From payment tools to financial infrastructure: the evolution and future of trillion-dollar stablecoins

Stablecoins are a trillion dollar opportunity. According to a research report released by Pantera Capital partners Ryan Barney and Mason Nystrom, stablecoins are a trillion dollar opportunity, which is not an exaggeration. As a cripto asset that is pegged 1:1 to fiat currency and maintains its price through algorithms or reserves, stablecoins, due to their non-speculative attributes, have increased their share of blockchain transactions from 3% in 2020 to more than 50% currently.

The development of the stablecoin market in the past two years

2024: A Breakthrough Year

This year, stablecoins have made important breakthroughs, with total annual transaction volume reaching 5 trillion US dollars and nearly 200 million accounts generating more than 1 billion transactions. Unlike the last bull market, the application of stablecoins has broken through the limitations of the DeFi ecosystem and has shown great potential in the field of cross-border payments, especially in emerging markets with strong demand for US dollars. Currently, the supply and transaction volume of stablecoins on the chain have reached record highs.

Traditional financial technology giants have made their own plans:

-

Stripe acquires Bridge platform for $1.1 billion, hailing stablecoins as superconductors of financial services

-

PayPal to launch its own stablecoin PYUSD in 2023

-

Robinhood announces partnership with cryptocurrency firm to prepare global stablecoin network

-

The US Treasury RWA market is nearly $3 billion, a 30-fold increase from the beginning of 2023, including: • Hashnote and Coppers USYC reached $880 million • BlackRocks BUIDL reached $560 million

2025: Scale will further expand

The asset management giant Bitwise previously released the Top Ten Predictions for the Crypto Mercado in 2025, which stated that with the passage of US stablecoin legislation and the entry of institutional funds in 2025, the market value of stablecoins is expected to double to US$400 billion, and the market size of physical asset tokenization (RWA) is expected to reach US$50 billion. ParaFi predicts that the tokenized RWA market will reach US$2 trillion in 2030, and the Global Financial Markets Association predicts that it may exceed US$16 trillion.

Global financial giants are actively deploying:

-

Goldman Sachs: Digital asset platform launched, assisting the European Investment Bank to issue 100 million euros in digital bonds, and plans to build a private chain

-

Siemens: First to issue 60 million euros of digital bonds on the chain

-

HSBC, JPMorgan Chase, Citigroup: Exploring Treasury Simbólicoization Business

Next, let’s take a look at some important RWA project segments:

RWA Track

Ondo Finance (ONDO)

ONDO Finance is an RWA project that focuses on introducing traditional financial instruments into DeFi. It works with traditional financial institutions to acquire U.S. Treasury assets. Tokenized securities are then issued through smart contracts to divide the ownership of these treasuries into small shares. Investors can purchase these tokens to indirectly hold U.S. Treasuries. The value of its tokens is closely linked to the value of the U.S. Treasuries it represents. Due to the important position and stability of U.S. Treasuries in the global financial market, ONDO has attracted many investors seeking stable returns and risk aversion. When the market is volatile, the price of its tokens is relatively stable, and the trading volume also shows a steady growth trend. As more investors increase their demand for the digitization of traditional financial assets, ONDO is expected to further expand its market share, especially among institutional investors and high-net-worth individual investors.

Market capitalization: 2,407,391,199

Rank: #51

Synthetix (SNX)

Synthetix is a protocol for building synthetic assets. Users can generate various synthetic assets pegged to real-world assets by pledging SNX tokens. The value of these assets is linked to stocks, commodities, currencies, etc. in the real world. For example, users can create synthetic assets pegged to Apples stock price. The platform uses oracles to obtain external asset price information, and its price fluctuations will reflect the performance of Apples stock in the traditional market. SNX provides investors with a convenient way to invest in traditional market assets without directly holding these assets, broadening investment channels. However, the transparency, liquidity and regulatory policies of synthetic assets are crucial to their long-term development, and they also face the risks of price feed mechanisms (Oracles) and market manipulation.

