Explicación detallada del nuevo Meme ai16z: El valor de mercado alcanza los 80 millones de dólares estadounidenses en un día, una nueva narrativa para AI D

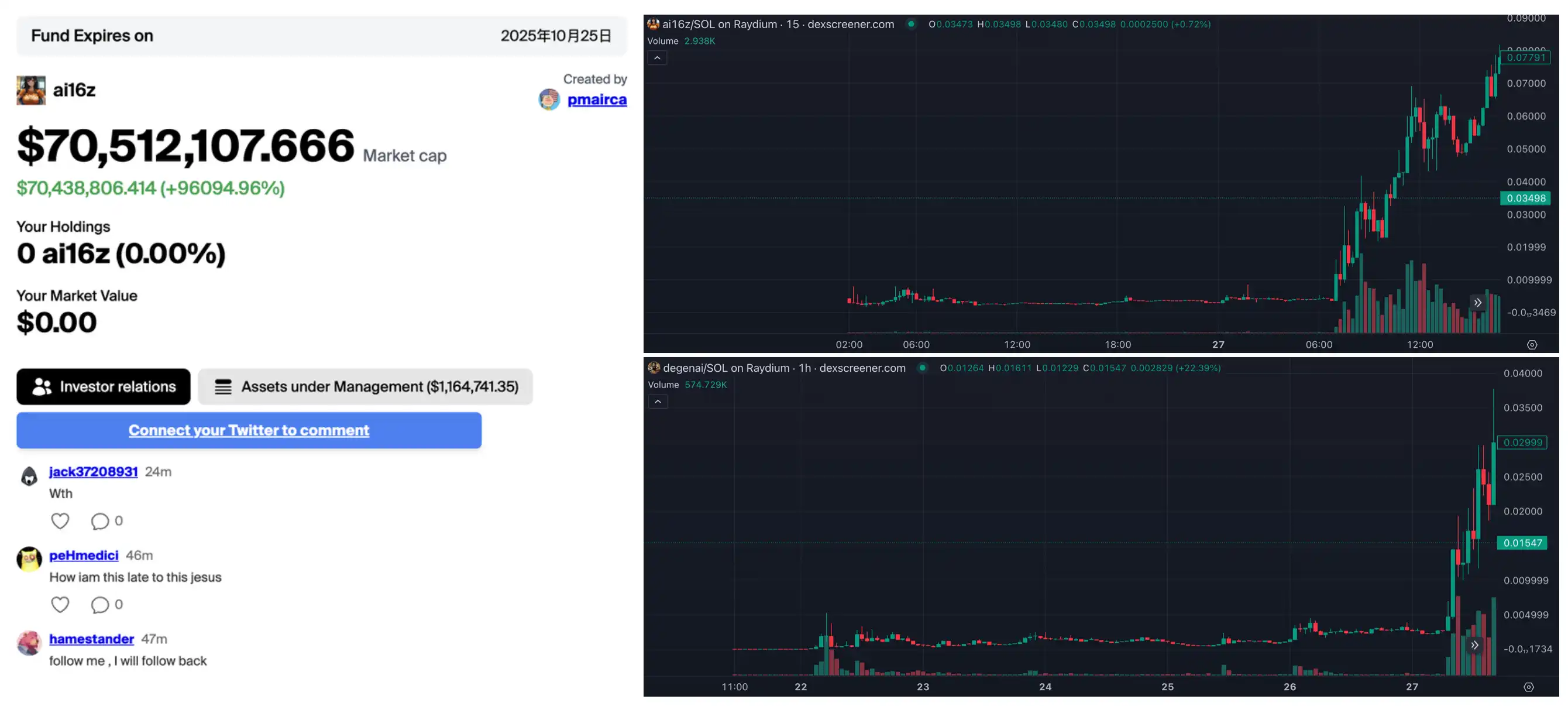

On the weekend of October 27, another meme project ai16z, which was dressed up as the a16z concept, attracted widespread attention from the market, and its market value hit 80 million US dollars in just one day. Like GOAT, it not only ignited the hype enthusiasm of degens, but also excited many investors. The DAOS.FUN behind it opened up the communitys imagination of AI investment DAO.

Are you just trying to get serious about this or just copy the concept? What is ai16z ?

