Un salvador en tiempos de escasez de liquidez: cómo el sector de las monedas meme está impulsando el tráfico hacia los exchanges de criptomonedas

Rescuer in Times of Liquidity Shortage: How the Moneda meme Sector is Driving Traffic for Crypto Intercambios

As the crypto market grapples with liquidity crises, meme projects have emerged as natural traffic generators, becoming a key user base for many crypto exchanges. In response, many crypto exchanges are offering increasingly user-friendly incentives within the meme coin sector to attract new users.

According to CoinGecko, the meme coin market is currently valued at approximately $53 billion, accounting for around 2.3% of the total cryptocurrency market capitalization. Among the top 200 cryptocurrencies by market cap, 19 are classified as meme coins. This increasing market share is redefining meme coins from being perceived merely as “joke investments” to serious contenders for investors’ attention and capital.

On the primary market front, the platform Pump.fun has launched about 2.3 million meme coins since January 2024. Statistics show that only 3% of participants have made more than $1,000 in profit, while an extremely rare 0.0028% of users have hit the “To The Moon” milestone, earning $1 million.

The crypto space’s trendsetters—builders and venture capitalists—remain heavily focused on meme coins. Mechanism Capital, a leading crypto fund, has already taken positions in meme coins, and Pantera Capital’s partner, Paul Veradittakit, remarked that “Meme coins are the Trojan horses of the cryptocurrency market.” Meanwhile, Zhu Su, co-founder of Three Arrows Capital, commented on social media that institutional interest in meme coins could become a major narrative in Q4. DWF Ventures, a prominent VC firm and market maker, stated on the X platform that “Meme coins are going to be the new GTM strategy for many ecosystems and projects.” DWF Labs has also disclosed that they are in talks with various meme coin projects and are open to allocating funds to support their growth.

It’s clear that for meme coin investors in the crypto market, focusing on the primary market often feels like a “drop in the ocean” with limited potential. The time-consuming process of selecting tokens and navigating investment mechanisms rarely yields significant returns. As a result, many meme users are turning to the secondary market, where they can rely on the selection processes of crypto exchanges to effortlessly secure steady profits.

In response, many crypto exchanges have capitalized on the high-traffic nature of the meme sector, rolling out favorable policies to win over meme coin investors. For example, some crypto exchanges have streamlined the listing approval process for meme coins, offered increased liquidity support, and even provided airdrops and reduced fees to attract new users.

With competition heating up, crypto exchanges that can swiftly capture market trends and promptly list popular meme coins are quickly becoming investor favorites. This strategy not only helps investors chase short-term gains with substantial upside potential but also allows them to secure an early foothold in the meme coin market. For secondary market participants, a crypto exchange’s ability to efficiently scout projects and maintain strong liquidity is key to enhancing the overall trading experience.

