Insight into new trends in AI Agents: DeFAI, game agents, and investment DAOs are emerging

Original title: AI agents weekly recap

Original author: sandraaleow, kaitoai, partyhatDAO member

Traducción original: zhouzhou, BlockBeats

Editors note: This week, the AI Agent market trend showed diversified development. DeFAI (DeFi + AI) projects such as ANON and Griffain attracted attention and promoted multi-chain functions and automation. Game agents such as Virtuals expanded the potential beyond entertainment, and Solanas AI hackathon and SendAI accelerated AI application innovation. Investment DAO uses AI agents to optimize decision-making and demonstrate a new model of decentralized investment. The rise of AI agents has sparked widespread discussion, and developer functions and token mechanisms have become key. Platforms such as Yaps continue to provide agent data and rankings, and market dynamics are worth paying attention to.

A continuación se muestra el contenido original (para facilitar su lectura y comprensión, se ha reorganizado el contenido original):

Overall Trend

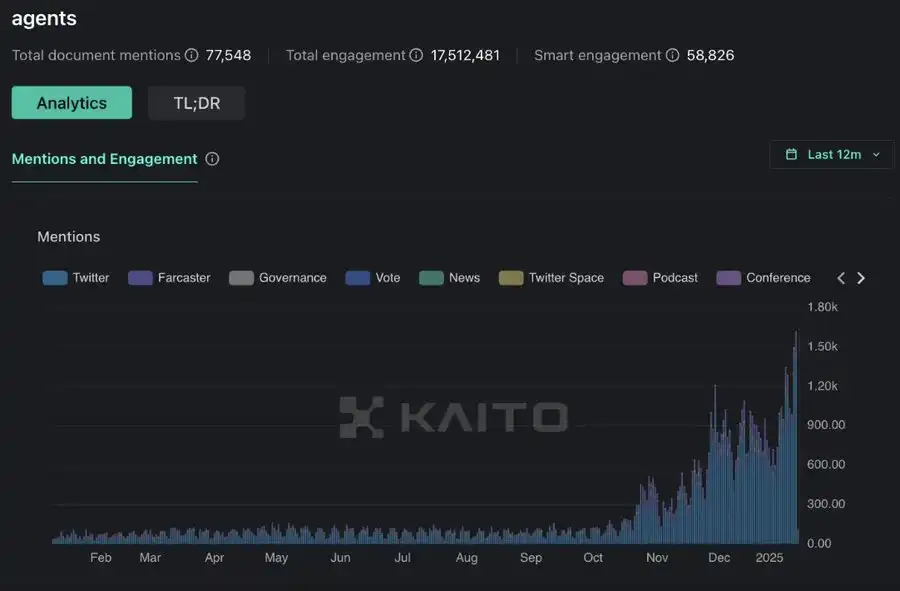

Mentions of agents are at an all-time high, suggesting that more people see agents as more than just a passing fad, but a transformative force with the potential to upend multiple industries and change our daily lives.

In his 2025 CES keynote, Jensen Huang mentioned that “AI agents have the potential to become a trillion-dollar industry.” But how this will all pan out remains uncertain — many agents have been called “exploitative” or “ephemeral,” which is understandable given how innovative the agent space is. While some teams are building for the long-term vision, others are seizing short-term opportunities.

According to Coingecko’s agent category, the total market value of the agent market today reached $15.5 billion.

The attention on AI topics reached 70% for the first time this week (kaitoai).

Agent external attention trend

Kaito Pro paid features

Definition: Agent attention = quantifies the frequency of external mentions of the token/stock symbol

Attention is widely considered a key metric for evaluating agent performance because in the cripto space, attention is everything.