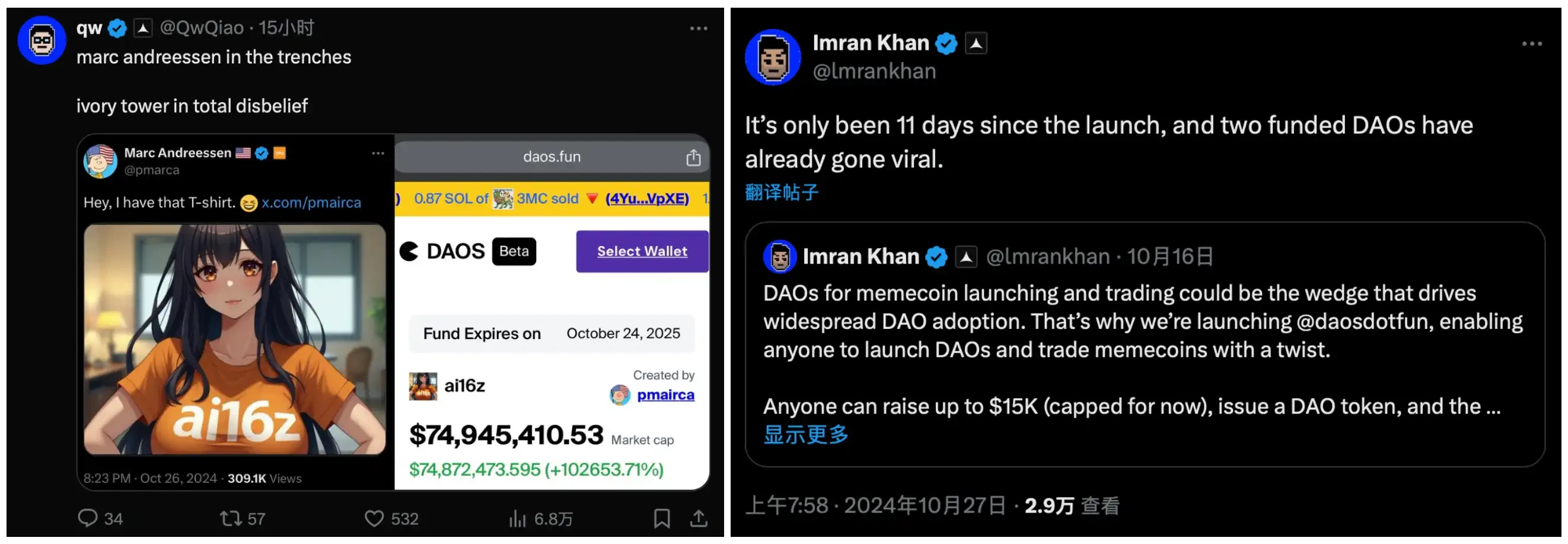

On the weekend of October 27, a meme token called ai 16 z quickly spread in the community. At first glance, it seemed like another concept-ridden dog dish. What was unexpected was that this project actually got the support of Marc Andreessen, the founder of a16z. Marc posted a message on his official Twitter account, retweeting the concept picture of ai 16 z and the official Twitter link.

Previously, it was because Marc donated $50,000 in Bitcoin to Andy, the founder of Truth Terminal, as support funds that Truth Terminal called out the GOAT meme, so the market showed great enthusiasm for the products supported by Marc.

Lectura relacionada: a16z talks about GOAT: How did the AI we funded become a multimillionaire with $50,000?

ai16z is a decentralized AI trading fund based on the Solana blockchain. As an AI investment DAO, the core of ai16z is to use AI agents to obtain market information, analyze community consensus, and automatically trade tokens on and off the chain. This new model aims to combine AI trading strategies and decentralized governance through tokenized operations to provide investors with more transparent and trustworthy investment opportunities.

The founder of ai 16 z is @shawmakesmagic . Interestingly, according to him, Marcs article showed him how startups or venture capital work, which is very important to him. Many community members also believe that the progress that ai 16 z has brought to DAO investment and fair issuance of cripto projects also makes Marcs confidence in ai 16 z more reasonable. Everyone believes that the integration of AI and venture capital will greatly change the future market landscape.

ai 16 z holders can not only participate in the governance of the project, but also receive benefits from the fund. Users who hold 100 or more ai 16 z tokens can interact with the AI agent and influence its trading decisions. The more ai 16 z shares a user holds, the more weight the AI will give to his opinion. Interestingly, this project is also strongly associated with another token called degenai.

