Coinw Research Institute: HyperLiquid in-depth research report

resumen

Hyperliquid is an innovative decentralized platform focusing on efficient perpetual contract trading. It provides perpetual contracts, spot trading, and a low-latency and high-throughput Layer 1 chain trading environment. It uses HIP-1 and HIP-2 to enhance liquidity, does not require KYC, has low handling fees, supports HyperEVM to develop DeFi applications, and incentivizes community participation through HYPE tokens. As of December 2024, it has 230,000 users, a trading volume of $500 billion, and an asset deposit of 1.12 billion USDC. The ecosystem includes projects such as PURR, HFUN, and farm. The total supply of HYPE tokens is 1 billion, which are distributed in a variety of ways to incentivize ecological development. The team is composed of experts in the field of trading, led by Jeff, and refuses external investment. It is committed to becoming a top high-performance public chain, focusing on user experience and decentralized principles, and attracting more users and developers to enrich its ecosystem.

Introducción al proyecto

Hyperliquid is an innovative decentralized trading platform that focuses on efficient perpetual contract trading. It has attracted a large number of users and investors through its unique liquidity aggregation technology and native token HYPE distribution strategy.

Sitio web: https://app.hyperliquid.xyz/

Gorjeo: https://x.com/HyperliquidX

Figure 1 Hyperliquid product development

1. Product Features

-

Perpetual Futures Trading: Users can trade perpetual futures with no expiration date on Hyperliquid, supporting up to 50x leverage.

-

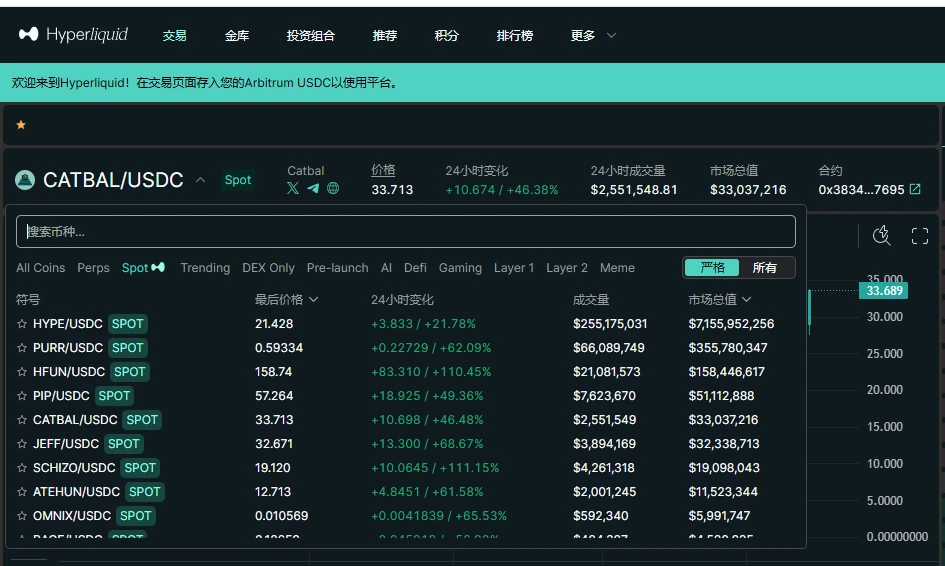

Spot Trading: In addition to derivatives, Hyperliquid also supports spot trading, enabling users to buy and sell cripto assets directly.

-

High-Performance L1 Chain: Hyperliquid is built on its own Layer 1 blockchain, which supports high throughput and low latency, providing a near-instant transaction experience.

-

HIP-1 and HIP-2 standards: HIP-1: Allows native tokens to be deployed on the chain and creates spot order books.

-

HIP-2: “Hyperliquidity” mechanism, providing an innovative way to ensure liquidity, permanently locked in the spot order book of HIP-1 tokens.

-

Transactions without KYC: As a decentralized platform, Hyperliquid does not require users to undergo identity verification (KYC), providing higher privacy protection.

-

Low fees: Hyperliquid’s transaction fees are set low, especially the negative fee model for market makers, which encourages users to provide liquidity.

-

HyperEVM support: Hyperliquid supports an enhanced EVM, allowing developers to build various DeFi applications on it while seamlessly connecting with native components.

-

Community participation and rewards: Through a points system and airdrops, Hyperliquid encourages users to participate and contribute to the development of the ecosystem. The distribution strategy of HYPE tokens is also designed to incentivize long-term community participation.

