2024 Bitcoin Development Report: Global regulation becomes clearer, DeFi and capacity expansion drive dual growth

Artículo original de Vaish Puri and Joey Campbell

Traducción original: TechFlow

When historians look back on 2024, they may see it as a year when Bitcoin went mainstream. It was a year that saw Bitcoin hit all-time highs, became a hot topic in the U.S. presidential election, 11 Bitcoin ETFs were approved for listing, and the halving event took place. And the global economy struggled under the pressure of inflation.

This year, Bitcoin has shown its unique multifaceted charm. In economically troubled countries (such as Argentina and Turkey), it is seen as a safe haven against high inflation; in the eyes of Wall Street elites, it has become an investment tool recognized by financial giants such as BlackRock; for cypherpunks and developers, it is a new canvas for innovation; and in the eyes of governments, it has changed from a threat that needs to be controlled to an opportunity that can be exploited.

Bitcoin technology is also evolving. The Bitcoin network, which once had simplicity as its core concept, has begun to try more new features. Re-enabled opcodes (such as OP_CAT) and revolutionary research (such as BitVM) have injected new possibilities of programmability and self-custody into Bitcoins base layer. The rapid development of the second layer network (Layer 2) provides solutions for transaction expansion; at the same time, the emergence of liquid staking derivatives has also brought the potential for Bitcoin to generate income.

