Volatilidad de BTC: resumen semanal del 30 al 14 de octubre de 2024

Key Metrics: (October 7, 4pm Hong Kong time -> October 14, 4pm Hong Kong time):

-

BTC/USD + 1.2% ($ 63, 500 -> $ 64, 250), ETH/USD + 1.8% ($ 2, 480 -> $ 2, 525)

-

BTC/USD December (year-end) ATM volatility + 1.4 v (56.1 -> 57.5), December 25d risk reversal volatility + 0.6 v (2.3 -> 2.9)

-

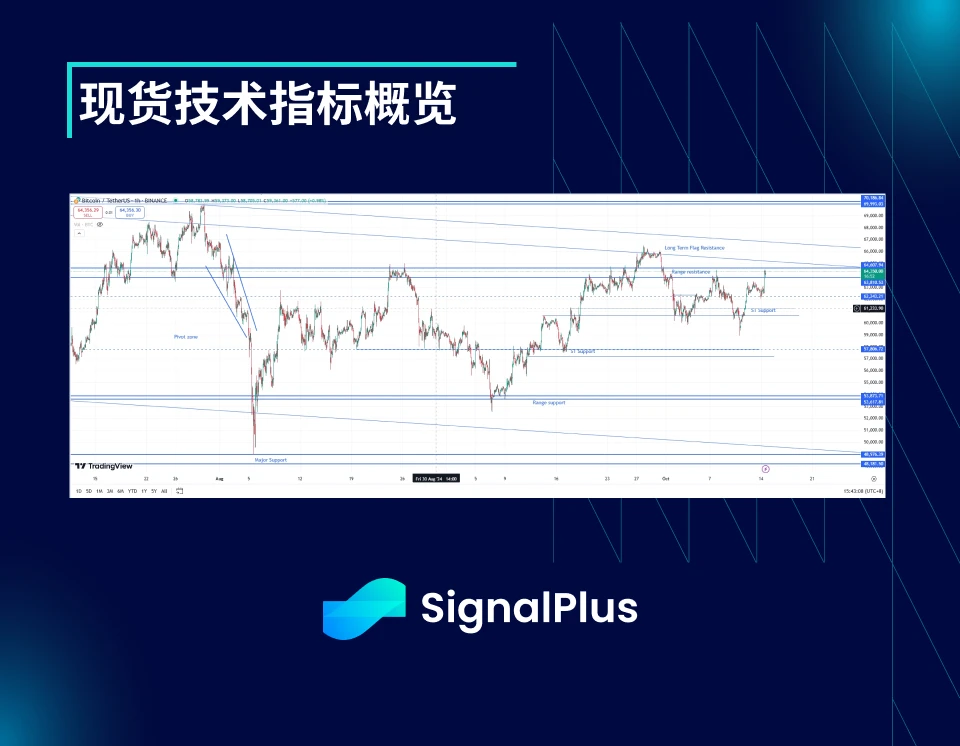

The price fluctuated wildly last week, but generally remained in the $60-65k range.

-

If the price breaks through $66-66.5 K, it will mean breaking the top of the long-term flag trend and the price is expected to rise to $70 K, which will bring more significant upside space.

-

If the price breaks below $59k, support is expected at $57k and then down to $53.5k

Mercado Events

-

There was mixed news for cryptocurrencies this week, resulting in wild price fluctuations. On Thursday, the U.S. Securities and Intercambio Commission (SEC) filed a lawsuit against a large crypto company, accusing it of engaging in unregistered crypto securities trading, triggering a brief liquidation of BTCUSD long positions, with the price falling below 60k, hitting a low of 58.8k. However, with Mt.Gox announcing on Friday that it would extend the repayment period for Bitcoin to 2025 to resolve creditor issues, the price of Bitcoin quickly recovered, with the spot price briefly breaking through 63k. Ultimately, BTC prices will continue to fluctuate in the $60k – 65k range before the U.S. election.

-

This week, Chinas stimulus expectations were dashed. Some medium- and long-term policy measures were announced at a press conference on Saturday, but there were no specific details on short-term stimulus or cash handouts. Although overall market sentiment is moving in a positive direction, there is not enough momentum for a rapid rise in the short term.

-

The slightly better-than-expected U.S. CPI data, coupled with last weeks strong employment data, cast doubt on the rationale for a 50 basis point rate cut in September. As a result, U.S. interest rate pricing rebounded quickly from the sharp rate cut expected by the market two weeks ago, pushing the dollar stronger against fiat currencies. However, despite this, cryptocurrency and gold prices remain generally supported.

-

Although many polls show the race remains 50/50, Trump currently holds a slight lead. The Democratic Partys handling of the growing tensions between Israel and Iran may affect the election in the coming weeks, but overall, this election will continue to be a matter of time.

ATM Implied Volatility

-

Realized volatility remained very low this week (around 35% – 45%), with spot prices hovering in the $60k to $63k range for most of the week, with only brief fluctuations on the weekend. Market participation was insufficient, and liquidity in perpetual contracts and futures was generally sluggish, as investors generally waited for the US election (or other catalysts) to drive prices higher.

-

Implied volatility continued to decline this week due to the sluggish performance of realized volatility and insufficient market participation. However, as the spot price briefly broke through $63k on Friday, implied volatility rebounded over the weekend; on Monday, the spot price continued to rise, breaking through $63k and challenging the $64k level.

