Polymarket se convierte en el mayor ganador de la apuesta electoral de $3.6 mil millones

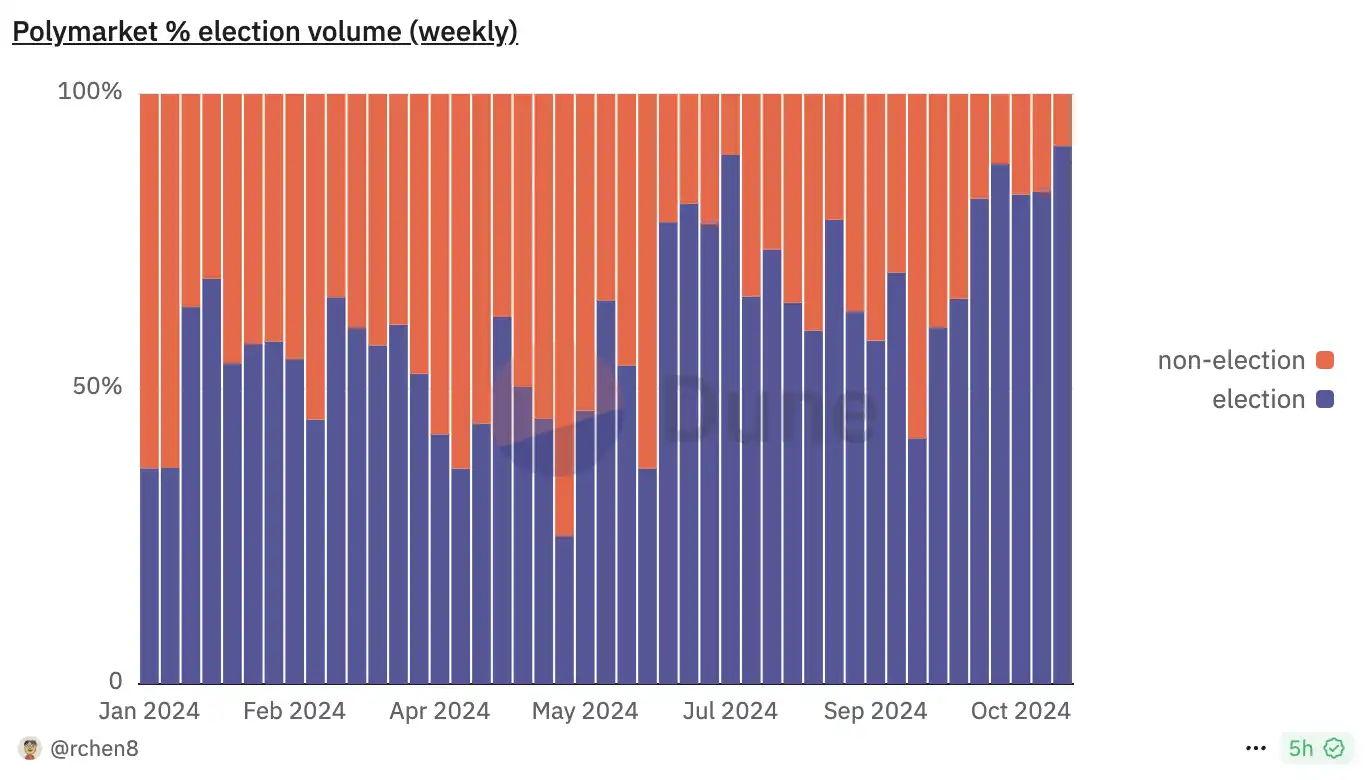

During the entire election period this year, the most popular application in the criptocurrency circle, apart from Pump.Fun, should be the prediction market Polymarket. Due to the excellent operation of Polymarket during the election, coupled with the promotion of Trump and some KOLs, the positioning of who can bet on the next president on Polymarket spread rapidly. The transaction volume related to the president continued to increase as the election night approached, until noon on November 6, due to too many people pouring into the Polymarket website, causing its server to crash briefly.

Throughout the election cycle, compared with the predictions of traditional polling organizations, the changes in odds on Polymarket have always been highly sensitive to news. Funds always precede news. When the winners of swing states have not yet been decided, the odds of Trumps victory on Polymarket have already increased.

