Bitcoin Suisse 2025 Outlook: Altcoin Market Value to Increase Fivefold; Wealth Effect May Drive NFT Boom

Original title: Bitcoin Suisse OUTLOOK 2025

Original article by Dominic Weibel, Denis Oevermann, Wolfgang Vitale, Matteo Sansonetti, Bitcoin Suisse

Traducción original: Wu dijo blockchain

Founded in 2013 and headquartered in Zug, Switzerland, Bitcoin Suisse is one of the earliest cripto financial service providers in Europe. The company offers a comprehensive range of services, including cryptocurrency trading, storage (such as providing secure wallet solutions) and custody services.

Prefacio

1. The macroeconomic environment will ease fundamentally and support a soft landing.

2. Bitcoin (BTC) will become a strategic reserve asset for the United States, and other sovereign nations will follow suit.

3. The price of Bitcoin will break through $180,000, approaching its historical high.

4. Bitcoin volatility will be lower than that of major technology stocks, indicating that it is gradually maturing into an institutional-grade asset.

5. Financial giants will launch institutional-grade Rollups on Ethereum.

6. An Ethereum collateralized ETF would result in market cap-adjusted fund flows exceeding those of Bitcoin.

7. Bitcoin dominance will peak before the end of the year.

8. Ethereum’s monetary policy will become its anchor, accelerating its progress towards “currency” attributes.

9. The altcoin season will peak in the first half of 2025, with the total market value increasing fivefold.

10. Solana will solidify its market position as the top general-purpose smart contract platform.

11. The wealth effect will drive the NFT craze at the end of the cycle.

The US election has triggered perhaps the biggest paradigm shift in the history of digital assets. This marks a dramatic change in the regulatory environment, with the worlds largest economy moving from strict restrictive regulation to an institutional embrace. It can be said that this is a plot twist – from the suppression of banking services by Operation Suffocation 2.0 to the discussion of establishing a national strategic Bitcoin reserve, this process heralds a fundamental adjustment in the governments position on digital assets, which has far exceeded the Bitcoin ETF or BlackRocks tentative approach to crypto assets.

Crypto PACs spent over $130 million in the election, winning bipartisan victories and shaping the most crypto-friendly Congress in history. We believe the coming era will be a re-run of the late 90s dot-com boom in crypto, when a lax regulatory environment and a friendly policy framework unleashed a wave of innovation. However, as with all political promises, words are cheap, and we will be watching closely to see if the new administration actually delivers on its promises.

With ETF records being broken and institutions entering the market at an unprecedented pace, traditional financial giants are not only testing the waters in crypto, but are fully committed. However, the landscape of development goes far beyond traditional finance, and emerging fields such as DePIN, DeSci, and DeAI are no longer just narratives, but solutions to real challenges. Polymarket has crossed the rift, and the development of on-chain privacy technology and the advancement of institutional-grade DeFi provide more exciting reasons for the next wave of crypto adoption.

Translating the above into more actionable substance, the 2025 Outlook forecast attempts to cover the breadth of the crypto market, covering improved macroeconomic conditions and liquidity, which are critical to sustaining the current crypto cycle, and Bitcoin’s expected journey to new all-time highs. Further key themes include Bitcoin’s rise as a strategic reserve asset, Ethereum’s increased institutional adoption through staking mechanisms, and the resurgence of altcoins and NFTs.

There is much to explore here. Before I dive into the details, I would like to express my deepest gratitude to Denis Oevermann, Wolfgang Vitale, and Matteo Sansonetti, whose excellent research made this report possible.

To our esteemed readers and friends: Thank you for your continued trust and interest in our research as we close out another remarkable year in the cryptocurrency space. While the holidays are a great time to rest, you’re also encouraged to keep an eye on the market: all signs point to 2025 being even more exciting.

— — Dominic Weibel / Head of Research

US Elected Candidates Supporting Cryptocurrency

1. Macroeconomic conditions will ease fundamentally, supporting a soft landing

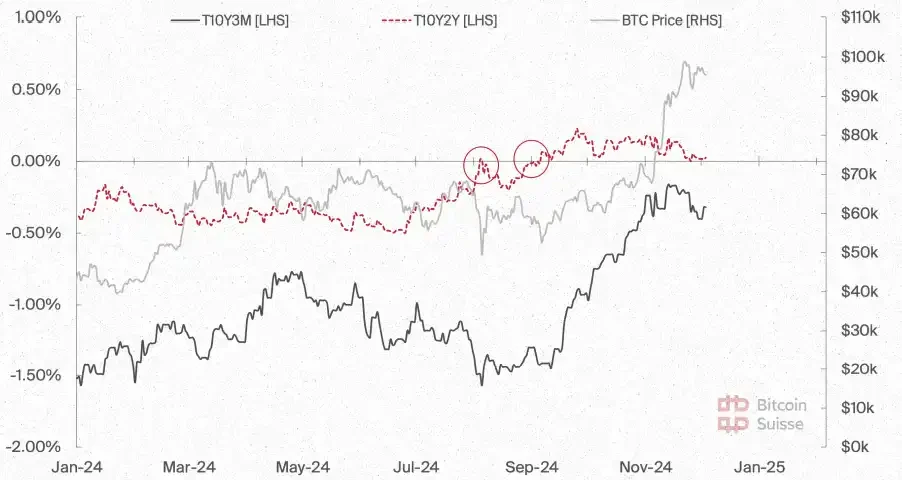

The US yield curve has been inverted for more than 24 consecutive months, one of the longest periods on record. Although the spread between 2-year and 10-year Treasury yields (2 y 10 y) has recently normalized, the 3-month and 10-year Treasury yield curve (3 m 10 y) remains heavily inverted, indicating that market imbalances continue. Bitcoin (BTC) has shown significant sensitivity to these changes, for example, in August 2024, when the 2 y 10 y curve temporarily normalized, Bitcoin plunged by $9,000 (-15%) intraday. As the short end of the yield curve gradually normalizes, volatility is expected to continue, which may create short-term buying opportunities. However, downside risks appear limited as market bullish sentiment and economic conditions stabilize, provided that major recession risks can be avoided.