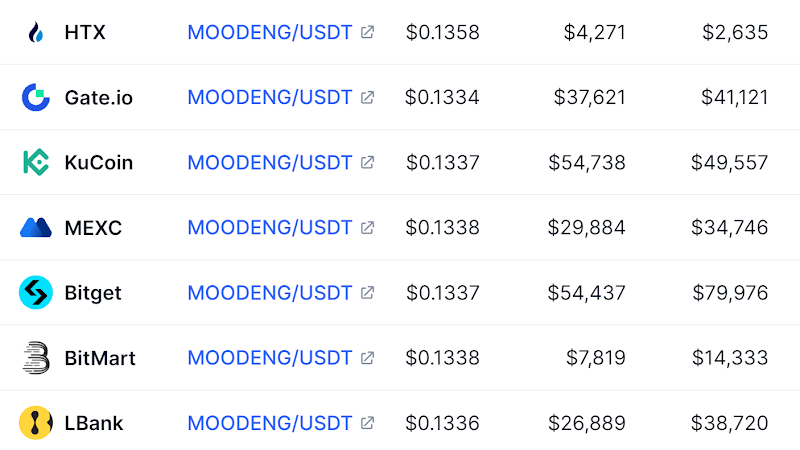

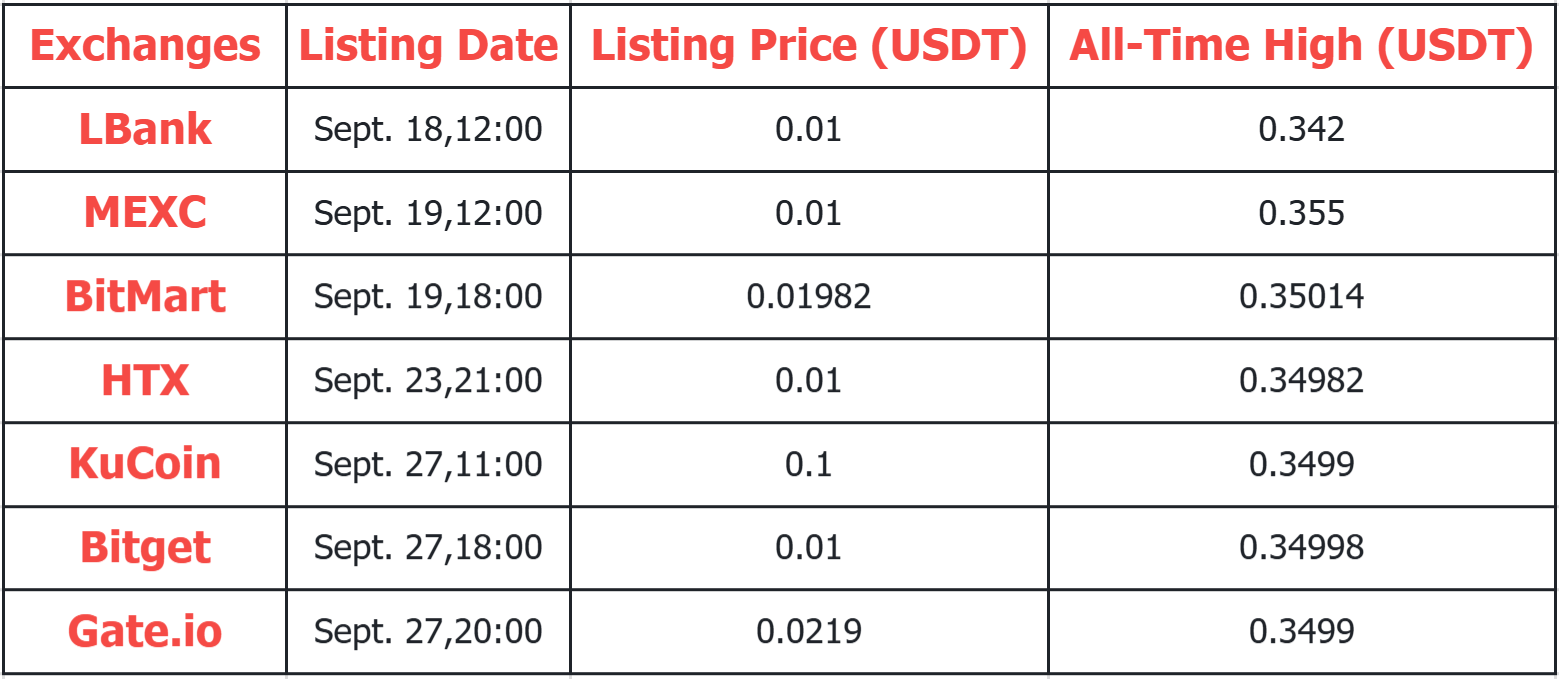

Take the recent standout, MOODENG, as an example. According to CoinMarketCap, this meme coin is already listed on major crypto exchanges such as HTX, Gate.io, KuCoin, MEXC, Bitget, BitMart, and LBank. The chart below summarizes the listing dates and opening prices for MOODENG across various crypto exchanges, ordered by the time of listing.

The chart also highlights that LBank was one of the earliest crypto exchanges to list MOODENG. In fact, a closer look at the K-line performance of MOODENG across different crypto exchanges reveals that many crypto exchanges, which were not the first to list the coin, launched it with what can be described as “rogue-style” inflated opening prices. For meme coin holders, this reinforces the advantage of choosing a crypto exchange that is the first to list a meme coin, as it offers a significantly lower entry price.

