6 top institutions’ outlook for 2025: AI craze will continue, a key year for exploring excess returns

Autor original: Stoic

Traducción original: TechFlow

We distill the core viewpoints of the worlds top institutions for you, saving you the time of reading hundreds of pages of reports.

Data sources: JP Morgan, Blackrock, Deutsche Wealth, World Bank, Goldman Sachs and Morgan Stanley.

1. JP Morgan’s core view

-

Global economic growth: The global economy is expected to maintain growth in 2025, but Chinas economy may slow down significantly.

-

Stock Mercado Forecast: The SP 500 is expected to reach 6,500, but global stock markets may show divergent performance.

Global Market Outlook

In the coming months, market trends will be influenced by the interaction between macroeconomic trends and monetary policy, while policy changes from the new US administration will also bring uncertainty.

Technological innovation, especially the “continuation of the AI boom,” will be an important factor driving the market.

Interest rate outlook

The baseline forecast assumes that global economic growth will be resilient, but the persistence of inflation will limit the room for further monetary policy easing in 2025.

However, the new Trump administration may bring risks, such as overly aggressive trade and immigration policies that may shock the supply side and undermine global market confidence.

Baseline scenario forecast

-

Global economic growth is strong.

-

U.S. stocks and gold performed well, but the outlook for oil and base metals was not optimistic.

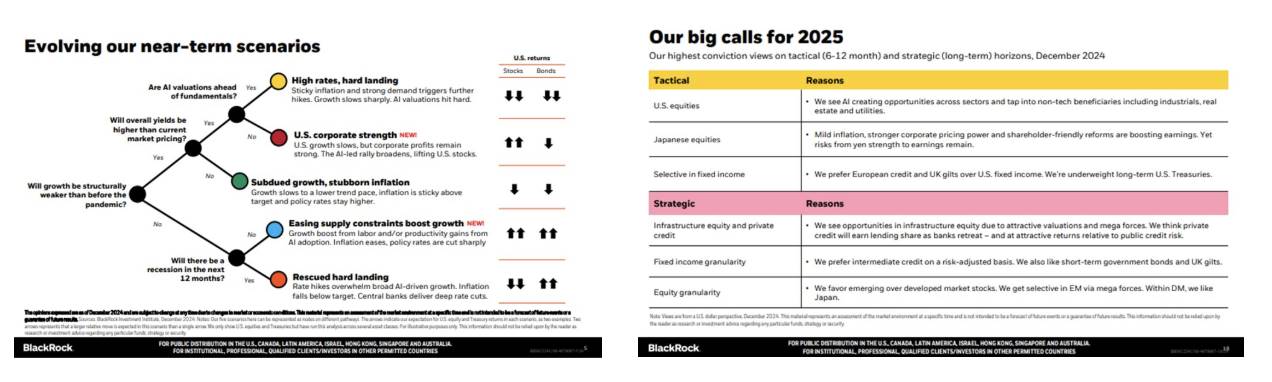

2. Blackrock’s core view

-

Special market environment: The current market is in a special stage, and long-term assets react abnormally strongly to the volatility of short-term events.

-

Investment strategy: Continue to be optimistic about risky assets and further increase holdings of US stocks because the AI theme is expanding rapidly.

-

Inflation and Interest Rates: Inflation and interest rates are expected to remain above pre-pandemic levels.

Market Outlook 2025

-

Inflationary pressures: Inflationary pressures are expected to persist due to increasing geopolitical divisions and accelerated spending driven by “AI infrastructure construction and low-carbon transformation.”

-

Fed Policy: The Fed is unlikely to cut interest rates significantly, and rates are not expected to fall below 4%.

-

Long-term bond yields: Given budget definicióncits, sticky inflation, and rising market volatility, investors may demand higher risk premiums, leading to higher long-term Treasury yields.

Key Investment Themes

-

AI-driven investment boom: The AI race will continue to drive market investments.

-

U.S. stocks continue to outperform: U.S. stocks are expected to continue to outperform, but investors will need to be flexible in responding to market changes.

-

Pay attention to risk signals: A surge in long-term bond yields or escalation of trade protectionism may become key signals for adjusting investment strategies.

3. Deutsche Wealth’s core view

Against the backdrop of a challenging economic environment, inflation is likely to remain high due to higher fiscal spending and potential tariff increases.