The cumulative trading volume of election prediction transactions on Polymarket has reached $3,612,184,597. The trading volume of Republican candidate Trump-related transactions on Polymarket is close to $1.48 billion, and the trading volume of Democratic candidate Harris is $1.01 billion.

Leading traditional polls and gaining popularity

On November 6, data from Polymarket showed that Trumps chances of winning experienced significant fluctuations. At 1 a.m., Trumps chance of winning was 59.4%, having risen to 63% earlier. By 9:46 a.m., Trumps chance of winning rose to 71.1%, while Harriss chance of winning fell to 29.1%. As of 11:17 a.m., Trumps chance of winning climbed further to 88.6%. Since then, Trump has been leading in votes in key swing states, and the odds on Polymarket have changed rapidly, and everyone is talking with money.

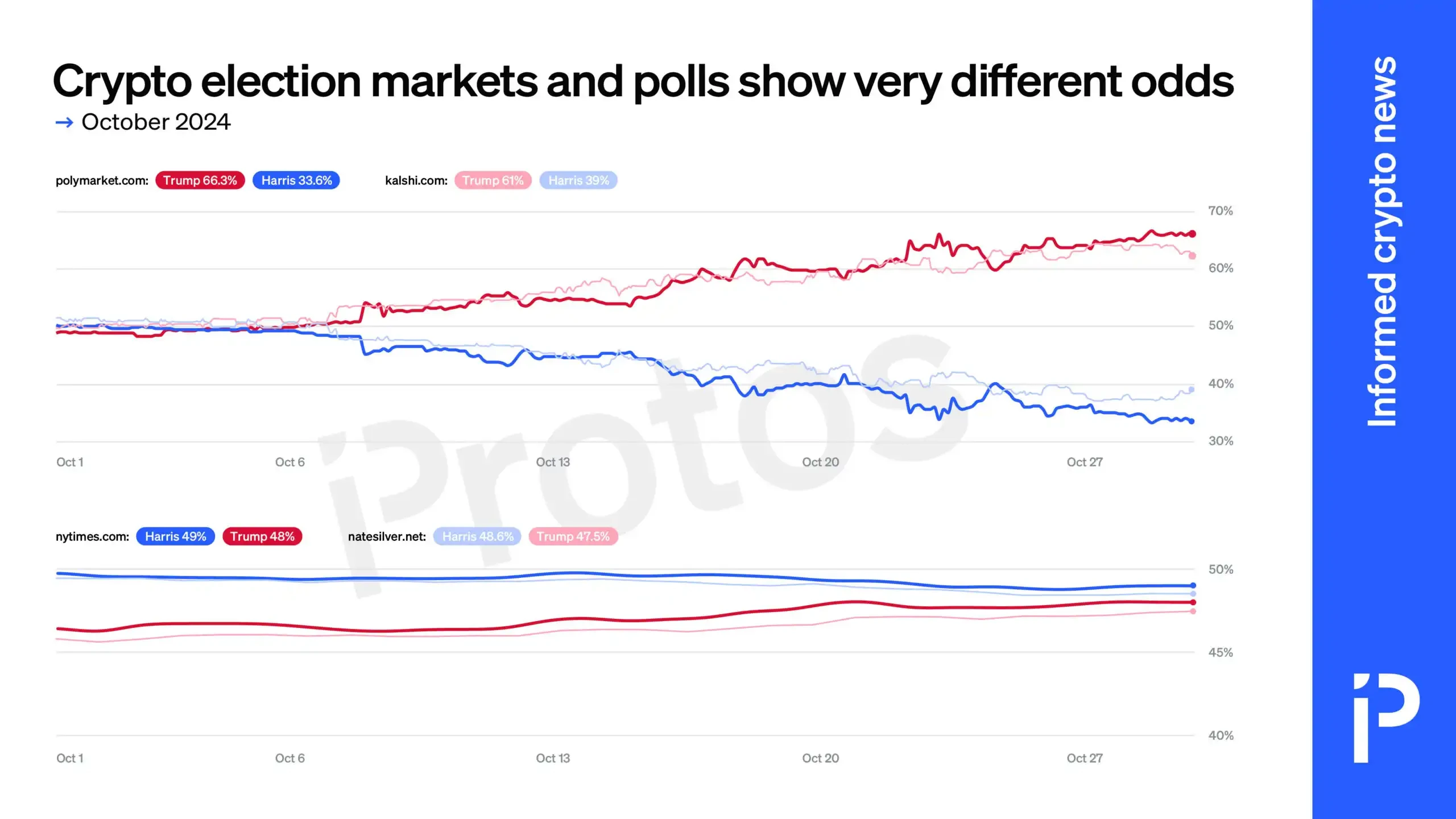

According to Protos data, Polymarket and Kalshi were compared side by side with the election odds from The New York Times (NYT) and Nate Silver, and the differences were obvious. For example, on October 31, Trumps chances of winning the US election were 66% on Polymarket, but only 48% on The Hill.

