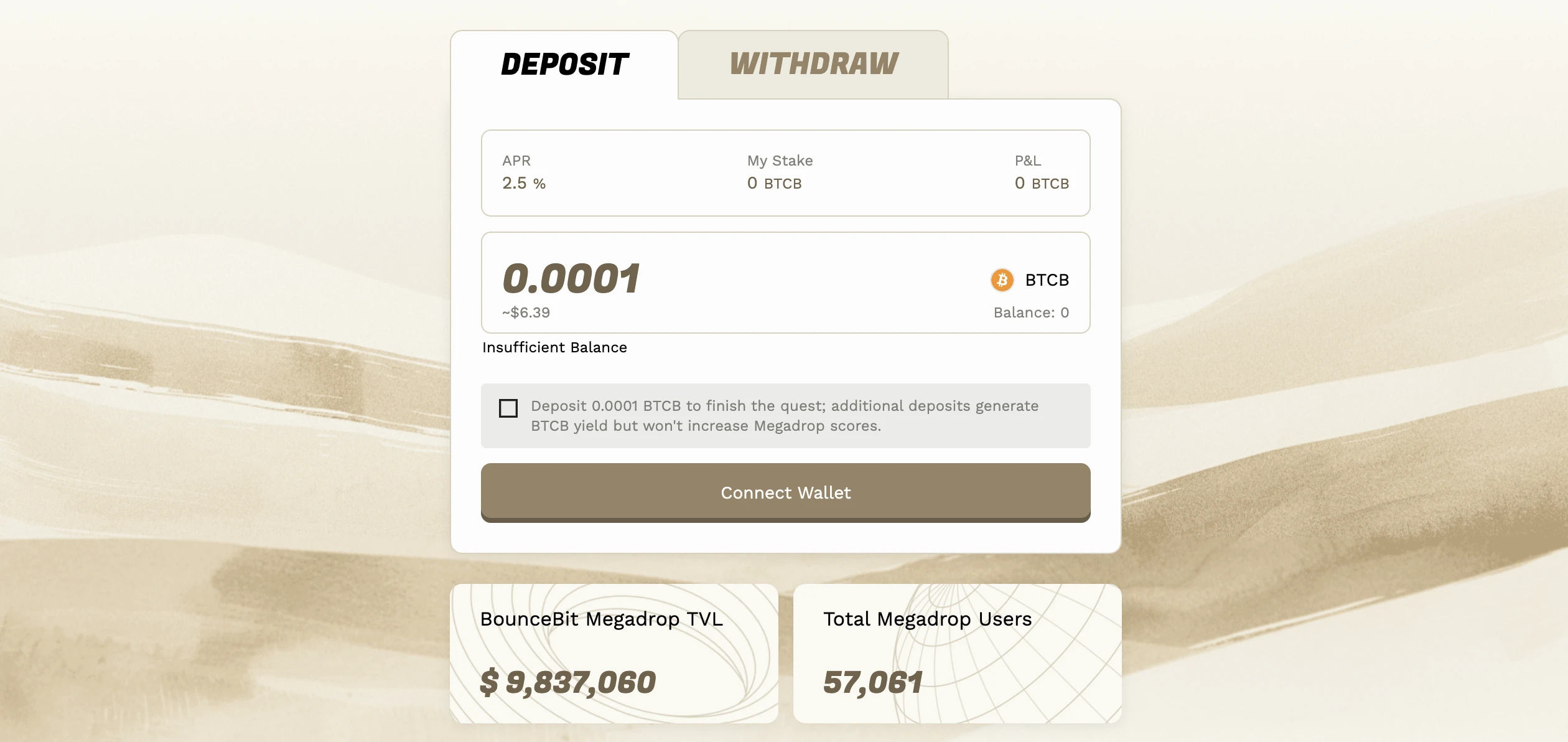

On April 26, Binance Megadrops first project BounceBit (BB) was officially launched. Users can apply for BNB regular products on the Binance Megadrop platform or complete the BounceBit Quest through the Binance Web3 wallet to obtain airdrop rewards. 8% of the total tokens will be used for this event. The event has been going on for only 2 days, with more than 57,000 users participating, and BounceBit Megadrop TVL is nearly 10 million US dollars. It is also worth noting that Binance will launch BounceBit (BB) at 18:00 Beijing time on May 13.

