Un vistazo a las 10 principales entidades que poseen Bitcoin

Original author: Jamie Redman

Traducción original: Luffy, Foresight News

Over the past decade, a large amount of Bitcoin has flowed into centralized exchanges, public and private companies, governments, exchange-traded funds (ETFs), and derivative token projects such as WBTC. This article will take a closer look at the top ten entities holding the most Bitcoin.

Survey of the top ten Bitcoin holders

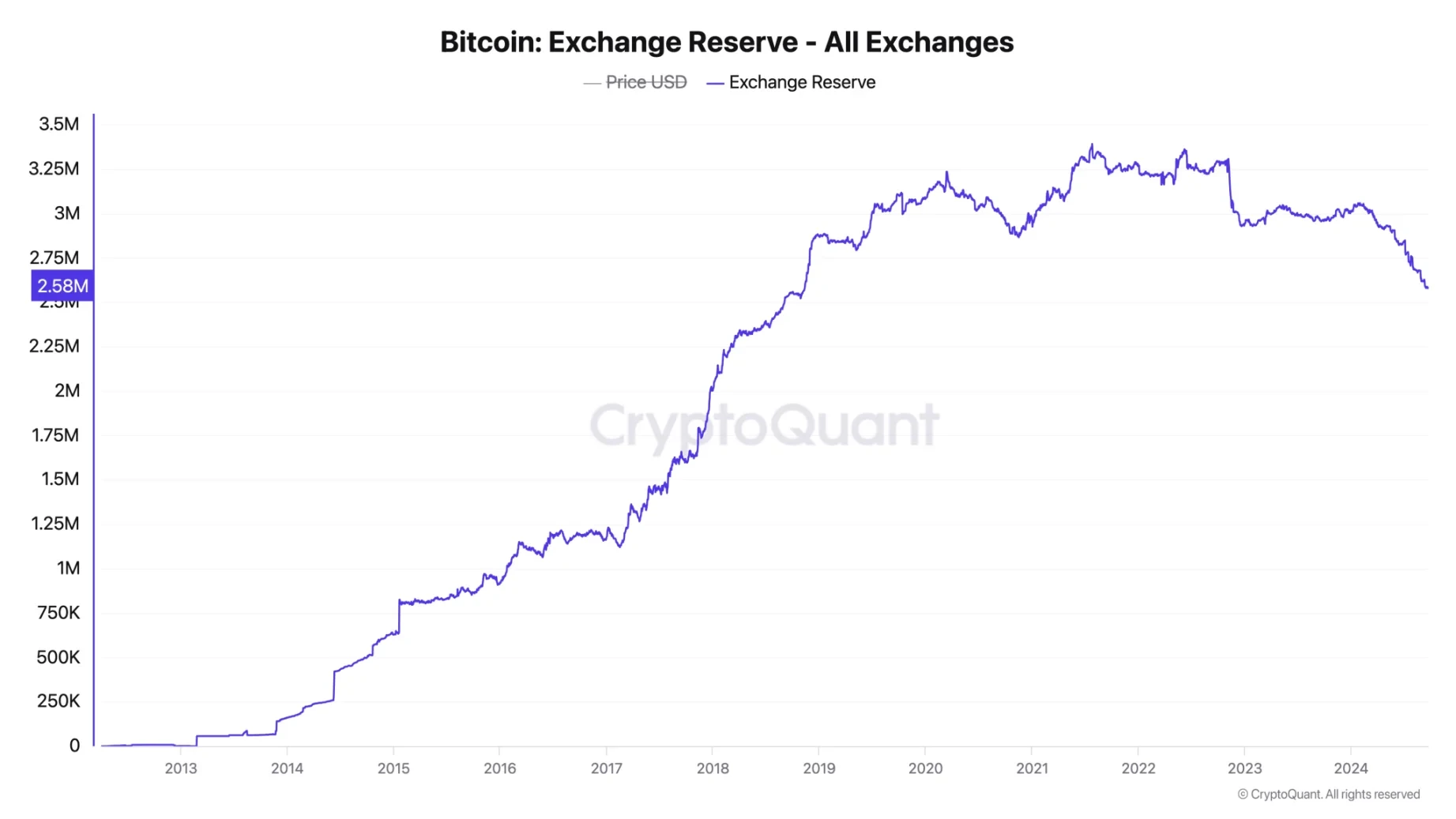

According to Cryptoquant data, currently centralized cryptocurrency exchanges hold about 2,581,607.09 bitcoins. From a trend point of view, the amount of bitcoin held by exchanges has been declining since 2022, but it is still higher than the amount of bitcoin held by exchanges during 2015-2017. On January 1, 2017, Cryptoquant recorded only 1.17 million bitcoins stored on these platforms. In addition to exchanges, the amount of bitcoin held by ETFs, DeFi projects, governments, private and listed companies has also been increasing since 2020.

