Cinco datos importantes interpretan el mercado actual: Después de medio año de espera, ¿llega el mercado alcista?

Autor original: 1912212.eth, Foresight News

Although the market is not as optimistic as most people think, it is not as pessimistic as some people think. No one expected that the cripto market, which started in March this year, would continue for half a year. At one point, some investors could not help but swear and complain about everything and the exchange. At one point, some ancient OGs predicted that they would be prepared for an 18-month protracted war. At one point, some whales tweeted to give up the cryptocurrency circle and called on more people to go all-in on A-shares.

Will there be another copycat season? Every time when the market is skeptical, it is precisely the bottom range of the market, and every time the answer from history always responds: there will be.

History is always surprisingly similar. In 2023, the market also began to be quiet in the middle of the year, and it took off in October last year. This year is also the case. Whats interesting is that some funds seem to be smart, as if they smelled the smell and quickly arranged in advance. Thanks to this, at the end of September, the market ushered in a big rise ahead of schedule. After a brief correction in early October, the self-prophecy of Rising October was realized again. The market has climbed from the short-term $52,000 to $68,000 again, only about $6,000 away from the historical high, and some of the once-despised altcoins have also gained a lot from the bottom, even two to three times.

After waiting for half a year, has the bull market come?

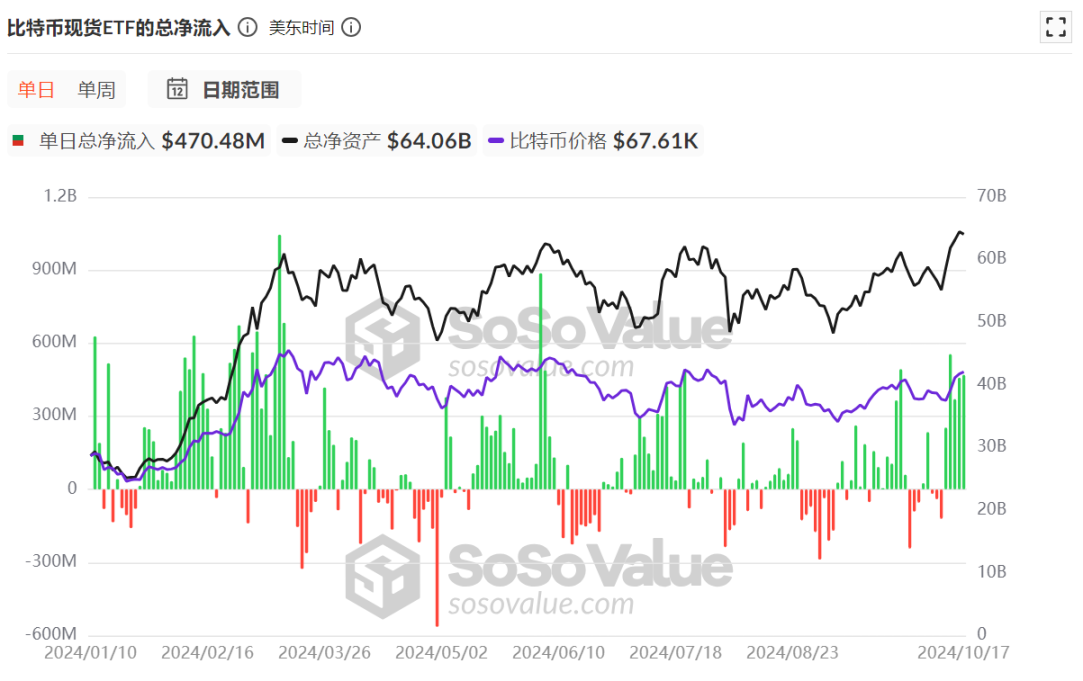

Bitcoin spot ETF data continues to see large inflows

The data of Bitcoin spot ETF represents the real amount of funds purchased over the counter. It is different from our personal transactions in that it represents some people who are willing to pay fees to let others buy BTC on their behalf. From the historical chart, when the net inflow is large, the buying volume is large, and the price of Bitcoin often rises. When the net outflow is large, the price falls.