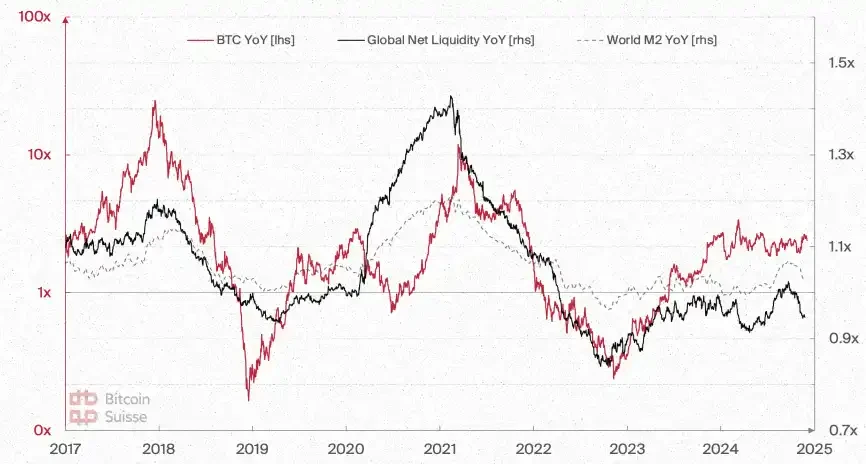

Based on historical patterns and the duration of 2y10y inversions, the 3m10y curve could normalize by the end of the year, with the Fed’s December 18 FOMC meeting likely to be the primary catalyst. This normalization trend is consistent with improving financial conditions, as evidenced by the decline in the National Financial Conditions Index (NFCI), which has retreated from tight conditions in 2023 to “normal” levels. Declining use of emergency liquidity tools, such as the Bank Term Funding Program (BTFP), further suggests easing conditions. Meanwhile, global net liquidity shows signs of gradual improvement, a positive sign for market stability, although current growth levels remain significantly below 2021 peaks. Sustained liquidity growth will be critical to sustaining the crypto market’s upward momentum, especially as the second half of the bull cycle unfolds.

So far, liquidity dynamics have been driven mainly by fiscal measures, while monetary liquidity has lagged. However, there has been a policy shift after the election, with macroeconomic policies shifting from demand-side stimulus to supply-side economic strategies. The new policies focus on deregulation, targeted tax cuts, and lower corporate financing costs, aiming to promote long-term productivity and employment growth. This strategic shift is expected to ease inflationary pressures while creating a more stable environment for economic growth. In addition, increased US oil production to stabilize reserves and energy costs could reinforce deflationary trends and benefit energy-dependent industries, thereby indirectly supporting the broader market. This will further promote an easing of monetary conditions and interest rates.

The evolving macroeconomic backdrop highlights the transition to a more sustainable growth model as supply-side measures are replacing the top-down demand-driven strategies of recent years. This strategic shift, combined with improved liquidity and stabilization of financial conditions, puts crypto markets in a strong position for continued gains. Bitcoin and other major crypto assets are poised to benefit from these favorable conditions, with improved macro conditions likely to drive stronger performance and unlock significant growth opportunities in the current bull cycle.

Global net liquidity is improving but remains significantly below its 2021 peak.

Yield Spreads and the Impact of Yield Curve Normalization

Global Net Liquidity and Global M2 Money

Global net liquidity: refers to the sum of asset purchases and balance sheet expansions by major central banks around the world, and is therefore the main driver of available liquidity in financial markets. Contractions in global net liquidity often coincide with downturns in financial markets, while expansions in liquidity drive overall economic growth and an upward trend in asset prices.

2. Bitcoin becomes a strategic reserve asset for the United States, and other sovereign nations will follow suit

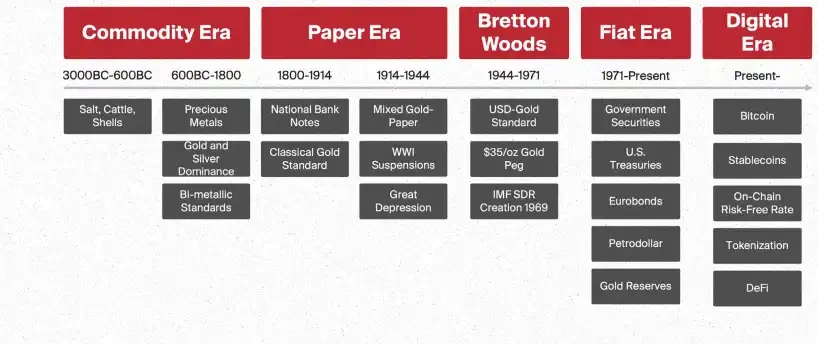

Bitcoin is at a critical stage of integration into the core of global reserve strategies. Against the backdrop of growing fiscal uncertainty, geopolitical divisions, and shifting monetary orders, we predict that Bitcoin will emerge as one of the core assets of national reserves. This trend will change the way countries hedge risks and achieve economic sovereignty, and strengthen financial resilience through diversified public funding allocation. Record central bank gold purchases and sovereign countries increasingly experimental attempts at Bitcoin further demonstrate the growing importance of diversified reserve assets.

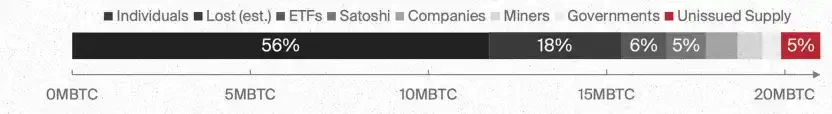

With the incoming Trump administration, we are observing growing momentum for the U.S. to adopt Bitcoin as a strategic reserve asset. The Lummis Bitcoin Act, which proposes the purchase of 1 million BTC, is a significant watershed move that could make the U.S. the largest national holder of Bitcoin, at approximately 5% of the network supply. This share is comparable in dollar terms to the U.S. share of global gold reserves. The U.S. government currently holds 200,000 Bitcoins through enforcement actions, which could be the starting point for a broad reserve strategy and provide precedent support for operations.

Not only is there a push at the federal level, but state governments are also gradually following suit. For example, Florida and Pennsylvania are actively purchasing Bitcoin directly for their treasuries, while Michigan and Wisconsin have chosen to take a more cautious approach through Bitcoin-related ETFs and trust funds. In addition, as public and private sector adoption indicators continue to rise, companies are adding large amounts of Bitcoin to their balance sheets, further highlighting the increasingly important role of Bitcoin in financial management.

From a global perspective, Bitcoin’s influence as a reserve asset is also becoming more evident. Our assessment shows that Bitcoin has surpassed the British pound to become the world’s fifth largest currency and the seventh largest asset. These milestones are significant. From a geopolitical perspective, Bitcoin’s neutrality is gaining traction, such as Russia and China’s recent recognition of Bitcoin as property.

As a hedge against the potential instability of the US dollar and a force supporting the dominance of the US dollar, Bitcoin is being seen as a solution to current financial challenges. Since 2000, the purchasing power of major fiat currencies has fallen by more than 70%, reinforcing the need for a hard monetary anchor. In addition, Bitcoin provides a key option for addressing the challenges of rising sovereign debt. The US federal debt has now reached a record high of $36 trillion and is expected to increase to $153 trillion by 2054. Bitcoins compound annual growth rate (CAGR) may provide the government with a powerful tool to offset the impact of debt growth.

