¿Cómo superó Polymarket las encuestas tradicionales en las elecciones generales?

Original article by: Haseeb >|<, Managing Partner at Dragonfly

Traducción original: TechFlow

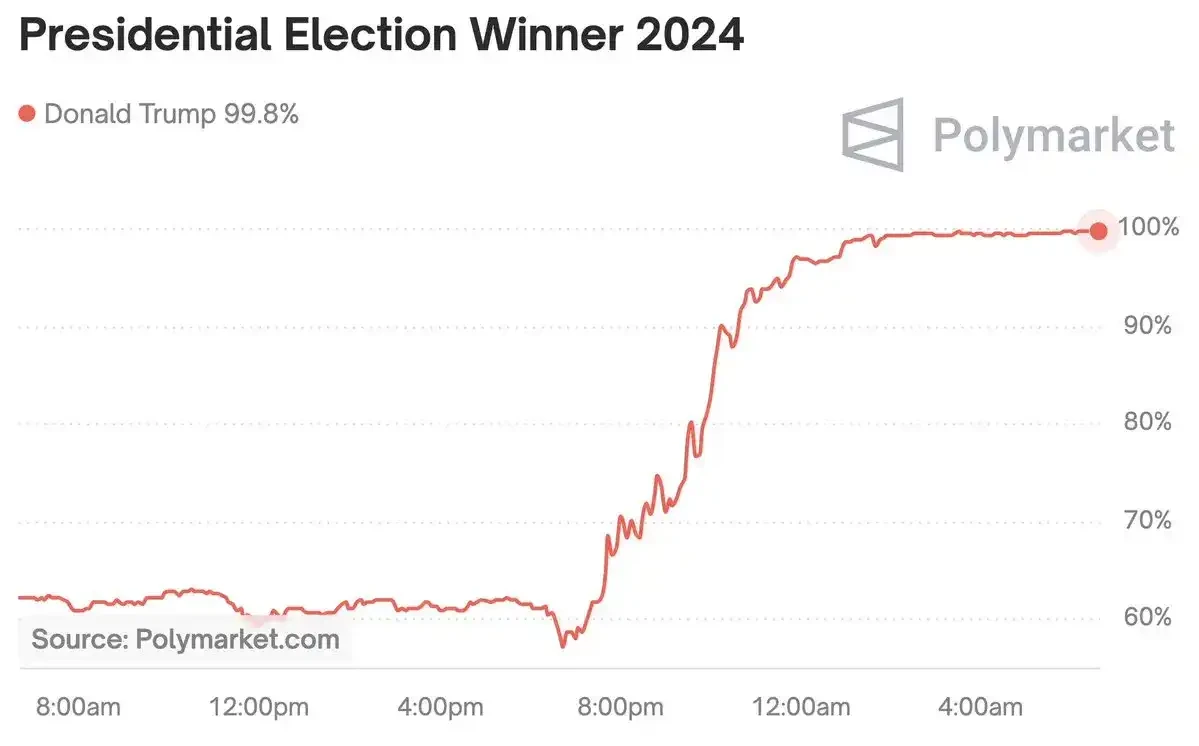

As the dust settled from the election, there was a story that the Wall Street Journal and the New York Times did not tell. While the mainstream media was busy with the spectacle on TV and hesitant to predict the results of key swing states, Polymarket, the worlds largest prediction market, had already made a judgment before midnight Eastern Time, saying that Trump had a 97% chance of winning the election. This was even before the media announced the results of any swing states.

1. Polymarket stayed one step ahead throughout the election

I want to explain why this is the case, because from the feedback I received on Twitter last night, most people have a deep misunderstanding of this.

Polymarket does two fundamental things better than the media.

First, Polymarket was more accurate before the election. Let’s look at the pollsters and analysts. The poll-based election model claimed that the race was a 50-50 situation, while Polymarket gave Trump a clear advantage, with his chances of winning being set at about 62% before the election.

If you remember, the mainstream media ridiculed Polymarket for their dissenting opinions. They thought Polymarket should agree with the opinions of those model makers! Apparently, this difference meant that Polymarket could not be trusted. They thought Polymarket was priced differently because its user base was full of Trump-supporting cripto enthusiasts. It was funded by Peter Thiel and only foreigners were trading on it. Since it was unregulated, they thought it must be rigged and big money was driving up the price of Trump. The criticisms went on and on.

Implicit in this criticism is a deep distrust of markets. As if markets cannot be trusted unless there is clear evidence of their reliability. Of course, if you really trusted markets, you might no longer trust the media. And the media’s business model is based on making you distrust other sources of information—otherwise, why would you keep clicking on their endless stream of attention-grabbing articles?