Looking at a wider sample, the average of traditional polling agencies such as Nate Silver, NYT or FiveThirtyEight shows that Trump and Harris have been within a few basis points in the past period of time. Obviously, judging from the results, the results given by Polymarket based on trading activities are more convincing than those of traditional polling agencies.

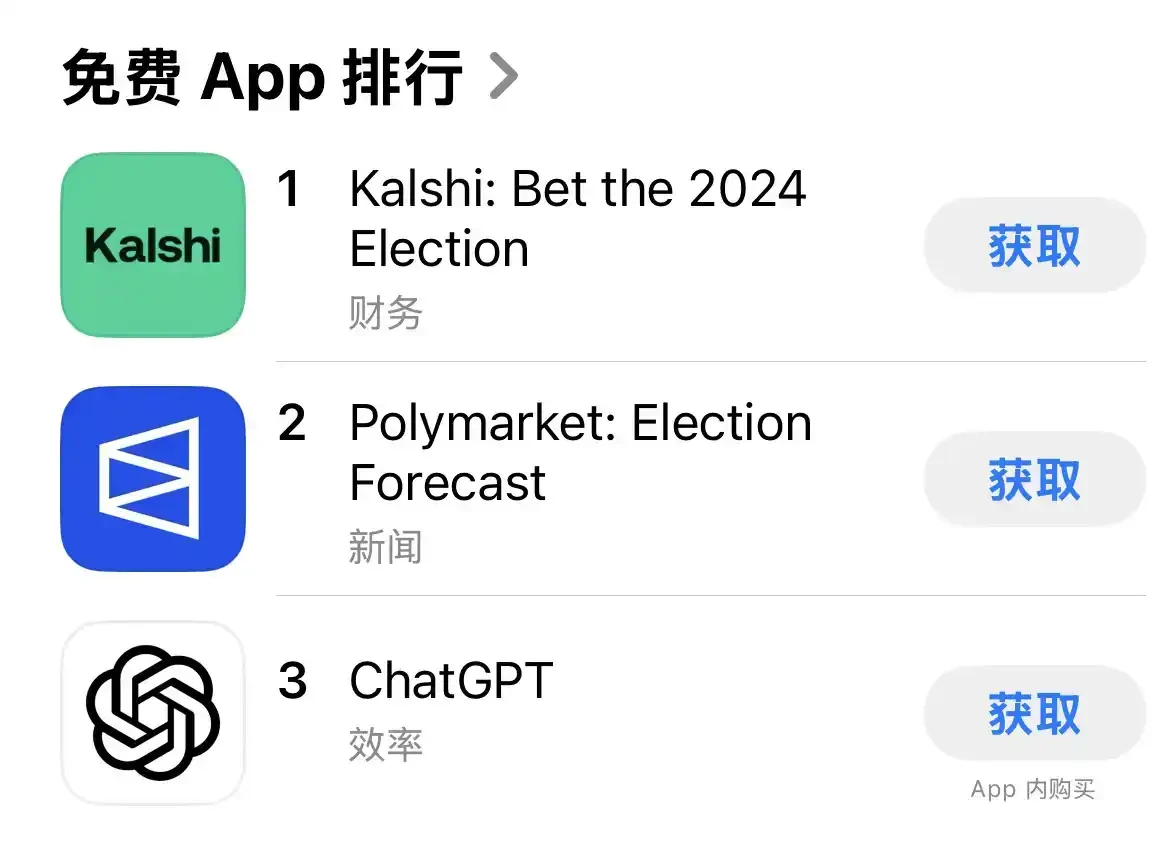

On November 6, according to data from the app analytics platform SensorTower, the regulated prediction market platform Kalshi is currently ranked first in Apples financial app category and also ranked first in free apps. At the same time, Polymarket has also risen to second place in the free app rankings, which is the highest ranking for both apps to date.

