Financiamiento Express de la Semana | 19 proyectos recibieron inversión, con un monto total de financiamiento revelado de aproximadamente

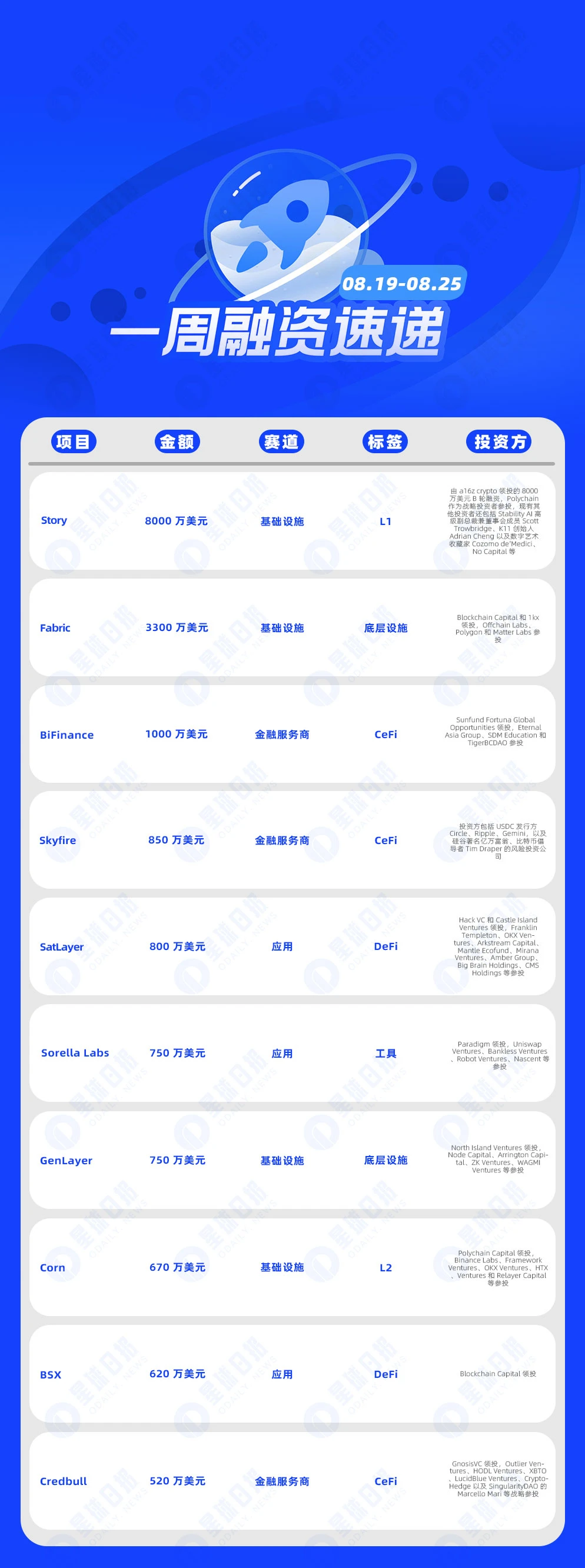

According to incomplete statistics from Odaily Planet Daily, there were 19 blockchain financing events at home and abroad announced from August 19 to August 25, which was unchanged from last weeks data (19). The total amount of financing disclosed was approximately US$193 million, which was an increase from last weeks data (US$170 million).

Last week, the project that received the most investment was Story, an intellectual property blockchain company, at $80 million; followed closely by Fabric, a company developing crypto “VPU” chips, at $33 million.

Los siguientes son eventos financieros específicos (Nota: 1. Ordenar por la cantidad de dinero anunciada; 2. Excluye eventos de recaudación de fondos y MA; 3. * indica una empresa tradicional cuyo negocio involucra blockchain):

On August 21, PIP Labs, the core contributor team of Story, an intellectual property blockchain, announced the completion of a $80 million Series B financing led by a16z crypto. Polychain participated as a strategic investor. Other existing investors include Scott Trowbridge, senior vice president and board member of Stability AI, Adrian Cheng, founder of K11, and digital art collector Cozomo deMedici, No Capital, etc. The new round of financing brings PIP Labs total financing to $140 million.