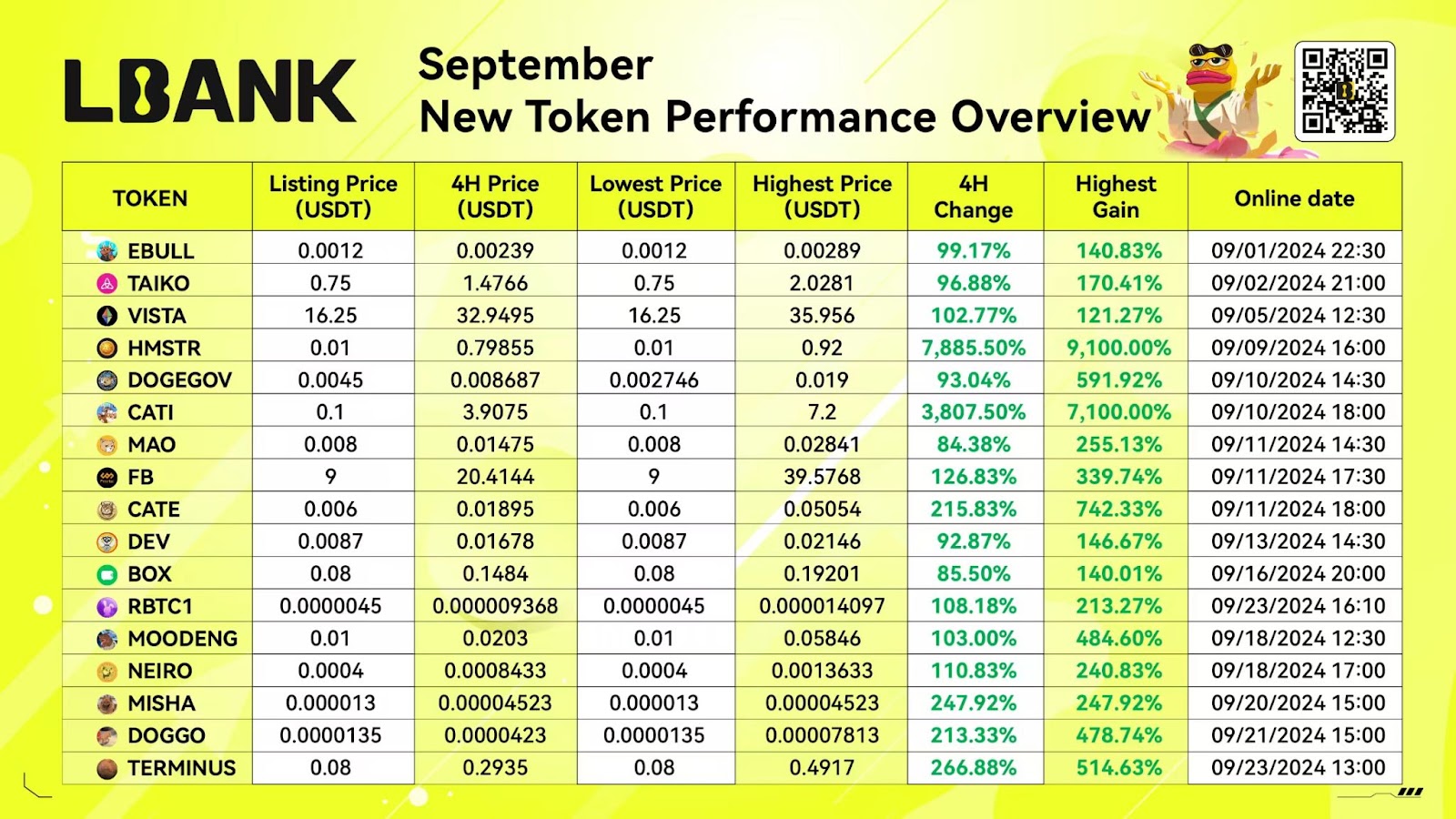

Take Banco L, for example, a prominent global cryptocurrency exchange. LBank led the way by listing MOODENG early (data sourced from LBank’s official social media). From September 1 and September 23, 2024, the crypto exchange listed 17 tokens in total, with 14 of them being meme coins, all showing impressive price growth. This shows how, during liquidity shortages in the crypto market, meme coins often step in as a spark, igniting new surges and delivering strong market performance.

For meme coin investors in the secondary market, timing, price increases, and liquidity remain the top concerns. Short-term price surges are key in attracting investors, and a crypto exchange’s ability to list trending meme coins as quickly as possible has become a critical measure of its competitiveness. To maintain this edge, crypto exchanges must be adept at quickly identifying potential projects and efficiently approving them for listing, ensuring they capture market opportunities early and provide users with optimal trading conditions.

Crypto exchanges that possess a sharp eye for identifying promising projects and are quick to react often provide users with substantial returns early on when meme coins are listed. This ability to offer significant gains has captured the attention of many investors. Another vital aspect for users when choosing a crypto exchange is the presence of strong liquidity support. Adequate awareness of the market and sufficient liquidity allow users to trade at better prices, minimizing the risk of losses due to slippage.

With the growing popularity of meme coins, more crypto exchanges are ramping up their presence in this sector, rolling out measures to safeguard liquidity and support projects in order to attract both users and project developers. This trend has not only fueled the rapid expansion of the meme coin market but has also intensified the competition between crypto exchanges.

In today’s competitive landscape, a crypto exchange’s ability to anticipate market trends and demonstrate technical expertise is crucial for attracting meme coin projects and users. As more creative meme coins enter the scene, crypto exchanges face the challenge of not only managing technology and liquidity but also refining their strategies to enhance their influence within the meme coin ecosystem. As the market evolves, the relationship between crypto exchanges and meme coin investors is likely to grow stronger, driving increased market activity and trading volumes.

Related: Do you need to find product-market fit before issuing tokens?

Original article by Alex Topchishvili, CoinList Original translation: 1912212.eth, Foresight News According to American businessman Eric Ries, product-market fit (PMF) is the moment when a startup finally finds a broad customer base that resonates with its product. Despite the differences between Web2 and Web3 startups, the profound insights about PMF apply equally to crypto: find it, or fail. This begs the question: should PMF be implemented before tokens are issued? In short, it depends on how many tokens the product needs to find product-market fit. The importance of using the token will determine the best time to introduce the token to the product. In this article, we will explore the problems that arise from issuing tokens before achieving PMF, as well as the few situations where it is appropriate to…