Bitwise: ¿Por qué el mercado de criptomonedas no puede escapar del efecto septiembre?

Original author: Matt Hougan, Chief Investment Officer of Bitwise

Traducción original: Luffy, Foresight News

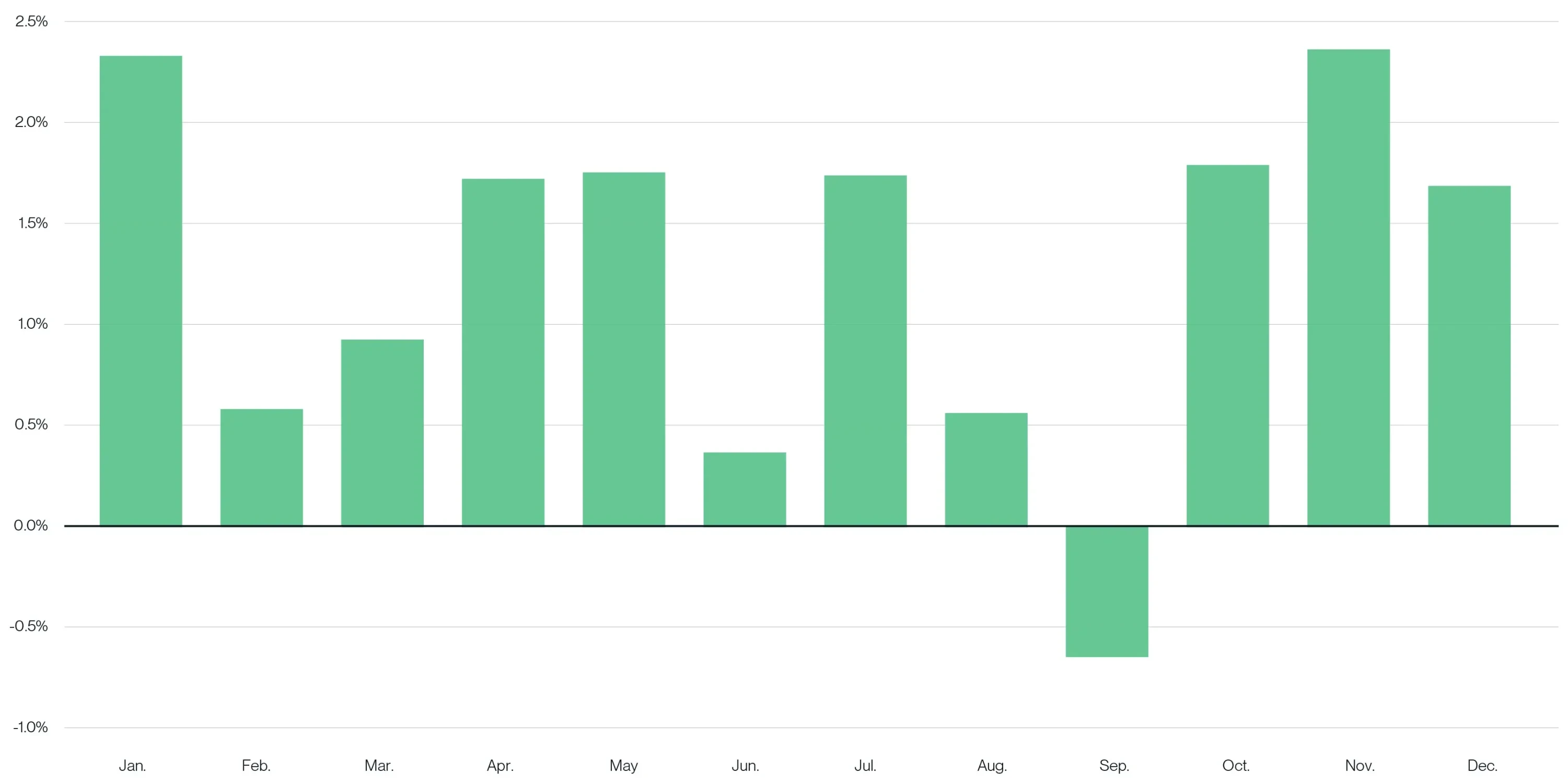

September is the cruelest. Since its creation in 2010, Bitcoin has lost an average of 4.5% in September. September is Bitcoin’s worst month to date and one of only two months with a negative average return.