Since the spot ETF was officially launched, the total net inflow has reached 20.66 billion US dollars. It is worth noting that from October 1st to date, there have been 6 days of net outflow, but there have been 7 days of net inflow, and the amount of net inflow is not large. On October 14, the net inflow exceeded 555 million US dollars, on October 16 and 17, the net inflow exceeded 450 million US dollars, and on October 15, the net inflow exceeded 370 million US dollars.

Although the net inflow and net outflow are roughly the same in terms of the number of days, the net outflow is small, while the net inflow is often several times the net outflow.

Even the unpopular Ethereum spot ETF has seen a rare single-day net inflow of $48.41 million since October.

The purchasing power of off-market funds remains quite strong.

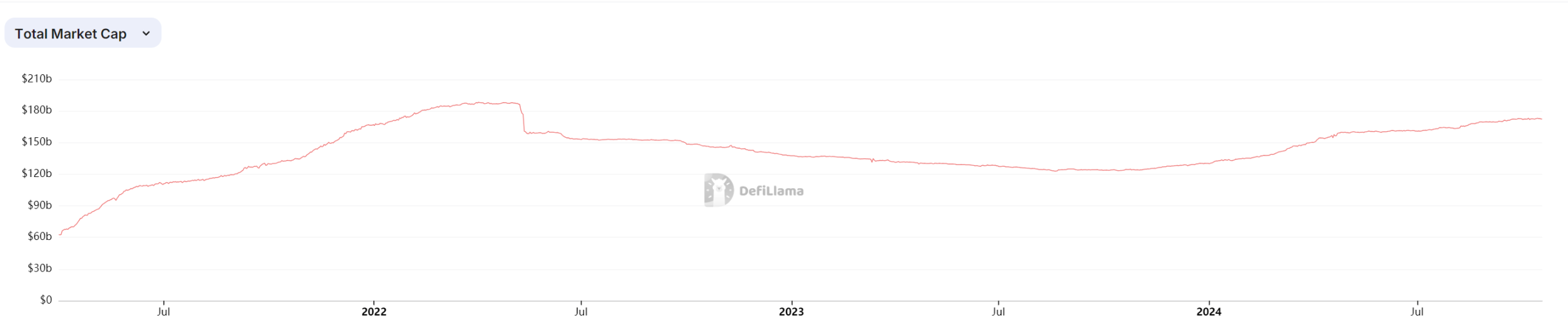

Stablecoin market capitalization is close to all-time highs

The change in the total market value of stablecoins represents the amount of capital flowing in. Although the market has experienced ups and downs and capital has flowed in and out over the past few years, it is difficult to be pessimistic when we take a broader perspective.

The total market value of stablecoins hit a record high of $186.3 billion in mid-2022, and then continued to decline, but generally remained above $120 billion. Fast forward to October 2023, capital inflows continue to accelerate, and the total market value of stablecoins has now exceeded $172.3 billion.

The historical high is just around the corner.