Market capitalization: 760,095,061

Rank: #117

Plume Network

Plume Network is an emerging platform focused on real-world asset financialization (RWAfi), which aims to simplify the issuance, trading and management of real-world assets through blockchain technology. It provides an infrastructure that allows enterprises and asset management institutions to easily on-chain traditional assets. The platform has a variety of functions, including asset tokenization, transaction matching, liquidity provision, etc. Its advantage lies in its strong compatibility and ability to support multiple types of traditional assets, such as real estate, bonds, equity, etc. This provides enterprises with a more efficient financing channel, but how to achieve effective docking with traditional financial institutions and regulatory compliance is its main challenge.

Stablecoin track

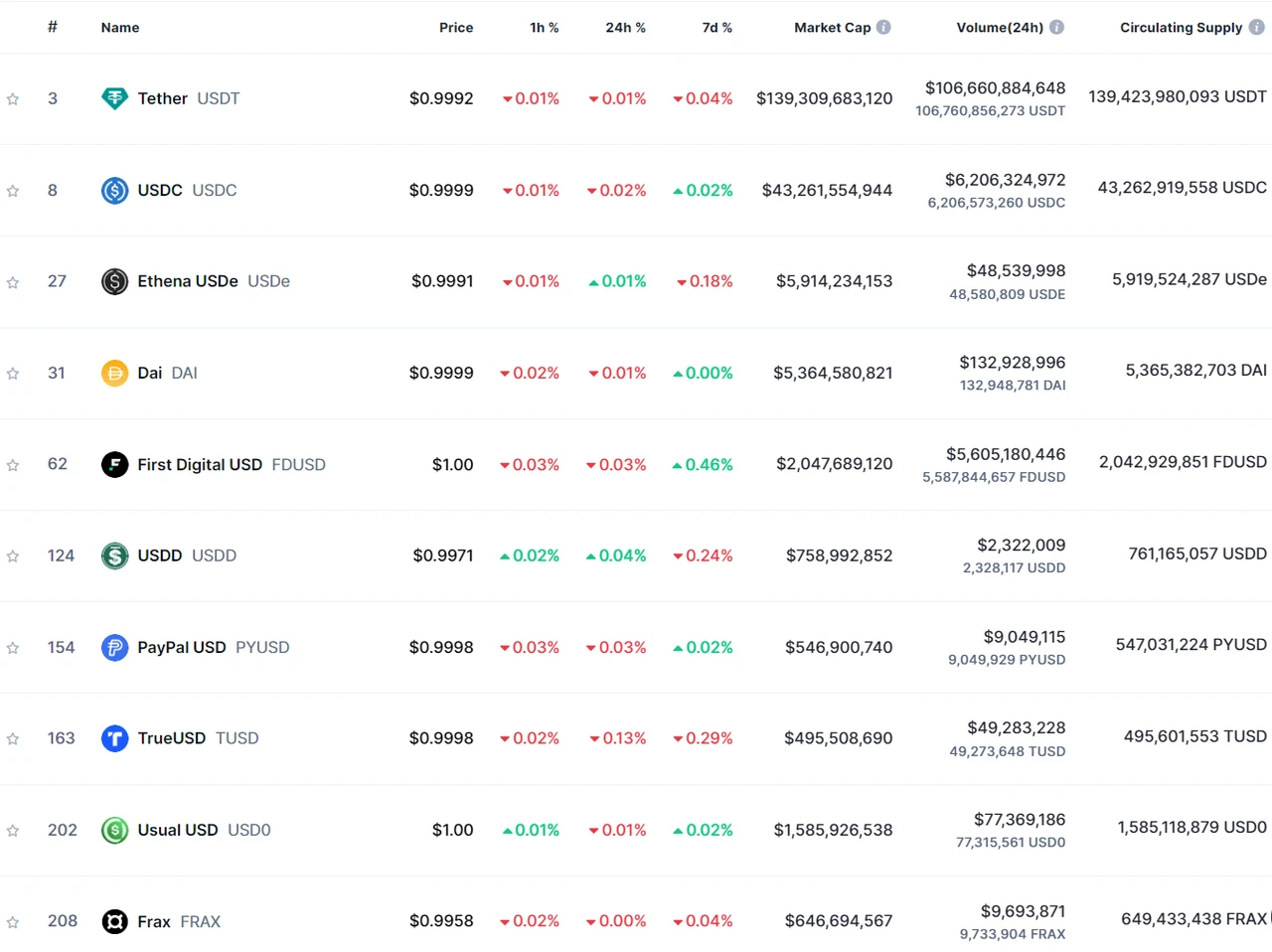

Among the top 10 stablecoins by market value, USDT has a total market value of 142.7 billion US dollars, far surpassing the supply of other stablecoins. USDC ranks second with a current market value of 41.9 billion US dollars, but judging from the on-chain transaction data, the usage rate of USDC exceeds that of USDT, and the total transaction volume in one month is nearly twice that of USDT. This month, the market value of USDDe has reached 6 billion US dollars, surpassing DAI (4.5 billion US dollars) to become the third largest stablecoin by market value.

