¿Polymarket está a punto de lanzar una moneda? Un artículo que analiza los 5 principales mercados de predicción de criptomonedas

Original|Odaily Planet Daily ( @OdailyChina )

Autor: Wenser ( @wenser 2010 )

Recently, the popular prediction market Polymarket has once again attracted great attention from the crypto community. It is understood that some users expect the platform to launch tokens next year, and a considerable number of traders are already trying to win potential airdrops. The reason for this idea is that PolyMarket currently does not charge transaction fees or subscription fees, and after the US election, a new round of growth and expansion may depend on token issuance. According to Fhantom Bets, the Polymarket website has seen an increase in trading volume after the B round of financing. Although the rumor of the issuance of the coin has not been officially confirmed or the estimated time has not been announced, it is speculated that the token release is likely to take place after the US election.

In view of this, the next focus of market attention may shift to other platforms in the prediction market track. Odaily Planet Daily will briefly review and analyze this in this article.

Overview of the prediction market track: TVL doubled in two months

On July 10, according to DefiLlama datos , the TVL of the prediction market sector was 77.42 million US dollars, which was a record high. Among them, Polymarket topped the list with a TVL of 47.69 million US dollars. Other protocol platforms with TVL exceeding 1 million US dollars include Azuro, Gnosis Protocol V1, Lumi Finance, Augur, EtherFlip, and WINR Protocol.

Today, two months later, according to information on the DefiLlama website , the TVL of the prediction market sector has exceeded US$146 million. In addition to Polymarket, which has always grown rapidly (TVL has nearly tripled to US$121 million), other platforms or protocols including Azuro have also grown to varying degrees.

Defilama website information

Looking closely at the rapid growth of the forecasting market sector, perhaps it can be attributed to the following:

-

The number of prediction events has increased. As the second debate of the US presidential election approaches (Odaily Planet Daily Note: This Tuesday, that is, tomorrow, Trump and Harris will have a general election debate, which is also the first confrontation between Harris and Trump after Biden withdrew from the Democratic presidential candidate) , the prediction market platform is becoming more and more active.

-

The cryptocurrency market is weak. The recent poor performance of the cryptocurrency market may also be a major reason for the growth of the forecast market trading volume and TVL. After all, when mainstream tokens such as Bitcoin and Ethereum have more downtime than uptime, compared with the gambling game of high-multiple contracts, the buy big and small and win and lose forecast markets that are more similar to binary options may be the market transactions that cryptocurrency stablecoin holders prefer.

-

Celebrity institutions support. In addition to the investment from Ethereum co-founder Vitalik, PolyMarket CEO Shane Coplan recently announced that Bloomberg Terminal has integrated the prediction market Polymarket . In addition, he pointed out: What was once just a fringe science fiction idea to change the flow of information has now become the new normal, as tens of millions of people have become accustomed to relying on Polymarket predictions as a source of fact to understand what is happening in the world.

-

Traditional prediction channels have failed. Taking the US presidential election-related guessing activities as an example, traditional prediction channels such as political commentators and opinion polls have exposed shortcomings such as poor timeliness, small sample data volume, and vague prediction results standards after experiencing a series of dazzling twists and turns such as Trumps conviction, Trumps assassination, Bidens withdrawal from the election, and Harris becoming the new Democratic candidate. In comparison, the encrypted prediction market, which has received real money bets and increased bets, has advantages such as greater sensitivity, representativeness, and result certainty, and has become the preferred choice of more and more people.

When it comes to “guessing news trends based on betting,” the crypto prediction market undoubtedly holds an advantageous position.

As a result, with PolyMarket as a good example, other prediction market protocol platforms are not willing to lag behind.

A review of the top 5 crypto prediction markets: each has its own strengths and weaknesses, and each has its own strengths

Due to limited space, we only briefly introduce the representative crypto prediction market projects in the current market for reference by readers and related users.

Azuro: A Liquidity Pool-Backed Staking Protocol

As betting protocols supported by liquidity pools, the difference between Azuro and PolyMarket is that the former is a basic protocol for creating on-chain prediction markets, including on-chain smart contracts and web components. Users can create multiple prediction market Dapps based on Azuro; while the latter is more like a fully functional front-end platform.

De acuerdo a Datos de dunas , the current prediction market transaction volume supported by the Azuro protocol has reached 204 million US dollars, the number of transactions has reached 5.814 million times, and the number of users has reached 30,900. In addition, according to the official Dune data panel , the total TVL of the Azuro protocol has reached 9.132 million US dollars, and the total number of applications is 34.

