Usual bonds unpegged, RWA stablecoin faces volatility test

Original author: Pzai, Foresight News

As a hot topic recently, RWA stablecoin has brought fresh water to the stablecoin field with the natural growth of off-chain assets, and opened up enough imagination space for investors. Among them, the representative project Usual has also won the favor of the market and quickly poured in more than 1.6 billion US dollars of TVL. However, the project has encountered certain tests recently.

On January 9, the liquidity pledge token USD 0++ in its project was sold off after Usual鈥檚 announcement. In the RWA stablecoin camp, some players are also experiencing varying degrees of depegging, which also reflects the change in market sentiment. This article analyzes this phenomenon.

Mechanism changes

USD 0++ is a liquid staking token (LST) with a staking period of 4 years, similar to a 4-year bond. For every USD 0 staked, Usual will mint new USUAL tokens in a deflationary manner and distribute these tokens to users as rewards. In Usuals latest announcement, USD 0++ will switch to a lower limit redemption mechanism and provide a conditional exit option:

-

Conditional exit: 1:1 redemption, requiring forfeiture of part of USUAL proceeds. This part is scheduled to be released next week.

-

Unconditional exit: redeem at the reserve price (currently set at $0.87), and gradually converge to $1 over time.

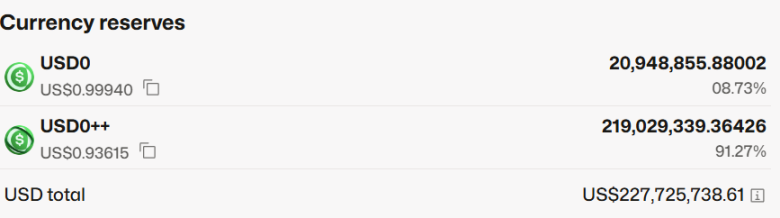

In the context of the volatility of the cripto market, the fluctuation of market liquidity (for example, the underlying assets of RWA – US Treasury bonds have been discounted in recent fluctuations) and the implementation of the superposition mechanism have poured cold water on investors expectations. The USD 0/USD 0++ Curve pool was quickly sold off by investors, with the pool deviation reaching 91.27%/8.73%, and the USD 0++/USD 0 lending pool APY on Morpho also soared to 78.82%. Before the announcement, USD 0++ maintained a premium mode to USD 0 for a long time, which may be due to the fact that USD 0++ provided an early exemption option of 1: 1 during the pre-market trading period of Binance, maximizing the airdrop income before the launch of the protocol for users. After the mechanism became clear, investors began to flow back to the more liquid local currency.

This incident has had a certain impact on USD 0++ holders, but most of the USD 0++ holders were motivated by USUAL and held the currency for a long time. Moreover, the price fluctuations did not fall below the floor price, which was reflected in panic selling.

Perhaps affected by this incident, as of press time, USUAL also fell to US$0.684, a 24-hour drop of 2.29%.

Fluctuation gradually

From a mechanism perspective, USUAL will have a process of anchoring the earnings to USD 0++ through USUAL tokens in the future (driving the coin price by burning USUAL, raising the yield and attracting liquidity backflow), and in the process of attracting new liquidity for RWA stablecoins, the role of token incentives itself is self-evident. The mechanism of USUAL is to reward the entire stablecoin holder ecosystem through USUAL tokens and anchor it while maintaining stable gains. In a volatile market, investors may need more liquidity to support their positions, further exacerbating the volatility of USD 0++.

In addition to Usual, another RWA stablecoin Anzen USDz has also been experiencing a long-term depegging process. After October 16 last year, the token continued to experience a sell-off, possibly due to the airdrop, and once dropped below $0.9, weakening investors potential returns. In fact, the Anzen protocol also has functions similar to USD 0++, but the overall pledge scale is less than 10%, which has limited impact on selling pressure, and its single pool liquidity is only 3.2 million US dollars, which is far less than the liquidity of USD 0 in Curve, which is nearly 100 million US dollars.

In terms of business model, RWA stablecoins also face many challenges, including how to balance the relationship between token issuance and liquidity growth, how to ensure that the growth of real income is synchronized with the chain, etc. According to Bitwise analysis, most of RWAs assets are U.S. Treasury bonds, and the single asset distribution also makes stablecoins partially affected by U.S. Treasury bonds. How to resist the mechanism or reserve has become a direction worth thinking about.

For stablecoin projects, they seem to have fallen into the mine, sell, and withdraw cycle of the DeFi Summer period again. Although this model can attract a large number of users and capital inflows through high token incentives in the short term, it does not essentially solve the problem of long-term value creation of the protocol. Instead, it is easy to cause token prices to continue to fall due to excessive selling pressure, ultimately damaging user confidence and the healthy development of the project ecosystem.

To break this cycle, project owners need to focus on the long-term construction of the ecosystem, and gradually build a diversified and sustainable stablecoin ecosystem by developing more innovative products, optimizing governance mechanisms, and strengthening community participation, rather than relying solely on short-term incentives to attract users. Only through these efforts can stablecoin projects truly break the cycle of mining, selling, and withdrawing, bring real benefits and strong liquidity endorsement to users, and thus stand out in the fiercely competitive market and achieve long-term development.

This article is sourced from the internet: Usual bonds unpegged, RWA stablecoin faces volatility test

Original | Odaily Planet Daily ( @OdailyChina ) Author | Asher ( @Asher_0210 ) Last Weeks Meme Summary ai16z series (ai16z, ELIZA, degenai) Price performance: For the three projects of the ai16z series, ai16z, ELIZA and degenai, according to GMGN data, after a week, ai16z rose by nearly 140% compared with last weeks recommendation (market value increased from US$380 million to US$900 million); ELIZA rose by 130% compared with last weeks recommendation (market value increased from US$31 million to US$72 million); degenais weekly increase was 26.8%. Project News: 1. The first Solana AI Hackathon is now online, and the AI Agent main track is supported by ai16z and the Solana Foundation. The AI Agent main track is supported by ai16z and Solana Foundation 2. ai16z partner Shaw posted on the…