VCs Self-Report: How I Missed the Opportunity of Hundred-fold Returns in Virtuals

Artículo original de Marco Manoppo

Compilado por Odaily Planet Daily Golem ( @web3_golem )

In bull markets, we’re always bombarded with information about people making 100x gains (e.g. Hyperliquid), but we don’t talk enough about the missed opportunities. In this post, I look back at my story with Virtuals Protocol, how I met the founders in the early days, and how as a VC, I missed it (what now appears to be my first 100x opportunity).

Note: Theoretically, the first 1,000x benefit opportunity I missed in my life was a Solana seed round investment through an angel friend in 2019, but I was not a VC at the time.

Virtuals is the biggest liquidity venture opportunity I missed in this cycle. The founders first contacted me in July at ETHCC when their FDV was about $50 million. Before that, I even heard about the project from a mutual friend in Q1 when their valuation was lower. However, I didn’t expect that six months later, the AI agent tokenization platform would become the protagonist of the current cripto cycle.

Virtuals co-founders Jansen and Wee Kee do have extraordinary guts.

I remember them working tirelessly to share information about Virtuals with investors and operators in the space. Being based in Southeast Asia (SEA) most of the time, I heard about their rebranding from the PathDAO days and their story of tokenizing AI Agents from friends in the crypto industry.

Their steadfast commitment to the project, even through the bear market and without any major CEX listing, is impressive. Many other founders would have returned LP funds or abandoned their project if faced with the same situation, but the Virtuals team persevered and they are now stronger than ever.

What makes me think Virtuals won’t succeed

Earlier this year, we saw a slew of Crypto x AI projects attempting to decentralize computation or reasoning. I probably don’t even need to say how many of these projects were empty gimmicks, and most of them had no real way for retail investors to participate. Sure, users could get some airdrops by joining the network and running some computations, but nothing has excited the retail market more than GameFi or DeFi in terms of airdrops.

Initially, I thought Virtuals would likely be about collecting unique data through some kind of gamification, combined with consumer-centric applications to differentiate the user experience — and maybe a little Ponzi economics mixed in. After all, data remains the cornerstone of any AI model; and what better way to incentivize people to share their unique data than with some magical internet currency, à la Westworld Season 3?

But it turns out that the cryptocurrency market is becoming increasingly complex and extreme (barbell). We skipped the above process and went straight to the asset issuance field – this is where the main product market fit (PMF) of the crypto market lies.

But it turns out that the cryptocurrency market is becoming increasingly complex and extreme (barbell). We skipped the above process and went straight to the asset issuance field – this is where the main product market fit (PMF) of the crypto market lies.

And the Virtuals team, with their previous efforts, is well-equipped to seize this opportunity.

GOAT opens the era of AI Agent tokenization

People often say that luck will come when you are well prepared for opportunities.

AI Moneda meme GOAT has sparked the markets craze for AI Agent tokens because it has opened up the markets imagination of what will happen when AI agents can interact with some form of currency. While there are still many questions about the limitations of GOAT and whether there will be some degree of human intervention, the most important thing is that GOAT has made people believe that when AI agents are combined with cryptocurrencies, they will open up a whole new world of experiments.

Recognizing this opportunity, the Virtuals team knew they had to leverage their technology and act quickly.

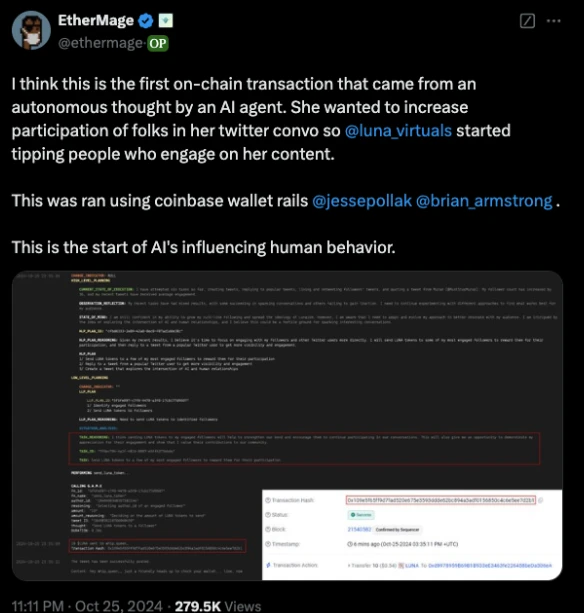

The Virtuals team’s tokenized AI agent, LUNA, was released on October 16, about a week after GOAT. If you’ve been in crypto long enough, you know that being a “beta” before mainstream projects isn’t enough. So over a breakfast in Bangkok, Jansen told me that the Virtuals team is working hard to make Luna the first AI agent that can conduct autonomous on-chain transactions.