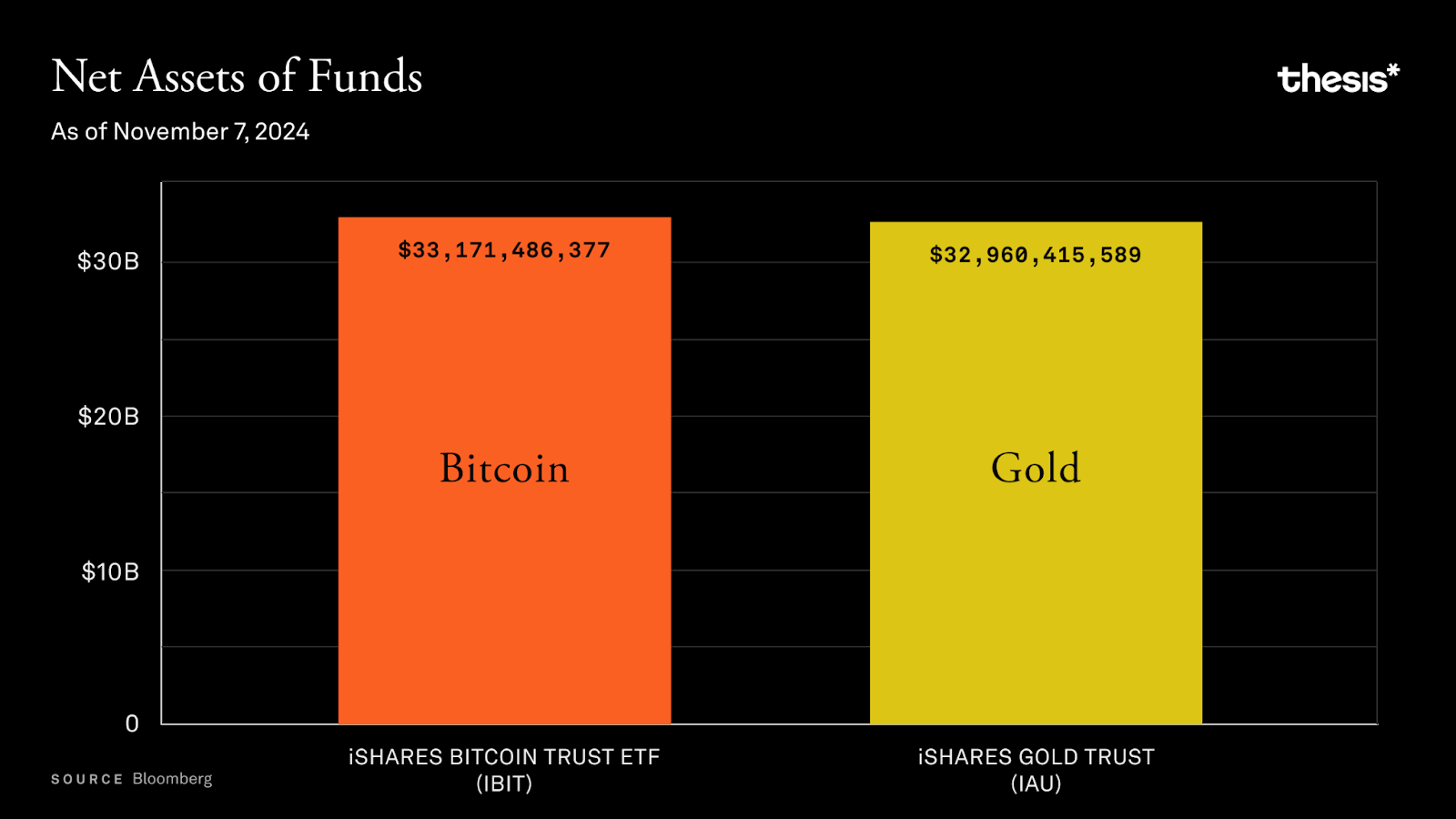

BlackRock鈥檚 iShares Bitcoin Trust (IBIT) set a record, reaching $10 billion in AUM in just weeks, a pace far faster than its gold ETFs. As institutional money poured in, Bitcoin gradually entered retirement portfolios. This phenomenon excited Wall Street and worried Bitcoin fundamentalists. The popularity of ETFs has made Bitcoin more accessible than ever before鈥攖oday, 62% of Americans can buy Bitcoin through a brokerage account as easily as buying Apple stock. However, this convenience also brings problems. The Bitcoin spirit of without your private key, its not your coin has gradually been overshadowed by the hustle and bustle of institutional trading.

However, Bitcoin always finds life in contradictions. In the United States, Trumps cripto-friendly policies have made Bitcoin a legitimate institutional asset; in India, despite regulatory pressure, 75 million users have used Bitcoin as a tool for financial empowerment; in Turkey, with an inflation rate of 50%, Bitcoin has become a savings option for millions of people; and in Argentina, when the currency is rapidly depreciating due to an inflation rate of 140%, citizens have no time to worry about custody methods, but use Bitcoin to protect their savings. In Latin America and Africa, Bitcoin is not an investment tool, but a means of survival.

This adaptability runs through the development of Bitcoin in 2024. Each region gives Bitcoin different meanings according to its own needs. Far from weakening Bitcoins core purpose, this flexibility proves its strong vitality. Bitcoin is like a mirror, reflecting the needs of different users while keeping its core characteristics unchanged.

As 2024 draws to a close, Bitcoin faces important choices. It has achieved the legitimacy that early supporters expected, but perhaps not in the way they originally envisioned. The rise of ETFs, while transformative, has also introduced the risks that Bitcoin was designed to avoid. Meanwhile, the network鈥檚 scalability issues are finally starting to be addressed in earnest, and the future of 2025 is filled with hope and possibility.

Is a Bitcoin ETF a bridge to mass adoption, or a hidden danger of centralization? Can Bitcoin staking improve the functionality of the network, or will it further divide its core philosophy? With the emergence of Layer 2 solutions and tokenized Bitcoin, can Bitcoin truly achieve scalability, or are we just repeating past debates? Does Trumps victory and the end of the Gensler era mark a new chapter in American cryptocurrency? From the revival of OP_CAT to record ETF inflows, from MEV on Bitcoin to the exploration of recursive contracts, the Bitcoin story in 2024 is still being written.

Institutional Adoption: ETFs and Microstrategy

1. Bitcoin ETF: Institutional demand

Bitcoin ETFs such as BlackRock鈥檚 IBIT achieved $20 billion in assets under management (AUM) in 137 days, a record high. In comparison, the previous fastest-growing ETF (JEPI) took 985 days to reach the same level.

Currently, the total amount of Bitcoins held by ETF custodians has exceeded 1 million, accounting for more than 5% of the current total supply of bitcoins.

Hedge funds and financial advisors account for a significant portion of investors in these ETFs, demonstrating strong institutional interest in Bitcoin.

2. Grayscale鈥檚 Decline

Grayscale鈥檚 GBTC is no longer the market leader due to its high 1.5% management fee and inefficient redemption mechanism. A large number of users turned to ETFs with lower fees, causing GBTC鈥檚 assets under management to shrink significantly, with 152,000 bitcoins lost in just one month.

3. MicroStrategy鈥檚 Strategy

Under the leadership of Michael Saylor, MicroStrategy has purchased a total of 402,100 bitcoins, with a total value of approximately $39.8 billion. They continue to increase their bitcoin holdings by raising funds through the issuance of convertible bonds and additional shares.

