Volatilidad de BTC: resumen semanal del 14 al 21 de octubre de 2024

Key indicators: (October 14, 4:00 pm Hong Kong time -> October 21, 4:00 pm Hong Kong time)

-

BTC/USD + 6.6% ($64, 250 -> $ 68, 500), ETH/USD + 7.9% ($ 2, 525 -> $ 2, 725)

-

BTC/USD December (year-end) ATM volatility -1.6 v (57.5->55.9), December 25-day risk reversal volatility +1.4 v (2.9->4.3)

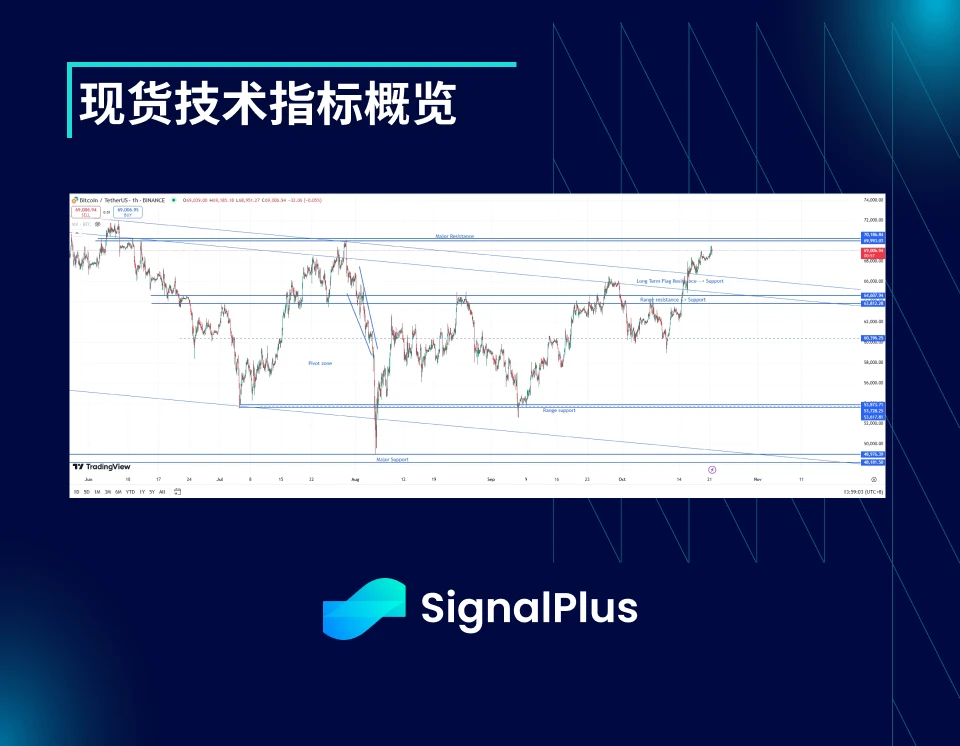

Overview of spot technical indicators

-

The spot market finally broke through the resistance of the long-term flag trend last week and entered a new price range of $67-69.5k. As the election situation changes, the market begins to prepare for Trump-related transactions in advance.

-

Currently, the $70k level is acting as very strong resistance. The upward trend is relatively mild (low realized volatility) and we expect this to continue in the short term. If the price breaks through $70.25k (and then $72k), the spot market could see a significant upward move. Conversely, a break below $63.75k could trigger a sell-off of spot market positions and a drop back to $60k with significant volatility.

Mercado Events

-

The long-awaited Uptober rally has finally begun, with the rise in Trumps chances of winning, coupled with the overall strong performance of US third-quarter earnings reports (and retail sales data), and the lack of further escalation of tensions in the Middle East, market risk sentiment has rebounded.

-

From a technical perspective, the price action this week continues to be bullish in the short term as the market has broken through the resistance of the $66.5k – $67k price range. Meanwhile, the rise in ETF inflows and the performance across asset classes also contributed to the rise, with gold rising to year-to-date highs against fiat currencies and the SPX index also hitting new year-to-date highs.

-

While Trump odds have moved up significantly (over 60% chance of winning), this move was driven primarily by a few very large individual bets. Poll odds remain solid around 50/50, which means we need to be cautious about the market positioning for a Trump victory (rising USD, rising criptocurrencies, higher US Treasury yields). Expect this election to be decided right down to the wire, and the coming week may see some pullback in recent Trump-related trades.

ATM Implied Volatility

-

This week, realized volatility rose as spot prices rose and broke through the range resistance. However, realized volatility remained relatively low during the rest of the week, with fixed-term realized volatility around 45 (while 1-week high-frequency volatility was close to 54). Large-scale ETF inflows provided support during price pullbacks, suppressing the pullback in realized volatility. At the same time, the market seemed to be trading long gamma in the high region, and the rise in spot prices was limited by gamma hedging.

-

Implied volatility failed to maintain its upward momentum after successfully breaking through $67k. The spot lacked follow-up and the price trend was relatively stable, which did not cause much splash in option trading. In addition, in the short term, the market is mainly strengthening its expectations of volatility through ratio call spreads and overlay selling, so despite the new demand, implied volatility has not risen significantly.

-

Last week, the spot markets early positioning for Trump reduced the need for tail hedging of the event, and the pricing of election volatility declined. However, given that the polls are still close to 50/50, we think the market has reacted prematurely based on the odds alone. With the intraday breakeven point below 5% and the probability of a complete Republican victory rising, we think it is worth holding an option position for the election period. At the same time, in the short term, the price retracement of Harris-related assets may be very rapid.

