Autor original: BitMEX

Despite strong macro-environmental bullishness, Bitcoin has been consolidating in the $63,000 to $66,000 range over the past week, giving us reason to remain cautious.

In this article, we will explore the macro factors for Bitcoin, summarizing key takeaways and indicators to provide insight into Bitcoins potential moves. We will also discuss the importance of remaining cautious despite the positive signals. In addition, we will also explore how options can be used to potentially leverage our balanced market view, considering both upside potential and downside risk.

Vamos a sumergirnos en ello.

3 Reasons to Be Cautious About Bitcoin

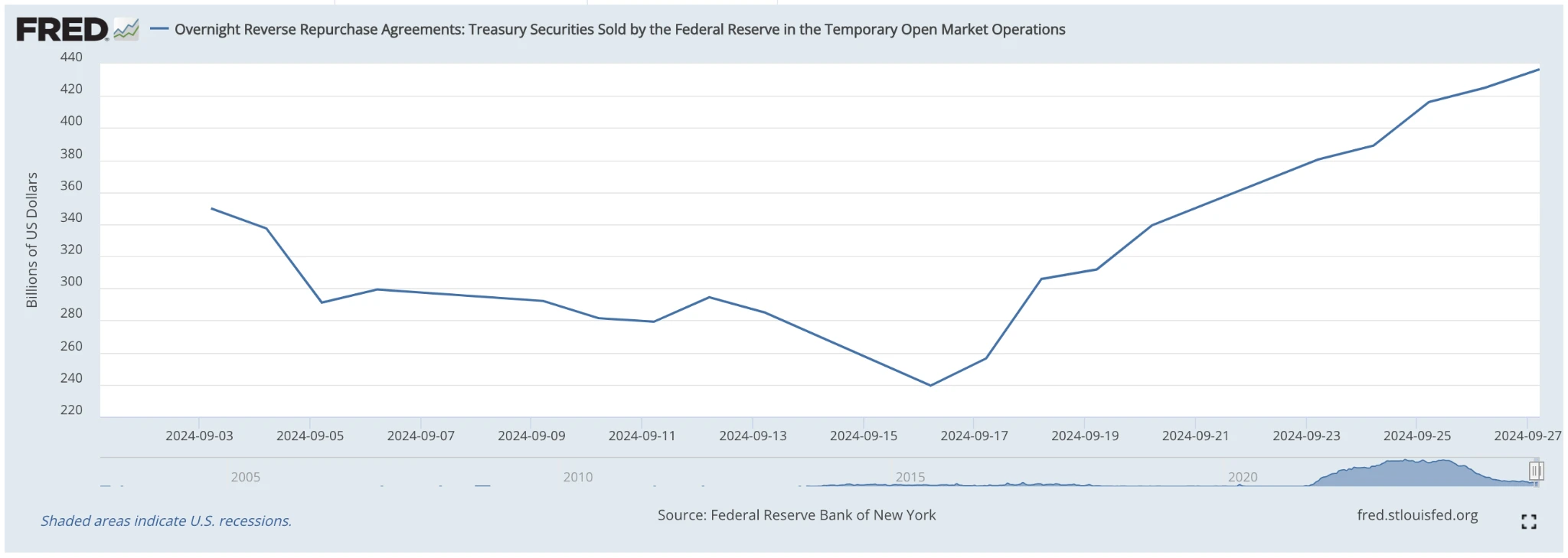

RRP balance continues to increase

RRP, or Overnight Reverse Repurchase Agreement, is one of our favorite macro indicators inside BitMEX. Why? It provides a clear picture of liquidity in a macro environment — a key factor when trying to understand where crypto is headed.

Historically, high RRP has been bad for Bitcoin and vice versa.

Since last week, we have seen a significant rise in RRP balances. In fact, they have risen to their highest level since September 2024, raising concerns about tightening liquidity. This dramatic increase in RRP balances has important implications for the market. Here are the reasons:

-

Reduced Liquidity: Higher RRP balances mean more money is stuck at the Fed, potentially reducing liquidity in various markets.

