Explorando el mercado de criptomonedas del sur de Asia: los juegos de clic para ganar son populares y la aceptación de los pagos con criptomonedas está aumentando

Autor original: Ignas | Investigación sobre DeFi

Traducción original: TechFlow

As cryptocurrency grows into a global industry, the dominance of Western and English-speaking KOLs may cause us to overlook opportunities outside the West.

For example, in my last blog post about the state of the market , I was surprised to find that OpenSocial has more users than Farcaster or Lens, despite having much less attention on the X platform. The secret to their success? Indonesia, Vietnam and India make up the majority of the user base.

So, in this blog post, I teamed up with Mai, the brains behind the Pink Brains official X account, to share insights on the South Asian crypto market.

We also interviewed several people from South Asian countries to learn about their personal experiences.

South Asia – The Wilderness of Cryptocurrency

Simbólico 2049 Singapore is undoubtedly the biggest cryptocurrency event in 2024, and one point that impressed us came from Andy’s sharing: “ The Asian market is still untapped. "

While East Asia — such as South Korea, Hong Kong, Taiwan, China, and Japan — has emerged as a major cryptocurrency hub with clear regulatory policies, large institutional and professional investor involvement, Central and South Asia and Oceania (CSAO) has taken a different, often overlooked approach to cryptocurrencies that is not often seen on Western crypto Twitter.

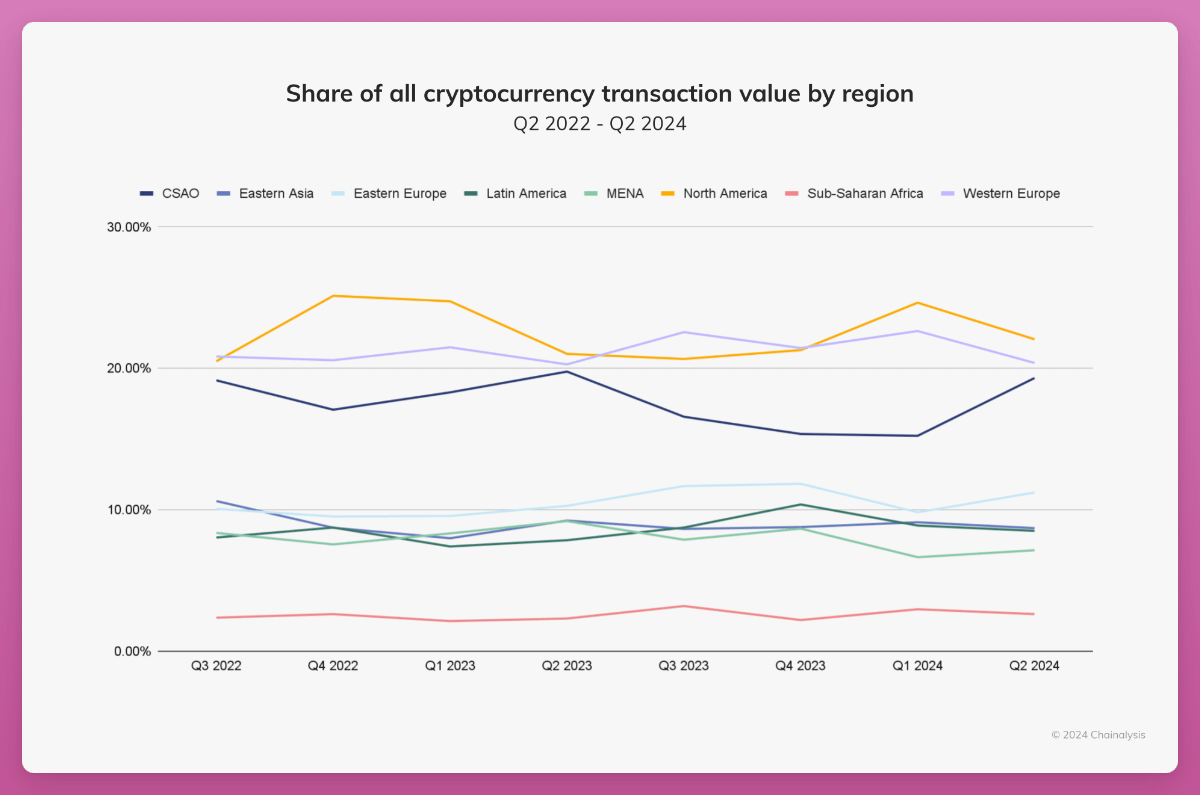

Below is the Chainalysis Global Cryptocurrency Adoption Index map for 2024.

