Informe de observación del mercado XEX: Ha llegado el momento de que la Fed ajuste su política

Bitcoin rallied immediately after his speech at the Jackson Hole Fed conference.

After a long wait, it looks certain that the US central bank will cut interest rates in September after Jerome Powell said the “time has come” to ease monetary policy.

“I am increasingly confident that inflation will continue to rise back to 2%,” Powell said in a keynote speech at the Kansas City Fed’s Jackson Hole symposium. He added: “The labor market has cooled substantially from its prior overheating. We neither seek nor welcome a further cooling of labor market conditions.”

Powell added: Now is the time for a policy adjustment. The way forward is clear, and the timing and pace of rate cuts will depend on incoming data, the changing outlook, and the balance of risks.

Although the market fully expects Powell to hint at a rate cut at the September Fed meeting, the tone of his speech may be slightly more dovish than expected. In the minutes after Powells speech, Bitcoin (BTC) rose more than 1% to $61,900. As of now, Bitcoin (BTC) has surpassed $65,000

After years of keeping the Fed’s policy rate close to zero, the U.S. central bank began a long series of rate hikes in early 2022, culminating in a hike in the federal funds rate to a range of 5.25%-5.50% in 2023. Since then, the Fed has been waiting for clear signs of a meaningful slowdown in inflation toward its 2% target before starting to cut rates. That day has certainly arrived.

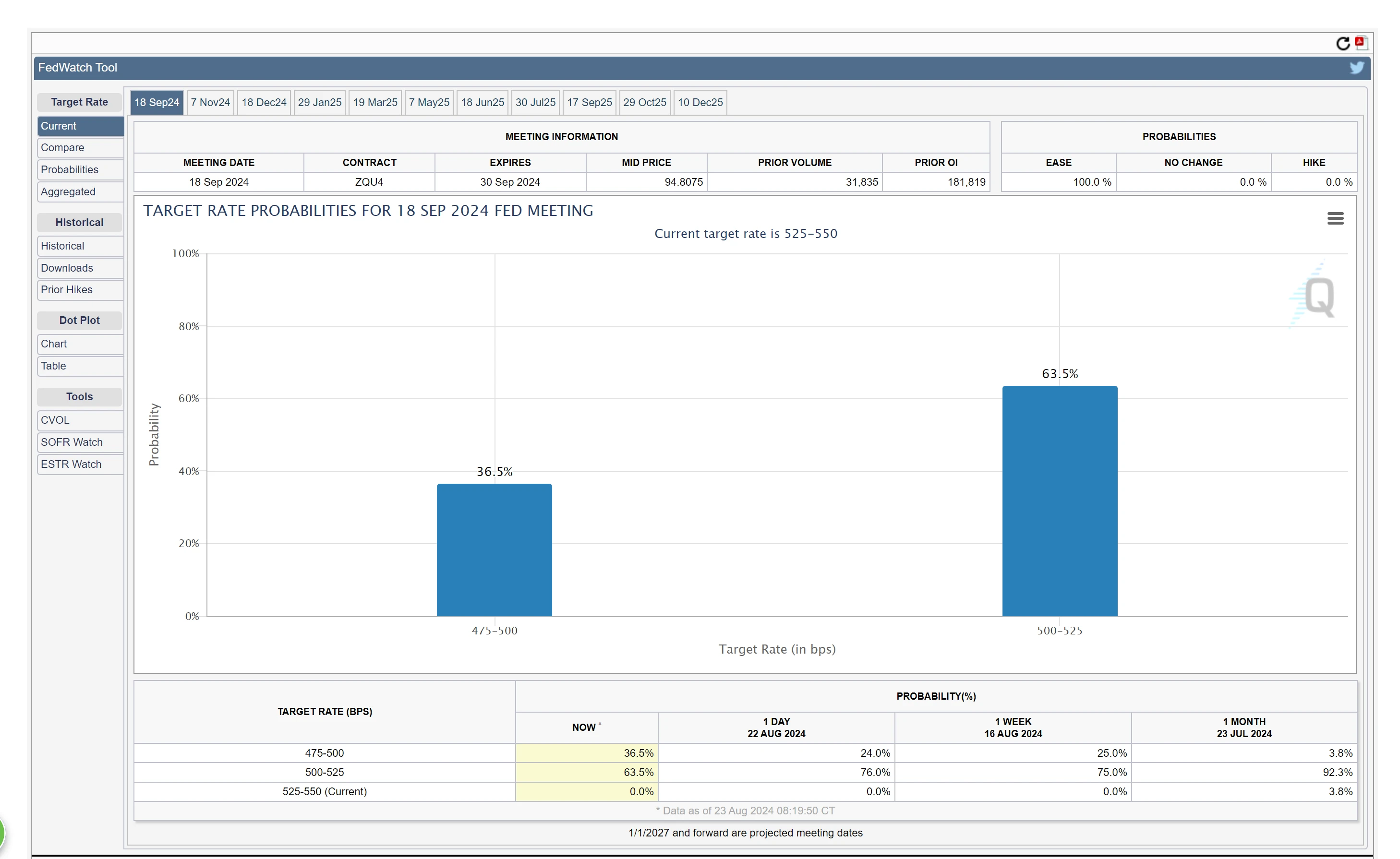

The question then becomes whether the Fed will cut the federal funds rate by 25 or 50 basis points at its mid-September meeting. The market continues to favor a 25 basis point cut, but the probability of a 50 basis point cut has risen from 24% a day ago to 32.5% now, according to CME FedWatch. There are a number of key economic reports between now and the September decision – including August employment and inflation data – that should be key to the Feds final decision.

Lower real interest rates tend to weigh on the value of the dollar and could support competing assets like gold and Bitcoin, said Zach Pandl, head of research at Grayscale Investments. Federal Reserve rate cuts, improving U.S. political sentiment toward cryptocurrencies, and net inflows into U.S. cryptocurrency ETFs should support Bitcoins price returning to all-time highs in the coming months.

About X Exchange

X Exchange is the worlds first Web2.5 intelligent digital asset trading platform. At X Exchange, we are committed to providing users with a safer, more efficient and more convenient digital asset trading experience through intelligent technology and Web2.5.

X Academy covers the basic operations and precautions before trading blockchain projects. We meet the needs of blockchain beginners, enthusiasts, practitioners, investors and any type of readers. Content types include introductions to blockchain and digital currency, entry-level learning articles, purchase operation procedures, how to distinguish good and bad projects, basic knowledge of spot contracts, smart trading, etc.

This article is sourced from the internet: XEX Market Observation Report: The time has come for the Fed to adjust its policy

Related: Avail DA mainnet is officially launched, and AVAIL tokens will be launched simultaneously

Avail, a modular project dedicated to integrating all Web3 users and developers through a unification layer, announced today the launch of the Avail DA mainnet and the AVAIL token. The launch of Avail DA is the first step in Avails vision to provide developers with the necessary tools to enhance blockchain scalability, improve liquidity, and provide seamless usability across different blockchain ecosystems. Avail DA is a modular blockchain solution designed to optimize data availability (DA) services for highly scalable and customizable Rollups. Avail DA is the only chain-agnostic DA layer that combines KZG commitments and data availability sampling (DAS). This is a major milestone in the history of blockchain development, allowing Rollups to immediately enjoy the features and benefits of the Ethereum danksharding roadmap. Avails light client uses proof of…