Bitcoins reserve asset status may not only enhance the United States fiscal resilience, but also counter the de-dollarization efforts of hostile countries. Legislative and bipartisan interest, especially in the context of evolving monetary conditions, suggests that Bitcoin may become one of the core pillars of strategic reserves alongside gold in the future.

The impact of Bitcoin achieving reserve asset status is difficult to quantify, but could trigger a profound shift in the global monetary landscape. Just as gold prices soared over the next decade after Nixon abolished the Bretton Woods system in 1971, Bitcoin could experience a similar currency repricing as it moves from a controversial fringe asset to a nationally adopted reserve asset. Reserve asset status could lead to a snowball effect, with sovereign states competing to accumulate holdings, which would fundamentally change Bitcoins market dynamics and could break the traditional four-year cycle pattern in the coming years. The key variables are timing and implementation strategy, not certainty about the direction of development.

History of Global Reserve Assets

Bitcoin supply distribution

“Bitcoin could help solidify the dollar’s position as the global reserve currency while serving as a reserve asset to significantly reduce the national debt.”

— Senator Cynthia Lummis

3. Bitcoin price will exceed $180,000, approaching a record high

As we head into 2025, we continue to observe the development of Bitcoin market dynamics, which is consistent with our first cycle peak forecast released in November 2023. Based on Bitcoin Suisses Dynamic Cycle Risk and Dynamic On-Chain Cycle Risk models, as well as the combined growth forecast, Bitcoin is expected to reach a cycle peak valuation of $180,000 to $200,000 in 2025, setting a new all-time high.

At the beginning of 2025, the price of Bitcoin entered a phase of heightened risk, accompanied by a high dynamic cycle risk. However, from a cycle perspective, the model does not indicate that this is an ideal time to take profits. Since the beginning of this year, the price of Bitcoin has consolidated in the range of high $50,000 to high $60,000, and then rose sharply to nearly $100,000. At the same time, risk indicators show that the current price environment is more stable than at the beginning of the year.

Earlier this year, Bitcoin reached a new all-time nominal high of around $73,000 (inflation-adjusted prices are still more than 5% below the 2021 all-time high of $67,000). While on-chain risk remains elevated, it has not yet reached a level that warrants profit-taking. Notably, long-term holders (LTHs) have shown some selling pressure, but this has been offset by demand from institutional investors, particularly Bitcoin ETFs, which have consistently absorbed several times the amount of Bitcoin produced daily since their launch.

Bitcoin currently accounts for only 0.2% of global financial assets, far less than traditional asset classes such as real estate, bonds, and gold. However, as institutional adoption increases — especially with important moves that may be imminent in countries such as the United States — Bitcoins trajectory could change significantly, disrupting traditional markets and accelerating its exponential growth. Against the backdrop of global assets totaling $910 trillion, even if Bitcoin accounts for 5% to 10% of these assets, the price of Bitcoin could increase 25 to 50 times to $2.5 million to $5 million per coin, assuming all other conditions remain unchanged and ignoring significant growth in global assets over time.

While this scenario is already significant, it may only be a transitional phase in the long term. For example, Michael Saylor predicts that by 2045, the price of Bitcoin will reach about $13 million per coin. In the short term, such adoption could trigger a super cycle that pushes Bitcoins valuation above $300,000 in this cycle, in line with the upper limit of the current trendline forecast.

Bitcoin Suisse’s Dynamic Cycle Risk Indicator and Dynamic On-chain Cycle Risk Indicator

• Price Color Points:

Plotted using Bitcoin Suisse’s Bitcoin Dynamic Cycle Risk Indicator to assess the relative risk of Bitcoin price levels.

• Bottom Oscillator:

Built on top of Bitcoins dynamic on-chain cycle risk indicator, it is used to analyze the relative risk level of on-chain activities.

Bitcoin Dynamic Cycle Risk Indicator

The Bitcoin Dynamic Cycle Risk Indicator is a proprietary tool from Bitcoin Suisse that assesses the relative risk of Bitcoin price levels by analyzing key factors such as momentum, trend strength, and cyclical dynamics among cryptocurrencies. The indicator adjusts to market conditions, maintaining a stable risk level when prices are rising modestly and reducing risk when prices are moving sideways or falling.

The Bitcoin Dynamic On-Chain Cycle Risk Indicator is a Bitcoin Suisse proprietary tool used to assess the relative risk of Bitcoin on-chain activity by analyzing multiple individually optimized and adjusted on-chain risk indicators. Each indicator is designed to reflect cross-cycle dynamics and is able to independently identify market tops and bottoms. This indicator dynamically adapts to market conditions, reducing risk during periods of subdued activity and increasing risk during periods of high on-chain activity.

Comparison of Bitcoin and Crypto Assets in Global Financial Asset Mercado Value

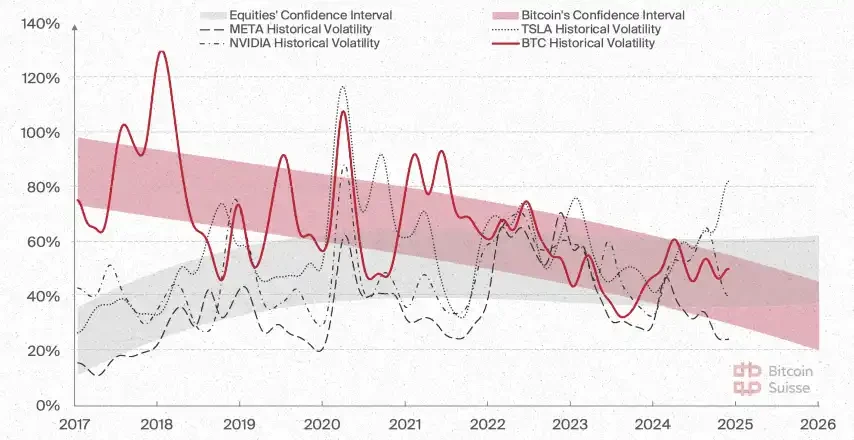

4. Bitcoin’s volatility will drop below that of major tech stocks, signaling the maturity of an institutional-grade asset

Since its inception, Bitcoin has been characterized by significant volatility. However, this volatility has continued to decline, and we believe new investment products may further narrow its volatility. The approval of the first spot Bitcoin ETF, and the regulatory approval of related listed options, has attracted new capital into the Bitcoin ecosystem, enhanced infrastructure, and expanded the range of investment opportunities. Since late summer, Bitcoin ETFs have consistently accounted for approximately 5%-10% of the average daily trading volume of spot Bitcoin.