According to Chainalysis, the Central and South Asia and Oceania (CSAO) region is the third-largest cryptocurrency market, with over $750 billion in inflows between July 2023 and June 2024. That’s 16.6% of the global total. Let that number sink in. Only North America and Western Europe have higher numbers.

The Central Southern Asia and Oceania region does stand out in the 2024 Global Cryptocurrency Adoption Index, with seven countries from the region making the top 20: India (1), Indonesia (3), Vietnam (5), Philippines (8), Pakistan (9), Thailand (16) and Cambodia (17).

How are people in South Asia adopting cryptocurrencies?

Vietnam

First, let’s look at Vietnam, where the majority of our DeFi creator studio Pink Brains team is from, and they offer personal experience with the market. According to Triple-A, Vietnam has the second-highest cryptocurrency ownership rate. About 21.2% of the population owns cryptocurrencies, second only to the UAE at 34.4%.

Vietnam also saw huge profits last year, ranking third globally, with $1.18 billion in cashed-out cryptocurrency earnings , according to Chainalysis data. That’s double the earnings of Spain and the Philippines, and three times the earnings of Thailand.

One of the reasons for this is the Vietnamese government’s ambiguous stance on cryptocurrencies. While cryptocurrencies are not banned, their actual use, such as payments or mortgages, is not allowed. This makes holding cryptocurrencies attractive, although the real adoption rate still lags behind other Southeast Asian countries.

-

Centralized exchanges (CEXs) are the first choice for most Vietnamese crypto investors. Binance, Bybit, OKX, and BingX are the most popular exchanges, while Coinbase has a small market share due to language barriers and complex KYC processes. Trading and holding cryptocurrencies on CEXs remains the most common investment strategy.

-

Airdrops and crypto mining are very popular here. You’ll see tons of Telegram and Facebook groups sharing tips, “hidden treasure” alerts, and token giveaways. In fact, it’s easy and cheap to buy cloned accounts, fake KYC, or set up bots with little to no hassle. This makes Sybil attacks from Vietnamese farmers a big challenge for the protocol. Some of the big airdrops you’ll hear about include Arbitrum, LayerZero, Aptos, and zkSync.

-

Most investors in Vietnam are not experienced traders. They mainly seek quick profits and see cryptocurrencies as a side job or a life-changing opportunity outside of their main job. Experienced investors usually look for low-market-cap tokens on decentralized exchanges (DEXs) while holding large assets on centralized exchanges (CEXs). Meanwhile, new investors since 2022 tend to chase airdrops and rebate rewards. Experienced traders usually lose money in major black swan events such as FTX or Luna, while newbies often suffer losses from false KOL signals, scams, or excessive leverage.

-

Vietnam is a top country for international math competitions and a hub for blockchain development talent. You may have heard of well-known names like Loi Luu (Kyber Network) and Vu Nguyen (Pendle), but there are also some notorious serial scammers here, like the guy behind Whale Mercados!

Note: My team is very disgusted with this person. Please see the discussion above to understand how he is undermining the interests of investors. Mai also told me that retail banking and non-cash payments in Vietnam are developing rapidly. Vietnam is moving along a similar path to China, with digital wallets, banking apps, and credit cards gradually replacing cash, especially in large cities. This change is good news for Web3, creating conditions for the popularization of crypto payments, just like the current situation in Singapore. More and more large companies are beginning to integrate blockchain technology into their businesses.

We have already seen some initial tests in the banking industry, such as HSBC Vietnam ’s first live blockchain experiment for L/C payments. These attempts show that Vietnamese businesses are very interested in blockchain technology.

But we still need to wait for the legal framework to be further opened up to cryptocurrencies.

India

Despite Indias changing regulations and taxes, the country remains a major player in the global crypto market. India imposes taxes of up to 30% on crypto gains and a 1% tax on all transactions, which has led some investors to look for less restrictive international exchanges. Despite these obstacles, cryptocurrencies are growing rapidly in India. The rise of innovative crypto startups in India shows that more favorable tax policies and clearer regulations are needed to maintain this momentum.

I asked Hitesh.eth on X what makes India unique. In addition to his unique perspective on crypto, Hitesh is developing a platform (DYOR) to help people understand crypto basics more easily. India has the largest pool of unemployed youth who are eager to work for incentives. If done right, applications can channel these incentives in the form of tokens and points, as we have seen in the past with Axie. In terms of infrastructure, India has some of the best developer resources at a much lower cost than the EU and US.