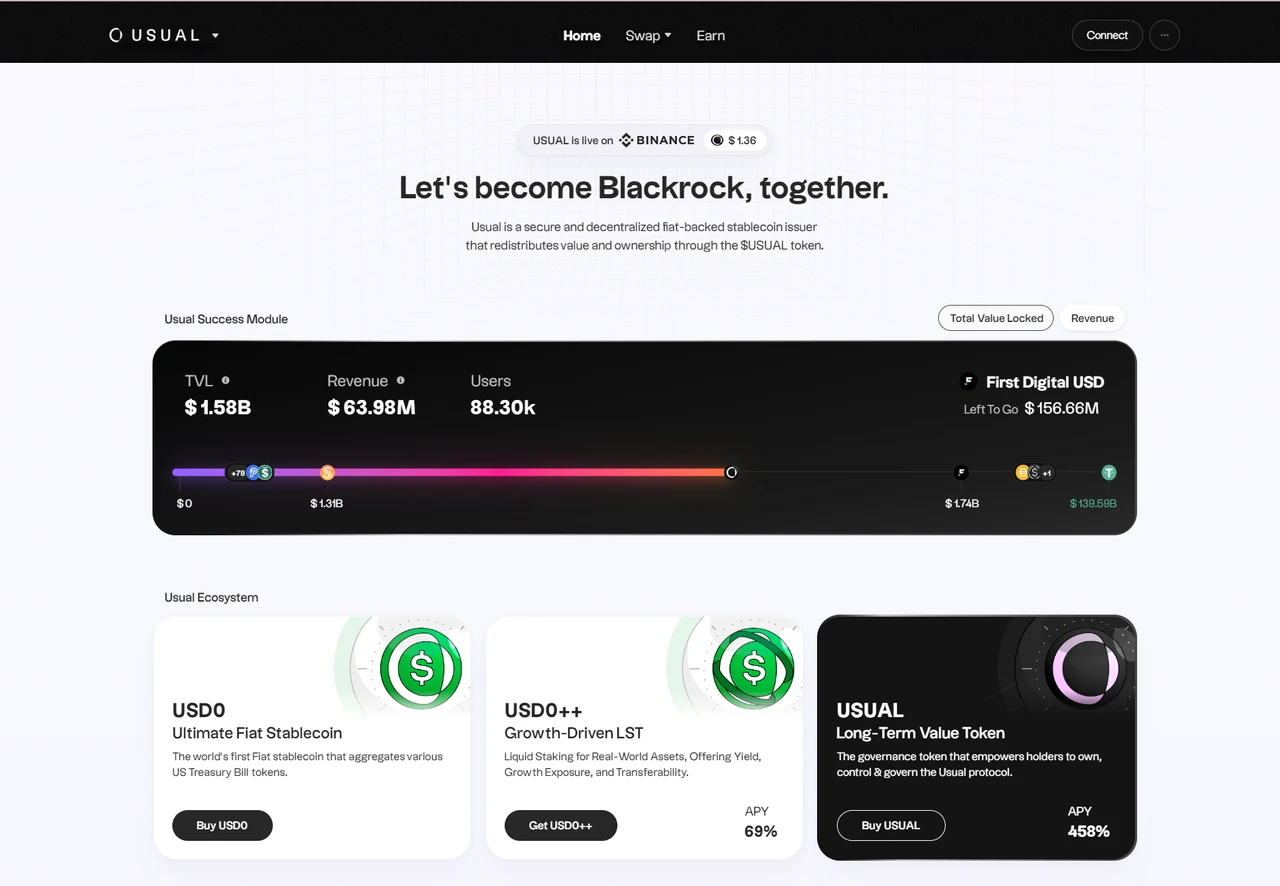

According to CMC market capitalization ranking, we observe that USD 0s market capitalization has also reached 1.5 billion US dollars, an increase of 77.17% in the past 7 days, and its ranking has jumped to 9th place. It is an innovative stablecoin protocol issued by Binance Launchpools online project Usual, which integrates BlackRock, Ondo, Mountain Protocol, M 0, and Hashnote, and transforms it into a permissionless, chain-verifiable and composable stablecoin. It has recently given users extremely generous airdrops, and its platform token USUALs price performance has also been very strong recently. The following chapters will share some stablecoin projects worth participating in.

Usual (USUAL)

Usual is a secure and decentralized issuer of legal stablecoins. By holding USD reserves, it ensures that its stablecoin USUAL can be exchanged for USD at a ratio of 1:1. At the same time, Usual distributes ownership and governance rights of the platform through its platform token USUAL. As a multi-chain infrastructure, Usual integrates the growing tokenized real-world assets (RWA) of institutions such as BlackRock, Ondo, Mountain Protocol, M0, Hashnote, etc., and transforms them into USD0, a permissionless, on-chain verifiable and composable stablecoin. USD0 is its first Liquid Deposit Token (LDT), which is ultra-short-term backed by real-world assets at a ratio of 1:1 and has high stability and security. Users can achieve convenient and diversified operation methods by directly depositing RWA or indirectly minting USD0 through USDC/USDT.