The main drivers of compressed Bitcoin volatility include: a steady flow of demand from institutional adoption, price inertia from a larger market cap, systematic portfolio rebalancing flows from asset allocators, sophisticated strategies from hedge funds that dampen extreme volatility, and the overall increasing maturity of the asset class.

Furthermore, the options market plays an important role in this trend. Historically, the options market has been shown to reduce the volatility of the underlying asset in the medium to long term through the combined effects of hedging activities and enhanced liquidity.

Professional investors may take advantage of the newly created market to amplify Bitcoin’s inherent volatility. Through strategic trading techniques, they have the potential to exacerbate volatility in the short term.

We believe that continued regulatory progress around Bitcoin will accelerate its position in the mature asset class. As volatility continues to compress in the future, we expect Bitcoin to further consolidate its position as digital gold and potentially reach volatility levels lower than high-tech stocks.

Declining Bitcoin volatility could improve its risk-adjusted performance. Over the past year, Bitcoins high returns have been accompanied by high volatility, which has had a negative impact on metrics such as the Sharpe ratio. Since 2017, Bitcoin has returned about 7,000% in absolute terms, with a Sharpe ratio of 1.108. In comparison, Teslas return over the same period was about 2,000%, with a Sharpe ratio of 1.101, while Nvidias return was 5,600%, with a Sharpe ratio of 1.996.

Declining Bitcoin volatility has a double-edged effect: as the asset matures, its stability metrics and institutional suitability improve, while also weakening the asymmetric return potential that the asset class has historically enjoyed.

Volatility forecasts for Bitcoin and selected stocks

The chart shows the 30-day rolling volatility of four assets: BTC, Meta, Tesla, and Nvidia. To reduce noise, Gaussian smoothing is used with a sigma of 30. The shaded area shows the confidence intervals for the averages of Bitcoin and selected stocks. Different quantiles are used for different assets to ensure consistency: Bitcoins confidence interval is based on the 80% quantile, while the traditional financial stock set uses the 95% quantile. The higher predictability of the traditional financial stock portfolio is attributed to the diversification effect.

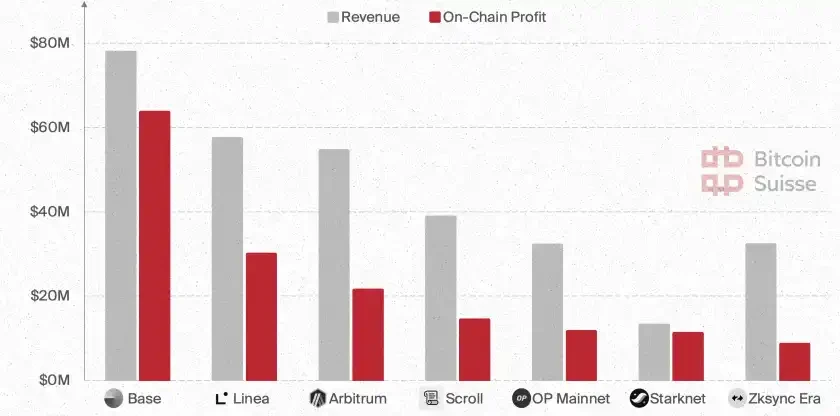

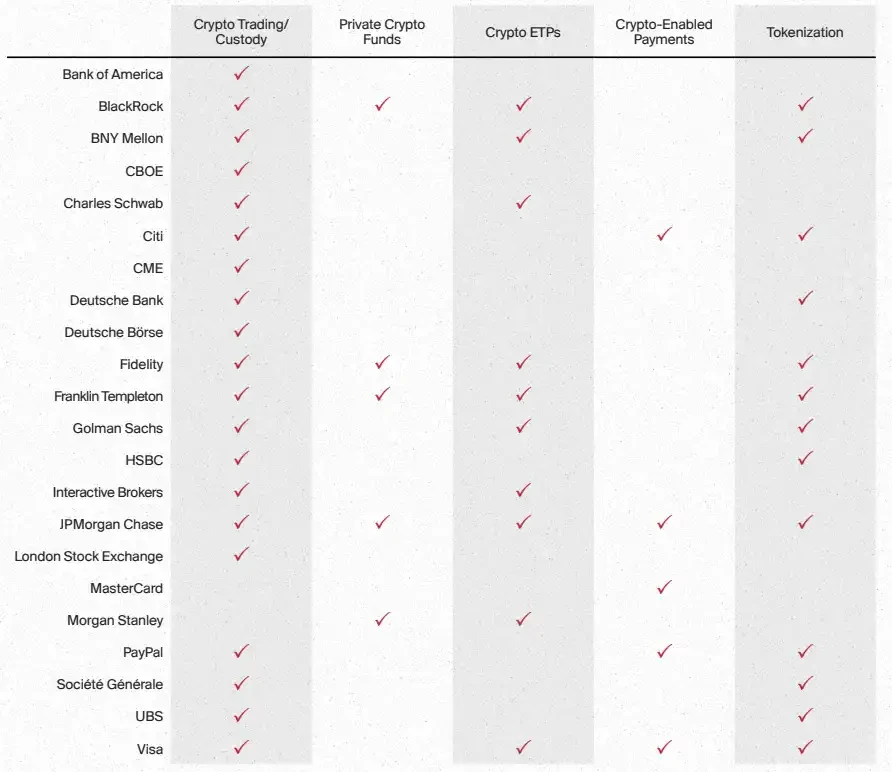

5. Financial giants will launch institutional-grade Rollups on Ethereum

Institutions are entering the crypto industry at an unprecedented rate. Stripe completed its largest acquisition ever with the purchase of blockchain payments company Bridge; BlackRock quickly replaced Grayscale as the largest crypto fund by assets under management (AUM). 13 of the 22 major global financial institutions have begun researching the tokenized market, which is expected to reach $16 trillion by 2030. Bitcoin ETFs have been adopted at a record pace, Swift has also launched a pilot project for tokenized fund settlement, and other important developments in the industry are numerous.

We believe that the conditions are ripe for institutional participation, and their next logical step is to further deepen their integration with the Ethereum blockchain through a complete Rollup implementation.

Ethereum offers undisputed high uptime, security, impartiality, and decentralization, and remains the platform of choice for institutional on-chain use cases such as stablecoins or tokenization. For example, BlackRock launched its tokenized fund BUIDL, while Visa announced its tokenized asset platform VTAP, with plans to launch a pilot project in 2025.

From a technical perspective, the implementation of EIP 4844 has been widely successful, reducing the cost of Rollup transactions to less than 1 cent and increasing the average daily Rollup transaction volume to 30 million. Base, Arbitrum, and Optimism are the Rollups with the most capital inflows in the industry since the beginning of the year, with TVL (total locked volume) increasing by more than 60%. In addition, there will be major cross-chain interoperability improvements in the future, which will enable these institutions to frictionlessly access Ethereum, the most capital-intensive smart contract ecosystem.