While the strategy has sparked some controversy, MicroStrategy remains one of the worlds largest Bitcoin holders and is also seen as an indirect way to invest in Bitcoin, with its shares trading at a three-fold premium to pure Bitcoin exposure.

4. Wider impact

As institutional investors join in, Bitcoins price volatility has gradually decreased. ETF option trading has further consolidated Bitcoins position as a long-term value storage tool and has become an important part of many investment portfolios.

ETFs provide a convenient investment channel for retail investors and financial advisors, but they have also been criticized for relying too much on the custody model, which goes against the self-custody spirit advocated by Bitcoin.

BRC-20, Ordinals and Runes

Through the Taproot and SegWit upgrades, the Bitcoin network introduced Ordinals and Runes, making NFTs and fungible tokens possible. These innovations have driven growth in network activity, but have also sparked controversy. Critics argue that they increase the burden on the network, while supporters argue that they help improve the sustainability of transaction fees and demonstrate Bitcoins permissionless innovation capabilities.

1. Trends and network influence

Due to the popularity of Ordinals collectibles, Bitcoin transaction activity surged and network transaction fees rose accordingly. In May 2024, at the peak of the Ordinals craze, transaction fees accounted for more than 75% of miners income, setting a record high.

The mempool size gradually returned to normal after reaching a peak of 350 million bytes at the end of 2023, and the introduction of Runes improved the management efficiency of UTXO.

Throughout the year, Ordinals, Runes and BRC-20 took turns to become the main force of trading activities, among which Runes accounted for the largest proportion of transactions.

2. Mercado and adoption

Platforms such as Magic Eden and OKX dominate the trading market, accounting for more than 95% of trading volume. With the optimization of user experience and cross-chain bridging with Solana, the adoption rate of Bitcoin NFT has increased significantly.

Despite the impressive performance of Ordinals collectibles at the beginning of the year, their prices have fallen by more than 50% from their highs after the halving.

Protocols like Liquidium allow users to use Ordinals and Runes as collateral for loans, further expanding the application scenarios of Bitcoin-native DeFi. At the same time, stablecoins (such as USDh launched by Hermetica) attempt to use Bitcoin as a collateral asset, although they still face technical limitations.

3. Cultural and economic shifts

Memecoins, digital art, and decentralized mercados are redefiniciónning how Bitcoin is used. While these trends are speculative, they also demonstrate Bitcoin鈥檚 core values of censorship resistance and permissionless innovation.

Simbólicoized Bitcoin: BTC on the EVM chain

Currently, using tokenized Bitcoin through the EVM chain (Ethereum Virtual Machine chain) is the most popular way to unlock Bitcoins utility, rather than relying on the second layer network (Layer 2). Due to the change in the WBTC custody model, the market landscape of tokenized Bitcoin has changed dramatically this year.

1. Tokenized Bitcoin and DeFi Applications

Tokenized Bitcoin (such as WBTC, tBTC, and the emerging cbBTC) accounts for more than 25% of the total value locked (TVL) in the decentralized finance (DeFi) sector.

While Ethereum is the primary testing ground for DeFi innovation, some Bitcoin-centric solutions, such as Bitcoin鈥檚 second-layer networks, are attempting to reduce reliance on custodians and better align with Bitcoin鈥檚 decentralized philosophy. However, these second-layer networks are still a long way from being officially launched.

2. Failure and lessons learned

Early tokenized Bitcoin projects such as renBTC, imBTC, and HBTC failed due to low adoption, hacker attacks, or centralization risks. We summarized these failure cases, called the Bitcoin Wrapper Graveyard, to analyze their key vulnerabilities.

With the change of BitGos custody model, WBTCs dominance has been challenged and user trust has declined. However, cbBTC launched by Coinbase has risen rapidly, with the locked volume (TVL) exceeding 20,000 BTC.

3. tBTC and decentralized alternatives

tBTC provides a decentralized tokenized Bitcoin model that avoids the risks of centralized custody. With its wide application in protocols such as Aave and GMX, tBTCs supply has increased by 4 times in 2024, showing the strong market demand for decentralized solutions.

4. Bitcoin-backed stablecoins

Stablecoins collateralized by Bitcoin (such as USDe and crvUSD) are becoming increasingly popular, with 30-60% of collateral assets being Bitcoin. However, these stablecoins may carry risks that Bitcoin users are unwilling to accept.

