Reddit becomes a popular platform for cryptocurrency trading: New retail investors prefer to buy Pepe

Autor original: Baba

Traducción original: TechFlow

As retail investors start buying our cripto again, we need to consider some new factors that were not previously important. Retail investors often don’t understand what TVL (Total Value Locked) is and rarely use Dune dashboards for analysis, so they don’t buy tokens based on the meticulous analysis commonly seen on Crypto Twitter. Instead, they are more focused on protecting their assets and pursuing the legendary 1,000x return.

Here are the main factors to consider when understanding retail investor mentality and their buying motivations:

-

Financial nihilism: Many people feel the cost of living is unaffordable and opportunities for upward mobility are dwindling, so they are attracted by the potential to improve their financial situation.

-

High-risk, high-reward perception: They see cryptocurrencies as a way to get rich quick.

-

Word of mouth: Stories about turning $100 into $1 million often generate buzz and attention.

-

Lack of knowledge: Retail investors often rely on people who are considered experts, such as anonymous users on Reddit and YouTube influencers who pretend to be experts.

-

Hundred U God of War: Most people are willing to invest $100, even if they might lose it, because it could bring huge wealth.

-

Ease of access: Apps like Robinhood make it easy for people to start trading from their smartphone or computer.

Given these dynamics, I have been watching indicators of retail investor interest. YouTube and Reddit are popular platforms for new investors to find “investing tips.” One indicator worth watching is the growth of members on the subreddit, as users on Reddit tend to be more retail investors.

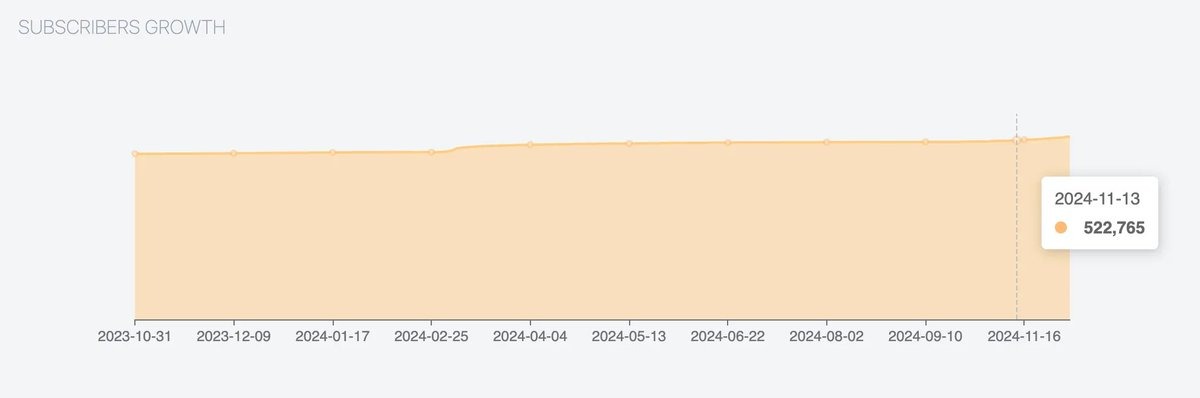

After analyzing many subreddits, PEPE and BONK had particularly significant membership growth.

PEPE:

BONK:

In contrast, WIF and SHIB grew at a slower pace:

WIF:

SHIB:

Key findings from the Reddit data:

-

Importance of Robinhood’s IPO: IPOs attract attention and capital inflows from retail investors.

-

Unit price bias: Retail investors are more likely to buy tokens with lower unit prices.

-

PEPE’s Leading Position: PEPE has received the most retail attention recently.

Since listing on Robinhood on November 13, PEPE’s Subreddit membership has surged, outpacing the growth of all other meme coins. This shows that Robinhood remains an important liquidity entry point for retail investors. Although WIF was also listed on Robinhood shortly after November 25, its membership growth still lags behind PEPE and even BONK.

Retail investors’ preference for low-priced tokens is particularly evident in subreddits and YouTube comments. Investors often brag about owning “100 million PEPEs” rather than focusing on the actual dollar value of their investment. This mentality stems from a lack of understanding of market cap and fully diluted valuation (FDV) — many believe that lower-priced tokens have greater upside potential.

PEPE’s subreddit is now the most active of this round of meme coins, as evidenced by its continued membership growth. This trend is driven by the popular subreddit narrative of “PEPE reaches $1” – which is equivalent to a 46,000x increase. While this goal is obviously difficult to achieve, such a story is similar to the narrative that has driven the surge in DOGE and SHIB. Retail investors rely on word of mouth, forming a feedback loop: as the price rises, the story of profitability spreads, attracting more people to join. For example, a retail investor tells a friend that they have made 3x on PEPE, but are still holding because “it’s too early”. The higher the price, the faster this information spreads.

If these trends continue on Reddit, Subreddit data will become an effective indicator of “alpha” — a measure of retail interest in tokens. Currently, PEPE appears to be the clear winner among this group, and the recovery of the Ethereum ecosystem will further accelerate this growth.

This article is sourced from the internet: Reddit becomes a popular platform for cryptocurrency trading: New retail investors prefer to buy Pepe

El hype de los memes ha entrado en la era de la resonancia entre humanos y máquinas. La columna de memes de hoy presenta un bot de IA que se lanzó en junio de este año: Truth Terminal (@truth_terminal). Opera en modo semiautónomo y los administradores humanos pueden aprobar sus publicaciones en Twitter y decidir con quién interactuar. Lo que lo hizo famoso fue que el fundador de a16z, Marc Andreessen, le dio $50,000 en Bitcoin. Andy Ayrey, el fundador de Truth Terminal, dijo que Truth Terminal no es un proyecto de criptomonedas, sino un estudio de los riesgos de cola del contagio de memes y la creatividad ilimitada sin supervisión en la era de los [grandes modelos de lenguaje]. A medida que los discursos de Truth Terminal tienen cada vez más efectos de propagación de memes, gradualmente han aparecido en el mercado muchos objetivos de hype relacionados. El 12 de julio, Truth Terminal expresó algunas opiniones sobre…