Mucho más rápido que Solana y compatible con EVM, ¿puede Monad convertirse en un disruptor de capa 1?

Original author: Daniel Li, CoinVoice

In the vast universe of blockchain technology, Ethereum, as a pioneer smart contract platform, has laid a solid foundation for the entire industry. However, with the explosive growth of application demand, the technical limitations faced by Ethereum and other existing infrastructures such as Solana – especially scalability and transaction speed – have become key bottlenecks for the development of the industry. To solve these problems, Monad came into being, promising to reshape blockchain performance standards with a high throughput of up to 10,000 transactions per second. Earlier this year, Monad Labs completed a $225 million financing led by Paradigm, marking the markets high recognition of the potential of Monad technology. This funding will help Monad further build and optimize its Layer 1 blockchain, bringing revolutionary changes to the blockchain industry.

Monad: Created to solve Ethereums scaling problem

Ethereum, as a leader in the blockchain field, has an unshakable position. It is not only the core of blockchain research, decentralized applications (Dapps) and community development, but also has the highest total locked value (TVL), demonstrating its leadership in the blockchain world. Thanks to the booming development of Ethereum, the Ethereum and Ethereum Virtual Machine (EVM) developer community has become the largest community in the crypto field, giving birth to countless innovative DeFi and dApp projects.

However, with the surge in the number of projects, EVM is also facing unprecedented challenges, especially the scalability problem is becoming increasingly prominent. The single-threaded nature of EVM limits the speed of transaction processing and increases execution time. In order to meet this challenge, the industry has proposed a variety of solutions, among which sharding technology and Layer 2 expansion strategy have attracted much attention.

Sharding technology aims to split a large blockchain network into multiple smaller shards to increase storage capacity and performance. However, the implementation of this technology requires a long period of demonstration and research, and its potential cannot be realized in the short term. The Layer 2 expansion strategy is to build an additional framework on top of the main blockchain to handle transactions and smart contract execution to reduce the burden on the main chain and improve the overall network efficiency and scalability. However, as well-known Layer 2 aggregation companies such as Arbitrum, Optimism, and Starkware have once again postponed the decentralization of their sorters, the challenges faced by Layer 2 in centralization are becoming increasingly severe.

In the face of these challenges, Keone Hon, the founder of Monad, has put forward unique insights. He believes that there are certain problems with the current expansion path of Ethereum. The layered strategy of Layer 1+Layer 2 will cause the blockchain to be divided into independent execution environments, thereby destroying the composability of the chain. Therefore, building a more efficient underlying network is the most correct solution, and this is where Monad comes in.

Monad is a high-performance L1 that is fully compatible with Ethereum. It focuses on using parallel processing technology at the Layer 1 level to improve the execution efficiency of EVM. This means that Monads goal is to achieve parallel processing of transactions directly on the Ethereum main chain without relying on additional Layer 2 solutions. This approach can maximize the processing power and scalability of EVM without sacrificing security and decentralization, thereby fully unleashing the potential of the EVM ecosystem. Currently, Monad has reached the ability to process up to 10,000 transactions per second, and the project is confident that this number will increase tenfold in the next few years.

Since its founding in 2022, Monad has completed two rounds of financing, a $19 million seed round in February 2023 and a $225 million round in April 2024. So far, more than 50 investment institutions have participated in the Monad project. These investors are full of confidence in the prospects of Monad and believe that it will promote the popularity of cryptocurrencies in the next 2-3 years. Matthew Walsh, founding partner of Castle Island Ventures, regards Monad as a solid foundation for stablecoins and calls it a killer application, which is expected to continue to grow exponentially in the next few years.

Monad: Reshaping blockchain performance with underlying optimization and parallel strategies

Monad is popular mainly due to its outstanding technical advantages. It did not choose to improve scalability through layer 2 solutions, but started from the underlying basic network and improved network efficiency through parallel execution strategies. The biggest advantage of this approach is that it maintains the security and decentralization of the network, which is crucial for the future development of Monad.

In terms of performance, Monad directly competes with established layer 1 public chains such as Aptos, Sui, and Solana, especially in terms of throughput and low finality time, far exceeding many other platforms. More importantly, while ensuring high performance, Monad also achieves full compatibility with EVM, which enables Ethereum developers to easily port their applications to Monad.

With the three core advantages of decentralization, extremely high scalability and Ethereum compatibility, Monad may become a game changer in the future blockchain gaming field.