2. Advantages of HyperLiquid

-

Decentralization and transparency : As a decentralized platform, Hyperliquid provides fully transparent transaction records and a KYC-free trading experience, enhancing user privacy and security.

-

High-performance trading: Built on its dedicated Layer 1 chain, Hyperliquid supports high throughput and low latency, providing fast trade execution with reduced slippage.

-

Innovative liquidity mechanism: Through the HIP-1 and HIP-2 standards, Hyperliquid introduced a new liquidity model, “Hyperliquidity” to ensure market depth and stability.

-

Low transaction fees: The negative fee strategy for market makers and the overall low fee structure significantly reduce transaction costs and attract more traders.

-

Multiple trading products: Support perpetual contracts and spot trading to meet the trading needs of different users.

-

User Incentives: Through the distribution of HYPE tokens and community participation rewards, Hyperliquid incentivizes users to participate and contribute in the long term to build an active ecosystem.

-

Community governance: A community governance mechanism will be introduced in the future, allowing users holding HYPE tokens to participate in the platforms decision-making process.

-

EVM compatibility: HyperEVM supports developers and applications in the EVM ecosystem, expanding its application possibilities in the DeFi field.

-

Compliance and openness: Despite being decentralized, Hyperliquid is committed to compliance, ensuring its services can operate legally around the world.

Figure 2 Technical principle of HyperLiquid

Source: HyperLiquid

3. Data Analysis

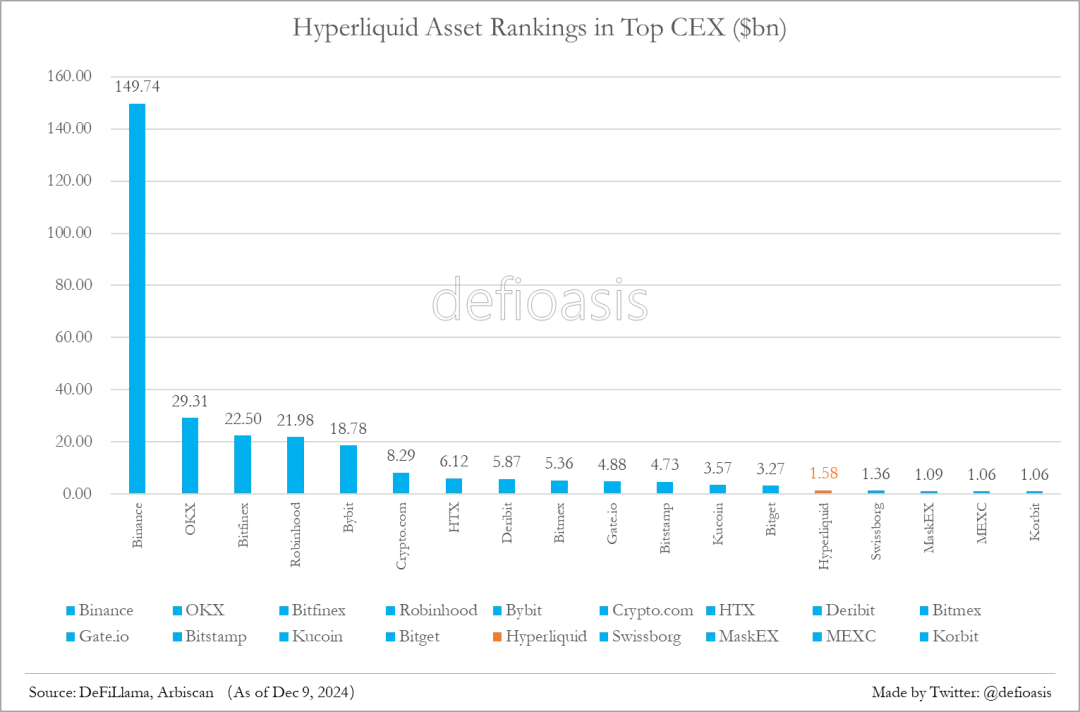

Hyperliquid is customized as a high-performance derivatives exchange Layer 1 and is compatible with EVM. Depositing assets in Hyperliquid is mainly done with the help of Arbitrum Bridge. Currently, USDT, USDC.e and USDC assets on Arbitrum are supported, but only USDC is supported as collateral. As of December 14, the assets in the Hyperliquid Deposit Bridge contract: 0x 2 D…3d F 7 reached 1.12 billion USDC and are still growing. If Hyperliquids capital is compared with CEXs clean assets, Hyperliquid can rank as the 14th largest exchange in the world, surpassing MEXC (about US$1.09 billion), and its next target is Bitget (about US$3.27 billion).