He said that “over 50% of the community-related positions are held by Indians, and many more are eager to join the space.” But the temporary nature of crypto jobs and high aspirations “leads to some issues, as shown by some airdrops in the past, which create a false impression of Indians. However, this perception should not be generalized as it is more case-specific than representative.”

Indonesia is one of the fastest growing markets in terms of transaction volume.

According to a product manager at Indonesian cryptocurrency exchange Pintu, the growth in crypto activity is driven primarily by speculation. Many people still see crypto as a way to make a quick profit, he said. Now, a lot of traders turn to Telegram groups for signals, just like they used to do with stock trading, but the activity in the crypto space is even more intense because new tokens are constantly emerging. He also said that stricter rules at the Indonesian Stock Exchange may be driving people toward cryptocurrencies. Since the new full-bid auction measures have made stock trading more stringent, some investors are looking for alternatives like cryptocurrencies.

Indonesia stands out in terms of decentralized exchange (DEX) and decentralized finance (DeFi) activity compared to regional and global averages.

This was confirmed by Eli 5 DeFi on X , who said: “Many Indonesians participate in cryptocurrency trading, usually starting with meme coins or airdrops because they are simpler and more attractive. Especially airdrops, which usually only require time and effort to participate.”

He added: “We have been using TON apps mainly lately, and some people have even set up their own communities to mine and play $DOGS , $NOT , and $HAMSTER.”

As Indonesians become more cryptocurrency savvy, yield farming, staking, and decentralized finance (DeFi) projects are growing in popularity. This growth has created a new community of “crypto enthusiasts,” with more than half of investors being millennials and Gen Z seeking emerging technology and quick profits.

DeFi is also on the rise, there are many DeFi builders from Indonesia – Eli 5 DeFi

Here are some famous examples:

-

@0x_eunice – Monad Co-founder

-

@Mariobern – Pyth Co-founder

-

@bradydonut – HawkFi Co-Founder

-

@BrianLimiardi – Copra Co-Founder

-

@smsunarto – Founder of Argus Labs

-

@bizyugo – No. 1, Debank

-

@mathdroid – Pandora

-

@PatriaAbditiar – Sociocat

Singapore

While countries like Indonesia and Vietnam have seen cryptocurrency adoption driven by “cryptocurrency degradation” and the promise of quick gains, the story is different in Singapore.

Ronald Chan from Saprolings (Web3 incubator) told me that after China shut down crypto companies, there was a surge in the number of crypto companies in Singapore. They chose Singapore for the following reasons:

-

Geographical proximity to China

-

Profound Chinese culture

-

Relaxed political environment

-

Low tax rate

-

Large Chinese-speaking population

-

Free movement of capital (including Bitcoin)

-

A strong legal system (this is very important)

-

Well-educated people to run the business

-

A strong financial centre in the region

-

There are few other options in the area

“We protect ourselves by being the bank that leads our neighbors.” – Ronald Chan

Second, regulatory developments and merchant services show that cryptocurrencies have greater potential than just trading and investing. Ronald noted that Singapore “grants banking licenses to both local and foreign banks to level the playing field, unlike many other countries.”

Additionally, Singapore has a nationwide QR code scanning system similar to Chinas WeChat Pay and Alipay (called Paynow QR), which most people use. Mastercard and Visa are available everywhere, but users and merchants are not happy because both sides have to pay extra fees.