In addition to market expansion, efficiency improvements, and overall first-mover advantage, institutions can also enter a whole new revenue stream through Sequencing (including MEV and transaction fees). Based on the existing Rollup benchmark, Sequencer annual revenue can reach up to $80 million.

Proprietary Rollups also provide institutions with full control over latencies, consensus rules, token standards, and execution environments, while supporting built-in compliance features such as mandatory KYC or AML checks, blacklist capabilities, and automated regulatory reporting at the protocol level.

Additionally, tokenization of ETFs and payment-related opportunities can further supplement Sequencer’s revenue streams. Cross-border payments, cost savings, short settlement windows, built-in FX capabilities through DeFi integration, B2B payments, programmable payment plans, and real-time fund management operations all provide strong support for Rollups. Equity and ETF packaging can also help institutions enter emerging markets, as 90% of the world’s population does not yet have access to brokerage services. Institutional funds such as BUIDL, which recently entered DeFi through Elixir’s deUSD protocol, show that this trend is already very obvious.

Finally, history shows that attempts at private blockchains have failed to take off, and Rollups on Ethereum are the natural evolutionary path. This model creates a vertically integrated stack where institutions control both the infrastructure layer and the financial product layer that runs on top of it. The advantages are self-evident: 2025 will be the year of institutional Rollups.

RWA Simbólicoization by Industry (Excluding Stablecoins)

Revenue and on-chain profits of top Rollups (last year)

On-chain profit measures the profitability of a Rollup by comparing gas fee revenue to data and proof submission costs on Ethereum. Increased profitability comes from high block space demand (supporting premium pricing) or from operators increasing base fee multiples.

Institutional adoption of cryptocurrencies

Current conditions are highly favorable for institutional players to take the next step and further deepen their blockchain integration by fully deploying Rollups on Ethereum.

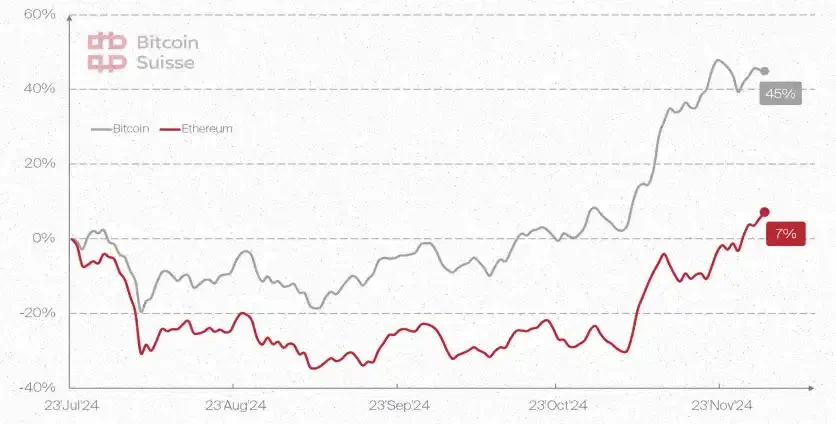

6. ETH collateralized ETFs will drive market-cap-adjusted inflows beyond BTC

Despite record-breaking Bitcoin ETFs with $32 billion in net inflows and IBITs approaching $50 billion in AUM in just 225 trading days, we expect the post-election environment to prompt a structural shift in flows toward ETH ETFs. Despite relatively poor performance since the launch of ETFs, fundamentals show that ETH is presenting increasingly attractive risk-reward characteristics amid a surge in institutional participation. November marked a turning point for ETH ETF capital inflows, with net inflows for the first time since its launch in July, and even a single-day inflow of $332.9 million, surpassing Bitcoins $320 million. In addition, recent inflows have caught up with Bitcoin after adjusting for market capitalization.

We believe that ETHs relative underperformance since its ETF approval primarily reflects the initial institutional preference for Bitcoins mature narrative and higher awareness, while also being impacted by regulatory resistance around ETH ETF staking yields. Regulatory uncertainty and the opportunity cost of not being able to earn staking rewards have significantly limited institutional inflows. However, this gap sets the stage for a strong rebound potential once the bottleneck is removed. We expect ETH staking ETFs to be approved quickly under the new Trump administration, unlocking 3%-4% yields. This feature caters to the needs of institutional allocators and is particularly attractive in a falling interest rate environment. We predict that staking yields will be significantly positive for Ethereum and will be the main catalyst to drive continued inflows into the ETH ETF. In addition, strategic acquisitions of staking service providers (such as Bitwise) further indicate that these players are actively preparing for this outcome.

In addition to the ETH collateralized ETF, we expect to see more cryptocurrency ETFs approved in 2025, including SOL and XRP, which could spark a broader discussion on L1 classification as a commodity. However, ETHs unique position — as a regulated, yield-producing asset with proven institutional adoption — is likely to remain unchallenged. Compared to Bitcoin, ETH is currently in the earlier stages of its institutional adoption lifecycle. With institutional money limited to rotating between just two major crypto assets, ETHs supply dynamics strongly suggest the potential for future value appreciation. Over 70% of ETHs supply has remained untouched over the past 12 months, while staking participation has hit record highs.

In short, we predict that the new wave of institutional crypto allocations after the election will be primarily yield-driven, with capital flows reversing. A favorable intersection of favorable regulation, yield potential, and supply dynamics will allow ETH ETFs to surpass BTC in market-cap-adjusted inflows by 2025.

ETH ETF performance since launch

ETH ETF cumulative net inflow and daily fund flow

Market-Market-Adjusted Fund Flows for ETH and BTC ETFs

7. Bitcoin dominance will peak by the end of the year

Bitcoins market dominance is expected to peak in this cycle at the turning point in 2025, marking an important change in the structure of the crypto market. While Bitcoins absolute value will continue to grow, its dominance will decline in the final stages of the bull market as capital shifts to investing in other crypto assets (i.e., Altcoins). This pattern is consistent with the market cycle driven by Bitcoins halving: Bitcoins dominance usually soars in the early stages, but as the bull market enters the final stage, Altcoins begin to dominate and their proportion declines.