“This will limit central banks’ room to stimulate the economy through interest rate cuts, forcing them to seek a balance between growth and inflation control. This uncertainty could change market expectations and trigger more volatility than in 2024. At the same time, geopolitical conflicts triggered by changes in trade policies could further exacerbate market instability.”

Asset Allocation Theme

-

The U.S. economy is likely to achieve a soft landing, with solid economic growth and strong investment.

-

Focus on growth stocks, but be wary of high volatility risks.

-

Corporate profit growth and large-scale stock buybacks will be positive for the U.S. stock market.

-

Investment advice:

-

Focus on the long-term positive trend of economic growth.

-

A diversified portfolio and active risk management are recommended.

Key Points Overview

-

Despite geopolitical tensions and high interest rates, global economic growth is expected to rise slightly to 2.7% in 2025-26 from 2.6% in 2024.

-

Despite the improvement in short-term growth prospects, growth in most economies around the world remains below the average for the 2010s.

-

Global inflation is expected to decline slowly, averaging 3.5% in 2025. Central banks are likely to remain cautious in easing policy.

-

Risks such as geopolitical conflicts and climate disasters still exist, and their impact on vulnerable economies is particularly greater.

-

Policy recommendations include supporting green and digital transformation, promoting debt relief, and improving food security.

4. World Bank Group Outlook 2025 Highlights

-

Despite the challenges of geopolitical tensions and high interest rates, global economic growth is expected to remain at 2.6% in 2024. By 2025-2026, as trade and investment gradually recover, this growth rate may rise slightly to 2.7%.

-

Despite the improvement in the short-term growth outlook, overall performance remains weak. In 2024-2025, nearly 60% of the world’s economies, accounting for more than 80% of global economic output and population, will grow below the average level of the 2010s.

-

Global inflation is expected to ease more slowly than previously expected, averaging 3.5% this year. As inflationary pressures remain, central banks are likely to be more cautious in easing monetary policy.

-

Multiple shocks in recent years have caused many emerging market and developing economies to stagnate in their efforts to catch up with developed economies. Data show that nearly half of EMDEs will lag behind developed economies between 2020 and 2024. For those fragile economies severely affected by conflict, the future outlook is even bleaker.

-

Although the risks have been balanced, the overall risk is still mainly downside. The main risks include:

-

Geopolitical tensions persist.

-

Global trade fragmentation could intensify.

-

High interest rates are likely to remain for a long time, coupled with continued inflationary pressure.

-

Natural disasters related to climate change are occurring more frequently.

-

To address the above challenges, global policies need to focus on the following aspects:

-

Maintain the stability of the international trade system.

-

Promote green and digital transformation and contribute to sustainable economic development.

-

Provide debt relief support to help ease pressure on highly indebted countries.

-

Improving food security, especially in fragile economies.

-

High debt and its servicing costs are a serious challenge for emerging market and developing economies, which need to find a balance between meeting huge investment needs and maintaining fiscal sustainability.

-

In order to achieve long-term economic and social development goals, countries need to adopt the following policy measures:

-

Improve productivity growth and drive economic efficiency.

-

Improve the efficiency of public investment and ensure that funds are used appropriately.

-

Strengthen human capital building, such as education and skills training.

-

Narrow the gender gap in the labor market and increase womens labor participation rate.