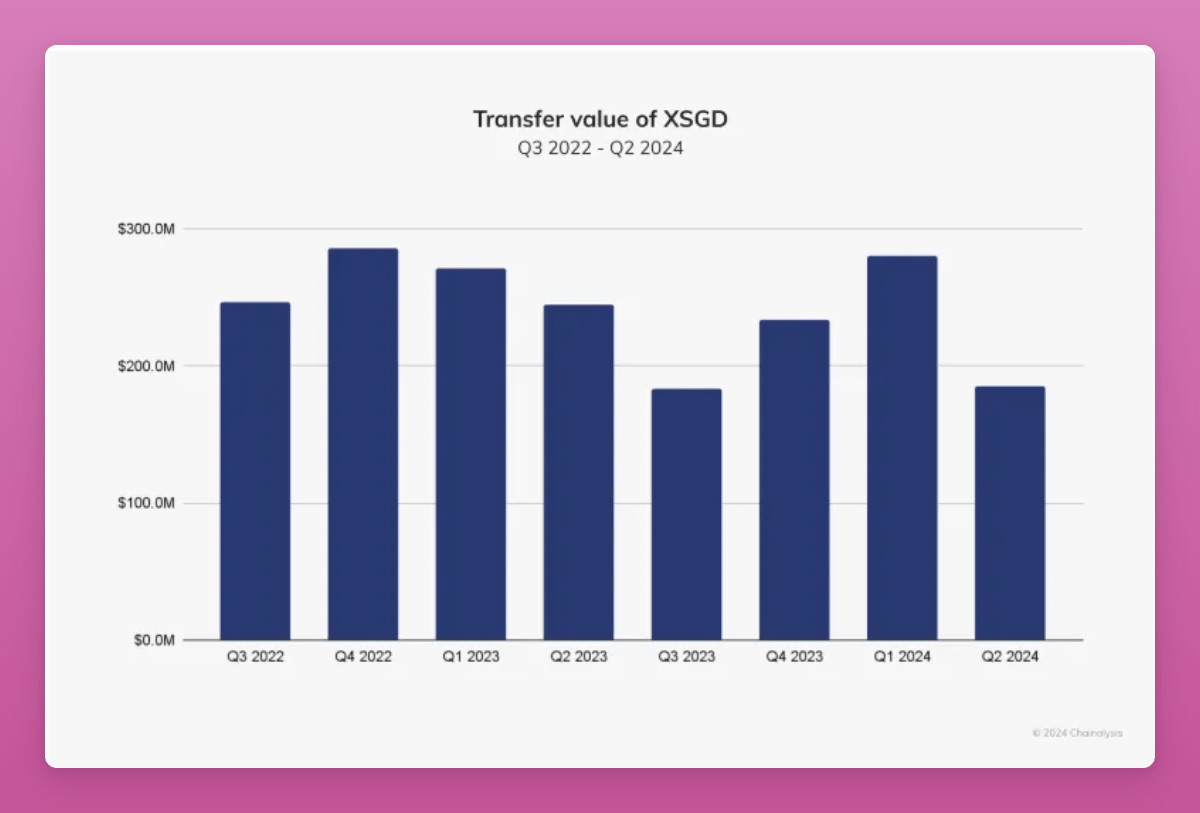

What’s more, Grab, the super app that many people use for ride-hailing, food delivery and other services, has begun allowing users to top up their e-wallets with cryptocurrencies. Users can now pay with Bitcoin, Ethereum, XSGD (Singapore’s local stablecoin), Circle USD and Tether.

Crypto payments for merchant services in Singapore reached nearly $1 billion in the second quarter of 2024, the highest level in two years.

This is an interesting shift, especially in a market where traditional payment systems are already efficient, and it shows that cryptocurrencies are gradually becoming a common asset for more people.

Meanwhile, more than 75% of XSGD transfers were in the amount of $1 million or less, with nearly 25% of transfers being under $10,000, a clear indication of the growing base of retail users in the local crypto market.

The reason for the success is clear regulation, which enhances trust in stablecoins.

In 2023, the Monetary Authority of Singapore (MAS) laid out guidelines for stablecoins, while in 2024, it introduced cryptocurrency custody and licensing rules.

This demonstrates the positive impact that clear regulation can have on cryptocurrency adoption in the United States.

Case Study: TON’s Successful Entry into South Asian Markets

It’s surprising that TON’s click-to-earn game is very popular in South Asia. Personally, I tried it but the rewards I got were not worth it for me.

You might underestimate TON because of its over-distributed airdrops and “brainless” click-to-earn games, but it’s actually consistent with their goal of bringing cryptocurrency into everyone’s pocket.

By receiving free tokens, a new wave of users can start learning how to trade on decentralized exchanges (DEXs), add liquidity, stake, and gradually explore other aspects of the ecosystem.