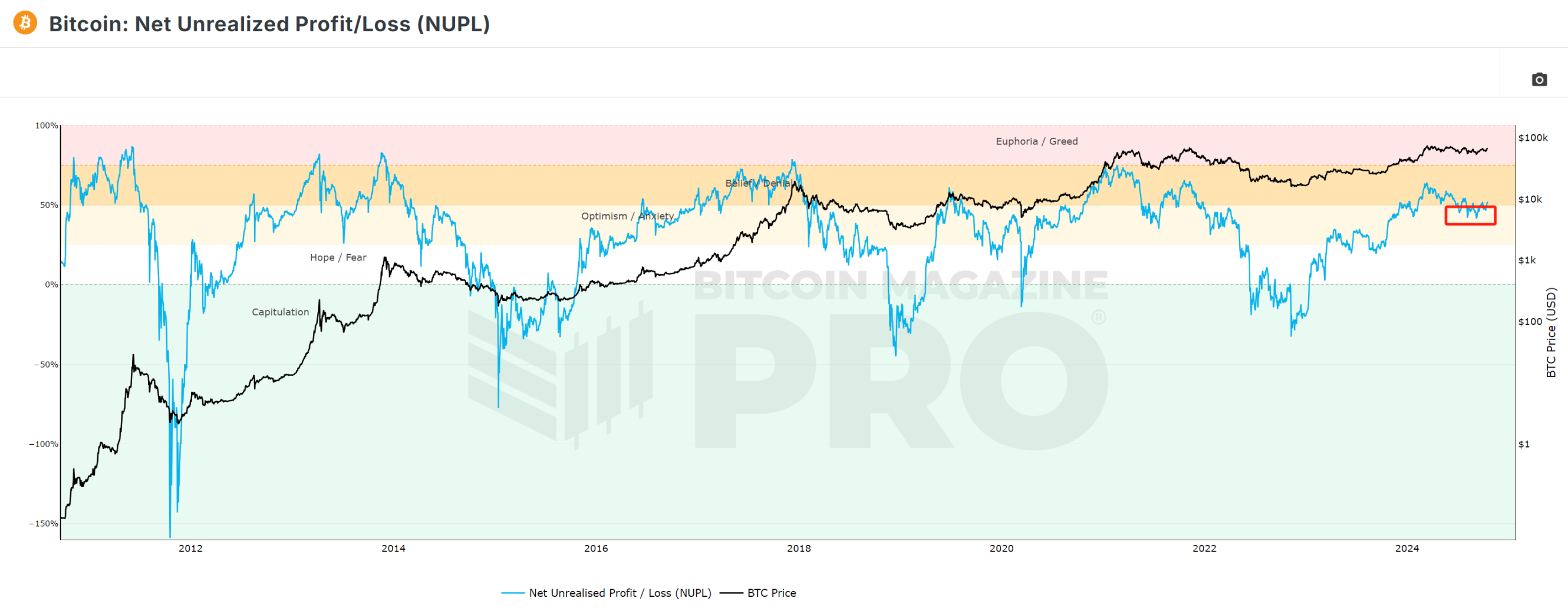

BTC’s unrealized net profit shows that most players are already profitable

Bitcoin unrealized net profit/loss, this indicator is mainly used to measure the profit/loss of players on the Bitcoin chain. We can see that the colors of the rows are red, orange, light yellow, gray and light blue from top to bottom. The blue at the bottom represents that most people are losing money, while the red at the top represents that most players are making a profit.

Cuando el gráfico de líneas se encuentra en la zona azul claro, suele ser el rango inferior de los precios de BTC, porque las personas que reducen sus pérdidas siguen abandonando el mercado para construir un fondo. Cuando el gráfico de líneas se encuentra en la zona amarilla o roja, suele ser el rango superior de los precios de BTC. Después de que la mayoría de las personas obtienen una ganancia, una cantidad considerable de órdenes de toma de ganancias optarán por detener las ganancias y abandonar el mercado, lo que dará como resultado la parte superior del ciclo. El ciclo se repite.

From the line chart, the market has climbed back from the light-colored area to the yellow area. According to data disclosed by IntoTheBlock, 95% of BTC addresses have achieved profits, and market sentiment has clearly warmed up.

Historically, such levels have tended to signal strong bullish momentum, though they can also represent potential overextension.

