November FOMC meeting minutes: The pace of rate cuts may slow down, or gradually shift to a neutral policy

Original title: Federal Reserve November FOMC meeting: The pace of interest rate cuts may slow down or even be suspended, neutral interest rate outlook

Original author: Natalia Wu, BlockTempo

The Federal Open Mercado Committee (FOMC) of the US Federal Reserve decided to cut interest rates by one basis point in its November meeting, lowering the benchmark interest rate to the range of 4.50%-4.75%. Last night (26), the Federal Reserve officially released the minutes of the November FOMC meeting. At that time, Federal Reserve officials said that they believed that inflation was easing and the risk of a significant slowdown in the economy and the job market was reduced, so they supported further interest rate cuts in the future.

But at the same time, it also emphasized that it will adopt a cautious attitude and gradually cut interest rates based on data performance. If inflation data does not meet expectations, the pace of interest rate cuts may be slowed down or even suspended.

In discussing the outlook for monetary policy, participants anticipated that if data were consistent with expectations, inflation continued to decline persistently toward 2 percent, and the economy remained near maximum employment, a gradual shift toward a more neutral policy would likely be appropriate.

However, some analysts believe that after the profit-taking on Trumps election victory, the Federal Reserves slowdown in the pace of interest rate cuts may delay the peak of Bitcoins bull market.

Will the Fed slow down its rate cuts?

The minutes also revealed that at this months meeting, 19 officials unanimously voted to cut interest rates by one basis point. Some officials believed that the upside risks to inflation had barely changed, while the downside risks to economic activity or the labor market had weakened.

Some officials also pointed out that monetary policy needs to balance the risks of easing policy too quickly and too slowly. Too quickly may hinder further efforts to combat inflation, while too slowly may excessively weaken the economy and employment. Some participants indicated that if inflation remains high, the FOMC may pause easing the policy rate and keep it at a restrictive level.

In addition, many officials believe that uncertainty about the so-called neutral interest rate – the policy level that neither restricts nor stimulates economic growth – complicates assessments of how restrictive monetary policy should be.

Officials estimates of the neutral rate have continued to rise over the past year. Chicago Fed President Austan Goolsbee said on Tuesday that his forecast for the neutral rate is close to the median estimate of 2.9% in the Feds September dot plot.

Fed officials support December rate cut

The Fed will hold its December FOMC meeting on December 18. Goolsbee this week predicted that the Fed will continue to cut interest rates, taking a stance that neither restricts nor promotes economic activity. Unless there is some convincing evidence of overheating in the economy, I see no reason not to continue to lower the federal funds rate.

Last week, he reiterated his support for further rate cuts and left open the possibility of moving at a slower pace.

On the same day, Neel Kashkari, president of the Federal Reserve Bank of Minneapolis, who is known as the hawk king, clearly supported the Feds interest rate cut in December. He said it was still reasonable for the central bank to consider another interest rate cut in December.

Right now, as far as I know today, a 25 basis point cut in December is still being considered – thats a legitimate debate for us.