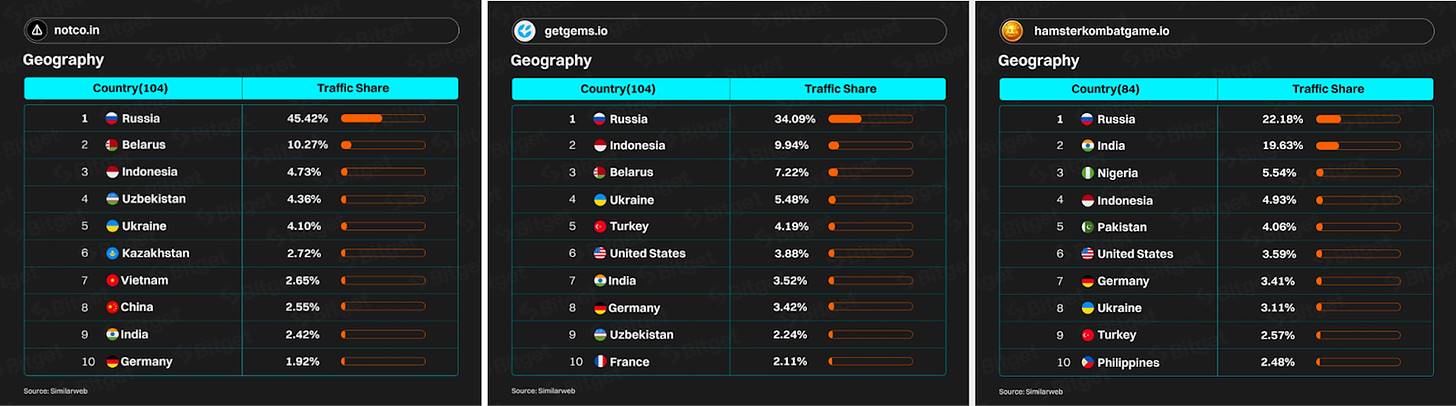

Do you know where these users are mainly from? CIS countries and South Asia.

Notcoin’s website (notco.in) has over 66% of its visits coming from CIS countries. This is followed by Asian countries such as Indonesia, Vietnam, China, and India. Getgems.io and Hamster Kombat show similar trends, consistent with Telegram’s user base.

The Telegram Mini Bot project that offers free tokens is similar to the rise of Axie Infinity in the Philippines.

The success of the TON blockchain can be attributed to two areas of high adoption: free airdrops and dot-to-dot games.

Free airdrop areas

Everyone is tired of the points-for-airdrop campaign. That’s what makes Telegram’s free airdrop scenario unique. It leverages Telegram’s 900 million users to distribute tokens like DOGS. DOGS started out as a meme and gained traction for its fair distribution and lack of a presale. This attracted new users to the blockchain and made DOGS different from typical crypto tokens.

DOGS was soon listed on major centralized exchanges (CEX) such as Binance. Airdrop amounts ranged from $10 to $60 per wallet. For many Western investors, this may not sound like much, but users can cash out across multiple accounts. For many people in developing countries, these airdrops provide a new source of income during economic difficulties.

Dot game

Tap-and-click games, such as Hamster Kombat, are growing rapidly in the South Asian country. In just three months, it reached 239 million registrations, making it one of the most popular tap-and-click games.

It also achieved over 10 million YouTube subscribers in just one week. Thats crazy. Thats unprecedented numbers in many Western countries.

According to Bitget Premarket data, the total market value of its tokens is $920 million, which means the airdrop could be worth around $550 million.

Click-to-earn games like Hamster Kombat have quickly gained a lot of attention among crypto influencers in Southeast Asia due to simple game mechanics, referral campaigns, and a great social presence.

These influencers are also very popular on TikTok and X, sharing referral links and spreading the word about this type of game.

Resumir

South and Southeast Asia is one of the most populous regions in the world, with a young, tech-savvy population, making it a key market for cryptocurrency businesses. It is now the third most important market after the United States and Western Europe.

However, because countries in the region vary significantly in terms of income, government regulations, and economic conditions, it is difficult for companies to develop strategies for each country.

Ton seems to be doing well with its strategy targeting the speculators’ market, and the acceptance of crypto payments is also increasing.

This article is sourced from the internet: Exploring the South Asian crypto market: Click-to-earn games are popular, and crypto payment acceptance is rising

Original author: The Black Swan Original translation: TechFlow We had some “false” hope last week and felt like we were out of the woods, but this week we felt lost again. Today, we’ll take a look at some stablecoins you can hold that generate yield in different ways. While you wait for better opportunities, it might be a good idea to hold on to some stablecoins. Here are five stablecoins that are currently offering the best yields (which is great in a boring “bull market”). introduction Many people are disappointed in the current market. Some choose to leave, while others continue to maintain a pessimistic view and discuss topics such as politics. Your social media is filled with discussions that have nothing to do with cryptocurrencies. At this time, cryptocurrency…