Stablecoins fully backed by Bitcoin remain an important development direction as they are more in line with Bitcoin鈥檚 spirit of decentralization and openness.

5. EVM Dominance

Although Bitcoins second-layer network has received much attention, the EVM ecosystem and its mature applications still dominate Bitcoins application in the DeFi field.

Although the second layer of Bitcoin has great potential, it is currently mainly used for speculative activities (such as airdrop arbitrage). In the future, solutions that are more in line with the Bitcoin core protocol are needed to achieve more meaningful application scenarios.

Bitcoin Staking

In 2024, Bitcoin staking has seen rapid development. A large number of new protocols use Bitcoin, the hardest currency, to support the Proof of Stake (PoS) system. Staking platforms have released Bitcoins liquidity through native staking, liquid staking derivatives, and re-staking innovations, and the total locked volume (TVL) has exceeded US$10 billion.

1. Native Staking

The Babylon protocol allows Bitcoin holders to stake their Bitcoin on a PoS chain while maintaining custody on the Bitcoin network.

Currently, 34,938 bitcoins have been pledged, with a total value of approximately US$3.53 billion, and the number of active stakers has reached 82,440.

Through contracts and penalty mechanisms, the protocol can effectively ensure the security of the PoS chain.

2. Liquidity Staking Derivatives (LSDs)

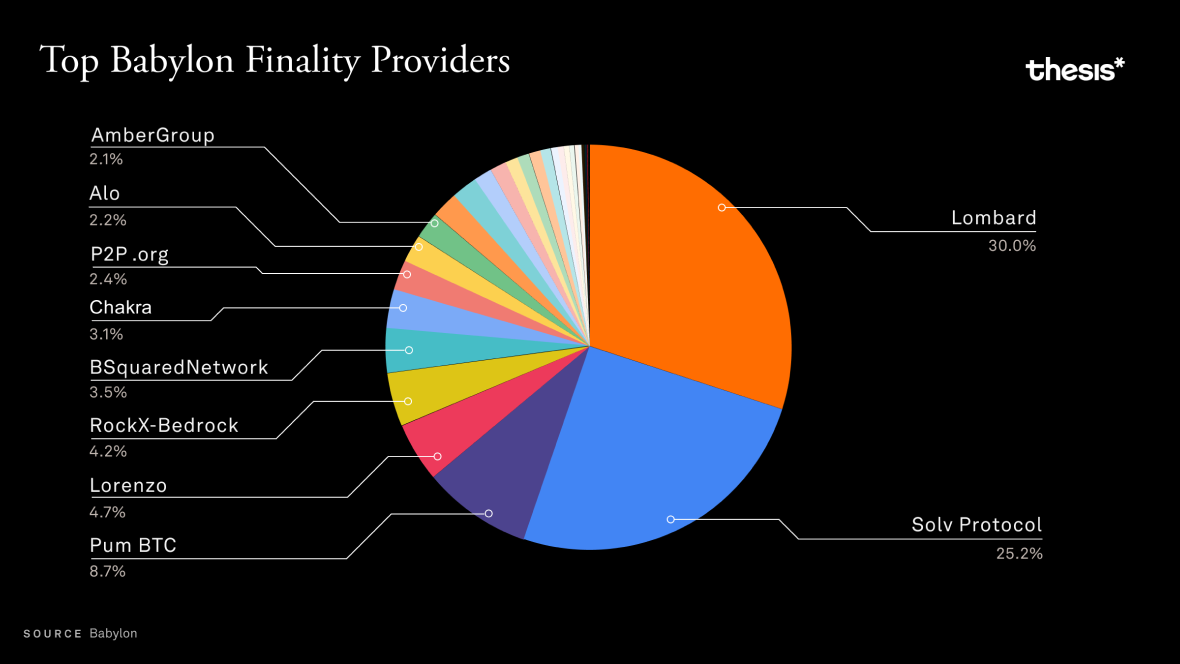

Lombard: Users can obtain LBTC after staking Bitcoin, which can not only earn Babylon staking rewards, but also be used in DeFi applications (such as Curve and Uniswap). The platform currently has a locked amount of US$1.68 billion.

Solv Protocol: Unifies Bitcoin staking operations through the Staking Abstraction Layer (SAL). Its Liquid Staking Tokens (LSDs) such as solvBTC can aggregate Bitcoin liquidity across chains, with a total locked volume of more than $3 billion.