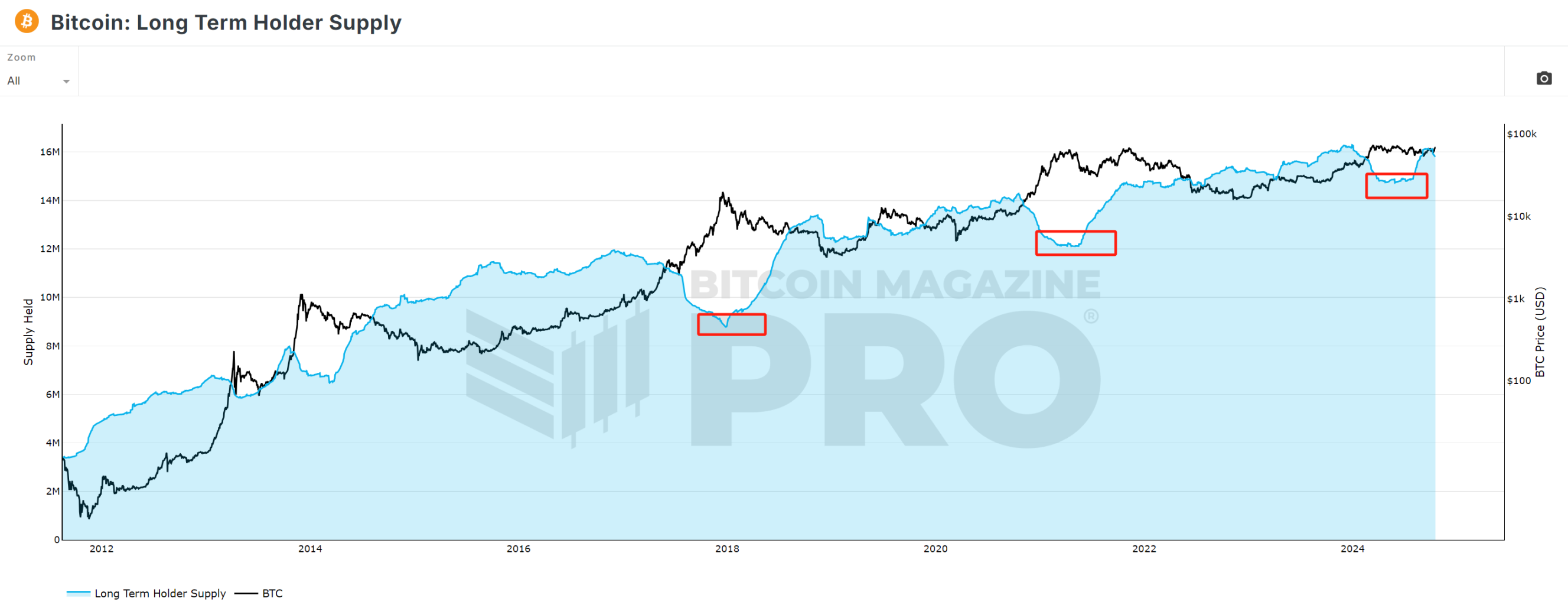

Long-term Bitcoin holders are still buying

The long-term holder amount mainly shows the total supply of BTC held by long-term holders. The long-term holder here specifically refers to the address holding BTC for more than 155 days.

The above chart shows that whenever the BTC price reaches a peak, the number of addresses of long-term Bitcoin holders decreases. This is because smart money always chooses to take profits and exit the market when the price reaches its peak. After the price drops, they continue to accumulate BTC again, and sell it again when the price reaches a high point, and the cycle repeats.

The chart shows that since the end of July this year, these long-term holders have started buying again, and the line chart on the right is quite steep. Obviously, these smart funds are optimistic about the future market outlook.