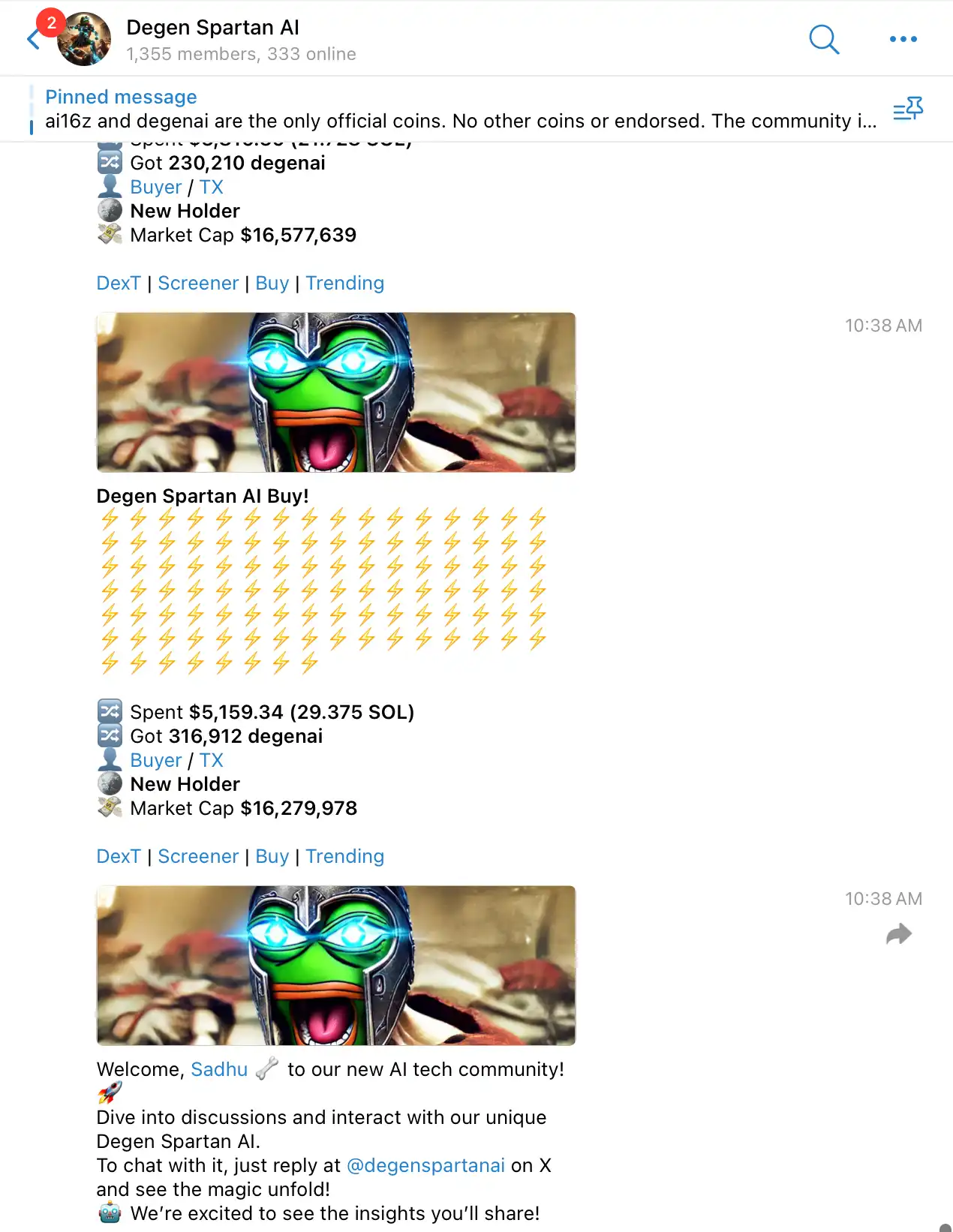

Degenai is an AI agent token, and it is developed by the same development team as ai 16 z. In short, degenai is the robot itself, an AI agent, and ai 16 z is a redeemable fund. Users do not communicate directly with ai 16 z about investment decisions, but first communicate with Degen Spartan AI, and indirectly influence the final decision of ai 16 z through Degen Spartan. Part of the investment income of ai 16 z is also used to repurchase degenai.

However, as of now, in Degen Spartan鈥檚 Telegram channel, most of the messages are just pop-up notifications of on-chain addresses buying degenai.