Who wins and who loses?

Crypto prediction markets have always been seen as products with strong cyclicality and only specific application scenarios, such as political elections and sports events. As the US election cycle draws to a close, the future development of Polymarket will be the focus of many peoples attention, but at present, the most eye-catching is this $3.6 billion election transaction. Under the heavy bet, French trader Théo spent $45 million on Trump, and eventually became the most profitable user on Polymarket.

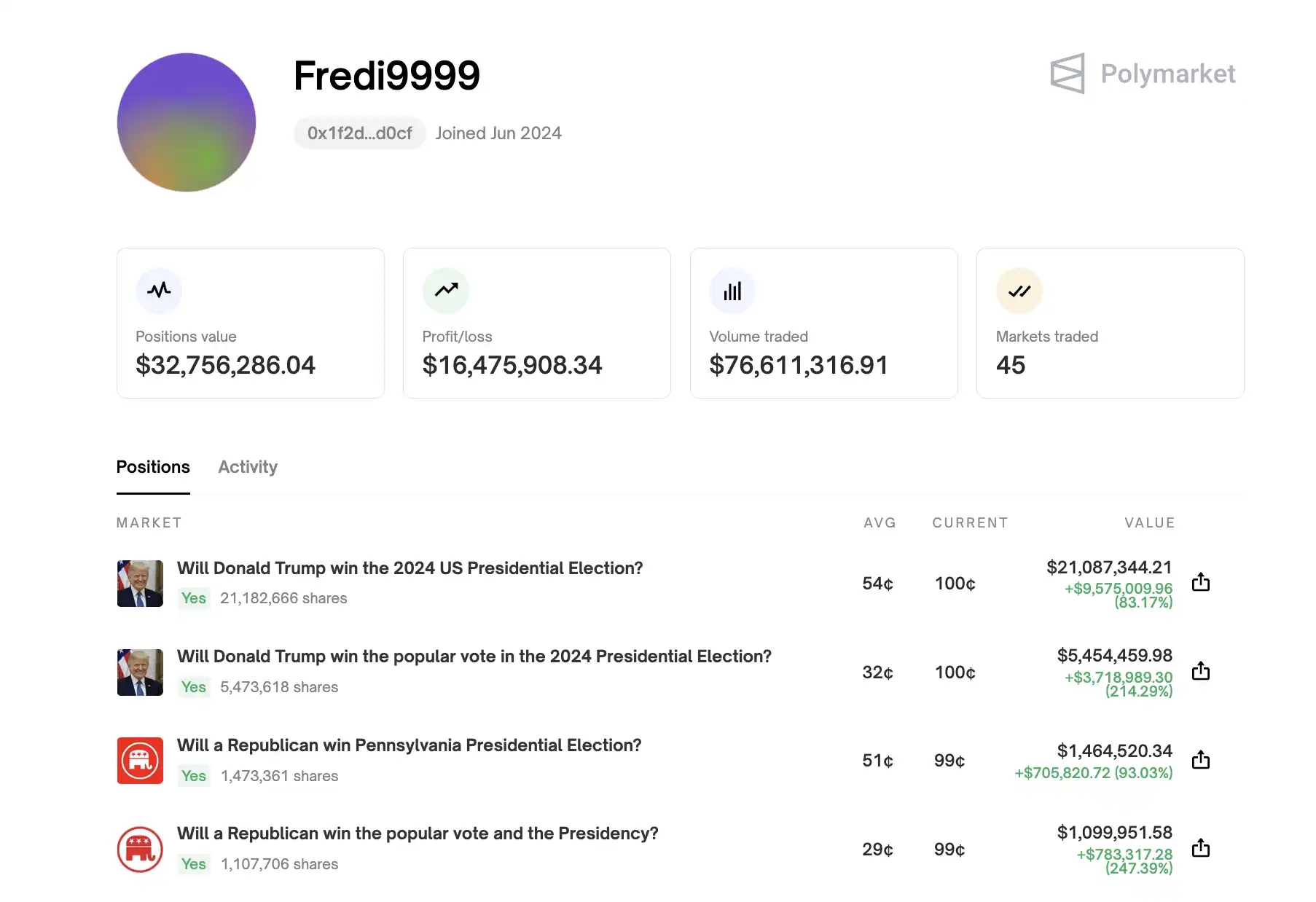

In August, Théo sent dozens of emails to Wall Street Journal reporters criticizing mainstream media polls that he believed were biased toward Harris. In a Zoom call, he claimed that Democratic-backed media were paving the way for social unrest by touting a tight race, when he expected a landslide victory for Trump. Théo said he was surprised by the attention to his trading and began making low-profile bets in August, buying millions of dollars in contracts on Trumps victory using the username Fredi 9999. At the time, Trump and Harris odds on Polymarket were roughly even.

