Movement Network Foundation Announces $MOVE Token Economics: 60% of Total Allocated to the Community

On November 26, the Move language infrastructure Movement Network Foundation officially announced the token economics of its token $MOVE.

$MOVE is Movements utility token and will be used to achieve the goals of the Movement Network Foundation.

60% of the total $MOVE supply will be allocated to the community, including the ecosystem and community, the foundation, and initial claims.

Features of Movement

Movement is the first Move blockchain based on Ethereum, providing higher security, high TPS and near-instant finality.

Unlike most Ethereum L2s, $MOVE is the native token of Movement, used to pay for gas and staking.

https://www.movementnetwork.xyz/article/movement-foundation-move-token

$MOVE Simbólico Distribution

-

40% Ecosystem + Community

-

10% Initial claim

-

10% Foundation

-

17.5% Early Contributors

-

22.5% Early Investors

$MOVE total supply: 10 billion, $MOVE initial circulation: ~ 22%.

$MOVE tokens will be TGE on Ethereum mainnet as ERC-20 tokens. After Movement public mainnet is launched (coming soon), $MOVE holders can migrate to Movement across chains.

$MOVE will be gradually unlocked over 60 months. The team and investors cannot participate in staking in the early stage.

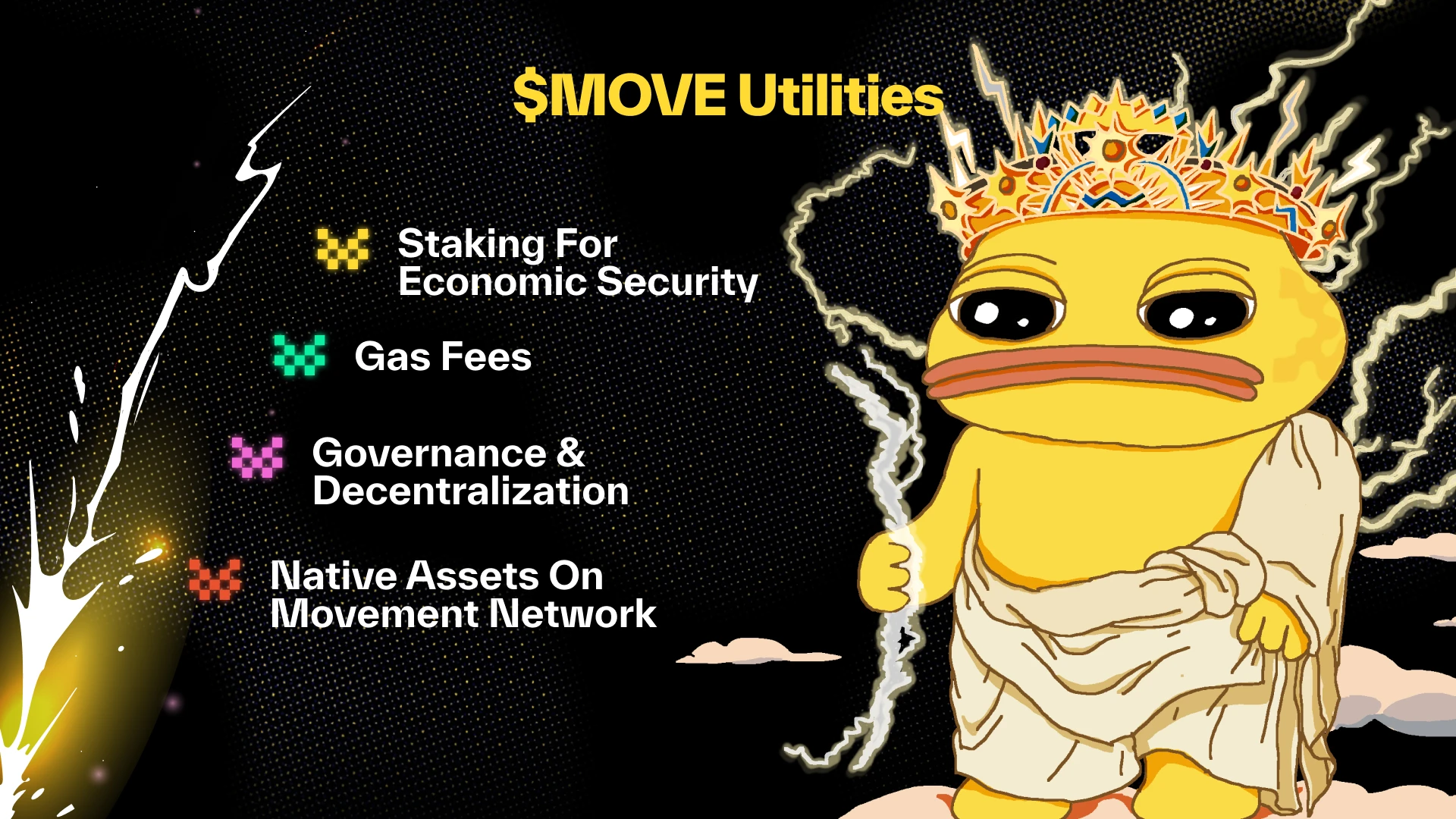

$MOVE Token Use Cases

The Movement Network Foundation is committed to providing multiple utilities for $MOVE, including:

1. Economic security pledge

Once the Movement public mainnet is launched and supports staking, validators will be able to stake $MOVE. Active validators will receive staking rewards for $MOVE by providing economic security for Movement.

2. Gas Fees

The gas fees of the Movement network are denominated and paid in $MOVE, part of which will be used to pay for transaction settlement on Ethereum. In the future, L2 built on MoveStack is also expected to use $MOVE to pay gas fees.

3. Governance and decentralization

In the future, the community will play a key role in the governance of the Movement Network. $MOVE holders can propose governance proposals and vote on network parameter adjustments.