In addition, Azuro has issued the token AZUR. According to Datos de Coingecko , the current price of AZUR is around US$0.086, with a market value of US$13.11 million. It has fallen by more than 60% compared to the high price of US$0.2396 two months ago.

It is worth mentioning that Azuro, which calls itself the blockchain prediction layer, Anunciado in April this year that it had completed a US$3.5 million financing round, with SevenX Ventures, Fenbushi Capital, Arrington Capital, Polymorphic Capital, Red Beard Ventures, Dewhales and G1 Ventures participating in the investment.

AZUR token information interface

BET: Solana Ecosystem Platform Launched by Drift

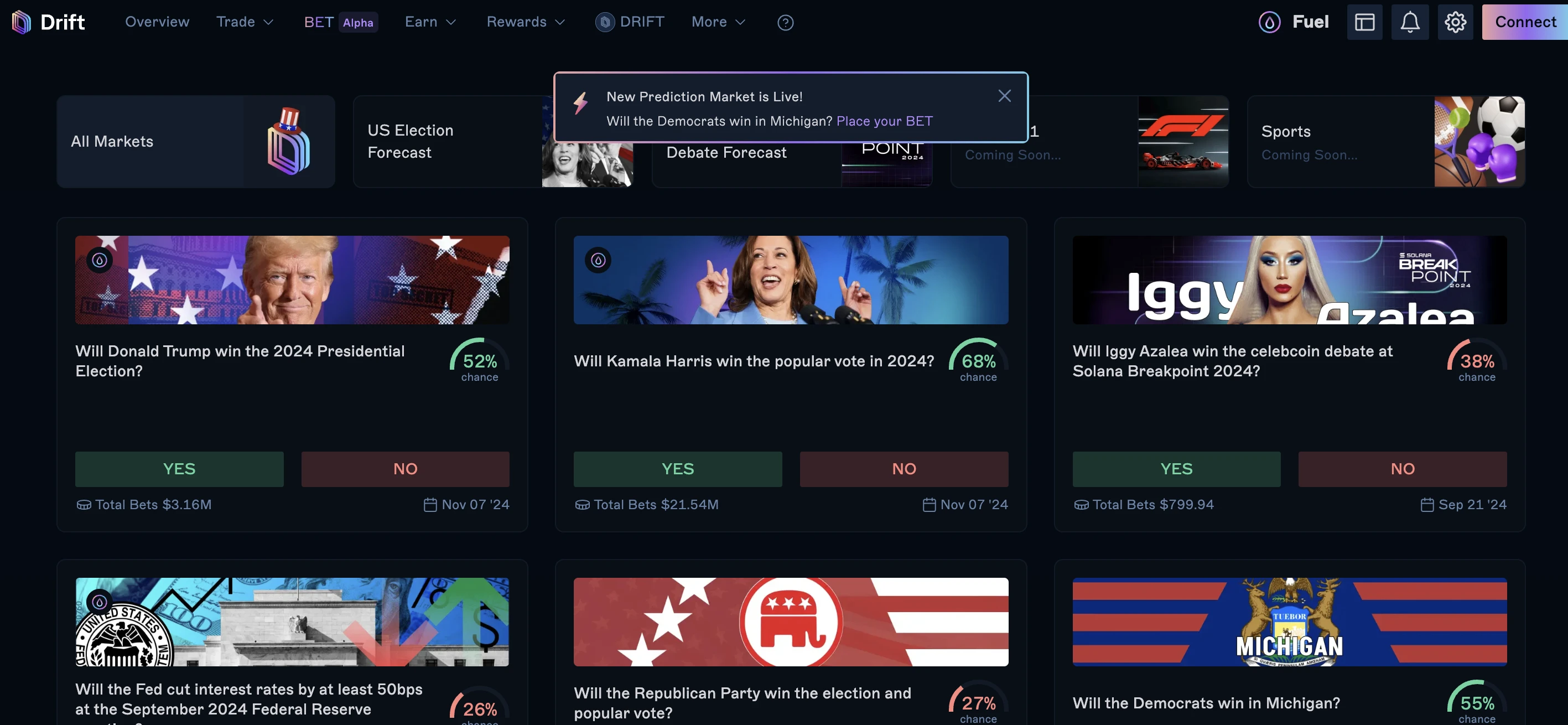

In mid-August, according to noticias oficiales , Drift Protocol announced the launch of the prediction market BET on Solana, and the first prediction market revolved around the US election. More market categories will be launched in the future, covering sports ( F1 , CryptoFightNight), cryptocurrency and culture (Solana debate results). In the introduction article, Why be (B)ullish on (E)very(T)hing on Drift? was used as the opening title, and a hidden English stalk was also played.