Bitcoin holdings on centralized exchanges

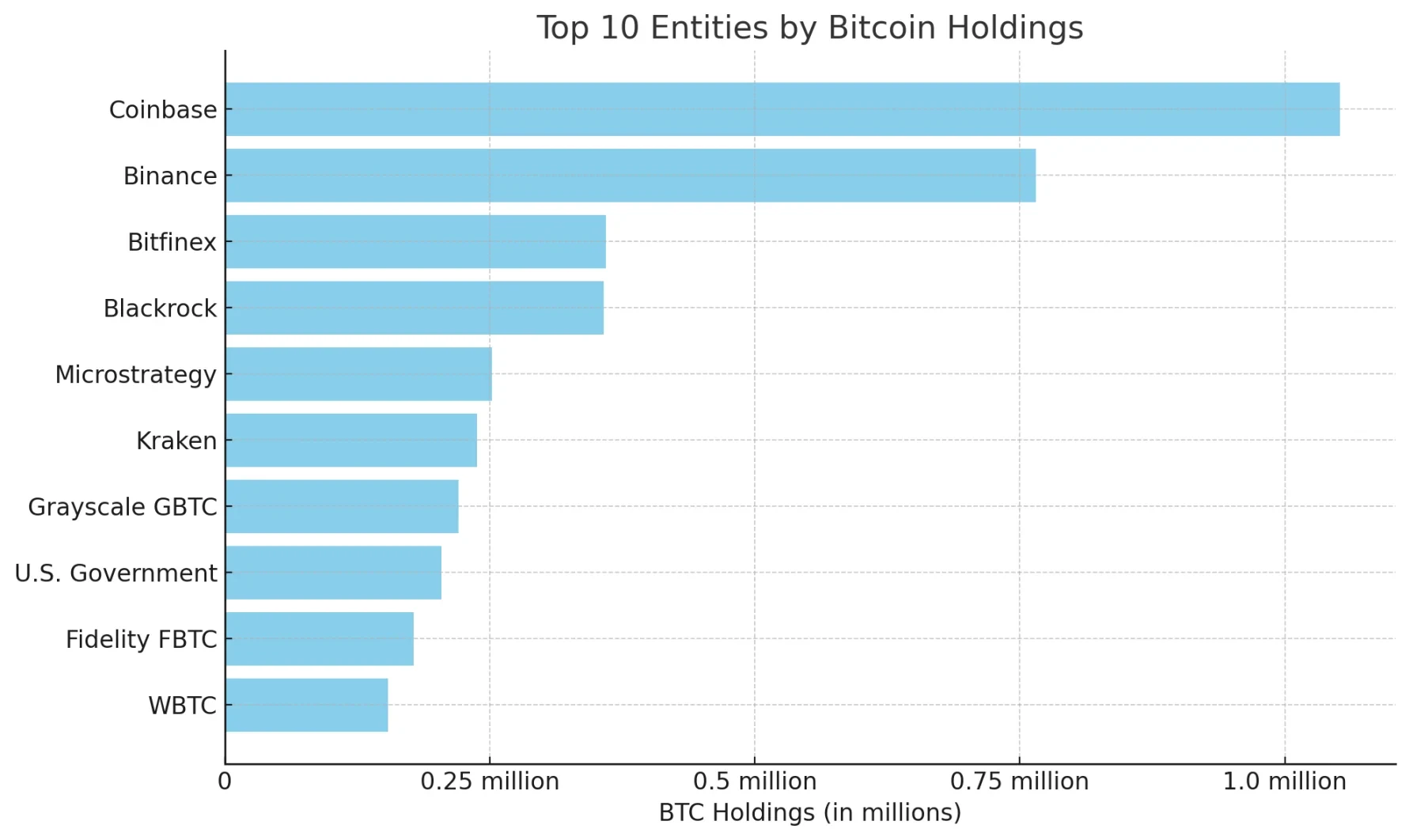

After studying the unspent Coinbase block rewards from 2009 to 2012, we decided to conduct an in-depth analysis of the top ten Bitcoin holders. As with previous studies, this study uses timechainindex.com to obtain on-chain data, but our study excludes unspent block rewards and an unknown individual referred to as X. The subjects of the study include centralized exchanges, governments, companies, and ETPs. The data shows that as of September 22, 2024, Coinbase is the largest Bitcoin holder entity.

Coinbase holds 1,051,650.41 bitcoins in 145,491 addresses, worth $66.4 billion. Binance is the second largest entity holding 765,072.92 bitcoins in 120,528 addresses. Bitfinex is the third largest holder, holding 359,687.52 bitcoins in 2,161 wallets. BlackRock ranks fourth, holding 357,550.21 bitcoins in 760 addresses. It is worth noting that BlackRocks bitcoins are kept by Coinbase Custody.

Data source: timechainindex.com and Microstrategy

Microstrategy claims that the company holds 252,220 bitcoins, ranking fifth after BlackRock, but the data we studied only counted 213,996.14 bitcoins held by Microstrategy in 501 wallets. Kraken ranked sixth, holding 237,900.9 bitcoins, with funds stored in 78,023 wallets. The seventh largest bitcoin holder is Grayscales GBTC, which holds 220,439.82 bitcoins, also managed by Coinbase Custody.

The U.S. government ranks eighth, holding 204,302.34 bitcoins, stored in 125 different wallets. Fidelitys FBTC fund uses its own custody solution to store bitcoins, and it holds 178,191.25 bitcoins, stored in 562 wallets. The last and tenth largest bitcoin holder is the WBTC project, which reserves bitcoins at a 1:1 ratio and then mints derivative ERC 20 tokens, and its bitcoins are stored in 948 wallets.

The distribution of Bitcoin among the top 10 holding entities highlights the growing institutional interest in the asset. It also shows that many users are still using CEX platforms to trade and store their Bitcoin. As Bitcoin is gradually integrated into everything from governments to public companies, it highlights the current shift from individual ownership to larger, more concentrated holdings. This trend may affect the liquidity and accessibility of Bitcoin in the future, especially with the continued expansion of ETFs and institutional custody solutions.