Figure 3 Comparison of asset deposits between HyperLiquid and various CEXs

Source: @defloasis

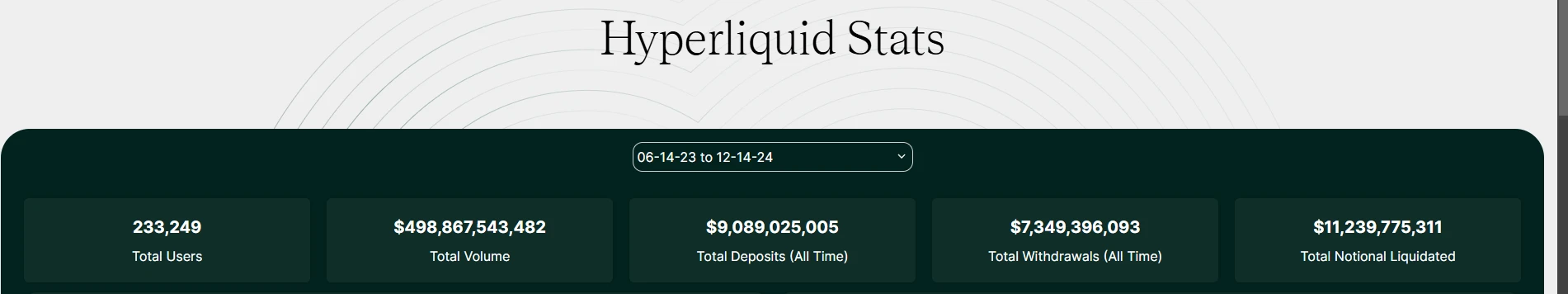

Overall data: As of December 14, the total number of HyperLiquid users has reached 230,000, and the total transaction volume has reached 500 billion US dollars.

Figure 3 HyperLiquid overall data

Source: HyperLiquid

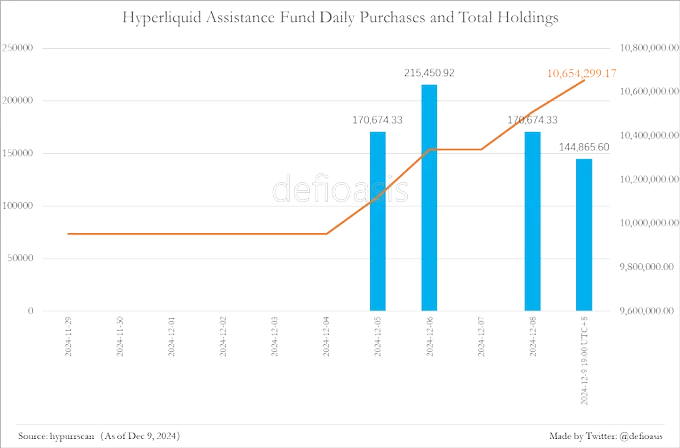

Hyperliquid Assistance Fund, which has raised over $82 million

The funds of Hyperliquid Assistance Fund mainly come from the contract transaction income of the Hyperliquid platform, that is, part of the USDC fees will go into this fund to support various activities of the platform, mainly including the repurchase of HYPE tokens. According to the hypurrscan browser, from December 5 to December 9 at 19:00 UTC+8, the Assistance Fund repurchased 567,083.22 HYPE from the secondary market, with a repurchase value of US$7,364,369.45, and an average price of about US$12.99.

Figure 4. Changes in Hyperliquid Assistance Fund

Fuente: definiciónoasis

4. Simbólico Ticket Auction to Obtain Spot Seats

Projects that want to go online on Hyperliquid need to obtain the right to issue new tokens through the Dutch auction mechanism, which is usually held every 31 hours. For a long time, Hyperliquid has focused more on derivatives trading, and most of the participants in the Token Ticket Dutch auction are Memes, and the auction price will hardly exceed US$20,000. However, with the wealth effect and popularity brought about by HYPE TGE, and with the opening of Hyperliquid EVM, it is expected that more types of projects will consider issuing tokens on Hyperliquid. In addition, some important tickets that were once auctioned at low prices may be selected by a regular project of the same name in the future, becoming a shell for listing Hyperliquid, and then buying it back from the original project party at a high price.

In recent auctions, the final price has risen sharply. The token ticket of SOLV set a new record of Hyperliquid auction at $128,000 on December 6. Considering that Solv Protocol is about to hold TGE, it is very likely that this SOLV is the same SOLV. If so, Solv Protocol will become the first major project to log in to Hyperliquid.