How Monads Work

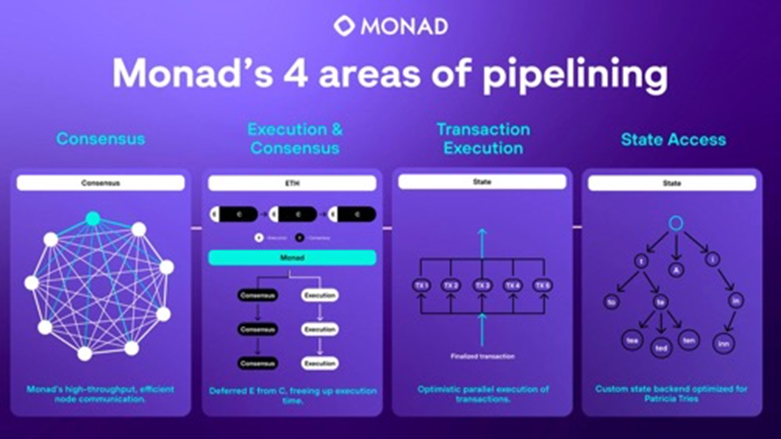

The working mechanism of Monad is mainly achieved by optimizing four core areas: MonadBFT, delayed execution, parallel execution, and MonadDB. Next, we will explore in detail how these four mechanisms work together to promote the efficient operation of Monad.

First, lets take a look at MonadBFT. This mechanism is the core of the Monad consensus algorithm, which draws on the essence of classic consensus algorithms such as Tendermint and HotStuff and makes innovative improvements. Compared with Tendermints three-phase commit process, MonadBFT adopts a more efficient 2-round leader-centric fan-out and fan-in approach. This mechanism ensures fast confirmation and finality of the blockchain while reducing communication overhead and latency. Specifically, when a leader proposes a block and distributes it to all validators, the validators respond quickly and send votes to the leaders of subsequent blocks. This pipeline consensus process not only improves efficiency, but also enhances the security and stability of the blockchain.

Next is the delayed execution mechanism. The core of this mechanism is to separate consensus from execution, so that nodes can quickly agree on the order of transactions without waiting for the execution of transactions to be completed. In traditional blockchains, consensus and execution are tightly coupled, which means that transactions must be executed first to determine the state and correctness before consensus can be reached on the block. However, this approach is inefficient because the execution process may become a bottleneck for consensus. Monad uses a delayed execution mechanism to allow nodes to determine the order of transactions in the consensus phase and execute transactions independently in the subsequent execution phase. This approach greatly improves resource utilization efficiency and enables Monad to handle more transactions.

Parallel execution is another key feature in Monad. It achieves parallelism through optimistic execution, which means that Monad optimistically processes transactions to determine dependencies. During the optimistic execution phase, Monad starts processing transactions without waiting for the previous transaction in the block to complete, while tracking the inputs and outputs of each transaction. This approach can reveal the dependencies between transactions and enable efficient re-execution. Through the parallel execution mechanism, Monad is able to process multiple transactions at the same time, further improving transaction throughput. In addition, Monad also empirically determines the dependencies of each transaction, which effectively shortens the need for complex scheduling algorithms and reduces the complexity and overhead of the system.

Finally, lets discuss MonadDB. Traditional blockchains such as Ethereum use Merkle Patricia trees to store their state so that data can be retrieved from the tree efficiently and tamper-proof. However, when this data is stored locally, traditional key-value storage databases such as LevelDB or RocksDB are usually used. These databases do not understand the tree structure of MPT and therefore cannot support Monads parallel execution requirements. To solve this problem, Monad launched its own database, MonadDB. The database is optimized to be natively compatible with the Patricia Trie data structure and can support Monads parallel execution and asynchronous I/O operations. By leveraging the latest advances in asynchronous I/O, MonadDb avoids bottlenecks that may occur when the system waits for one transaction to complete before moving on to the next transaction.

Monad has only been established for two years. Although the time is relatively short, it is undeniable that Monad is a blockchain with great long-term potential. Although the Monad mainnet has not been launched, the Devnet internal testnet has reached 10,000 TPS, which is a very high starting point. According to the projects plan, Monad can expand to 100,000 TPS in the next few years. If this expectation can be realized, then Monad will undoubtedly become a disruptor of the entire blockchain industry, and its representative parallel execution and superscalar pipeline framework will also become the mainstream development direction of public chains in the future.

Monad: Inventory of hot ecological projects

Monad Labs, the developer of the Monad blockchain, raised $225 million in a Series A round in April, led by heavyweight firm Paradigm, at a reported valuation of $3 billion. Monad has also become the largest parallel EVM public chain currently integrated, and compared to other EVM-compatible public chains such as BSC, Polygon, and Avalanche, Monads throughput of 10,000 transactions per second (tps) has achieved a discontinuity.