Fuente de imagen: Project official website

So, why can BounceBit become the first project on the Binance Megadrop platform and how should novice users (only about US$15 is required to participate) participate in making money, Odaily Planet Daily will introduce them one by one based on official information.

BounceBit: BTC re-staking infrastructure

Introducción

BounceBit is a BTC re-staking public chain, whose goal is to create a native BTC re-staking ecosystem to reimagine the value of BTC. By introducing a dual staking system of native BTC and BounceBit (BB) tokens, the value of BTC is maximized and more profit opportunities are provided for BTC holders.

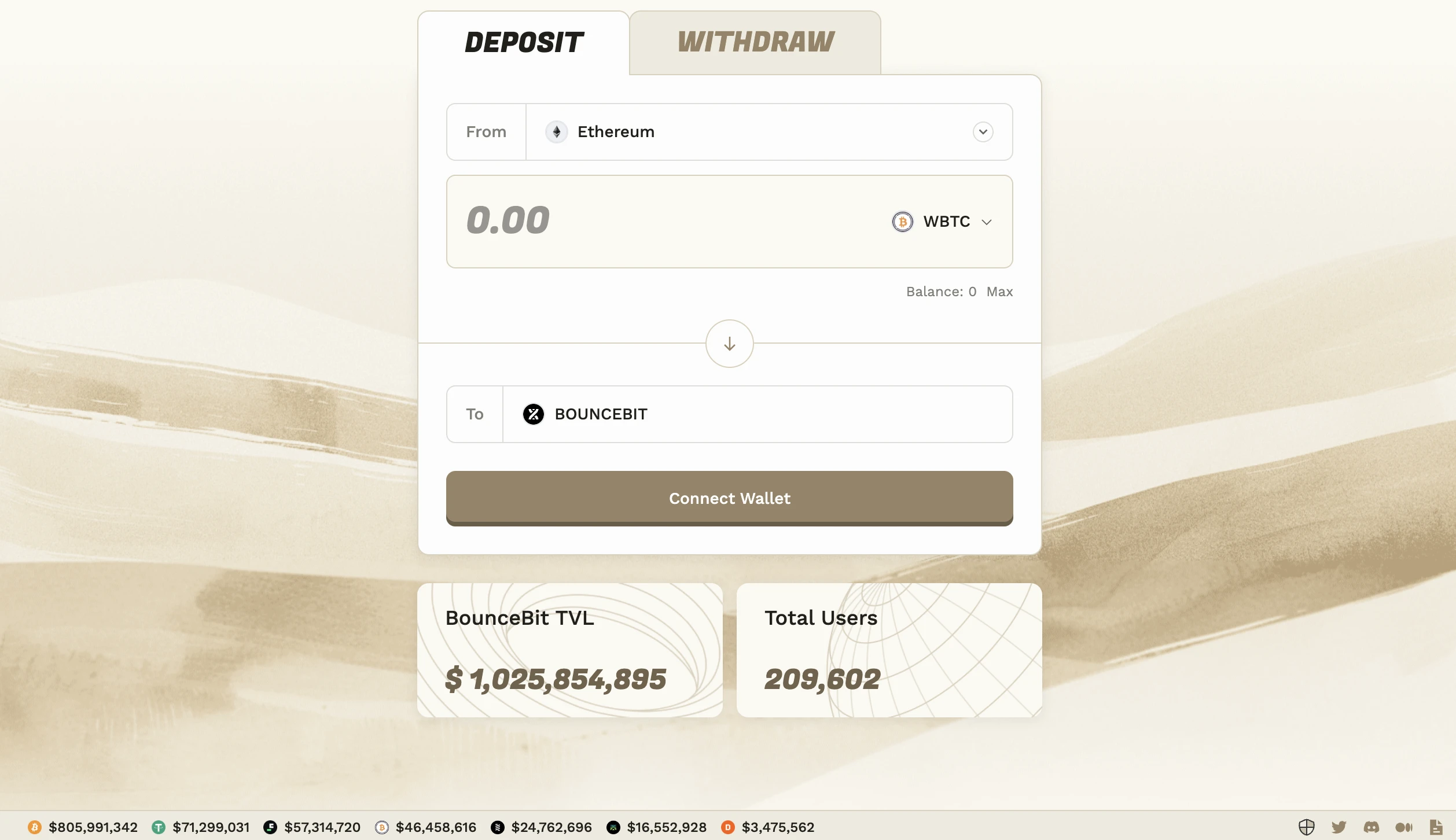

At present, according to the official website data, TVL has exceeded 1 billion US dollars. Among them, the amount of BTCB pledged exceeds 806 million US dollars, the amount of USDT pledged exceeds 71.3 million US dollars, the amount of FDUSD pledged exceeds 57.31 million US dollars, the amount of WBTC pledged exceeds 46.46 million US dollars, the amount of AUCTION pledged exceeds 24.76 million US dollars, the amount of MUBI pledged is nearly 16.55 million US dollars, and the amount of DAII pledged exceeds 3.48 million US dollars.

Total locked amount of the project

Project Highlights

As a BTC ecological infrastructure, BounceBit (BB) has the following highlights:

-

BTC Re-staking: As assets generate interest through arbitrage strategies managed by experienced asset management entities, users are rewarded with a BTC-pegged version called bounceBTC (BBTC) that can be delegated to node operators, who return the staked certificates (stBTC) to the stakers.

-

Dual-currency PoS: Dual-currency PoS is a hybrid consensus mechanism where each validator can accept both BBTC and/or BB tokens. This system expands the stakeholder base and weaves an extra layer of resilience and security into the network consensus structure.

-

BounceClub: BounceClub can be used as an on-chain space where users can use the built-in mini-programs to create DeFi experiences. No code is required and it can be easily integrated from the App Store.

-

Liquid Custody: BounceBit introduces the concept of Liquid Custody to keep collateral assets liquid and provide more opportunities to earn returns. When users deposit assets into BounceBit, they will receive a Liquid Custody Token (LCT), which represents their assets being custodied at a 1:1 ratio.