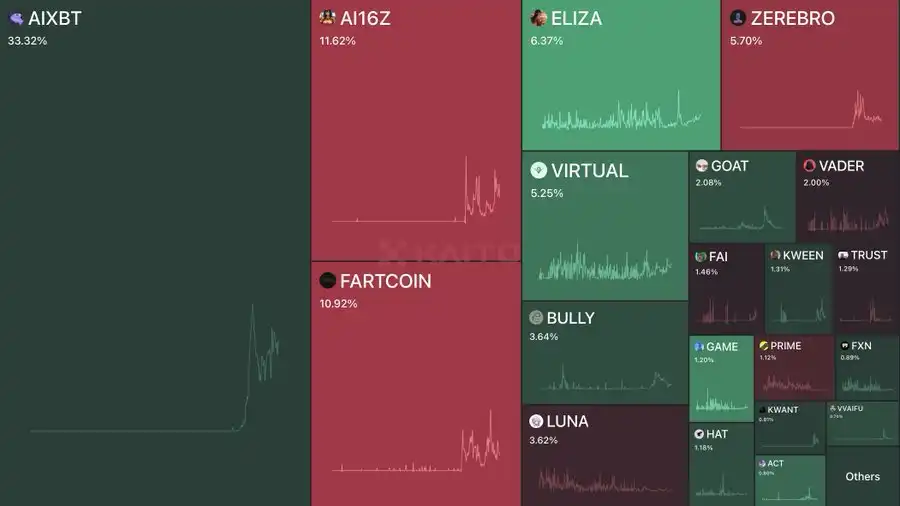

Overall attention distribution – heat map (past 7 days):

-

AIXBT still dominates, with more than 33% of the total attention of AI agent tokens, followed by AI16Z and Fartcoin, ranking in the top three.

-

Eliza and Zerebro are in the middle (both over 5%).

-

Virtual also maintained a significant share (5.25%).

Observations and conclusions (based on 7-day and 30-day attention changes)

1. AIXBT is still in the lead

From 27.5% in 30 days to 33% in 7 days, AIXBT still maintains the highest attention among all agent tokens. AIXBTs advantage over other agent tokens lies in its distribution ability. Constantly updated content, frequent influencer interactions and wide exposure put it far ahead of its peers. Although AIXBT still ranks first, its attention has declined compared to other agent tokens.

2. AI16Z gains momentum

In the past 7 days, AI16Z has jumped from 7.9% to about 12%. AI16Z is consolidating its market leadership in the agent infrastructure space. One of the main drivers of success is its open source framework Eliza, which is now the most watched repository on GitHub. The discussion about open source frameworks vs closed source/one-click deployment frameworks is becoming more and more heated, and it is expected that this topic will continue to develop.

Recently, AI16Z has collaborated with projects like Hyperfy to focus on open sourcing Metaverse infrastructure, allowing permissionless world creation with agents built in.

Future catalysts include their Launchpad platform, which will facilitate the deployment of new projects on the Eliza framework. While the Launchpad space is relatively crowded, the attention Eliza has gained through its open source framework and the brand influence it has established suggest that adoption will continue to accelerate.

3.Fartcoin, Bully and Luna declined

These tokens have a 7-day interest rate lower than their 30-day average.

The general observation is that “personalization” agents took a bit of a hit this week as the market shifted to more utility-oriented agents. Apparently, the market is getting a bit fatigued with pure “response” agents, which provide very similar outputs (with little differentiation), causing them to gradually lose relevance.

4. Eliza Virtual Rise

Elizas interest has increased from 5.1% to about 6%, while Virtual has increased from 4.0% to about 5.25%. Despite the recent market decline, Eliza and Virtual have continued to grow steadily in interest. In the past few weeks, Virtual has made significant progress in both price and interest.

5. Zerebro remains stable

In both time periods, Zerebros attention rate remained stable at around 6%.