Example tokens include solvBTC.BBN (Babylon), solvBTC.CORE (CoreDAO), and solvBTC.ENA (Ethena).

3. Re-staking

Platforms such as Lombard and Solv use staked Bitcoin for additional DeFi benefits (such as liquidity provision and lending) through re-staking. Lombards re-staking lock-up volume alone has exceeded US$1.04 billion.

Bitcoin staking is still in its early stages of development and currently relies mainly on reward mechanisms and high returns to attract users. In the long run, its sustainability depends on the growth of real demand. However, major players such as Lombard and Solv have dominated the market, which may lead to centralization risks. The total locked-in amount of these two platforms in Babylon has reached 1.32 billion US dollars.

Although liquidity staking provides users with greater flexibility, it also introduces more trust assumptions. The future direction of Bitcoin staking remains to be further observed.

Scalability: Sidechains, Rollups, and Second Layer Networks

1. New progress

Taproot and the Opcode Renaissance: Proposals such as Taproot (coming in 2021) and OP_CAT enhance Bitcoin鈥檚 programmability and privacy and support contract functionality.

BitVM: By not changing the Bitcoin consensus mechanism, it introduces Turing-complete contract functionality and supports more complex off-chain computing.

2. Layer-2 Solutions

Sidechains:

Examples include Rootstock (RSK), Liquid Network, and Mezo.

Sidechain technology introduces smart contract functionality to the Bitcoin network and improves transaction throughput. However, these projects usually rely on joint security models or merged mining to ensure the security of the blockchain.

Rollups:

-

ZK-Rollups: Provide fast transaction confirmation through Zero-Knowledge Proofs while having strong cryptographic security.

-

Optimistic Rollups: Assume that transactions are valid by default and verify the authenticity of transactions through a fraud proof mechanism. This method can significantly improve the scalability of the network, but there will be a certain delay in transaction confirmation time. Example: The Citrea project uses zk-STARKs technology and Clementine bridging solution to build a trustless Bitcoin cross-chain bridge.

State Channels (such as Lightning Network):

State channel technologies such as the Lightning Network allow users to complete almost instant payments off-chain with extremely low fees.

The current total capacity of the Lightning Network has reached 5,380 BTC, with an annual growth of 11%.

The trend shows that the number of channels in the network is decreasing, but the capacity of a single channel is increasing, which also raises concerns about the centralization of the network.

In developed countries (such as the United States and Germany), the Lightning Network is mainly used for large payments, while in emerging markets it is more used for small payments and microtransactions.

3.Build on Bitcoin (BOB):

Although the BOB project uses Ethereum as the settlement layer, its core goal is to build an economic system centered on Bitcoin and use tokens such as WBTC and tBTC to realize this vision.

In 2024, BOBs total locked value (TVL) increased from US$1.5 million to US$238.27 million, mainly due to deep integration with Uniswap V3 and Avalon Finance.

4. CoreDAO and Ecosystem Growth

CoreDAO combines the security of Bitcoin with DPoW (delegated proof of work) and DPoS (delegated proof of stake) technologies through the Satoshi Plus mechanism.

The ecosystem has launched coreBTC, a Bitcoin-backed core token for DeFi applications, further expanding the functionality of Bitcoin.

In 2024, CoreDAO achieved significant growth: the network grew by 95%, 13.3 million new addresses were added, and daily transaction volume peaked at over 500,000 transactions.

This article is sourced from the internet: 2024 Bitcoin Development Report: Global regulation becomes clearer, DeFi and capacity expansion drive dual growth

Related: Matrixport Investment Research: BTC is expected to reach $160,000 in 2025

In 2024, BTC has consistently met and exceeded key price predictions. Institutional investors who have actively embraced BTC ETFs have realized significant gains, which may motivate them to further increase their allocation to BTC in 2025. BTC expected to exceed 8% adoption threshold by 2025 BTC and the broader cryptocurrency market are approaching a critical adoption milestone, with the potential to surpass the 8% adoption threshold by 2025. Historically, technologies that have crossed the 8% adoption threshold, such as smartphones and social media, have typically experienced exponential growth due to network effects and wider availability. As BTC gradually gains mainstream acceptance, it is expected to transform from a niche asset to a core component of global financial markets. The likelihood of a major BTC price correction is reduced Market dynamics…