Although the Monad mainnet has not yet been officially launched, its strong technical strength and broad market prospects have attracted the favor of many developers. Currently, more than 80 projects have been deployed on Monad, and it is expected that when the mainnet is launched, another 150 projects will choose to build on this platform. This prosperous ecological development trend fully demonstrates the potential and industry influence of Monad. The following are several Monad ecological projects worth paying attention to.

aPriori

aPriori is a liquidity staking platform in the Monad ecosystem, focusing on Miner Extractable Value (MEV). It aims to provide users with efficient staking solutions while maintaining the liquidity of assets, allowing users to flexibly utilize their assets while participating in staking.

Financiación

aPriori successfully completed a seed round of financing of $8 million in 2024, led by the well-known investment institution Pantera Capital and supported by Binance Labs. This financing will provide strong financial support for its technology development and market promotion.

Core Features

Liquidity staking: Users can stake their crypto assets and obtain liquidity tokens, which can be used in other DeFi protocols to improve the efficiency of asset use.

MEV Optimization: Optimize transaction order through smart contracts, maximize user benefits, and ensure that users get the best returns when participating in the market.

High-performance support: Leveraging the high throughput of the Monad network, it supports up to 10,000 transactions per second, ensuring fast processing and efficient execution of liquidity pledges.

Kintsu

Kintsu is a liquidity staking protocol in the Monad ecosystem, which aims to provide users with a flexible staking experience. It allows users to staking assets while still being able to use them flexibly, meeting users demand for liquidity.

Financiación

Kintsu successfully completed a $4 million seed round on July 25, 2024. The round was led by Castle Island Ventures, with participation from other notable investors including Brevan Howard Digital, CMT Digital, Spartan Group, and others.

Core Features

Liquidity staking: After users stake their assets, they can obtain liquidity tokens, which can be used in other DeFi applications to improve the liquidity of assets.

Decentralized validator mechanism: supports validators to join without permission, enhances the decentralization and security of the network, and ensures the safety of user assets.

Composability: Kintsu鈥檚 Liquid Staking Token (LST) can be easily integrated with other DeFi applications to create more income opportunities for users.

Kuru

Kuru is a decentralized order book exchange (CLOB) in the Monad ecosystem, which aims to provide users with a single platform to find, research and trade spot assets on the chain. Kurus design concept is to provide better capital efficiency and liquidity through an efficient order book mechanism, and to enhance the users trading experience by leveraging the high throughput and fast block time of the Monad network.

Financing scale

Kuru completed a $2 million seed round on July 25, 2024. The round was led by Electric Capital, with participation from other investors including Brevan Howard Digital, CMS Holdings, Breed VC, and angel investors such as Monad CEO Keone Hon.

Core Features

Decentralized transactions: Kuru allows users to conduct transactions in a decentralized environment, ensuring the transparency and security of transactions and reducing the users trust cost.

Diversified financial products: Provide a variety of financial products including lending, liquidity mining and insurance to help users optimize asset allocation and achieve higher returns on investment.

Monad Pad

Monad Pad is a Monad-based token and NFT launch platform. Monad Pad supports project owners or developers to launch early fundraising for tokens or NFTs in the form of pre-sales or public sales. It provides a convenient fundraising channel for emerging projects and helps project owners obtain the required financial support.

Financiación

Monad Pad completed a $945,000 seed round of financing in July 2024, with participating institutions including CMS and Sneaky Ventures, providing financial support for its subsequent development.

Core Features

Token and NFT issuance: Support project parties in early fundraising for tokens and NFTs, lowering the threshold for project launch.

Original NFT Series: An NFT series called Purple Frens was released, and holders can receive a share of the platforms revenue, enhancing user participation and profit potential.

This article is sourced from the internet: Much faster than Solana and compatible with EVM, can Monad become a layer 1 disruptor?

Related: Taking stock of Harris potential running mates: What are their stances on cryptocurrency?

Original article by Sander Lutz, Decrypt Original translation: Alex Liu, Foresight News Overview Kamala Harris’s choice of running mate may hint at how she plans to govern if elected, and the leading contenders for the office have shown varying degrees of support or caution toward cryptocurrencies. Some contenders, like Josh Shapiro and Andy Beshear, have been actively involved in or supportive of cryptocurrency-related activities at the state level, while others, like Roy Cooper, have taken a more cautious approach. Other leading candidates, such as Gretchen Whitmer and Mark Kelly, have less clear crypto stances, but have political allies who have supported pro-crypto legislation or have otherwise signaled a potential openness to the industry. Kamala Harris’ unlikely rise to the Democratic presidential nomination has flipped the script on how the November…