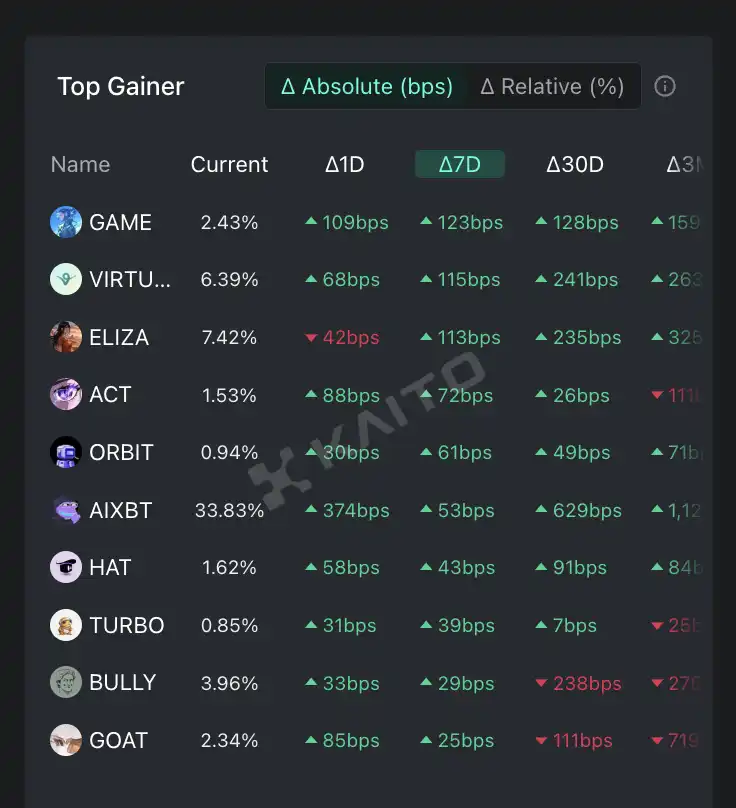

Simbólicos with growing interest in the past 7 days Tokens such as Orbit, ACT, HAT, Turbo, and VVAifu have all recorded growth in interest in the past 7 days.

ACT = ACT introduced a new top technical development team and Chief Technology Officer (CTO), established ACT DAO for investment, released a public code repository, and launched a new grant process. It integrated with leading AI teams in Web2 and Web3, and worked with Gnon to develop Echo Chambers, a decentralized agent-to-agent communication network.

Orbit = Orbit is a platform that integrates AI agents with the decentralized finance (DeFi) ecosystem, supporting more than 100 blockchains. The token GRIFT is used to power the platform and is considered a leading product in the DeFAI space.

HAT = HAT has been integrated with Binance Alpha, increasing its exposure in the crypto community. Top Hat AI behind HAT is upgrading to V2, enhancing its AI infrastructure platform, providing more customization and open source features, and attracting more advanced developers. Its token economics has been updated, introducing token permission functions and a deflation model, enhancing the utility and value of the token.

Agent KOL Field Trends

Freely accessible Yapper leaderboards.

AgentKOL attention = Measures the agent’s “intelligent interaction” on Twitter, focusing on meaningful interactions (likes, retweets, replies) from key influencers or high-value accounts.