CEX holdings dominate the top three, users need to pay attention to risks

It is important to emphasize that, while Coinbase custody holds two-thirds of the Bitcoin held by US ETFs and the top three exchanges manage the largest Bitcoin reserves, the majority of these assets belong to retail investors and high net worth individuals. These funds are customer assets, but the exchanges still have 100% complete control over them. If a breach occurs and their cold wallets are stolen, the exchange will either have to compensate customers or go out of business, leaving users to bear the consequences of their mismanagement.

This is why non-custodial wallet solutions have been recommended for more than a decade, as they give users full control over their funds. While exchanges are suitable for trading, many have been hacked since the advent of cryptocurrency trading platforms, and breaches continue to occur. For safety reasons, users are advised to only keep funds they can afford to lose for trading on exchanges, while keeping the rest of their digital assets in non-custodial wallets.

This article is sourced from the internet: A look at the top 10 Bitcoin holding entities

El 1 de agosto de 2024, OKX Ventures, el brazo inversor de la empresa líder de intercambio de activos criptográficos y tecnología Web3 OKX, y Aptos Foundation, líder mundial en blockchain, anunciaron que lanzarán conjuntamente un nuevo fondo de $10 millones para apoyar el crecimiento del ecosistema Aptos y la adopción generalizada de Web3. El fondo se utilizará para desarrollar un programa acelerador, operado en asociación con Ankaa, para impulsar el crecimiento de proyectos y aplicaciones de calidad basados en Aptos. Aptos es una blockchain PoS de capa 1 escalable que utiliza el lenguaje de programación Move para hacer que las transacciones en cadena sean más confiables, fáciles de usar y seguras. El acelerador brindará a los proyectos seleccionados del ecosistema Aptos soporte de riesgo, orientación enfocada, exposición al mercado y una red conjunta de expertos de OKX, Ankaa y Aptos…