Shortly after its launch, Solana Floor disclosed that the platform attracted liquidity amounting to US$3 million at one point.

De acuerdo a Datos de dunas , the platforms current total transaction volume exceeds US$24.78 million, the total number of transactions is 6,872, and the total number of users is 1,027. There is still a certain gap compared to the industry leaders. However, considering that the current open version is the Alpha version, it mainly focuses on political guessing activities, and its future potential is still worth looking forward to.

BET Platform Alpha Version Page

SX Bet: A sports betting platform

The platform was founded in 2019 and is built on the Ethereum ecosystem. According to its official account @SX_Bet , it is the worlds largest sports betting platform and mainly focuses on betting on the final winners of major events such as tennis, football, baseball and basketball. Recently, Crypto, Degen Crypto and politics have been added to its betting section. The bets are based on the price trends of mainstream crypto assets and on-chain meme coins and the winner of the US election. It is understood that the project has received support from investment institutions such as Nascent, Hack VC, and CMCC Global.

Unlike prediction markets such as PolyMarket, SX Bet is more like traditional sports betting, supporting only single bets. Bets cannot be traded freely before the outcome of the predicted event is determined. Therefore, it is impossible to exit the guessing activity in the middle and lock in profits in advance like PolyMarket.

The innovation of this platform is that it has realized a combined betting system for the first time, that is, users make predictions on a series of events, and only when all predictions are correct can they get a larger final prize pool. To some extent, it can be regarded as a leveraged prediction market.

In addition, according to its página web oficial , its payment channels support traditional payment tools and Crypto deposit methods, which are relatively user-friendly. According to on-chain information , the current price of SX Bet platform token SX is around $0.055, and the on-chain market value is around $7.48 million.

SX Bet official website interface

Augur: The failed prediction market project

Compared to Polymarket, which is still active in the market today, Augur is undoubtedly a negative example – although Polygon supported the project through a $1 million incentive plan in 2021, as a prediction platform, without more liquidity introduced, the only thing waiting for it is slow death.

The last tweet from its official account @AugurProject era on November 18, 2021, when the project anunció que it would introduce AugurDAO and cooperate with DXdao, a decentralized autonomous organization that manages the prediction market Omen, to build AugurDAO using the DXdao structure. Governance will be driven by REP v2 holders, but the final result was naturally unsatisfactory.

Currently, the projects token REP is close to zero. Previously, Upbit officially delisted Augur (REP) on July 13, 2023.