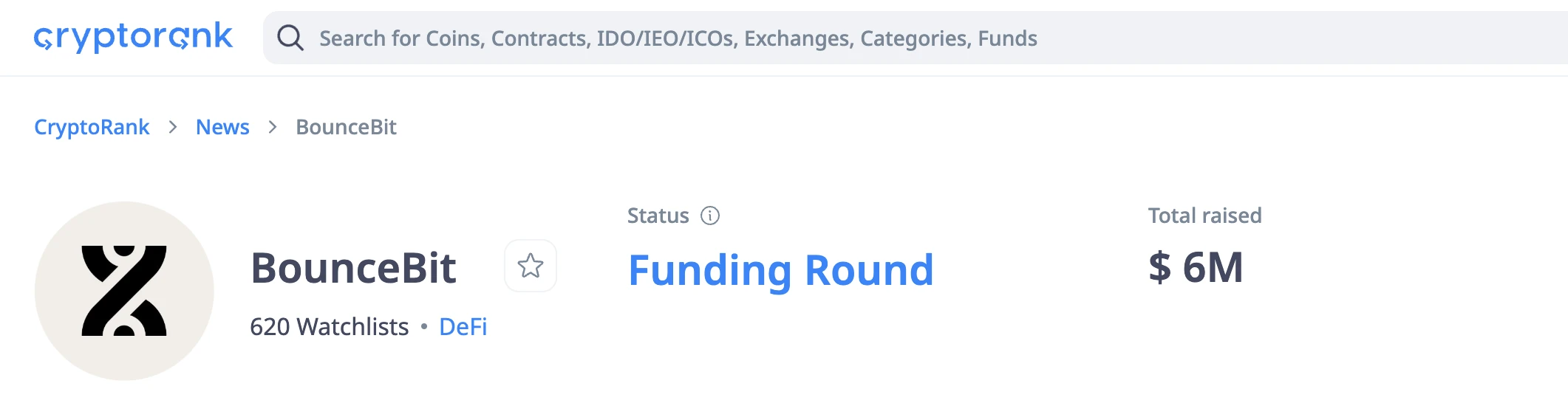

Financiación

BounceBit has completed a $6 million seed round of financing. This round of financing was jointly led by Blockchain Capital and Breyer Capital, with participation from dao 5, CMS Holdings, Bankless Ventures, NGC Ventures, Matrixport Ventures, DeFiance Capital, OKX Ventures and HTX Ventures. Individual investors include Calvin Liu, Chief Strategy Officer of EigenLayer.

Fuente de imagen: criptorango

Modelo económico de tokens

According to a research report released by Binance Research, the total supply of BounceBit token BB is 2,100,000,000 , and the specific distribution is as follows:

-

Binance Megadrop: 168,000,000 BB, 8% of total supply;

-

Liquidity providers: 63,000,000 BB, 3% of the total supply;

-

Testnet incentives: 84,000,000 BB, 4% of the total supply;

-

Advisors: 105,000,000 BB, 5% of total supply;

-

Equipo: 210,000,000 BB, 10% of the total supply;

-

BounceClub and ecosystem reserves: 294,000,000 BB, accounting for 14% of the total supply;

-

Inversores: 441,000,000 BB, 21% of the total supply;

-

Staking Rewards: 735,000,000 BB, 35% of total supply.

mapa de ruta

According to the information currently released, BounceBits planned roadmap for the next year is:

2024 Q2: Ecosystem construction, BounceClub distribution, Premium Yield product development, BounceBit mainnet launch;

2024 Q3: Options and structured products, lending, and more CeDeFi products;

2024 Q4: BounceBit re-staking platform;

2025 Q1: Construction of Shared Security Client (SSC) ecosystem.

So, after having a basic understanding of the BounceBit project, Odaily Planet Daily will guide you step by step to participate in the airdrop event of Binance Megadrops first project BB token.