4. Movement Network鈥檚 Native Assets

$MOVE will become the native asset of the Movement Network, and DApps on the Movement Network can use it for:

-

Liquidez

-

Colateral

-

Pago

-

More scenes

Why release $MOVE before mainnet launch?

This is to enable the postconfirmations mechanism to start correctly.

Post-confirmation makes it possible for Movement to achieve transaction finality in as fast as 1 second (or even less). Movement鈥檚 post-confirmation requires pre-established economic security. By establishing economic security for $MOVE before the mainnet launch (via the liquidity deposit contract), we can optimize post-confirmation in a real-world environment.

https://blog.movementlabs.xyz/article/postconfirmations-L2s-rollups-blockchain-movement

By combining the security of Move and the efficiency of MoveVM with the network effects of Ethereum, Movement brings a huge leap forward for Ethereum. $MOVE will play a key role in realizing Movement鈥檚 vision.

Stay tuned for more exciting content.

This article is sourced from the internet: Movement Network Foundation Announces $MOVE Token Economics: 60% of Total Allocated to the Community

Related: BitMEX Alpha: Weekly Trader Report (October 4th – October 11th)

Original author: BitMEX Brief Overview The cryptocurrency market had a lackluster week, and it seems the October bull run is yet to come. This week, despite new highs in the U.S. stock market, major cryptocurrencies remained largely flat. The memecoin sector saw a notable recovery, led by POPCAT. Uniswap also performed well after launching its Unichain second-layer network solution, showing that the market is responding positively to technological advances in the DeFi space. In our trade analysis section, we will dive deeper into the Unichain announcement and analyze its potential impact on $UNI price targets. Data at a Glance Coins that perform well $POPCAT (+ 22.1%): Catcoin surpasses Dogecoin $UNI (+16.1% ): Uniswap launches Unichain — the project’s biggest announcement in 3.5 years $WIF (+11.9% ): $WIF shows signs of…