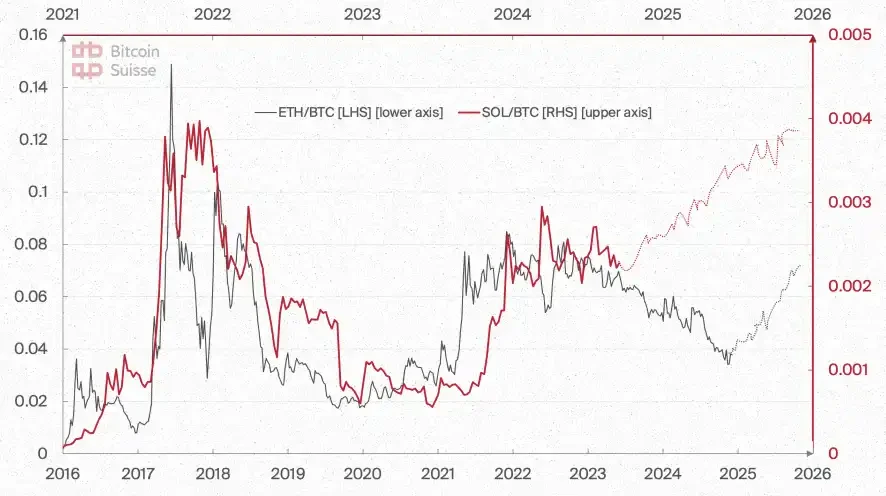

Ethereum (ETH) and Solana (SOL) are the key assets expected to outperform Bitcoin in this phase of trading against BTC. Unlike most altcoins, many of which have relatively stable USD valuations, their ratios to Bitcoin have approached zero over time. ETH and SOL have behaved like oscillators, remaining resilient in their relative strength to Bitcoin. This resilience reflects their growing importance in the broader crypto ecosystem, offering investors a more diversified growth trajectory than Bitcoin.

The expected decline in BTC dominance is consistent with historical trends and broader macroeconomic dynamics, including liquidity cycles, halving progress, and the typically slowing market sentiment after halvings and elections. As liquidity improves and investment appeal of riskier assets increases, the trend of capital shifting to altcoins will amplify their excess returns. This structural shift highlights the role of altcoins in the late cycle, where their relative returns are expected to exceed Bitcoin.

Although Bitcoin will continue to maintain strong returns, the majority of gains in the late bull market are expected to come from altcoins. This situation reflects a maturing market structure where capital prefers higher-risk opportunities when market sentiment is high. As Bitcoins dominance declines, altcoins will take a larger market share, prompting investors to re-evaluate portfolio strategies in the final stages of the bull market. After this phase ends, Bitcoins dominance is expected to rise again, laying the foundation for the next market cycle.

Bitcoin Dominance Trends

Ethereum (ETH) and Solana (SOL) vs. Bitcoin (BTC) Cyclical Fluctuations

8. ETH’s monetary policy anchor accelerates its monetization process

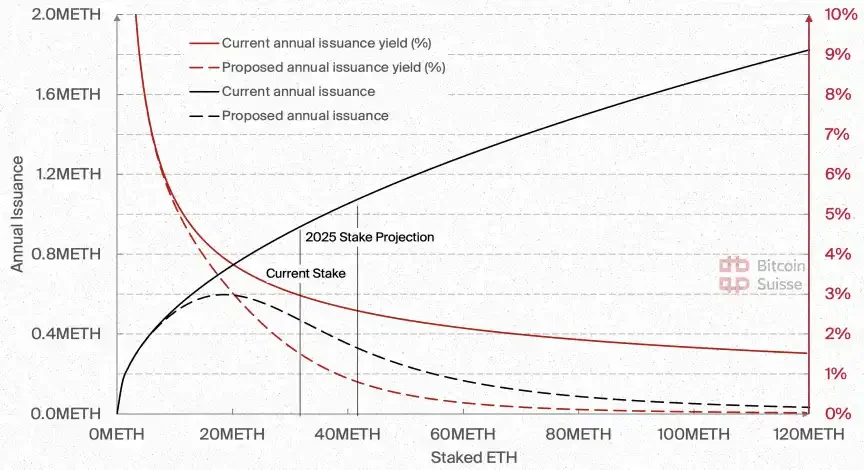

Despite strong support for modifying ETHs monetary policy, the issuance rate of Ethereum staking rewards will not change in 2025, and there will be no consensus to include the changes in the hard fork expected in 2026. During 2024, several Ethereum researchers questioned the sustainability of the staking economy and proposed a new issuance curve that would cap the staking ratio or adopt a mechanism to stabilize it near the target value. These proposals are intended to address the risks that may arise from excessive staking ratios, including unnecessary inflation and pressure on the network. In extreme cases, ETH may be replaced by a single dominant liquid staking token (LST), which would have an unacceptable impact on Ethereum.

We believe that it is critical for ETH to maintain its role as a trusted neutral currency in global settlements, and therefore we are concerned about the high pledge ratio. However, in order to achieve the goal of monetization, there are also objections that any issuance adjustment may weaken its perception as a sound currency (especially in comparison with Bitcoins fixed monetary policy).

Although ETH’s issuance policy has changed several times, the most notable example being the introduction of staking, the rise of competitors such as Celestia and Solana in 2024 has made it even more important to maintain ETH’s monetary properties. While competitors can quickly optimize specific areas, the process of having their new currency accepted as money is much more difficult.

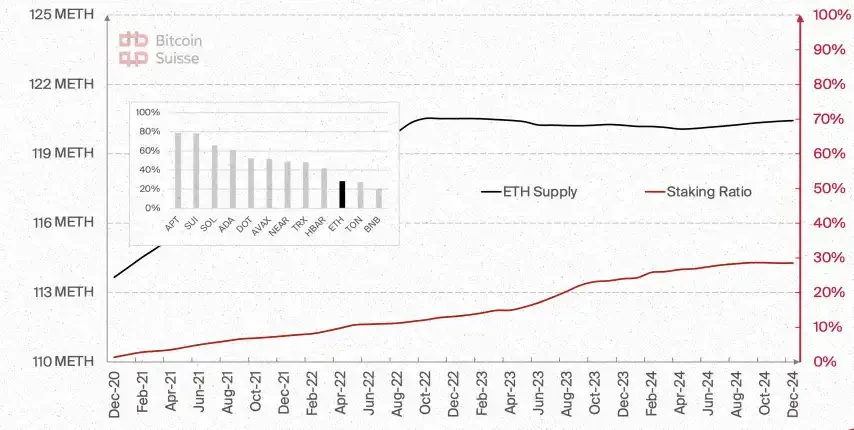

Due to the importance of this decision and the disagreement on how to monetize, we expect the Ethereum community to have difficulty reaching a consensus on changing the issuance policy by the end of 2025. In addition, we believe that even if an ETH staking ETF is approved, its staking ratio will not reach the level shown by most PoS chains. We expect the staking ratio to increase at a similar rate to last year (+18%), reaching ~33% in 2025. The relatively low staking ratio and the integration of validators after the implementation of EIP-7251 will further reduce the urgency of policy changes.