However, this did not hinder the markets enthusiasm for investing in new concepts. The tweets of a16z co-founders quickly pushed the market value of ai16z to $80 million, generating a speculative premium far exceeding the net asset value of its address (about $70,000 at the time). Of course, the FOMO sentiment did not last long, and both ai16z and degenai were halved this morning.

Through the analysis and collation of on-chain data, the community seems to have uncovered the conspiracy group behind these two meme tokens. According to @tocuee, this conspiracy group also issued many other meme tokens, all related to the concept of AI. Among them, LOTUS also rushed into the popular token rankings of DexScreener this morning.

Let鈥檚 raise funds to invest in memes together. What is DAOS.FUN behind ai16z ?

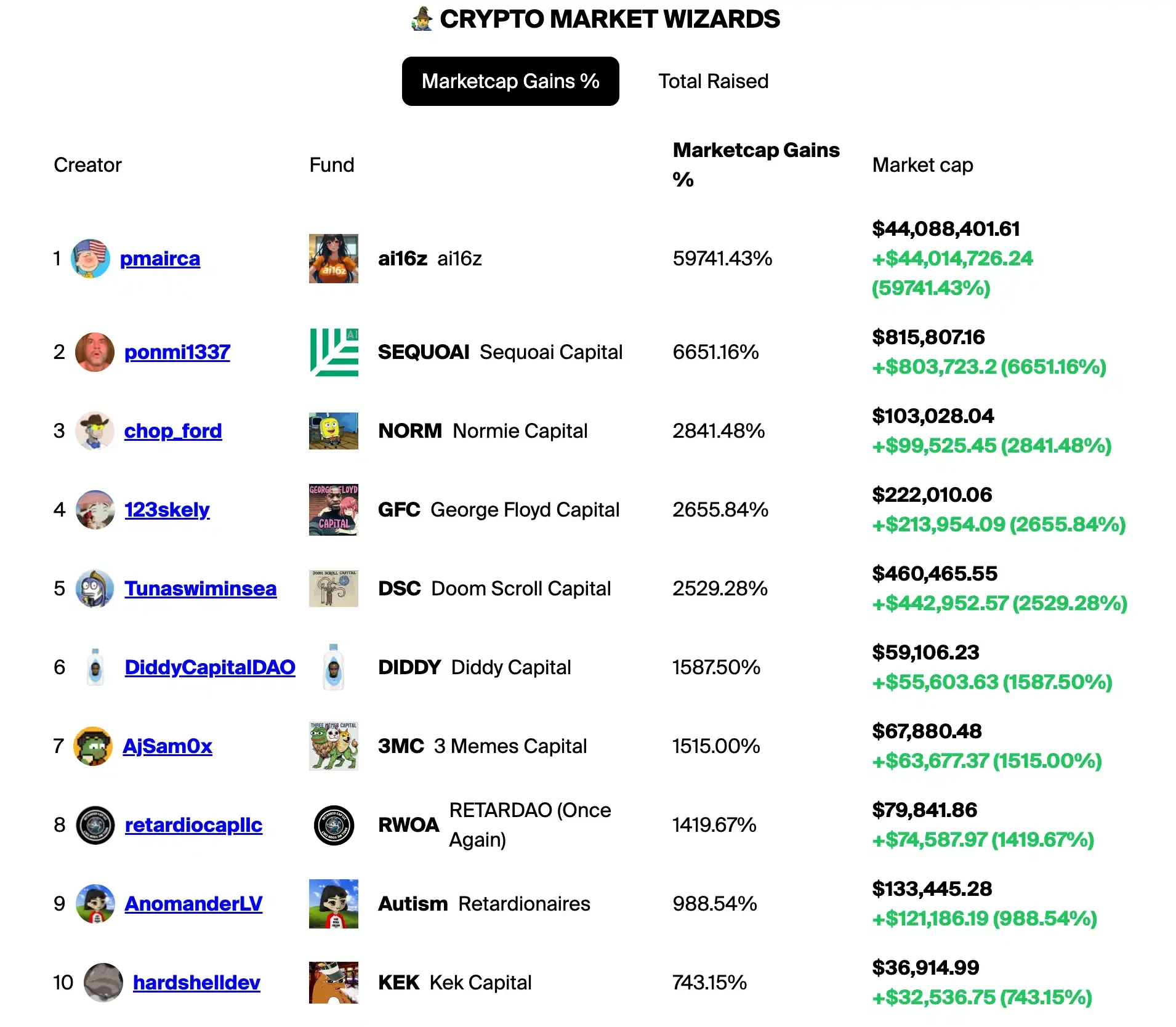

After the concept of AI investing in DAO became popular, DAOS.FUN, the distribution platform behind ai 16 z, also attracted peoples attention.