Average monthly returns of Bitcoin from 2010 to 2024; Source: Bitwise Asset Management, Glassnode and ETC Group; Data range is August 2010 to September 2024.

The situation shows no signs of getting better. Bitcoin has fallen in nine of the 13 Septembers on record, according to NYDIG’s analysis. September 2011 was Bitcoin’s worst month ever, with a 41.2% drop. This month, as of Sunday, Bitcoin is down 7%.

As the Green Day song goes, “Wake me up when September ends.”

What drives the “September effect”?

There are many discussions about the causes of the September effect, but there is no particularly convincing theory. Here are three main theories:

1. September is a bad month for all risk assets

Bitcoin isn’t the only asset to be impacted by the back-to-school season. Since 1929, September is the only month in which the stock market has seen more declines than increases. This phenomenon is particularly pronounced in the Nasdaq 100.

Economists have tried to attribute the decline to a variety of factors, including increased volatility following a summer economic slowdown and year-end losses for mutual funds. But no one is sure.

Whatever the reason, its happening again: As of Friday, September 6, the Nasdaq 100 was down nearly 6% this month.

Average monthly gain of the Nasdaq 100 Index; Source: ChartoftheDay.com; Data range is from January 1985 to December 2023.

2. SEC Enforcement Season Puts Pressure on Cryptocurrency

The SEC’s office hours run from October to September of each year. Historically, you’ll find a lot of enforcement actions in September as lawyers work to complete their annual deadlines. Today, SEC enforcement season is heating up: this month, we’ve seen the SEC’s settlement with crypto fund provider Galois Capital, as well as a Wells Fargo notice against NFT platform OpenSea. Many predict that by the end of the month, there will be an even greater intensity of lawsuits and settlements against crypto entities. I’m not surprised; I’ve been hearing rumors of larger enforcement actions since early summer, and we’ve long warned about the dangers of SEC enforcement season.

3. Reflexivity

The best explanation for the September effect is probably: reflexivity. People now expect September to be bad, and it is. As is often the case: expectations drive markets.

In contrast, Bitcoin investors have historically favored October, which is known as “Uptober.” Bitcoin has risen an average of 30% in October, which may have fueled investor enthusiasm. Historically, October and November are among the best performing months for cryptocurrencies.

Crypto Market Outlook

Like most people, I don’t know what to make of the “September Effect.” I don’t know how much of an impact the above factors have, or what other untapped forces are at work. Regardless, it’s affecting the psychology of the current crypto market.

What I do know is that, aside from seasonal factors, the most important thing is to focus on the current market situation. In this way, I began to understand the reasons behind the weakness of cryptocurrencies in September this year.

Markets hate uncertainty, and there is a lot of uncertainty in the market right now.

The U.S. presidential election will have a major impact on cryptocurrencies, and it is too close to call at this point. I think it will be difficult for the market to take a firm stand until we have more clarity on future leadership and policy.

The timing and magnitude of the Federal Reserves interest rate cuts have sparked a fierce debate. Despite widespread consensus that loose monetary policy is coming, investors are recalibrating their bets: the probability of a 50 basis point rate cut in September has decreased, but the probability of a cut of more than 125 basis points in December has increased.

ETF flows are mixed. While inflows into Bitcoin and Ethereum ETFs have slowed (the U.S. Bitcoin ETF just experienced its longest period of net outflows since its launch in January), if you look closely you can see that investment advisors are adopting Bitcoin ETFs faster than any new ETF in history.

My prediction is that as this uncertainty starts to dissipate in October and November, we will see a big rally in cryptocurrencies. This is in line with historical trends, which may or may not be a coincidence. Regardless, be prepared.

This article is sourced from the internet: Bitwise: Why the crypto market cannot escape the September effect?

Related: The rise of RWA real assets

1. Tracing the origin of RWA RWA – Real World Assets RWA, the full name of which is Real World Assets, literally means real-world assets, which refers to the digital and tokenized representation and trading of real-world assets in the blockchain or Web3 ecosystem. These assets include but are not limited to real estate, commodities, bonds, stocks, artworks, precious metals, intellectual property, etc. The core concept of RWA is to bring traditional financial assets into the decentralized finance (DeFi) ecosystem through blockchain technology, thereby achieving more efficient, transparent and secure asset management and transactions. The significance of RWA is that it makes assets that are relatively difficult to flow in the real world liquid through blockchain technology, and on this basis can participate in the DeFi ecosystem to conduct operations…