But anyone with experience in markets knows this: it doesn’t matter what the market is made up of, whether it’s Republicans, Democrats, foreigners, or whatever. In fact, we know that JP Morgan uses Polymarket, as do some of the world’s largest hedge funds (most with non-US subsidiaries). It’s integrated into the Bloomberg Terminal and has been referenced on CNN. Yet the media talks about Polymarket as if it were just a 4chan-like platform.

You have to know that Polymarket did $3.6 billion in trading in the presidential election. This is the most traded election betting market in history, with an order of magnitude more volume than any other election market. This is far more important than the career prospects of any single predictive model maker. Mercados work because there are so many interests riding on the right answer.

Those alleged biases — like crypto enthusiasts or non-Americans who support Trump — didn’t affect the market’s accuracy. (In hindsight, non-Americans may have been more sobering in predicting the election outcome.)

But the identities of the participants are not important. Prediction markets aggregate information from many different participants to produce prices that transcend bias. Markets don’t care about ideology, they only care if the results are correct.

The fact is, Polymarket is more accurate than any pollster or modeler.

Now, I want to be clear: the difference between 60/40 and 50/50 sounds big, but it isn’t. Elections are inherently fraught with uncertainty. According to high school statistics, if you wanted to determine whether a coin was rigged to be 60/40 instead of 50/50, you would need to toss the coin over 100 times to be 90% certain. The result “Trump won this election” does not tell you whether the coin was 60/40 or 50/50.

My point is not that Polymarket was completely right and the forecasting models were completely wrong. In fact, the difference between them was not that big. What I want to emphasize is that the market has always priced Trump higher than the polls. Remember, the market knows the polls and the analysts conclusions. The market incorporates all the available information, but Polymarkets pricing is different from the polls. The only explanation that analysts can think of is that Polymarket is biased.

They don’t have the humility to consider that, perhaps, Polymarket might have something that the polls don’t capture.

Polls are not as accurate as they used to be. That’s now clear. Before the internet, polls were much more accurate. Back then, landline poll response rates were routinely over 60%. Today, they’re around 5%. That means pollsters are subject to huge sampling biases that can’t be corrected with simple statistical corrections. (Also, pollsters—as sellers of products with reputations to protect—often converge their forecasts to avoid being outliers, which affects the synthesis of poll results.)

Moreover, Trump is such a unique and divisive figure in American politics that, in three consecutive elections, we have seen polls seriously underestimate support for him, a phenomenon known as the “shy Trump voter” effect.

Polymarket may think that the polls missed some important information. The polling agencies said that they have updated their models and made adjustments. Polymarket’s response was: I don’t believe it. And it turns out that Polymarket is right.

I repeat! Polymarket is not claiming that Trump has a 90% chance of winning. 62% is not an absolute number, as the election itself is full of uncertainty. What puzzles me is that the media has shown no curiosity about this discrepancy. Maybe Polymarket knows something we dont? Or, there is some information that we are ignoring that is not reflected in the polls?