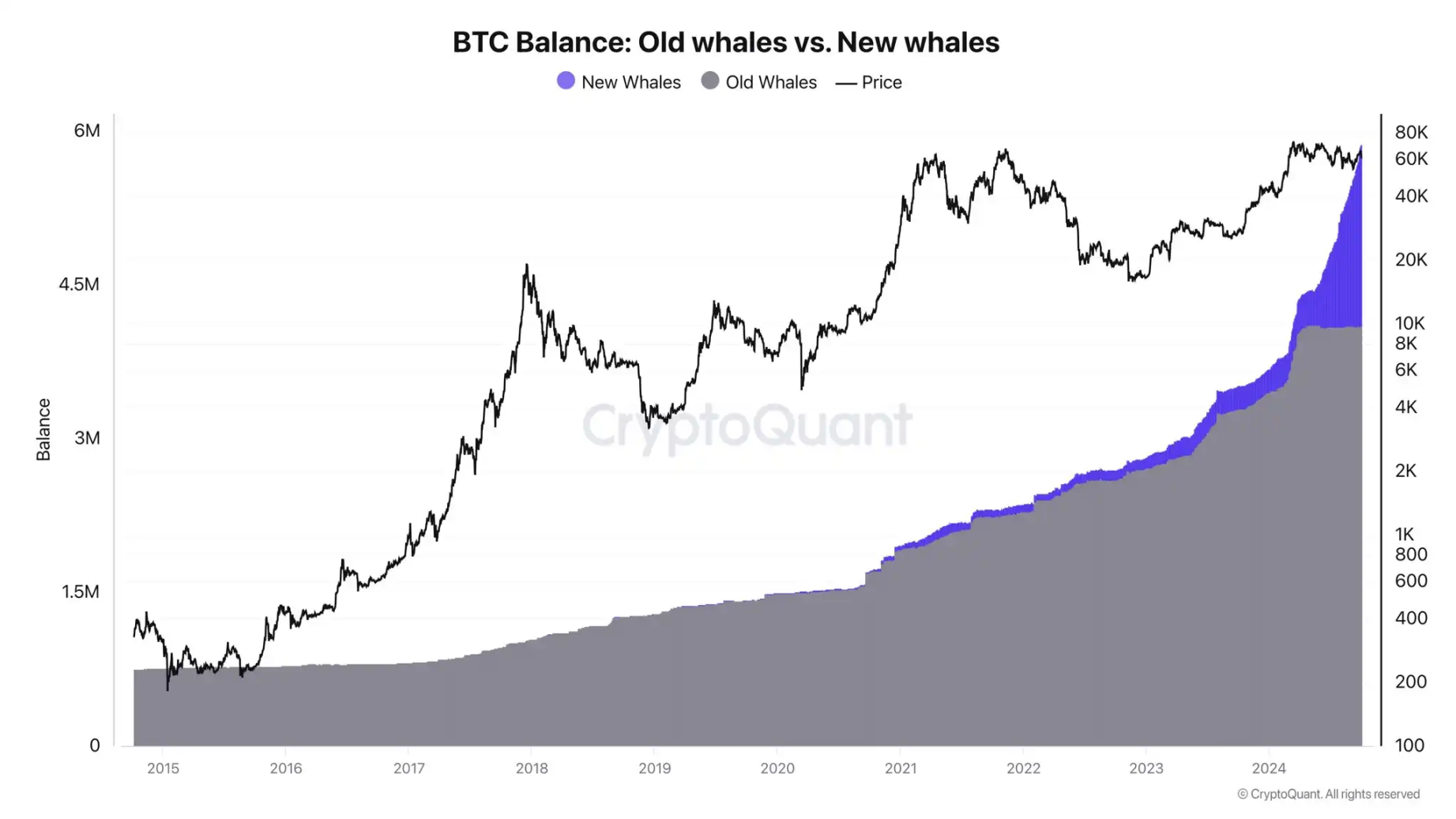

It is worth mentioning that according to CryptoQuant data, new whale addresses are hoarding BTC almost crazily. Founder Ki Young Ju said that the BTC market has never seen such hoarding behavior. Some people believe that new whales are mainly caused by ETF inflows, but recent hoarding behavior shows that these new whale addresses have little correlation with ETFs.

The total open interest of Bitcoin contracts has reached a record high

Today, according to Coinglass data, the total open interest of Bitcoin contracts across the entire network rose to above US$39.7 billion, setting a record high.

Contract data often represents the market funds’ view on the future market trend. It often lags behind the performance of Bitcoin spot prices. Because of this, when the market tends to be extremely optimistic about the future short-term trend, it is also easy to usher in a callback, clean up chips and leverage.

It is worth noting that in the past six months, the open interest of Bitcoin contracts has remained at a relatively high level. This data is a record high, breaking the data of over 38 billion US dollars at the beginning of this year for the first time. Mercado optimism has clearly risen.

resumen

On the macro level, the Federal Reserve will cut interest rates in November and December, and some liquidity funds from around the world will continue to be injected into risky assets, and the liquidity of the crypto market will be more abundant. A series of on-chain indicators show that the market is recovering and funds are flowing in.

The market is always born in despair, grows in half-belief and half-doubt, matures in anticipation, and shattered in hope.

Perhaps, after waiting for nearly half a year, a new round of bull market in the crypto market is ready to take off.

This article is sourced from the internet: Five major data interpret the current market: After waiting for half a year, is the bull market coming?

Original author: TechFlow The RWA sector has been making a fortune in silence during this atypical bull market. When everyones emotions are easily driven by memes, if you look at the data carefully, you will find that the performance of tokens in the RWA track so far this year is probably better than that of tokens in most other tracks. When U.S. Treasuries become the largest RWA, the trend of the track being affected by the macro economy will become more obvious. Recently, Binance Research Institute released a long report titled RWA: A safe haven for on-chain returns? , which provides a detailed analysis of the RWA tracks landscape, projects, and revenue performance. TechFlow interpreted and refined the report, and the key contents are as follows. Key Takeaways The total…