Bitcoin rises to all-time high, are retail investors FOMOing?

Original author: Matt Crosby

Original translation: Luffy, ForesightNews

As Bitcoin enters price discovery mode again, cripto market participants are curious: Has retail FOMO set in? Will the retail influx we saw in past bull cycles happen again? Using data on active addresses, historical cycles, and various market indicators, we will examine the current state of the Bitcoin market and what it may portend for the near-term future.

Rising retail interest

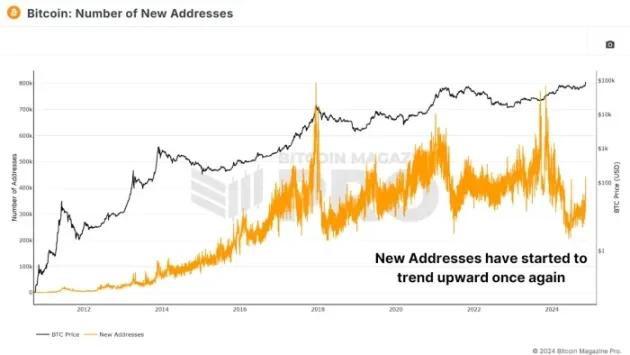

One of the most direct signs of retail interest is the number of newly created Bitcoin addresses. Historically, a sharp increase in new addresses tends to mark the start of a bull run as new retail investors flood into the market. However, in recent months, new addresses have not been growing as fast as one might expect. Last year, we saw around 791,000 new addresses added to Bitcoin in a single day, indicating strong retail interest. In contrast, while the number of new addresses is currently rising slightly, we are still hovering at lower levels.

Figure 1: The number of new addresses on the Bitcoin network is beginning to rise

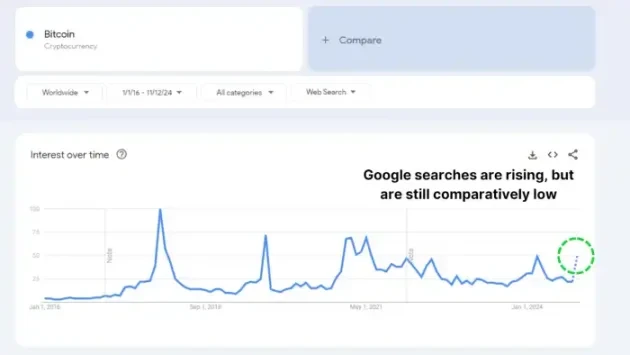

Google Trends also reflects this interest. Although searches for Bitcoin have been increasing over the past month, they are still far below the peaks in 2021 and 2017. Retail investors seem to be showing new curiosity, but it has not yet reached the level of frenzy of excitement like FOMO.

Figure 2: Google searches for “Bitcoin” are also rising, but still relatively low

Changes in holders

We are witnessing a transfer of Bitcoin from long-term holders to newer short-term holders. This supply shift could signal the start of a new market phase, with experienced holders taking profits and selling to newer market participants. However, the total number of Bitcoins transferred remains relatively low, suggesting that long-term holders have not yet sold off their Bitcoin in large numbers.

Figure 3: The amount of Bitcoin changing hands to new holders has only increased slightly

Historically, during the last bull run in 2020-2021, we saw a large amount of funds flow from long-term holders to new investors, driving the subsequent price increase. Currently, this transfer is not obvious, and long-term holders choose to continue holding Bitcoin despite the price increase. This reluctance to sell shows that holders are confident in the potential for further gains.

Spot-driven gains

A key to Bitcoins latest rally is that it is spot-driven, in contrast to previous bull markets that relied on leveraged positions. Open interest in Bitcoin derivatives has only seen a small increase, in stark contrast to previous peaks. For example, open interest was quite substantial before the FTX crash in 2022. Spot-driven markets are not over-leveraged and tend to be more stable and resilient because fewer investors are at risk of forced liquidation.

Figure 4: Open interest has been declining over the long term, with only a slight increase recently

Big players are hoarding

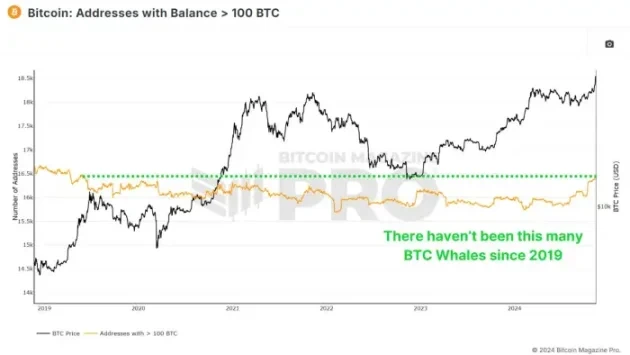

Interestingly, while the number of retail addresses has not increased significantly, the number of whale addresses holding more than 100 BTC has continued to increase. In the past few weeks, wallets holding large amounts of BTC have added tens of thousands of Bitcoins, worth billions of dollars. This shows that even if Bitcoin reaches its all-time high, whale investors are still confident that the current price level will rise.

Figure 5: The number of addresses holding at least 100 BTC has reached its highest level since 2019

In past bull cycles, we saw whales exit or reduce their holdings near market peaks, and we are not seeing such behavior this time. Accumulation by experienced holders is a strong bullish signal as it shows confidence in the long-term potential of the market.

en conclusión

While Bitcoin’s run to all-time highs has revived attention, we have yet to see signs of retail FOMO set in. This means we may only be at the beginning of this bull run. Long-term holders remain confident, whales are accumulating Bitcoin, and leverage remains moderate, all of which indicate a healthy market with more room to run.

As we continue into the bull cycle, market structure suggests that there is still the potential for a larger retail-driven surge in the future, which will propel Bitcoin to new heights.

This article is sourced from the internet: Bitcoin rises to all-time high, are retail investors FOMOing?

La Fundación Ethereum revela sus gastos Recientemente, la venta de ETH por parte de la Fundación Ethereum y la transparencia de sus fondos han atraído una amplia atención en la comunidad criptográfica. En respuesta, la Fundación Ethereum anunció sus gastos oficiales a fines de agosto. Según el gráfico, las nuevas instituciones representaron la mayor parte del gasto de la fundación, con 36,5%. Vitalik Buterin dijo que esta categoría incluye subvenciones a varias organizaciones, como Nomic Foundation, L2 BEAT, Decentralized Research Center y 0x PARC Foundation, y el objetivo principal de construir estas nuevas organizaciones es fortalecer la comunidad Ethereum a largo plazo. La segunda categoría de gasto más grande de la Fundación es L1 RD, que representa 24,9% del gasto total. Esta categoría incluye financiación para equipos de clientes externos (62%) e investigadores internos de la Fundación (38%). El gasto interno…