On August 19, Fabric, a company developing cryptographic VPU chips, announced the completion of a $33 million Series A financing round, led by Blockchain Capital and 1kx, with participation from Offchain Labs, Polygon and Matter Labs. The new funds will be used to build computing chips, software and encryption algorithms. The core of Fabrics roadmap is to build a new processing unit called Verifiable Processing Unit (VPU), which will be specifically used to process encryption technology.

BiFinance Completes $10 Million Series A Financing, Led by Sunfund Fortuna Global Opportunities

On August 19, digital asset trading platform BiFinance announced on X platform that it had completed a $10 million Series A financing round, led by Sunfund Fortuna Global Opportunities, with participation from Eternal Asia Group, SDM Education and TigerBCDAO. It is reported that BiFinances valuation in this round of financing reached $100 million. The new funds will be used to further connect traditional financial assets such as stocks and bonds with the Web3 ecosystem and provide asset-backed tokens (RWA/STO) to enterprises.

On August 21, Skyfire, founded by former Ripple executives, announced the completion of a $8.5 million seed round of financing to provide encrypted payment solutions for AI agents. Investors include USDC issuer Circle, Ripple, Gemini, and the venture capital firm of Tim Draper, a well-known Silicon Valley billionaire and Bitcoin advocate.

On August 21, Babylon-based Bitcoin re-staking platform SatLayer announced the completion of a $8 million Pre-Seed round of financing, led by Hack VC and Castle Island Ventures, with participation from Franklin Templeton, OKX Ventures, Arkstream Capital, Mantle Ecofund, Mirana Ventures, Amber Group, Big Brain Holdings, CMS Holdings, etc. SatLayer co-founder Luke Xie revealed that the projects initial goal was to raise $4 million, but when it began fundraising in April, the round was oversubscribed within a month.

On August 21, Sorella Labs, a crypto startup dedicated to solving Ethereums MEV problem, completed a $7.5 million seed round of financing, led by Paradigm, with participation from Uniswap Ventures, Bankless Ventures, Robot Ventures, Nascent and others.

GenLayer Completes $7.5 Million Seed Round Led by North Island Ventures

On August 21, the smart contract blockchain project GenLayer announced the completion of a $7.5 million seed round of financing, led by North Island Ventures, with participation from Node Capital, Arrington Capital, ZK Ventures, WAGMI Ventures, etc. The new funds will be used to enhance GenLayers artificial intelligence technology, thereby realizing the creation of smart contracts that can access the Internet in real time and make decisions in a decentralized environment for the first time.

Ethereum L2 network Corn completes $6.7 million financing, led by Polychain Capital

On August 20, the Ethereum L2 network Corn completed a financing of US$6.7 million, led by Polychain Capital, with participation from Binance Labs, Framework Ventures, OKX Ventures, HTX, Ventures and Relayer Capital.

Base Ecosystem DeFi Protocol BSX Completes $6.2 Million in Financing

On August 22, the Base ecosystem DeFi derivatives protocol BSX announced the completion of a $6.2 million seed and pre-seed round of financing. The seed round was $4 million, led by Blockchain Capital. The pre-seed round was completed two years ago with a fundraising amount of $2.2 million.

Polygon PoS on-chain private credit fund Credbull raises $5.2 million, led by GnosisVC

On August 22, Credbull, a compliant private credit fund based on the Polygon PoS chain, completed a financing of US$5.2 million, led by GnosisVC, with strategic participation from Outlier Ventures, HODL Ventures, XBTO, LucidBlue Ventures, CryptoHedge, and Marcello Mari of SingularityDAO.