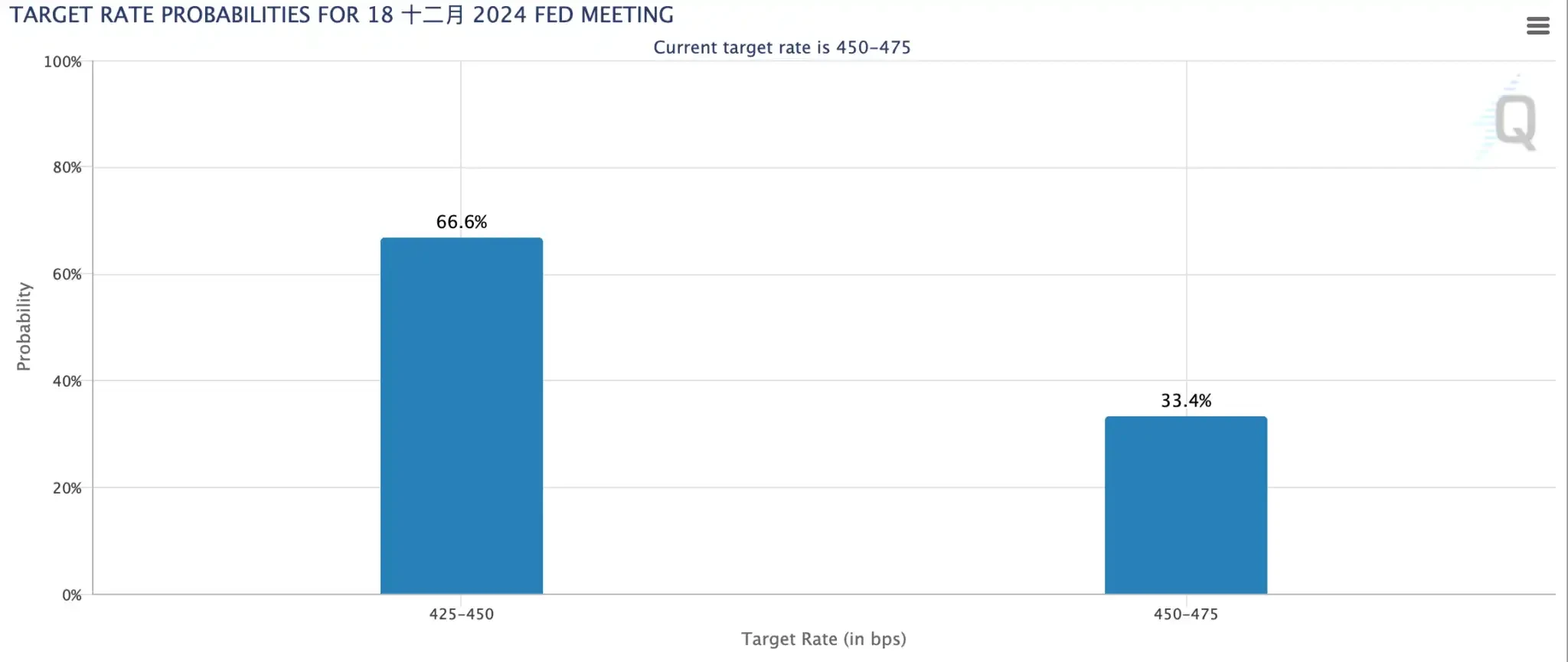

FedWatch: The probability of a rate cut in December exceeds 60%

However, given the continued resilience of the U.S. economy and recent strong inflation data, several Fed officials have urged caution in future rate cuts. Fed Chairman Jerome Powell also sounded hawkish in mid-month, suggesting that officials would cautiously cut rates.

The economy is not sending any signals that a rate cut is urgently needed, and the better economic conditions allow us to proceed with caution in our decision-making.

Powells hawkish signal also caused the markets expectations for another one-basis rate cut in December to plummet. However, after the release of the FOMC meeting minutes yesterday, the market slightly increased its bets on a one-basis rate cut in December, from about 52% yesterday to the current 66.6%, and the probability of suspending the rate cut is only 33.4%.

However, the market and institutions also predict that the Fed will slow down the pace of interest rate cuts next year. Nomura Securities latest forecast points out that the Fed will suspend interest rate cuts at its December interest rate meeting, and will only cut interest rates by 1 basis point each in March and June 2025; Cathay United Banks chief economist Lin Qichao said last week that the Fed will still cut interest rates by 1 basis point in December this year, and will cut interest rates by another 1 basis point each in March and June next year.

Source: FedWatch Herramienta

This article is sourced from the internet: November FOMC meeting minutes: The pace of rate cuts may slow down, or gradually shift to a neutral policy

Fuente original: @ElenaaETH Compilado por: Odaily Planet Daily Wenser (@wenser 2010) Nota del editor: Se lanzó oficialmente la red principal de ApeChain, ApeCoin lanzó oficialmente la plataforma ecológica de emisión de monedas con un solo clic Ape Express y el precio de APE se duplicó de la noche a la mañana. Muchos jugadores de monedas Meme volvieron a poner sus miras en la nueva plataforma. Odaily Planet Daily compilará y organizará el ecosistema de ApeChain y las herramientas relacionadas con el juego de Ape Express en este artículo para referencia de los lectores. Ciencia de ApeChain En pocas palabras, ApeChain es un ecosistema blockchain desarrollado por @yugalabs, utilizado principalmente para respaldar proyectos NFT y expandir el ecosistema @BoredApeYC. Puede promover el desarrollo de aplicaciones de fundición, comercio y dApp de NFT, al tiempo que brinda a los usuarios una experiencia de operación en cadena perfecta. Como dijo antes el cofundador de Yuga Labs, @GordonGoner, Apechain está lleno de herramientas…