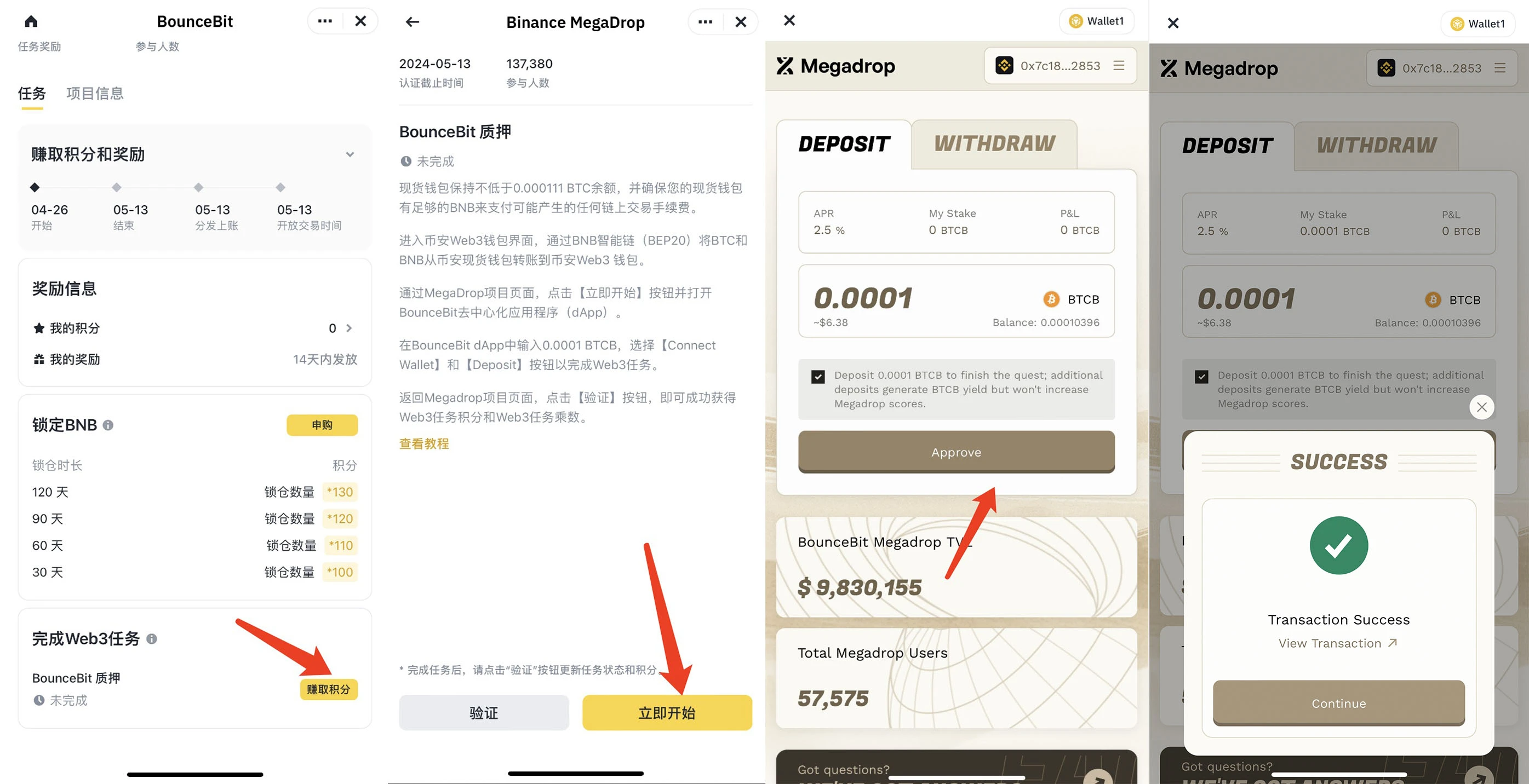

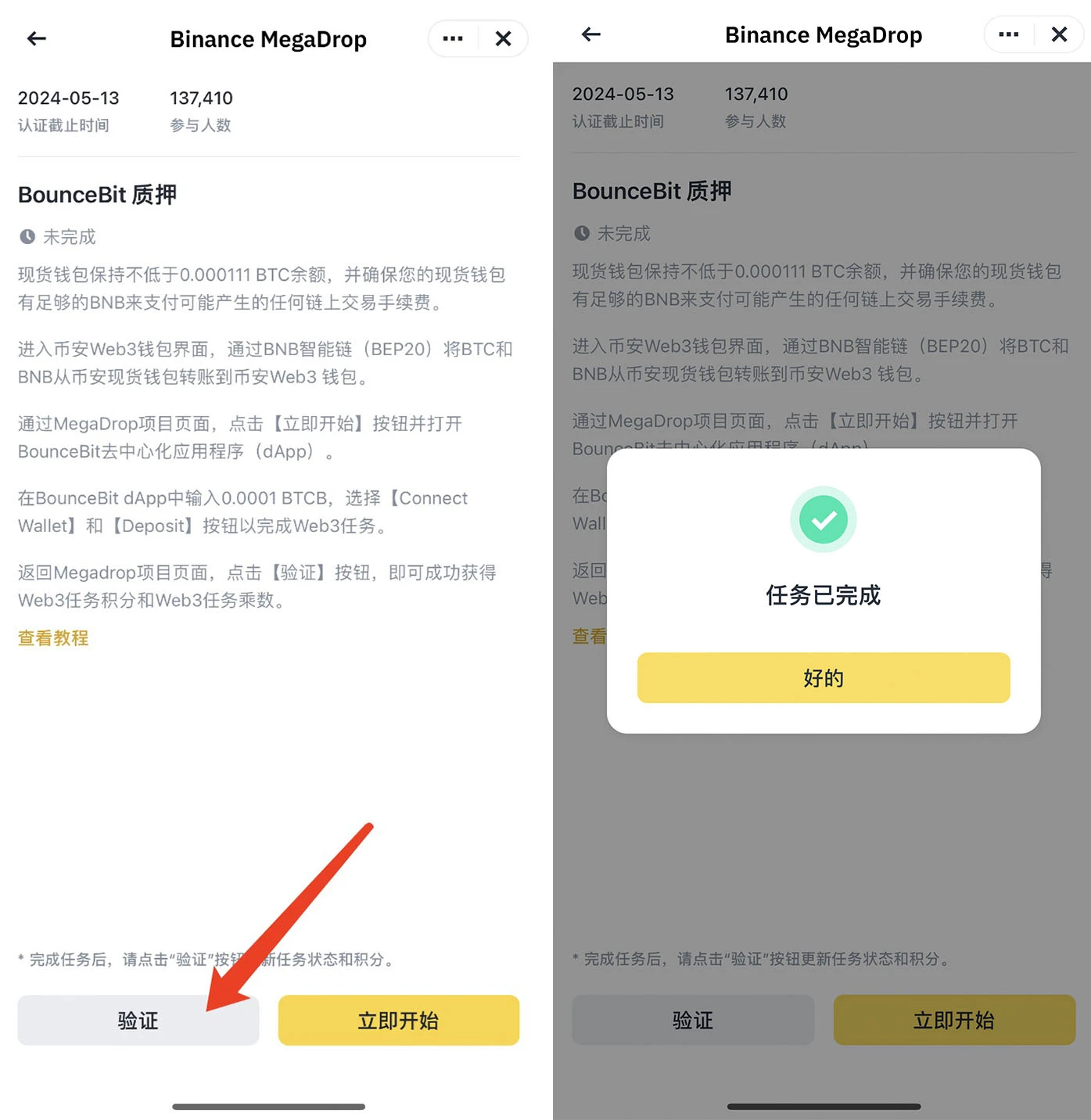

BounceBit Project Web3 Task Operation Demonstration

Binance Megadrop First Project: BounceBit

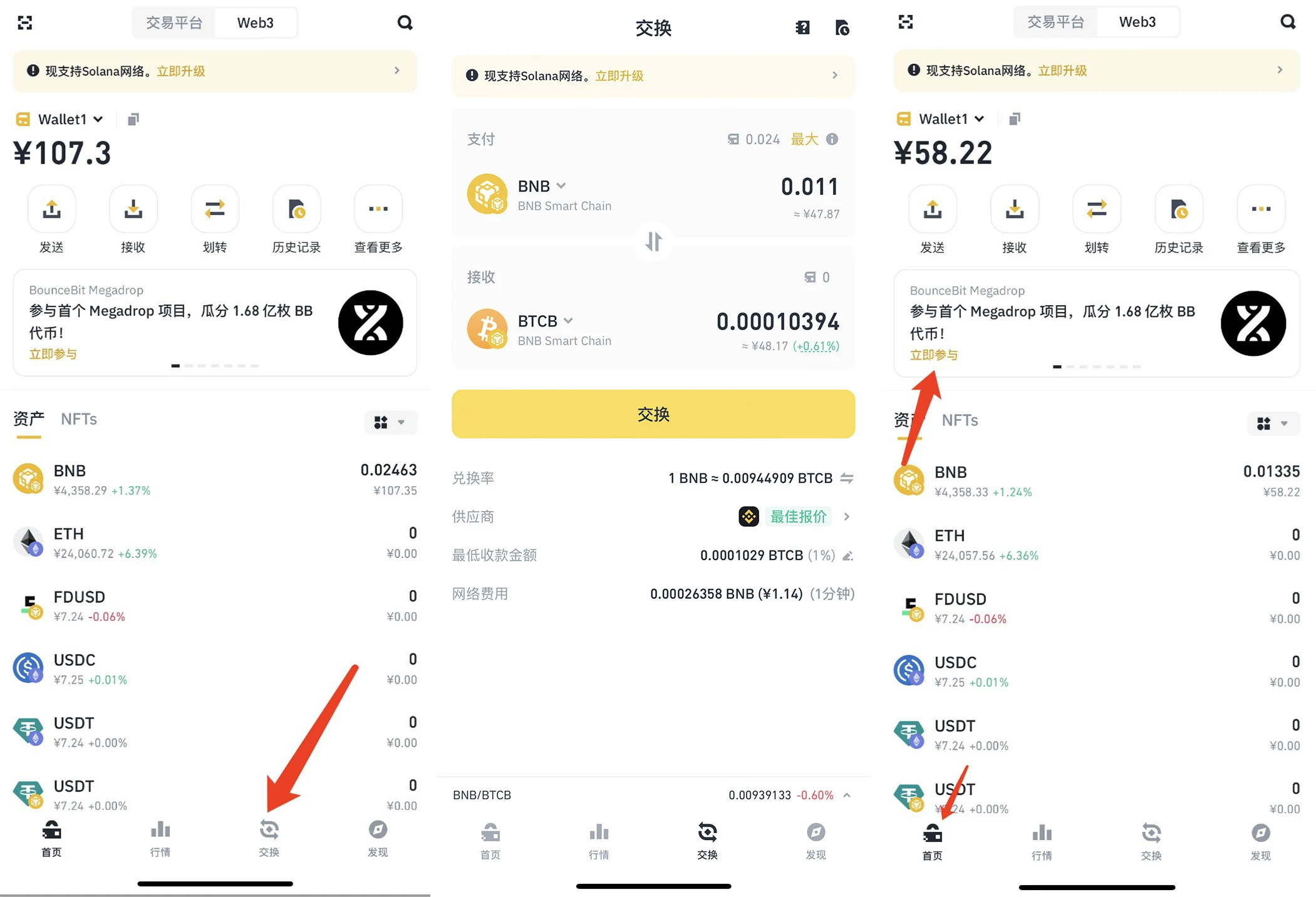

STEP 1. Open the Binance Web3 wallet (need to be created in advance) and deposit a small amount of BNB (can be exchanged for 0.0001 BTC);

STEP 2. Exchange 0.0001 BTCB and enter the megadrop task page;

STEP 3. Enter Web3 Tasks and complete the 0.00 01 BTC deposit task;

STEP 4. Return to the Megadrop event main page to verify the task.

This article is sourced from the internet: Over 57,000 users participated in two days. Detailed explanation of Binance Megadrops first project BounceBit (with operation tutorial)

Relacionado: He aquí por qué la corrección del precio de Ripple (XRP) podría continuar

En resumen, la actividad de desarrollo se redujo casi 10 veces en solo diez días, lo que generó preocupación sobre el interés en XRP. Las direcciones activas diarias cayeron 20% en la última semana, lo que podría afectar el precio de XRP. Los gráficos de la EMA acaban de formar una señal bajista, lo que indica que la corrección podría continuar. ¿Qué sigue para el precio de Ripple (XRP)? Se ha observado una disminución significativa en la actividad de desarrollo de XRP, con una disminución diez veces mayor en diez días. Esto genera preocupaciones sobre el interés y la innovación continuos dentro del ecosistema XRP. Además, las direcciones activas diarias asociadas con XRP cayeron 20% la semana pasada. Esta reducción en la participación de los usuarios podría ejercer una presión a la baja sobre el precio de XRP. Finalmente, el análisis técnico basado en gráficos de medias móviles exponenciales (EMA) sugiere la formación de una señal bajista. La actividad de desarrollo es…