We believe that the consolidation of ETH’s monetary policy in 2025 will have a positive impact on its valuation while differentiating it from other platforms. However, we do not rule out the possibility of future adjustments after a broader social consensus is reached, thus definiciónning the “final form” of the staking economy.

Example: Proposed changes to the issuance curve and issuance yield

The issuance yield is lower than the staking yield because it does not include transaction fees and MEV

ETH total supply and pledge ratio changes

Comparison of staking ratios of major PoS networks

9. Altcoin season will peak in the first half of 2025, with total market value expected to increase fivefold

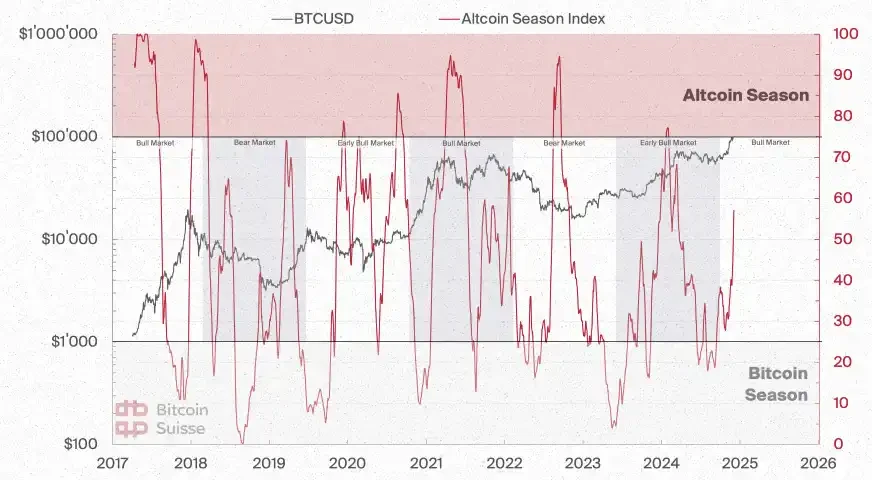

The Altcoin season is upon us as the crypto market enters a critical phase towards 2025. Historically, this shift usually occurs in the late stages of a Bitcoin-led bear market, when Altcoins continue to underperform (dark grey area in the chart). However, the upcoming market rotation will drive capital (primarily from Bitcoin) to Altcoins, marking the beginning of a decisive and significant Altcoin season.

The most explosive Altcoin seasons usually coincide with the final sprint of Bitcoins bull market, usually occurring when Bitcoin reaches its cycle peak. This cycle seems to be no exception. Bitcoins market cap is expected to approach $4 trillion, and its dominance will decline accordingly, creating ideal conditions for Altcoin outperformance. Current trends suggest that the first half of 2025 will usher in the strongest and most significant Altcoin season of this cycle, which will be particularly evident when Bitcoin consolidates near its peak, driven by capital rotation and high risk appetite.

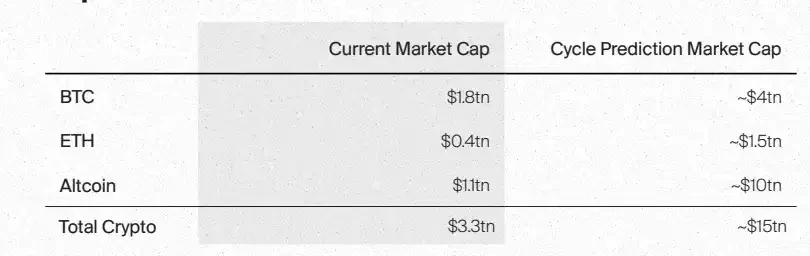

Using the market capitalization targets of Bitcoin and Ethereum as a benchmark, we can clearly see the potential performance scale of Altcoins. Assuming that the total crypto market capitalization reaches about $15 trillion in this cycle, Bitcoin is expected to have a market capitalization of $4 trillion and Ethereum is expected to have a market capitalization of $1 to $1.5 trillion, which will leave about $10 trillion for Altcoins. At present, TOTA L3 (i.e. the total market capitalization of Altcoins excluding Bitcoin and Ethereum) is only $1 trillion, which means that as the cycle matures, the Altcoin market as a whole may have up to 10 times the growth potential.

The peak market cap of Bitcoin, the expansion of Ethereum, and the expectation of capital flows to Altcoins together form the basis for a deep Altcoin season in the first half of 2025. This period will provide significant excess return opportunities, and some assets are expected to achieve exponential growth. As market dominance shifts, actively deploying and diversifying Altcoins will be the key to capturing the full potential of this high-growth phase.

Altcoin Seasonal Index: Points to Significant Increase in Recent Altcoin Returns

Altcoin Season Index: Measures whether the top 50 crypto assets (excluding stablecoins) outperform Bitcoin over a set period of time. When the index value is above 75, it indicates the entry of Altcoin Season; when it is below 25, it shows Bitcoin dominance.

TOTA L3: The total crypto market value after excluding Bitcoin and Ethereum, which is basically the market value of all Altcoins.

Bitcoin, Ethereum and Altcoin Market Cap Forecast: Pointing to Multiple Growth in the Future

10. Solana solidifies its position as the top general-purpose smart contract platform

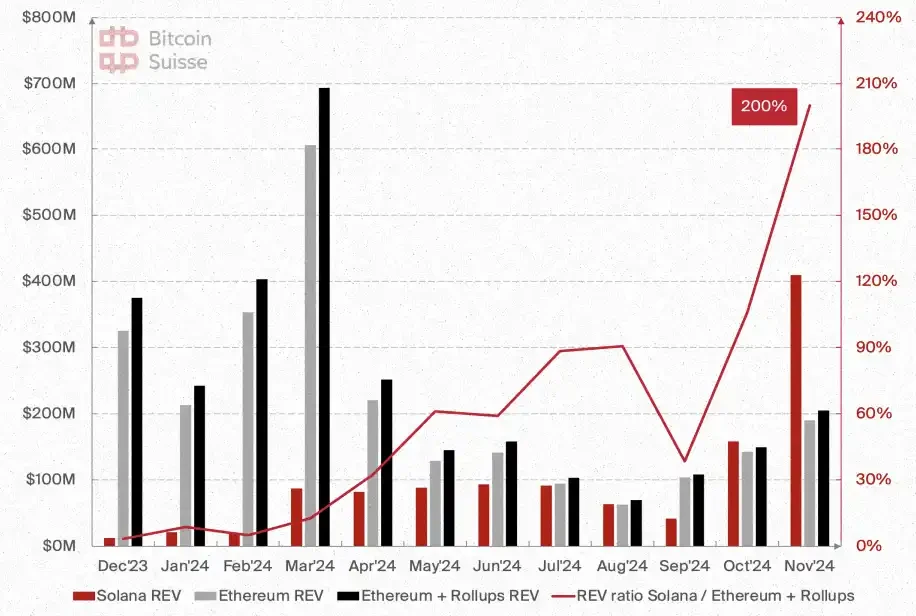

In 2024, Solana becomes a strong competitor to Ethereum in terms of real economic value (REV: transaction fees + MEV tips) and recognition by founders, investors, and users. We expect Solana to continue to have an advantage in a competitive environment in 2025 as foundational improvements continue to be made.