-

Reduced risk appetite: As liquidity decreases, investors may be less willing to take risks, which could have a negative impact on assets such as Bitcoin and other cryptocurrencies.

-

Caution on risk assets: The combination of reduced liquidity and lower risk appetite generally creates a challenging environment for risk assets such as cryptocurrencies.

Bitcoin ETF continues to see capital inflows

Bitcoin ETF net inflows are performing well. ETFs have attracted $1.157 billion in net inflows for seven consecutive days since the Fed cut interest rates. Now that the Central Bank of China has joined the ranks of easing liquidity, we expect even larger inflows. The last time we saw seven consecutive days of inflows, $BTC was close to its all-time high. At the current price of $66,000, the strong and growing inflows indicate that there is a large amount of supportive funds from outside cryptocurrencies ready to step in if a pullback occurs.

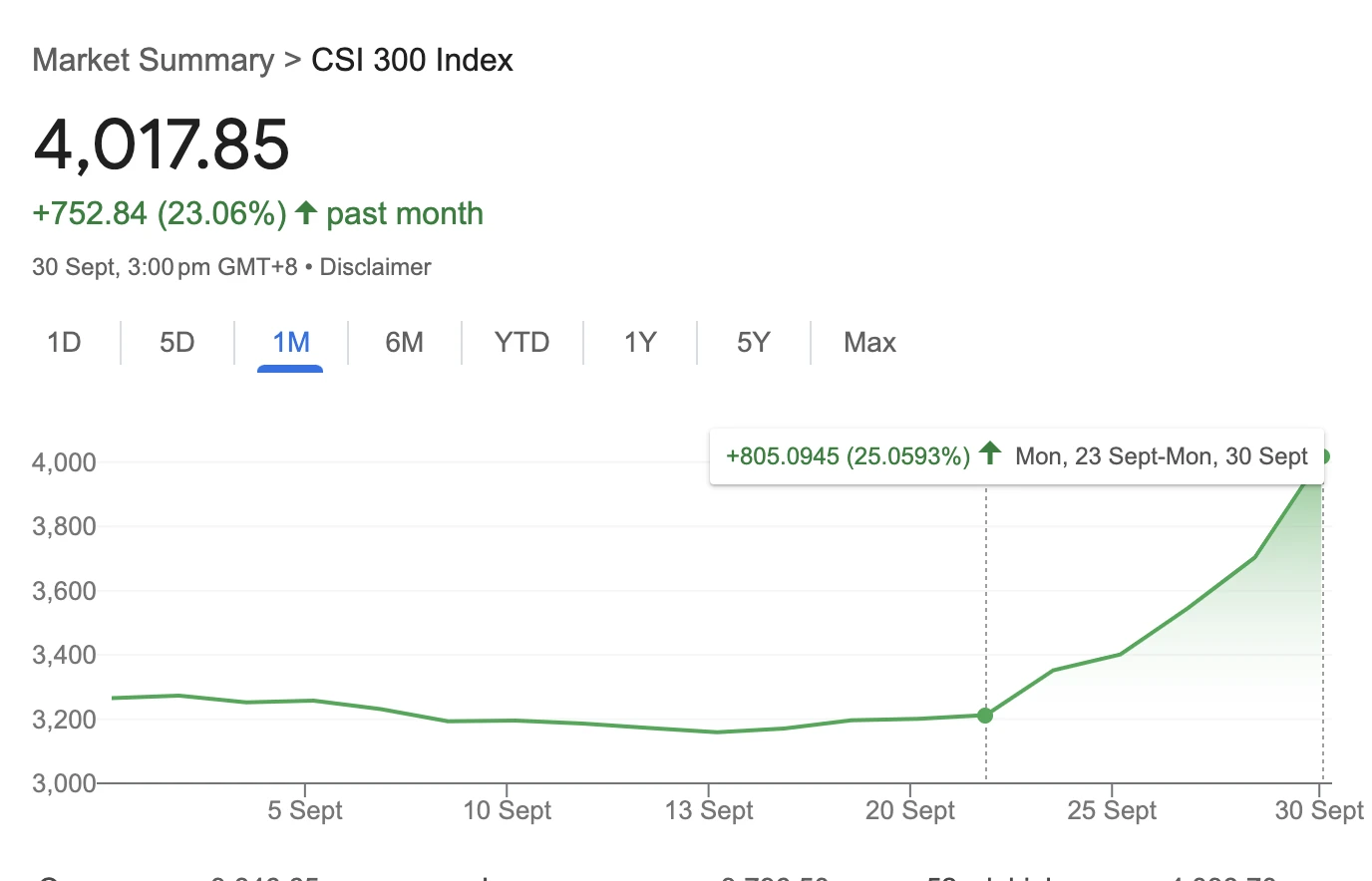

China’s strong rebound distracts retail investors from crypto markets

Chinese stocks staged a historic comeback, surging for nine straight sessions as government stimulus lured investors back into what was once one of the world’s worst-performing markets. The 25% gain in five days rivaled the growth of altcoins.

The CSI 300 surged 9.1% on Monday, its biggest gain since 2008, as traders rushed to buy stocks on the last trading day before a long holiday. The index had fallen more than 45% from its 2021 high to mid-September and has since rebounded more than 20% – entering technical bull market territory. Last weeks rebound was the most significant since 2008.

However, a strong Chinese stock market is not necessarily bullish for cryptocurrencies in the short term. Traders may be shifting crypto funds to trade in the Chinese market. This can be seen in the current discount in the OTC USDT to RMB withdrawal price – the price discount is more than 1.1%, while normally, this price is at a premium because the RMB is not a free-floating currency.

Ponga en práctica sus opiniones sobre el mercado: Negociación de opciones

Taking these factors into account, do you think $BTC may rise slightly before October 11th, but is unlikely to break $68,000?

Considere la estrategia Call Spread 1 x 2

The Call Spread 1 x 2 strategy involves buying one call option and selling two call options with a higher strike price, all with the same expiration date. This strategy is ideal for traders who believe that the underlying asset (in this case, Bitcoin) will experience a modest uptick but will not exceed a certain price point. It allows for potential profits with limited risk while also providing some downside protection.