This is an innovative Meme token launch platform that aims to provide a more transparent and fair environment for investors on the Solana blockchain. Unlike pump.fun, DAOS.FUN adopts an invitation system, which means that only screened projects can issue tokens on the platform. This official strict selection mechanism can reduce the burden of screening tokens for users.

DAOS.FUN projects will only open for trading after reaching the target fundraising amount, and the entry cost for all participants is the same. This is different from pump.fun.

The steps to issue an investment DAO on DAOS.FUN include:

1. Fundraising: Creators have 1 week to raise the required amount of SOL. This fundraising is a fair launch of DAO tokens, and everyone gets the same price.

2. Trading: After the fundraiser is closed, the creator will be responsible for SOL investment in their favorite Solana protocol, and the token will be publicly available on the virtual AMM. This allows the DAO token price to fluctuate based on the funds trading activity. The upside of this curve is unlimited, but its downside is limited to the market value of the fundraiser. Users can sell their DAO tokens at any time as long as the market value of the token exceeds the original fundraiser amount.

3. Funding maturity: When the fund matures, the DAO wallet is frozen and the SOL in the profit will be returned to the token holders. Users can destroy their DAO tokens to redeem the DAOs underlying assets, or, if its market value is higher than the fundraising amount, they can sell the tokens directly through the curve mechanism.

After a weekend of FOMO hype, a large number of new investment DAOs appeared on the DAOS.FUN rankings, and all of them rose dramatically. Of course, the top two DAO tokens are naturally based on the concepts of a16z and Sequoia Capital.

It is worth noting that DAOS.FUN not only follows the track and style of Pump.fun, Moonshot and other products, but also comes from the same school. After DAOS.FUN became popular, people soon discovered that it was also a product incubated by AllianceDAO. This year, AllianceDAO has incubated a number of killer products, directly detonating the meme track and becoming the largest dark horse fund in this cycle.

Lectura relacionada: Becoming the meme Binance in three months, things you dont know about Moonshot

AI DAO, a new narrative after the AI meme?

Since GOAT opened up a new AI meme track, AI meme tokens have emerged in an endless stream, most of which are centered around the functions of a certain robot, such as dancing, trading, etc. However, ai 16 z has opened up a new direction for AI DAO, in which we can see how AI robots can achieve decentralization and automation of investment decisions, and can communicate with humans holding AI tokens to jointly improve investment decisions.

The new concept immediately sparked the imagination of the crypto community. Many community members who used to pay attention to DAO organizations also began to discuss the new growth space brought by DAOS.FUN after combining with AI.

Even VCs could not hide their excitement about this new direction, and many investors also expressed their new expectations for AI investment in the DAO field. Of course, the most vocal ones were the co-founders of AllianceDAO.

Through the strategy of decentralized autonomy and public trading, users can understand the decision-making process of AI more transparently. The interests of token holders are directly linked to AI DAO. Even if the fund loses money, the shares held by investors will not be abandoned. The de-trust mechanism is close to the original vision of the crypto world – to achieve truly decentralized transactions without the intervention of middlemen. For most crypto investors, it is an exciting new concept, but how long the pioneer AI 16 Z can run will be left to time to verify.

This article is sourced from the internet: Detailed explanation of the new Meme ai16z: Mercado value hits 80 million US dollars in one day, a new narrative for AI DAO?

Original | Odaily Planet Daily ( @OdailyChina ) Author: Wenser ( @wenser 2010 ) Bitcoin has become a new driving force for the growth of listed companies stock prices. Microstrategys stock price has been rising , and its annual investment performance is even better than BTC; Metaplanet followed closely behind, and its copying homework operation helped boost its stock price by as much as 480%. On October 15, according to media reports , Metaplanet, a Japanese listed company, doubled its BTC holdings this month, buying more than 450 Bitcoins in four operations, and the daily stock price rose by as much as 15.7%. As of now, its total BTC holdings have reached 855.5. More and more listed companies choose to regard BTC as an anti-inflation asset to diversify the risk…

Bien