On August 22, crypto lending platform Arch announced the completion of a $5 million seed round of financing, led by Morgan Creek Digital and Castle Island Ventures. At the same time, Galaxy provided it with $70 million in debt financing. The funds will be used to serve institutional clients and individual investors. Arch was founded in February 2022 by financial industry veterans Dhruv Patel and Himanshu Sahay to revive the crypto lending industry that has been hit by the collapse of companies such as BlockFi and Genesis.

On August 20, the Web3 social gaming ecosystem Soulbound announced the completion of a $4 million financing round, with participation from iAngels, Animoca Brands, Big Brain Holdings, NGC Ventures, Panony, Delta Blockchain Fund, and Blocklords CEO David Johansson. The new funds will be used to establish gaming partnerships, increase social interactions, and expand anchor bounties and social tasks.

On August 22, Web3 oracle service provider Stork Network completed a $4 million seed round of financing, led by Lightspeed Faction, with participation from Lattice, CMS and Wintermute. The new funds will be used to enhance its product offerings.

On August 24, Bitcoin payment company Ark Labs completed a $2.5 million Pre-seed round of financing, led by Draper Associates, with participation from Fulgur Ventures, Axiom Capital and angel investor Stephen Cole.

On August 22, Miami-based Bitcoin Lightning Network payment startup TMRW completed a $1.3 million Pre-Seed round of financing led by Maple VC and participated by angel investors including Brad Mills.

On August 23, Ducat, a Bitcoin native stablecoin project on Runes, announced on the X platform that it had completed a $1.25 million Pre-Seed round of financing, led by UTXO Management, with participation from THE CMS, Bitcoin Frontier Fund, Revelo Intel, MARIN DIGITAL VENTURES, Samara Asset Group, ₿itcoin Startup Lab, Bitflow, X+, and others.

On August 23, Web3 security and transparency platform g8keep announced the completion of a $1.25 million financing round, with participation from Robot Ventures, Base Ecosystem Fund, cygaar, devops 199fan and others. The new funds will be used to expand its security and transparency platform to address defects in token issuance and transactions, including correcting vulnerabilities exposed by users and ensuring that users are provided with a safe and reliable digital asset usage environment.

On August 22, TON ecosystem blockchain fantasy sports platform Fanton Fantasy Football announced the completion of a $1 million seed round of financing, with participation from Animoca Brands, Delphi Ventures, Kenetic Capital, Hashkey x TON Accelerator, PAKA Fund and Sign VC. The specific valuation information has not yet been disclosed.

Last Odyssey Completes Seed Round Financing, with Animoca Brands and OKX Ventures Participating

On August 20, Last Odyssey, the first 5X (explore, expand, collect, eliminate, exchange) social basic strategy game, completed its seed round with investment from well-known venture capital OKX Ventures, Animoca Brands, Coin 98 Ventures, Selini Capital and Summer Capital. Built by Everest Ventures Group, Last Odyssey will continue to improve its gameplay and focus on e-sports elements to expand the immersive Web3 gaming experience and grow its community.

This article is sourced from the internet: Financing Express of the Week | 19 projects received investment, with a total disclosed financing amount of approximately US$193 million (August 19-August 25)

Related: IOSG Ventures: Is economic security a meme?

Original source: IOSG Ventures On June 3, Solana founder Anatoly and Ethereum Foundation researcher Justin mentioned the issue of economic security in a debate organized by Bankless. Toly believed that economic security was a meme, which triggered subsequent discussions among many bilateral KOLs. The overall discussion is rather fragmented, so we will simply organize and analyze it from Tolys point of view. 1. Toly’s Logic Due to the existence of centralized staking services, the cost of acquiring 33% of nodes for attack is much less than the actual staking value. The POS chain with a very small pledge economy has never been attacked, which means that the security of the POS network is guaranteed by the operating mechanism of the distributed network. Even if an attack occurs, it can be…