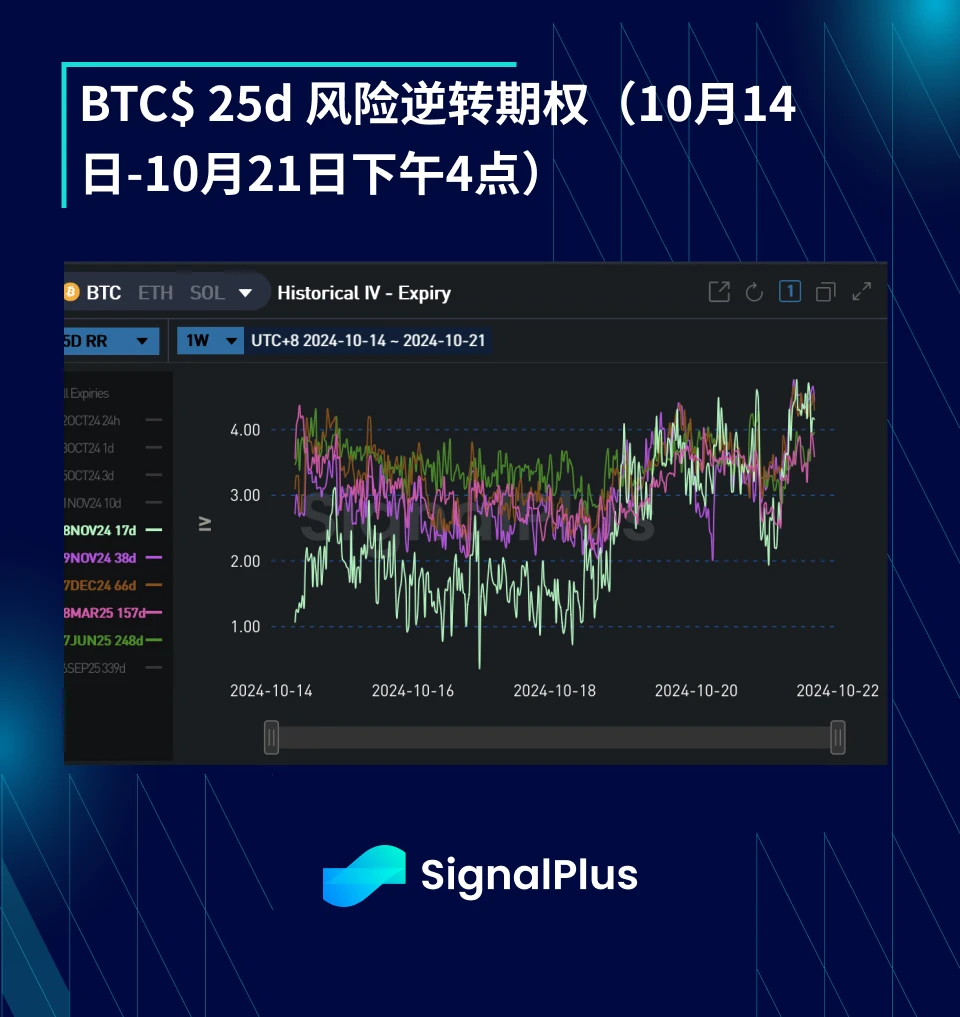

Skewness/Convexity

-

Volatility skew prices have risen sharply this weekend as spot prices have breached the upper limit of their range, with a chance of setting a new all-time high. However, this is completely contrary to the current spot-volatility correlation, and so far we have observed lower implied volatility when spot prices have risen. Furthermore, the movement in volatility skew is not limited to post-election expiries, the volatility skew has also risen before the election, so this movement cannot be attributed solely to the Trump premium. We expect volatility skew prices to fall quickly if the odds fall back to the 50/50 level in the polls.

-

While we have observed a positive correlation between spot and implied risk reversals this week, convexity trades have been moving sideways. We attribute this to the continued abundance of options contracts on the $100k to $120k wing of the market and the lack of demand for tail hedging from far-end users.

Good luck with your trading this week!

You can use the SignalPlus trading vane function at t.signalplus.com to get more real-time crypto information. If you want to receive our updates immediately, please follow our Twitter account @SignalPlusCN, or join our WeChat group (add assistant WeChat: SignalPlus 123), Telegram group and Discord community to communicate and interact with more friends.

Sitio web oficial de SignalPlus: https://www.signalplus.com

This article is sourced from the internet: BTC Volatility: Week in Review October 14鈥揙ctober 21, 2024

On August 27, Eric Zhang, founder of DoraHacks, spoke with Robbie from Web3 media The Rollup about decentralized governance and public product funding in the Cosmos ecosystem. DoraHacks previously launched an innovative grant program, the “ AEZ Quadratic Grant” , which uses a groundbreaking on-chain community voting and governance mechanism to provide important financial support for early public product projects in the Cosmos ecosystem. The following are the highlights of the interview. The full interview can be viewed here: https://x.com/DoraHacks/status/1828485174419702161 DoraHacks, The Rollup, and Public Goods Funding Eric first briefly introduced the history of DoraHacks. DoraHacks has been established for ten years, and its mission is to build a global community and hackathon platform focused on empowering open source developers to motivate them to independently design and build new products.…