REP Simbólico Market Information

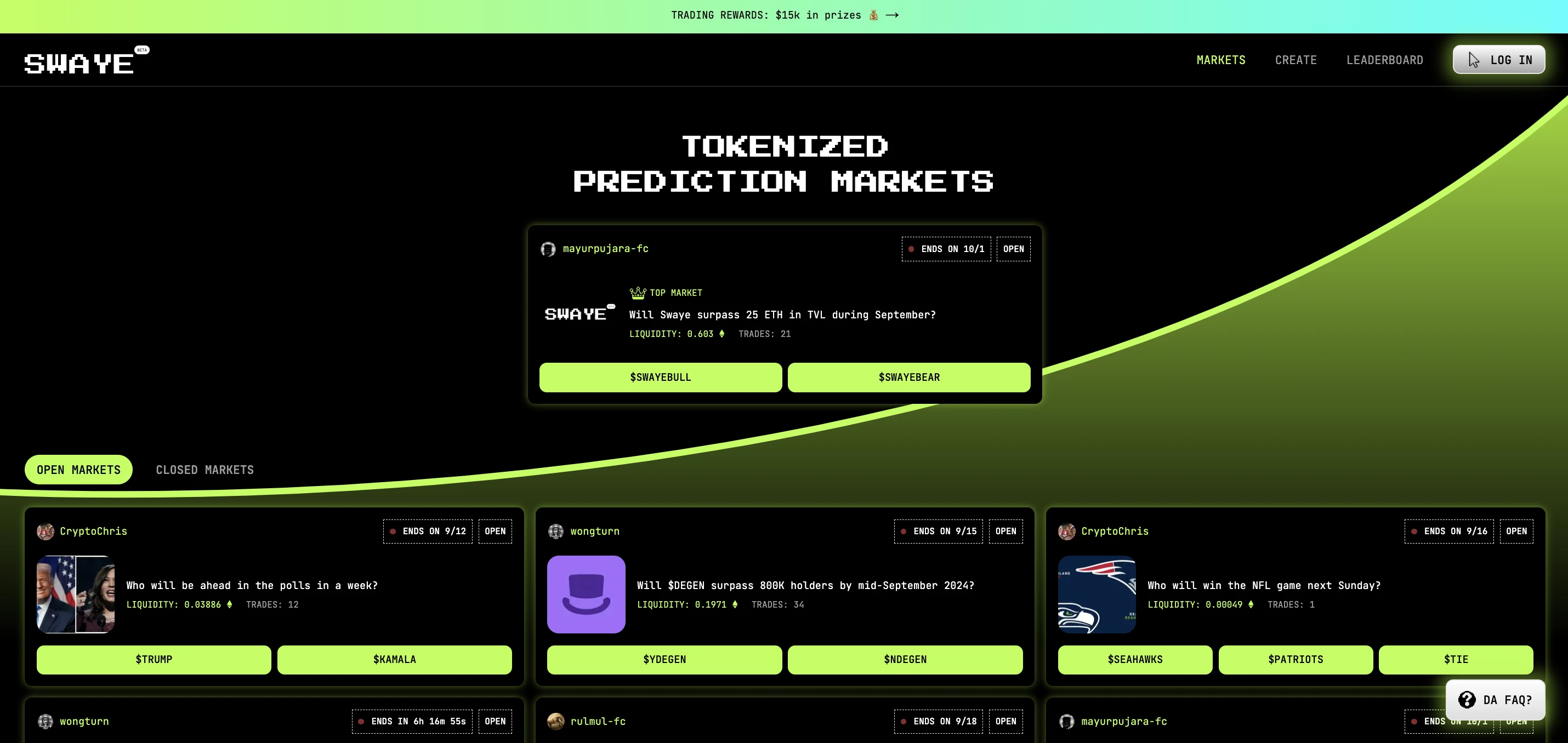

Swaye: Permissionless Market Creation and Social Integration Incentives

Although Polymarket has once again attracted great attention from the market in the year of the US election, it has many shortcomings that have been criticized, one of which is the market creation mechanism that still requires centralized review by the platform. In comparison, Swaye may be a choice that many people are more motivated to try.

On the one hand, Swaye attempts to combine the prediction market and Meme coins. Early users can not only bet on specific results, but also have more motivation to spread the word because betting activities help increase LP profits and losses. On the other hand, Swaye has also completed the integration of the Farcaster social protocol, making it easier for users to share predictions through social dynamics, thereby providing the possibility of creating viral spread.

Según el ranking interface of its official website , despite the low liquidity, the top-ranked trader still received a return of over 112%. In time, perhaps Meme coin will become an indispensable part of the prediction market.

Interfaz del sitio web oficial

Conclusion: The crypto prediction market has not yet reached its final stage, and the AI prediction market may become the next high ground

Recently, at the 2024 Korea Blockchain Week event, Ethereum co-founder Vitalik Buterin dicho that artificial intelligence and prediction market technology can speed up the generation of community notes on the social media platform X (Odaily Planet Daily Note: Community Notes is a feature of the X platform that allows the community to add context to potentially misleading posts) . Vitalik pointed out that the biggest criticism of community notes is that they dont appear fast enough, which may cause some users to be misled by inaccurate information before the notes appear, and prediction markets may be a solution to this problem.

Previously regulated prediction market platform Kalshi also recently won a CFTC lawsuit, allowing it to launch US election predictions online. Although the platform only operates in the United States and settles transactions in ordinary US dollars, this is enough to be regarded as a big positive for the prediction market.

Compared with the market size of hundreds of billions of dollars in the traditional guessing market, the total TVL of the entire prediction market makes us believe that the crypto prediction market is far from the end, and PolyMarket is not invincible. In the present and near future when AI is developing rapidly, perhaps the AI prediction market will become the next development highland of the cryptocurrency industry.

This article is sourced from the internet: Polymarket is about to issue a coin? An article reviewing the top 5 crypto prediction markets

Related: Written at the time of Trumps attack: Crypto assets are the key to the era of chaos

Original author: Sima Linwei, editor-in-chief of DeThings We are already in an era of chaos. The concept of the Chaos Era originated from Liu Cixins science fiction novel The Three-Body Problem. In the novel, the Chaos Era refers to a catastrophic era in the Three-Body civilization caused by the chaos in the movement of three stars. In recent years, this concept has been extended to the real world to describe the turmoil and uncertainty in our current society. Since the late 1970s, people have felt the golden age of a new round of high economic growth led by Chinas participation in the process of globalization. This inertia of peace and development makes it easy for contemporary people to forget the proportion of the era of chaos in the long history…