To avoid wild price swings, Théo spread his bets over multiple days. However, as his bets grew, Théo noticed that other traders would avoid quotes when buying Fredi 9999, making it difficult for him to bet at the ideal price. So he created three more accounts in September and October to mask his buying behavior.

If Trump wins and sweeps the election as he expects, Théo could make more than $80 million, doubling his bets. His main bet is that Trump wins the electoral vote, and he’s betting millions more on Trump winning the popular vote — a scenario many observers consider unlikely. He’s also betting on Trump winning in swing states like Pennsylvania, Michigan and Wisconsin.

Lectura relacionada: 30 million bets on Trumps victory, this mysterious whale says: just to make money

Today, the election results are finally announced, and one of Théo’s accounts, Fredi 9999, has made a total profit of $16.47 million.

Taking the four betting options under the Who will win the presidential election transaction with the largest trading volume under the political election topic on Polymarket as an example, BlockBeats lists the users with the largest profits and losses below.

Triunfo

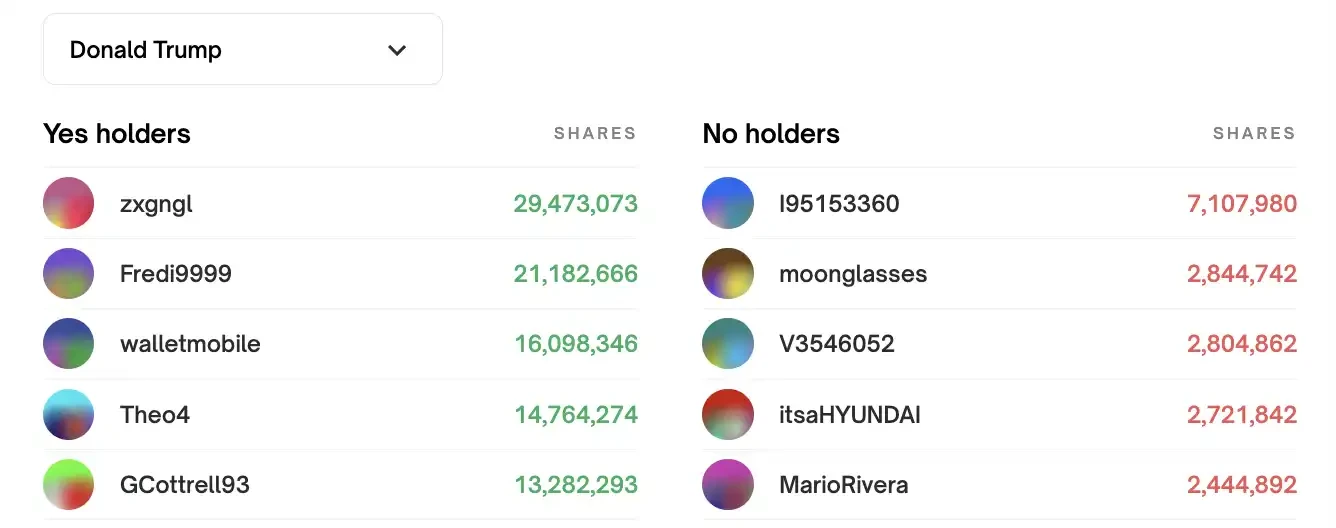

The following figure shows the distribution of users’ betting shares on whether Trump will be elected president on Polymarket. The “supporters” on the left represent users who believe Trump will be elected, among which the largest holder “zxgngl” holds 29,473,073 shares, with a total profit of $11.315 million. Other major supporters include the aforementioned “Fredi 9999” and “walletmobile”.

The “opponents” on the right are users who believe that Trump will not be elected. The largest holder, “I 95153360”, holds 7,107,980 shares and currently has a loss of $1.192 million.