-

We expect gamma to be subdued this week as optimism about Chinas stimulus fades and US data is relatively quiet. The only risk in the short term is an escalation in the Middle East, but this is unlikely to have much of an impact at this point.

-

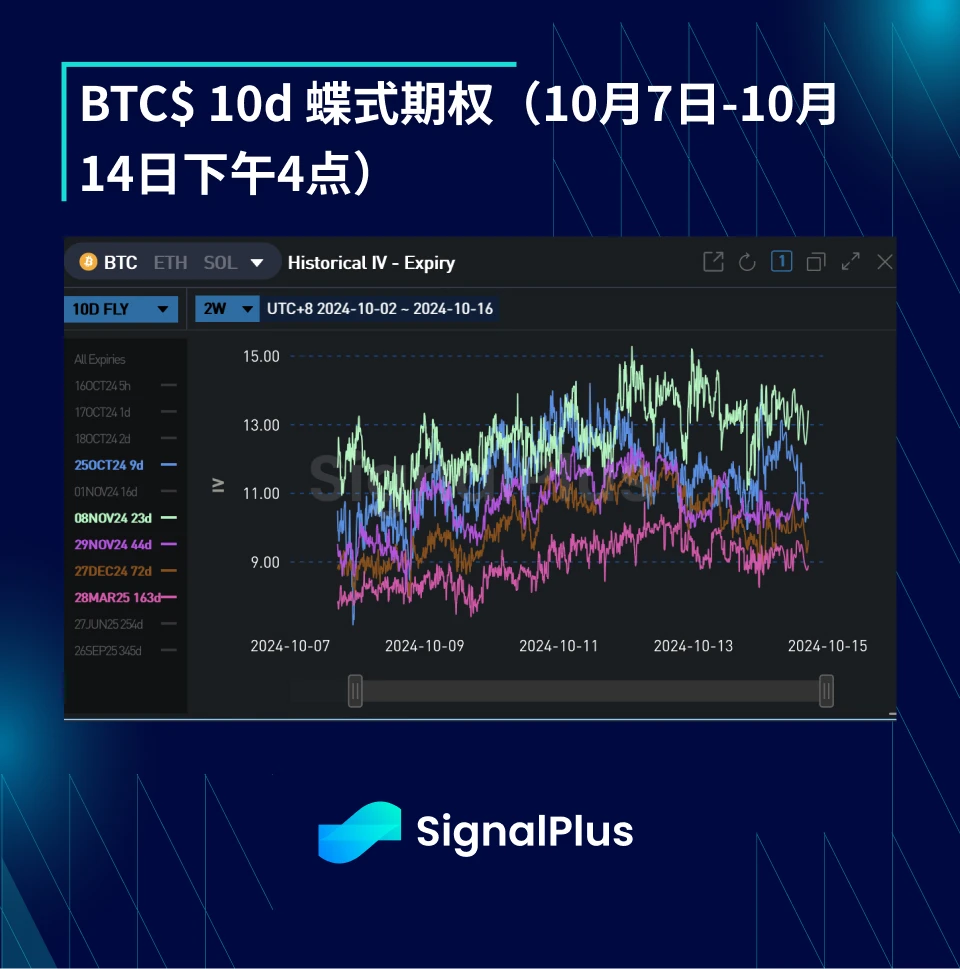

Last week, pricing in election volatility declined as options expiring on November 1 came online for trading. The market was primarily selling forward volatility agreements (FVAs) on October 25 and November 1, selling options expiring on November 1 and hedging with options expiring at the end of October. This in turn put pressure on options expiring on November 8 and somewhat reduced the weight on that day. As the election approaches, we expect demand for options expiring on this event to rise as there is less theta to be paid during this period.

Skewness/Convexity:

-

Influenced by the release of Mt. Gox-related news and BTCs strong rebound after a brief drop below $60k, the market regained confidence in the rise, and the volatility skew price rose again at the end of last week. However, overall, the markets reaction to the volatility skew was flat, indicating that the market held a Gamma position at a high spot price level.

-

From the perspective of convexity, the market remains sideways and volatile, price breakthroughs are still under control, and there are many wing-proportion bullish spread strategy supplies at the end of the year.

Good luck with your trading this week!

You can use the SignalPlus trading vane function at t.signalplus.com to get more real-time crypto information. If you want to receive our updates immediately, please follow our Twitter account @SignalPlusCN, or join our WeChat group (add assistant WeChat: SignalPlus 123), Telegram group and Discord community to communicate and interact with more friends.

Sitio web oficial de SignalPlus: https://www.signalplus.com

This article is sourced from the internet: BTC Volatility: Week in Review October 30 – October 14, 2024

On October 14th, Eric He, LBank’s Chief Angel Officer and Risk Control Advisor, shared insights into the exchange’s future market plans and global compliance strategy via social media. He noted, “To better meet the regulatory requirements of various jurisdictions, our official independent sites will launch in several regions by the end of this year and early next year! ” As a global leader in cryptocurrency trading, LBank is pushing forward with compliance efforts and expanding its operations. This strategic initiative signifies a new chapter in LBank’s global roadmap. The exchange aims to offer more localized and compliant trading services while speeding up its global expansion to tap into new market possibilities. LBank: The Pioneer in the Crypto Exchange Industry Established in 2015, LBank has steadily grown into one of the…