Market capitalization: 634,268,673

Rank: #133

Ethena (ENA)

Ethena is often regarded as a decentralized stablecoin USDe project and Ethereum synthetic dollar protocol, providing crypto native currency solutions and Internet bonds, aiming to solve the autonomous currency issuance and basic pricing problems in the web3 world, and return the currency issuance rights to the web3 world. In 2023, the on-chain transaction settlement stablecoin will exceed 12 trillion US dollars. AllianceBernstein predicts that the stablecoin market size will reach 2.8 trillion US dollars by 2028. If ENA is recognized by the market, the value space will be huge. However, ENA also faces various risks. In terms of financing risk, although it can benefit from financing, it may pay fees, but the negative income is not lasting and there are reserve funds to protect users; in terms of liquidation risk, the leverage of derivative transactions is not high, and there are many ways to ensure that the risk is controllable; custody risk depends on the over-the-counter settlement provider, and the risk is reduced through bankruptcy isolation trusts and multiple partners; the risk of exchange bankruptcy can be dispersed and reduced through cooperation among multiple exchanges and retaining asset control; although the collateral risk supports assets that are different from the underlying assets, the low leverage ratio and small collateral discount make it have a small impact. In general, the ENA project has both opportunities and challenges, and its subsequent development is worthy of attention.