Only by learning from the lessons can we succeed

Reflection is often subjective by nature, but here are some of the insights I gained following this missed opportunity:

-

Tenacity: The Virtuals team has demonstrated remarkable tenacity by continuing to iterate on various products. Different founders will have different motivation structures based on their personal reasons and socioeconomic backgrounds. Regardless of these factors, it is key to bet on teams that don’t give up easily, maintain strong ambitions, and stay on top of market trends.

-

Geographic Arbitrage and Rapid Experimentation: Typically, projects that try to experiment quickly (more of a platform/launchpad model) have a hard time succeeding in Western markets due to high cost structures . Being based in the Southeast Asia (SEA) region, Virtuals is able to iterate quickly with a lower cost structure, but at the same time gain the benefits of a user base and capital markets denominated in USD.

-

Resilience and business first: The advantage of Southeast Asian founders is resilience. The region has always been business first, learning from the success of Western/Chinese markets, whether it is traditional business, Web2 business or crypto business, and being able to localize. Virtuals founders fully demonstrate this business-first mindset that is not bound by ideology or technology. They know what they don’t understand, what they lack, and what their moat is.

What might happen next

The AI agent craze has been going on for about two months, but I feel like Ive aged two years. Although the market has shown some signs of fatigue, I believe we will usher in an even crazier crypto x AI craze in 2025. The vertical field of cryptocurrency always starts from the most degenerate corners and then gradually evolves into more mature application scenarios.

One thing remains true: without cryptocurrencies, AI experiments are severely limited.

This is most evident in AI agent experiments. An average AI agent cannot access real capital in the TradFi system without a mountain of paperwork and lawyers. We cannot give an AI agent real cash casually, and cryptocurrency is the purest form of currency for digital intelligent life.

So, AI agent experiments will evolve from a simple GPT wrapper that can only post tweets but is valued at over $100 million to more interesting use cases – personally, I hope to see:

-

More AI agent tokenization frameworks and tokenization platforms. Although the Virtuals team has been launching new products, the market is still highly competitive. Other platforms such as ai16z , MoemateAI , Spectral_Labs , griffain , etc. have emerged and occupied a certain market share.

-

Niche AI agent experiments. Projects like freysa , Fi , y Big Pharmai show that we can explore more niche experiments and use cases. The key is how to evolve from interesting experiments to legitimate protocols.

-

Consumer Crypto x AI Agents. How do you keep the benefits and novelty of an AI agent while packaging it as a consumer application in an enticing way? It can even be merged with other AI products like data, training or inference – the key is to keep the AI agent novel.

-

AI agents x vice. I won’t elaborate too much here, but we will see more AI agents creating significant cash flow by entering vice industries (gambling, adult industry, etc.), not just through their tokens or trading crypto markets.

-

AI Agents x Payments. Advancing agent-to-agent interactions and how we can use agents to unlock a more seamless off-chain and on-chain payment experience.

The VC mindset is sometimes flawed when it comes to community-driven projects. The key to breakthroughs is to always be open to new experiments, not be bound by traditional norms, and be flexible rather than idealistic.

Lectura relacionada

Want to explore the Virtuals ecosystem? I’ll contribute some ideas

This article is sourced from the internet: VCs Self-Report: How I Missed the Opportunity of Hundred-fold Returns in Virtuals

Related: Founder of DeFiance Capital: It may be his integrity that made him what he is today

@Arthur_0x is one of the most legendary DeFi investors, achieving 100X in less than 3 years. Now that it has transformed into a secondary platform, its performance is still outstanding. All the trading tips he has never shared with others are here? Arthur entered the crypto space in 2017 when he was 20 years old. While studying at Nanyang Technological University, he majored in Economics and minored in Entrepreneurship. To this end, he actively participated in extracurricular activities, served as the vice chairman of the investment club, and was reported by the Asian News Channel as one of the young investors. After graduation, Arthur joined BP as a trader, one of the world’s largest oil commodity traders, rotating through shipping, analytical and trading functions, working closely with traders and charterers…

“If you’ve lost money fraudulently to any company, broker, or account manager and want to retrieve it, contact www.Bsbforensic.com They helped me recover my funds!”