With a fast iteration cycle, a strong core developer team, and consistency in value proposition and optimization strategy, Solana is currently in an ideal position to enhance its network effect. However, next year it will face fierce competition from Ethereum and other existing platforms (such as Aptos, Sui) as well as emerging platforms (such as Monad, MegaETH). High throughput and low fees may no longer be significant differentiators, so key improvements must be achieved at the fundamental level while increasing bandwidth and reducing latency.

The most anticipated upgrade in 2025 is the maturation of Firedancer, which will make Solana a more robust multi-client network. Firedancers codebase will be independent of Agave, significantly reducing the risk of chain client failures, and validators can easily switch clients without waiting for problems to be resolved. Firedancer is already running in non-voting mode on the mainnet, allowing the team to collect data and test new features and optimizations.

Other foundational improvements will focus on several key areas:

• State growth mitigation: Addressing state growth by increasing the use of state compression techniques.

• Handling of state contention: Improve state contention issues by adopting a central transaction scheduler globally.

• Development of zk-rollups: More zk-rollups are expected to emerge, relying on the recently introduced dedicated system calls.

• Token economics improvements: by redistributing priority fees to stakers (SIMD-0123) and continuing discussions on reducing issuance.

• Enhanced Scalability: Improved scalability through advances in asynchronous execution technology and hardware capabilities.

• Enhanced anti-censorship capabilities: Enhanced anti-censorship capabilities by implementing a multi-parallel leader mechanism.

• Lightweight full-node client development: Continue to advance the Mithril project and reduce hardware requirements.

While we do not expect all of these improvements to be realized by 2025, the partial shift from “rapid iteration, breaking things and then building things up” to more focus on strategic, fundamental improvements by independent teams gives us confidence in Solana’s sustainable success as a top general-purpose smart contract platform. This success will be reflected in Solana continuing to be the platform of choice for DeFi and DePIN founders, and becoming more attractive to institutional-grade tokenized asset issuers, which is critical to realizing the potential of a global, permissionless, and efficient state machine.

Solana and Ethereum Monthly AEV

11. The wealth effect will drive NFT momentum at the end of this cycle

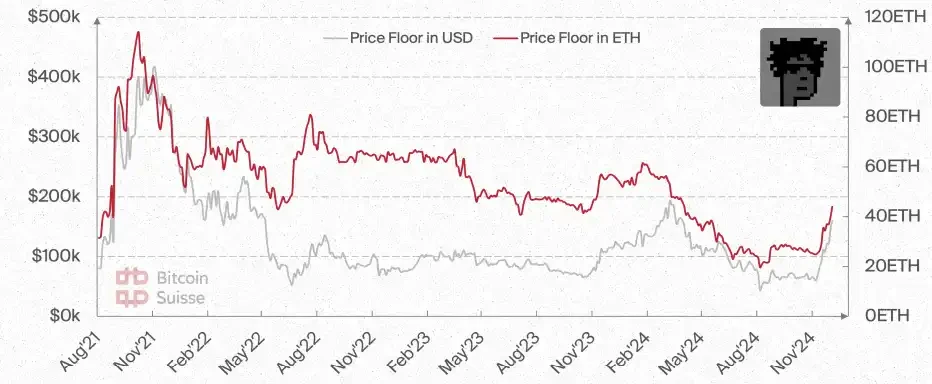

In recent years, the NFT market has experienced a deep correction, with market expectations and reality falling apart. We expect this trend to reverse later in this cycle, driven primarily by industry-wide wealth effects and capital rotation. While the performance of most NFT collections is likely to remain subdued, we believe that top collections such as CryptoPunks or Fidenzas have established themselves as social identifiers in the crypto space, as well as high-end digital artworks, especially generative artworks. With the support of blockchain, generative art has gained an ideal performance platform, proving the value of durable, irreplaceable, and ownable digital content through verifiable scarcity and on-chain provenance.

Projects represented by Pudgy Penguins have received more attention recently. The project is the second largest NFT project by market value, boosted by the expected launch of its PENGU ecological token. In the current trend of cryptocurrency culture, there is a clear trend towards MemeCoin, and the meme nature of PENGU may be beyond the markets expectations. In addition, as the most successful consumer brand in the crypto field, the launch of the Abstract chain by its parent company may further accelerate its momentum.

The increase in trading volume in November and the recent performance of collectibles seem to indicate early signals of this trend. Magic Eden has become the first major NFT platform to complete a valuation event, and OpenSea may be brewing a similar event. These events may increase the stickiness and liquidity of the NFT market. Driven by these catalysts, we expect the value of related NFT collectibles to appreciate significantly. As in the previous cycle, we observe that NFTs usually lag before the market boom reaches its peak, so the late wealth effect may once again trigger a new wave of demand for highly scarce collectibles.

We predict that early Artblocks collectibles will be natural beneficiaries of this momentum. These collectibles combine historically significant on-chain generative art, endorsement by renowned artists, proven collector demand, and true scarcity. Furthermore, these collectibles have maintained a fairly high price floor during the bear market and are poised to benefit from the next phase of market maturity, especially those works that represent key moments in digital art history.

This trend is likely to be further enhanced in future cycles with the rise of a younger generation that is more familiar with digital technology.

Historical performance of CryptoPunks (in ETH and USD)

Fidenzas historical performance (in ETH and USD)

This article is sourced from the internet: Bitcoin Suisse 2025 Outlook: Altcoin Market Value to Increase Fivefold; Wealth Effect May Drive NFT Boom

Original | Odaily Planet Daily ( @OdailyChina ) Author | Fu Howe ( @vincent 31515173 ) As 2025 approaches, many institutions have made predictions about the future of the crypto market. Among them, the real world asset (RWA) sector has become a hot topic. Bitwise pointed out in its top ten predictions for the crypto market in 2025 that the market size of tokenized RWA is expected to reach 50 billion US dollars. This optimistic prediction makes the market full of expectations for the prospects of RWA. Recently, the star projects in the RWA sector have performed particularly well, adding fuel to the heat. RWA projects that have issued tokens have ushered in a new round of growth: the price of ONDO tokens has exceeded 2.1 USDT, setting a record…

Hola