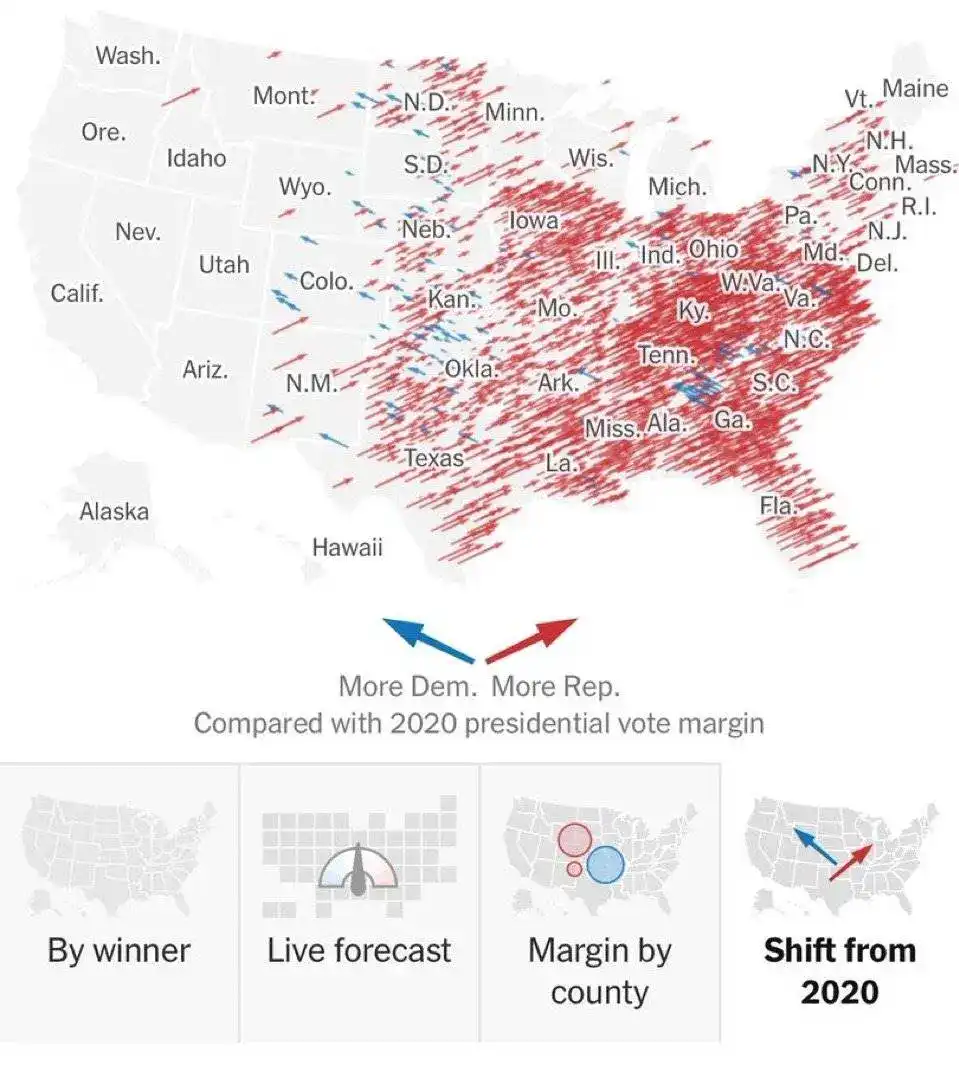

Remember, Trump performed far better than the polls expected across the country, in both Republican and Democratic states. He won every swing state and even the popular vote, which seemed incredible to most people.

Are you really confident that there is no other way to discover the true feelings of tens of millions of Americans without relying on traditional polling organizations and good old internet surveys?

This is what markets teach us. Markets are smart, but they don’t explain why—they only show what happens.

2. This brings us to the second way Polymarket goes beyond media

Polymarket predicted the election results in real time, before the media did. The unpredictability of the market was on full display on election night. Polymarket reacted fast and furiously before any of the swing state results were announced. According to Polymarket, the election was settled at midnight, while the mainstream media waited until 6 a.m. the next morning to officially announce the results. Why?

First, Polymarket discovered an important correlation that the mainstream media doesnt bother explaining to its audience. Poll errors are rarely random; they are often correlated across states. So when traders see Trump beating poll expectations by a wide margin in less competitive states like New York City (a classic Democratic state) or Florida (a classic Republican state), that means the national poll error is likely large.

Polymarket caught on quickly, realizing that the swing states were no longer competitive. By 11:30 p.m., Polymarket had put Trump’s odds in Pennsylvania at 90 percent, even as only a fraction of Pennsylvania’s votes had been counted.

Prediction markets don’t wait for red tape or commentator analysis. They don’t care if they break the traditional ritual of waiting for the votes to be counted. Remember the outrage when Fox News called the Arizona results early in 2020 (which turned out to be correct)? Trump even threatened to boycott the channel. This reinforced the lesson that major media outlets must count the votes honestly and not be too smart.

Yet markets don’t care about drama, they only care about results. Apparently, it’s very difficult to explain to CNN viewers that the election is over, that the polls in the non-competitive states are too far off, that Kamala’s prospects are bleak, and that you should go to bed instead of waiting for the results in the swing states. This goes against the narrative that the media has been reinforcing for months. The public wants a simple, understandable story where everyone knows where the story is going — you wait until the results in the swing states come in, until a certain color bar crosses the 270-vote line.