Harris

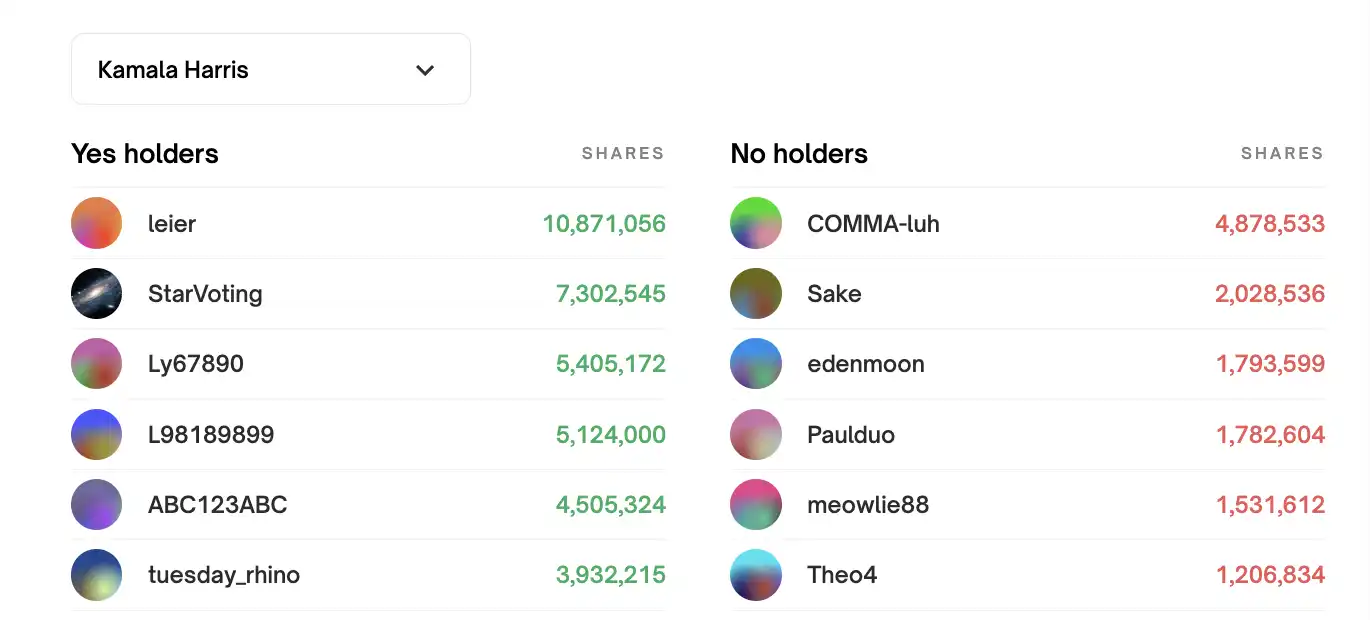

The following figure shows the distribution of bets on whether Harris will be elected president by users on Polymarket. The supporters on the left represent those users who believe Harris will be elected. The largest holder leier holds 10,871,056 shares, and the total loss of this user has reached 4.99 million US dollars. Other major supporters include StarVoting and Ly 67890.

The “opponents” on the right are users who believe that Harris will not be elected. The largest holder is “COMMA-luh”, who holds 4,878,533 shares. In addition, this user also placed bets on the “Trump will be elected president” transaction, with a total profit of over $210,000.

This article is sourced from the internet: Polymarket becomes the biggest winner in $3.6 billion election gamble

Autor original: Chandler, Foresight News La cuenta regresiva para las elecciones presidenciales estadounidenses de 2024 ha comenzado. Según datos de NBC News, a las 2:00 am hora local del 30 de octubre, más de 50 millones de votantes en los Estados Unidos han emitido votos anticipados para las elecciones presidenciales de 2024. A medida que la campaña electoral se calienta, los votantes se centran cada vez más en la dirección futura de la economía estadounidense y las diferencias en las opciones políticas. Los analistas de Morgan Stanley Monica Guerra y Daniel Kohen analizaron el impacto potencial de las elecciones presidenciales estadounidenses de 2024 en el mercado en un informe reciente, señalando que las señales económicas son mixtas y la incertidumbre de los inversores está aumentando. La fluctuación del sentimiento del consumidor y los precios persistentemente altos están influyendo en la opinión de los votantes, mientras que los indicadores tradicionales del mercado no pueden proporcionar una predicción clara…