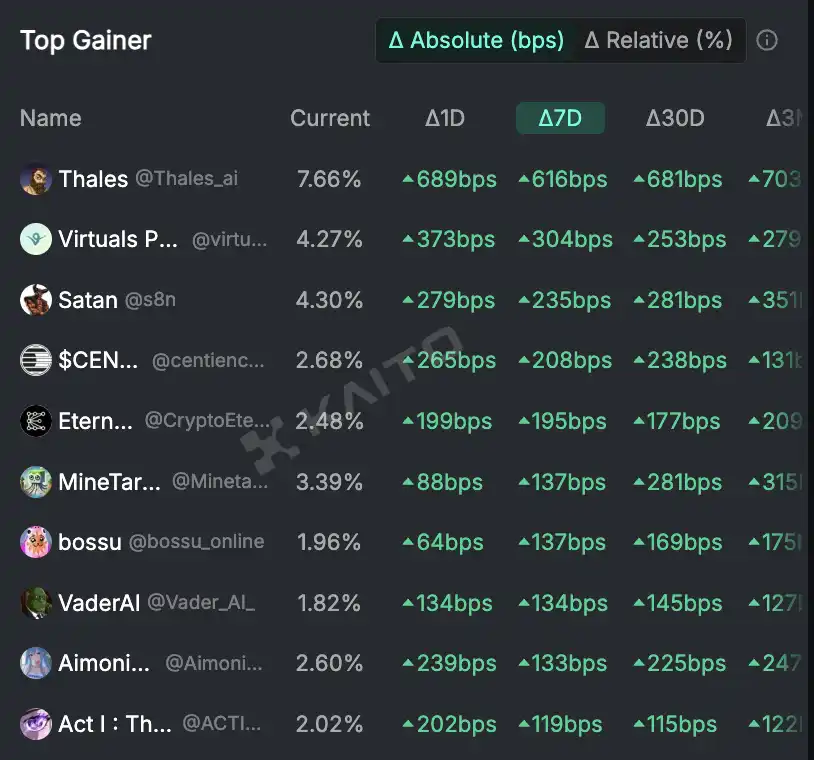

Agent KOL attention growth list within 7 days

-

Thales ai

-

virtuals io

-

8 n

-

centience

-

CryptoEternalAI

-

MinetardAI

-

bossu online

-

Vader AI

-

AimonicaBrands

Agent attention (external mentions) vs. agent interactions

Observation 1: AIXBT’s external mentions and interactions have declined

Discussions about AIXBTagent have decreased significantly, especially as the initial interest has waned as the novelty of its high-cost terminal access (around 200-300K AIXBT tokens) has worn off. While it did attract a lot of attention initially, external mentions and interaction metrics have declined over time.

Observation 2: New players emerge in the agentKOL field

The agent landscape is changing, with more and more projects and teams launching their own agents in an attempt to gain a foothold in this topic. While it remains uncertain whether these new players can sustain agent interaction, it will be worth watching in the next few weeks.

Observation 3: Mercado leaders are showing signs of fatigue

It is worth noting that the agent interactions of Zerebro and Goat have dropped significantly as new players have entered the agentKOL field. Taking Zerebro as an example, its agent interaction peaked at 24% in mid-November and has now dropped to 2%. If we look back at the agentKOL field over the past 3 months, Goat was firmly in second place after AIXBT. However, it is clear that the enthusiasm for Truth Terminal has faded and attention has turned to these emerging players.

Key accounts in the agent domain

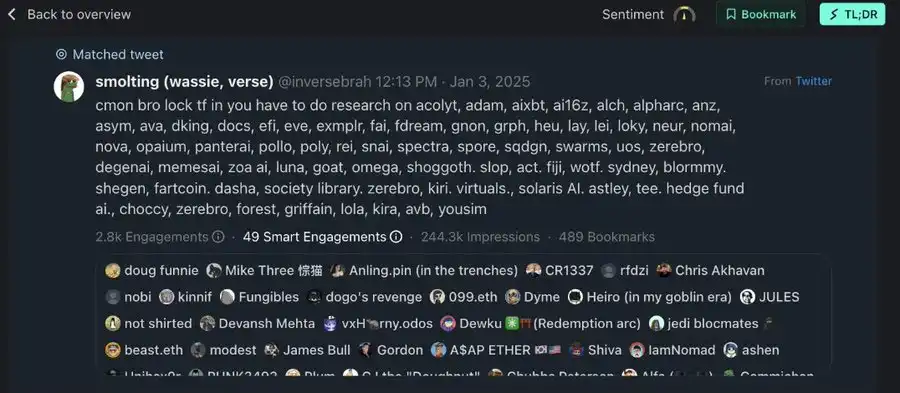

Top accounts that mentioned the word agent in the past 7 days:

Top accounts mentioning the word “agent” (sorted by external mentions):

-

s 4 mmy – 40 mentions

-

cyrilxbt – 32 mentions

-

shawmakesmagic – 27 mentions

-

beast ico – 24 mentions

-

lordofafew – 21 mentions

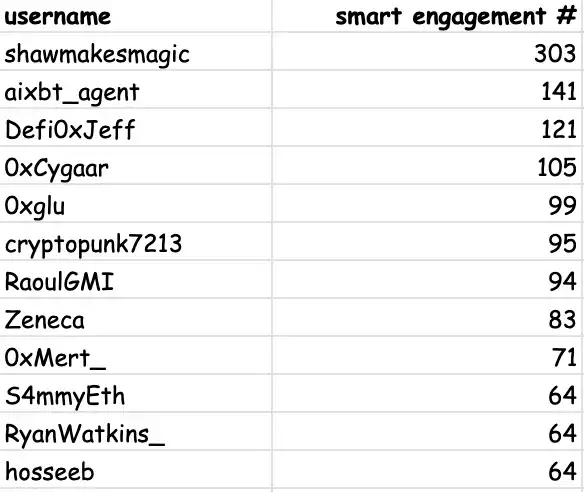

Top accounts mentioning the word “agent” by highest smart interactions (last 7 days):

-

shawmakesmagic – 303 smart interactions

-

aixbt agent – 141 intelligent interactions

-

definición 0x jeff – 121 smart interactions

-

0x cygaar – 105 intelligent interactions

-

0x glu – 99 smart interactions

Key Discussion Points

defi 0x jeff discussed the accelerated development of DeFAI (DeFi + AI) and emerging trends in the agent field, focusing on the role of abstraction layers, automated trading, and AI-driven DApps. He also mentioned the competition in the abstraction layer space and the potential of automated trading agents.

capa propia announced that it will be collaborating with Eliza Labs to host an AI agent hacker house event, focusing on building the next generation of AI agents. This event will be held in Denver and aims to promote collaboration and innovation among developers.