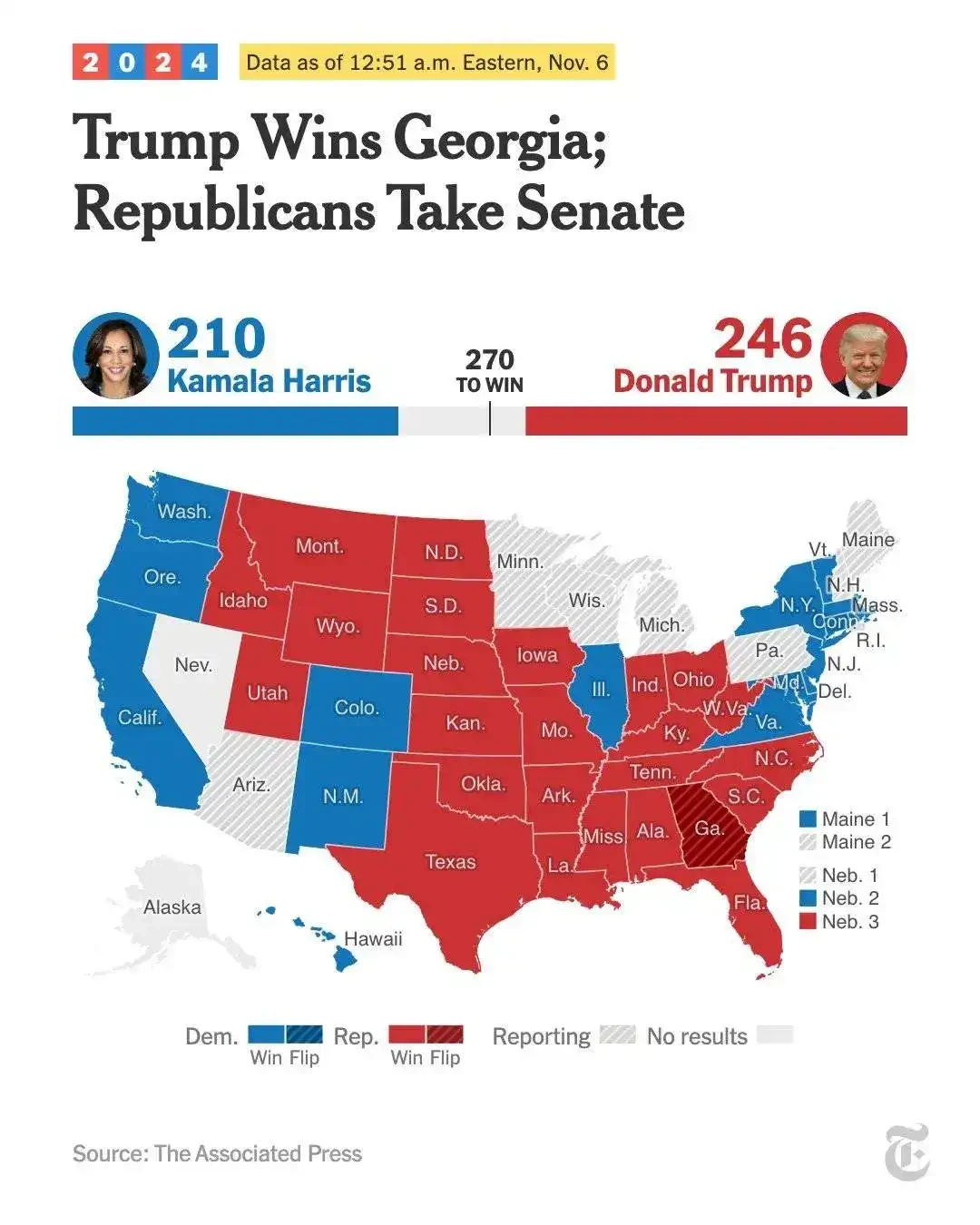

At 12:51 a.m., the New York Times was still displaying dramatic charts and headlines. By this time, Polymarket had already put Trumps chances of winning at 98%.

So election observers stayed up all night just to let the media complete its meaningless ritual of coloring in strips.

Polymarket’s traders are not bound by narrative, nor motivated to stir up drama for ratings — they just give their verdict.

@shayne_coplan, founder of Polymarket, said the Trump campaign was watching Polymarket to try to better understand how to read the odds. The media even dared to complain about Trump declaring victory at 267 votes — at which point Polymarket’s odds were so low they showed 100%.

The beauty of markets is that they react quickly to new information. Traders who integrate information fastest are rewarded — profits. This is something that traditional media cannot do because they need to process events through multiple layers of interpretation, narrative construction, and internal politics (like Murdoch’s meddling in the 2020 Arizona results).

The decentralized nature of Polymarket bypasses all of this red tape, allowing information to flow freely and without interference.

Last nights events are worth pondering. This election is a strong warning to the Democratic Party, a repudiation of the expert class, and an immune response to the arrogant media.

However, for Polymarket, this night was a perfect demonstration of its value. The lesson for me is: when something important happens in the world, skip the columns and go straight to the Polymarket odds. Disclaimer: I am an investor in Polymarket. I have always been passionate about prediction markets, and I am very relieved that their value is finally being recognized. Also, I may be wrong in some details because I am very tired, but you should get my point.

This article is sourced from the internet: How did Polymarket outperform traditional polls in the general election?

Original author: insights 4.vc Original translation: TechFlow The cryptoasset market has experienced exponential growth over the past decade, leading to increased participation from both retail and institutional investors. However, this growth has also highlighted significant regulatory challenges, particularly in the EU, where a fragmented regulatory approach has led to legal uncertainty and inconsistency across member states. The lack of a unified framework has hampered market development, created barriers to market entry, and raised concerns about consumer protection and market integrity. Objectives of the Regulation MiCA aims to address these challenges by: Establishing a single regulatory framework: creating a comprehensive set of rules that applies to all EU member states and the European Economic Area (EEA). Strengthening consumer and investor protection: Implementing measures to protect investors and mitigate the risks associated…