Hyperliquid Ecosystem Analysis

Many people think that Hyperliquid is a decentralized derivatives exchange, but its essence is a high-performance L1 public chain with zero-g as. And the market value of $HYPE token has reached 20 billion US dollars, which can be directly compared with Sui and Solana. Many high-quality projects have emerged in the ecosystem:

1. Ecosystem meme leader: PURR

Gorjeo: https://x.com/hyperintern

This is the leading meme project of hyperliquid, with a market value of 340 million US dollars and a daily trading volume of 65 million US dollars, which is already a large scale.

2. Token launch platform in the ecosystem: HFUN

Sitio web: https://hypurr.fun/

It can be simply understood as PumpFun on the Solana chain. The current market value is 150 million US dollars, and the daily trading volume is 20 million US dollars.

3. The first AI agent project: farm

Gorjeo: https://x.com/thefarmdotfun

It can be simply understood as a project such as ai16z or virtual. The current market value is 36 million US dollars and the daily trading volume is 43 million US dollars.

Overall, HyperLiquids decentralized derivatives business has been very well developed. Both the user experience and liquidity are top-notch. However, the ecosystem is still on the eve of an explosion.

Figure 5 HyperLiquid market data

Data source: HyperLiquid

Modelo económico de tokens

-

Total Supply: The total supply of HYPE tokens is 1 billion.

-

Token Distribution: Genesis Distribution: 31% of the tokens (310 million) were allocated to users who participated in the Genesis event, and these tokens have been fully unlocked.

-

Future Emissions and Community Rewards: 38.888% of tokens are used for future emissions and community incentives, including distribution through activities, points, and participation rewards.

-

Core Contributors: 23.8% are allocated to the team and early contributors. These tokens will be locked for one year after genesis, most will be unlocked in 2027-2028, and some will continue to be unlocked after 2028.

-

Hyper Foundation Budget: 6% is used to support the development and ecosystem construction of Hyperliquid.

-

Community Grants: 0.3% are used to provide funding for community projects.

-

Hyperliquidity (HIP-2): 0.012% is allocated to the Hyperliquidity mechanism for permanent liquidity locking.

-

Usage: Transaction Fees: HYPE tokens can be used to pay transaction fees for transactions on the Hyperliquid platform.

-

Governance: A governance mechanism may be introduced in the future, and users holding HYPE tokens can participate in the decision-making of the platform.

-

Incentives: Points systems and airdrops are used to incentivize user participation and liquidity provision.

-

Points system: Earn points through trading volume, participation in activities, etc. These points can be converted into HYPE tokens or other rewards to promote user activity and the healthy development of the platform ecosystem.

-

No Private Placements or Centralized Intercambio Allocations: Hyperliquid has not reserved HYPE tokens for private investors, centralized exchanges, or market makers in order to maintain its decentralized philosophy.

Team Background

Hyperliquids team is composed of experts who have worked as market makers in centralized exchanges and have provided services to multiple large platforms between 2020 and 2022. Currently, the only real name is HyperLiquids founder Jeff (https://x.com/chameleon_jeff)

Investment and Financing Background

No, we have not received any investment from any institution.

Project Summary

HyperLiquids ultimate goal is to be a top-level high-performance L1 public chain. Founder Jeff learned from the dilemma of no one trading after the airdrop of other decentralized derivatives exchanges that only by putting users first can the project really go further and better. Therefore, the project rejected all investment institutions and cooperation. And did not actively go online on any centralized exchange. 31% of the tokens were directly airdropped to users. And the project maintained the characteristics of ultra-low transaction fees and 0g as fees. This is the final form of a decentralized derivatives exchange. With the improvement of the project ecosystem, more top developers and users will enter the HyperLiquid ecosystem.

This article is sourced from the internet: Coinw Research Institute: HyperLiquid in-depth research report

Original author: @Web3 Mario Abstract: The US election has come to an end. Trump swept the United States with overwhelming momentum and made a strong comeback. In my previous article, I have already discussed the political and economic plans of both sides and their impact on the future cryptocurrency market in a very complete manner. There are also many articles describing related views, so I will not repeat them. In addition to paying attention to the election dynamics during this period, the author also felt and observed a relatively microscopic phenomenon. Some of my thoughts are very interesting, so I specially summarized them and shared them with you. In general, in this US election, the media war between the two sides will greatly weaken the credibility of mainstream media and…