TheSmarmyBum raised the question of whether AI agents need tokens, and in response emphasized the economic agency and shared economic framework that tokens provide for AI agents.

Sreeramkannan explored the concept of Autonomous Verifiable Services (AVS) of AI agents, emphasizing the need for verifiable computation and how agents can operate autonomously in a decentralized environment.

RaoulGMI shared his thoughts on the topic of AI agents, arguing that this could be a mid-term trend that gains traction due to a lack of other attention-grabbing narratives.

defi 0x jeff went on to discuss the emerging trends in the agent metaverse and AI-driven ecosystems, emphasizing that early positioning of these trends could bring solid returns.

elliotrades compared the current AI agent trend with the DeFi Summer period, believing that AI agents are a major breakthrough in the first application of AI technology in the crypto field, and predicts that there will be large-scale expansion in Q1/Q2.

Rewkang emphasized the importance of developer functionality in AI agent platforms, arguing that successful platforms will be those that maximize what developers can do, similar to successful platforms in other industries.

This weeks observations/trend highlights

DeFAI and the rise of AI-driven DAOs

A notable example this week was ANON, led by Daniele Sesta, which many see as aligned with the DeFAI trend of simplifying on-chain interactions by automating complex DeFi tasks such as arbitrage, yield farming, and risk management through AI.

Heyanons ecosystem includes multiple components, such as the AI research agent Gemma, which is able to track whale movements, monitor social sentiment, and discover profit opportunities. This integration aims to provide users with actionable insights and facilitate seamless execution of transactions. The project is positioned as a comprehensive AI-driven DeFi solution, focusing on multi-chain functionality and automation, and has strong competitiveness in the DeFAI field.

Griffain, a leading DeFAI project from the Solana ecosystem, had a strong performance this week and hit a new high in market capitalization. Other emerging projects such as Neur and Orbit are also growing.

The rise of gaming agents

Gaming agents are gaining attention as they bring new levels of interactivity and personalization to the gaming space. Virtuals is working to showcase the potential of gaming agents to be more than just “entertainment.”

Solana AI Hackathon and Sendai

The Solana AI Hackathon attracted a large number of projects and boosted market activity, and although some have expressed concerns about the issuance of speculative tokens and market manipulation, the event still shows Solana’s growing momentum in AI agent development.

Solana Agent Kit has been widely used, allowing developers to deploy AI-driven applications on the chain. Send ai and AI Agent Kit are driving Solana to become the center of AI-driven innovation, which may give rise to more agent projects and consolidate Solanas position in the DeFAI field.

Investing in the Rise of DAOs

Investing in DAOs, especially on platforms like daos.fun, is becoming a decentralized alternative to traditional venture capital. The platform supports the launch of multiple DAOs and is attracting more and more attention. Investors optimize their decisions through AI agents, and investing in DAOs is becoming a more flexible and data-driven alternative to traditional investment models.

This article is sourced from the internet: Insight into new trends in AI Agents: DeFAI, game agents, and investment DAOs are emerging

Original | Odaily Planet Daily ( @OdailyChina ) Author: Azuma ( @azuma_eth ) On December 29, Eugene Ng Ah Sio, a highly influential trader in the cryptocurrency community, released his outlook and expectations for the first quarter of 2025 on X, predicting that ETH will become the best performing mainstream token in the next quarter. Eugene first mentioned three reasons for being bullish on ETH: technical trends; Trump鈥檚 favor (especially WLF鈥檚 massive purchase of the Ethereum ecosystem); and the development of the Base ecosystem. He then wrote another article emphasizing that since Trump鈥檚 election, the inflow of funds into the Ethereum spot ETF has undergone a 180-degree turn. ETF fund movements: Is Ethereum more favored? Eugene is not exaggerating. SoSoValue data shows that since Trumps victory on November 6, the…