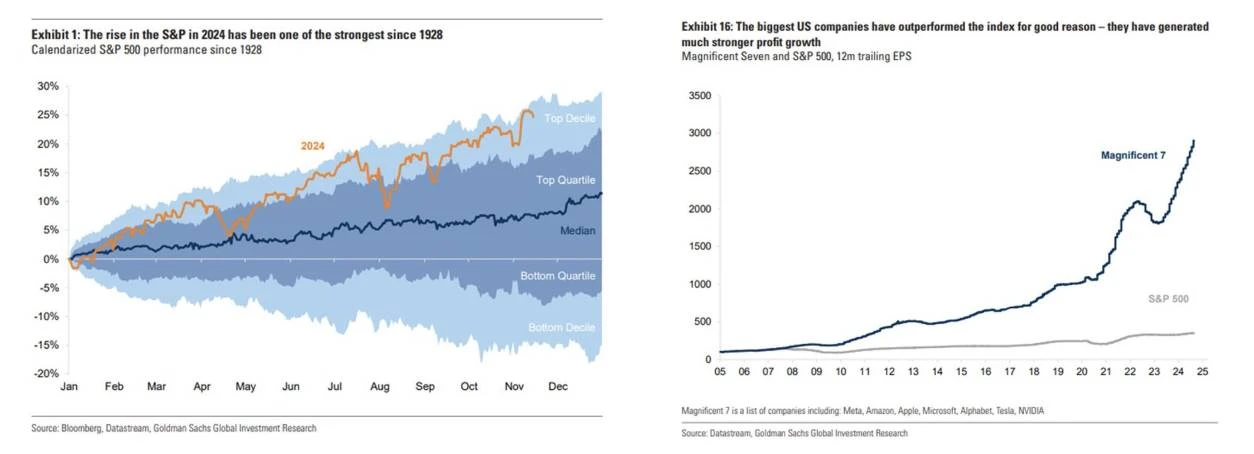

5. Goldman Sachs’ core view

“2025: A critical year for exploring excess returns”

-

Falling interest rates are occurring simultaneously with growing economic growth, an environment that can be bullish for the stock market.

-

Current stock valuations are close to highs, and future earnings growth will be the main driving force for the market.

-

Global stocks have risen 40% since October 2023, making markets more vulnerable to negative news.

-

The SP 500s gains were one of the strongest since 1928. The Nasdaq rose more than 50%, while NVIDIAs gains were as high as 264%. This trend was mainly driven by expectations of peak inflation and Fed policy shift.

-

Rising price-to-earnings ratios have led to historically high valuations for equity and credit, with European and Chinese markets in particular performing close to their long-term averages and no longer undervalued.

-

Although stocks are trading at high valuations, this does not completely inhibit the possibility of further gains. However, high valuations may put some pressure on future returns.

-

Large U.S. technology companies have outperformed, largely thanks to strong profit growth, and their valuation levels reflect their quality fundamentals rather than excessive market hype.

Risk Analysis

The two main risks mentioned in the report are:

-

The recent market optimism has already pre-empted some returns, making the market more vulnerable to adjustments.

-

There are still many unknowns regarding tariff risks, which may create uncertainty.

Goldman Sachs highlighted strategies to address these risks “through diversification and generating alpha.”

Specific strategies include:

-

Broaden the investment scope and participate in more asset classes;

-

Look for potential value investment opportunities;

-

Diversify your investments geographically to spread risk.

6. Morgan Stanley’s Market View

Core Themes

-

Morgan Stanley believes that current market valuations are generally too high, and most investors no longer think that asset prices are cheap. Therefore, it is recommended to prioritize excess returns (alpha) by optimizing asset allocation and investment selection, rather than relying solely on the overall market return (beta).

-

The bull market is entering the optimistic phase. The market is entering the optimistic phase of the bull market, which is usually the late stage of the bull market, and may be followed by the fanatical phase, which is the final sprint before the bear market arrives. Morgan Stanley said that the market performance in 2025 is still worth looking forward to.

-

The potential impact of generative AI on private equity markets is considered one of the key themes for 2025. The rapid development of this technology may bring new opportunities and challenges to private equity investment.

Summary and suggestions

Some common trends and themes can be found from the views of major institutions, such as high market valuations, the impact of AI technology, and the importance of diversified investments. These contents can serve as a reference for investors to formulate strategies.

It should be noted that these views are not absolute truths, but provide different perspectives for investors to compare and analyze.

If this post gets traction, I plan to write a separate article specifically looking at the outlook for the criptocurrency market. If there are other reports or research institutions worth looking into, please feel free to recommend them to me and I’d be happy to research further.

This article is sourced from the internet: 6 top institutions’ outlook for 2025: AI craze will continue, a key year for exploring excess returns

Original author: Haotian (X: @tme l0 211 ) In my last article, I shared the logical relationship between AI DePIN, AI MEME, AI Agent and other AI narratives. However, when exploring the potential Alpha of AI, the question arises: should I choose AI MEME that may come from a conspiracy group with a strong wealth effect but frequently replaced? Should I choose a protocol framework that is still in the early stages of building infra? Or should I choose some cool single AI with specific application scenarios? To be honest, I was confused for a long time. The following are just some superficial opinions: 1) There is no doubt about the general trend. AI Agent is neither an asset nor an application, but a new paradigm of narrative in the…