Market capitalization: 3,030,206,926

Rank: #42

Frax (FXS)

FRAX is the first partially collateralized, partially algorithmic stablecoin protocol, combining the advantages of traditional fiat collateral and algorithmic regulation. Through smart contracts, FRAX achieves a dynamic balance between stablecoin supply and market demand. FRAXs innovation lies in its flexible collateral mechanism, which allows users to mint FRAX stablecoins by depositing US dollars or other cryptocurrencies. The protocol also introduces FRAX Share (FXS) as a governance token, which allows holders to participate in platform governance and share revenue. The protocol also has three applications. Fraxswap is an automated market maker with built-in TWAMM, which can conduct long-term block trades. Fraxlend is a lending platform that can create ERC-20 token lending markets, support multiple functions, and create custom terms for over-the-counter debt markets. Fraxferry is a cross-chain bridge that can securely transfer locally issued Frax protocol tokens without the need for bridging or third-party applications, and funds are received within 24-48 hours. Frax Finance builds a feature-rich DeFi ecosystem through stablecoins and applications, providing users with diverse services and choices in different scenarios.

Market capitalization: 355,706,115

Rank: #194

Lista DAO (LISTA)

Lista DAO is a liquidity pledge and LSDFi project based on the BNB chain. It was formerly known as Helio Protocol. It was established after receiving investment from Binance Labs and merged with Synclub. It aims to provide returns for pledged crypto assets and support the lending of decentralized stablecoin LISUSD. The core mechanisms include stablecoin lending, liquidity pledge, and innovative collateral. Stablecoin lending operates through an over-collateralization model. LISUSD is a decentralized stablecoin that does not rely entirely on being pegged to fiat currencies. It supports a variety of collateral assets and introduces new pledge assets in the innovation zone. In terms of liquidity pledge, users pledge crypto assets to obtain liquidity tokens, such as sLISBNB for staking BNB, which can be operated on multiple platforms, while obtaining pledge income. They can also pledge sLISBNB to borrow LISUSD, and the current loan interest rate is 0%. Overall, Lista DAO has great potential in the DeFi field and is expected to establish a place with its services and innovations.

Market capitalization: 85,255,603

Rank: #475

Resumir

In summary, RWA and stablecoins demonstrate the great potential of combining blockchain technology with traditional finance. With the advancement of technology and the gradual clarification of regulations in the future, they are expected to mature further and become an important bridge connecting traditional finance and the blockchain world. These projects have lowered the threshold for financial participation through innovative mechanisms, improved the liquidity and transparency of assets, and are attracting more and more institutional and individual investors. For investors, a deep understanding of the operating models and potential risks of these projects will help seize opportunities in this field. However, the rapid development of this field is also accompanied by risks, including market volatility, uncertainty in regulatory policies, and technical security issues.

Another point that needs special attention is that although RWA and stablecoin projects provide investors with unprecedented opportunities, there are also potential risks of insufficient compliance and transparency. Therefore, when participating in such projects, investors should fully understand the relevant risks and carefully evaluate investment returns and their own risk tolerance. This report is only for information sharing and does not constitute any investment advice. In the future, with the gradual clarification of regulatory policies and the continuous optimization of technology, RWA and stablecoin tracks are expected to achieve wider applications and more far-reaching impacts around the world.

This article is sourced from the internet: From payment tools to financial infrastructure: the evolution and future of trillion-dollar stablecoins

Original author: Honest Mr. Mai (X: @Michael_Liu 93 ) It has been a long time since I wrote such a long article. This is an article with a strong investor flavor. Because the logic is interlocking, it may not be easy to read, but after reading it carefully, it will definiciónnitely give you a new understanding of the crypto market and the Meme track. Today, I will try to answer three questions from the perspective of an institutional investor: 1. Has the crypto industry reached mass adoption? 2. Will Meme become the killer application that opens up the mass penetration of the crypto market? What is the underlying logic of the Meme track? 3. At what stage of the cycle is the Meme market today? 1. Has the crypto industry…