Estrategias comerciales

Buy 1 $BTC call option with a strike price of $65,000, expiring on October 11

Sell 2 $BTC call options with a strike price of $66,000, expiring on October 11

Beneficios potenciales

-

Breakeven Point: $67,928

-

Maximum loss: If $BTC breaks above $67,928 on expiration date, maximum loss could be unlimited

-

Max profit: If $BTC is $66,000 on expiration date, the maximum profit is $1,961

Ventajas

-

Low Cost: Selling two higher strike call options offsets the cost of buying one lower strike call option.

-

Profit Potential: Maximum profit is realized when the underlying asset price reaches the strike price of the sold call option at expiration.

-

Flexibility: Profit in both moderately bullish and slightly bearish scenarios.

riesgo

-

Unlimited loss potential: If the asset price significantly moves above the strike price of the short call option, the loss could be large.

-

Limited upside: Profits are capped at the strike price of the sold call option, and you may miss out on larger gains if the asset price rises significantly.

-

Margin Requirements: Selling naked call options may require significant margin, which may tie up capital and limit other trading opportunities.

This strategy is suitable for traders who expect the underlying asset price to rise modestly or move sideways. It offers a balance between cost reduction and profit potential, but requires active management and hedging due to the risk of significant losses in the event of a sharp rise in asset prices.

This article is sourced from the internet: BitMEX Alpha: Reasons for cautious optimism on Bitcoin

Original author: Ignas | DeFi Research Original translation: TechFlow As cryptocurrency grows into a global industry, the dominance of Western and English-speaking KOLs may cause us to overlook opportunities outside the West. For example, in my last blog post about the state of the market , I was surprised to find that OpenSocial has more users than Farcaster or Lens, despite having much less attention on the X platform. The secret to their success? Indonesia, Vietnam and India make up the majority of the user base. So, in this blog post, I teamed up with Mai, the brains behind the Pink Brains official X account, to share insights on the South Asian crypto market. We also interviewed several people from South Asian countries to learn about their personal experiences. South…