Columna de volatilidad de SignalPlus (20240820): ¡BTC! ¡BTC!

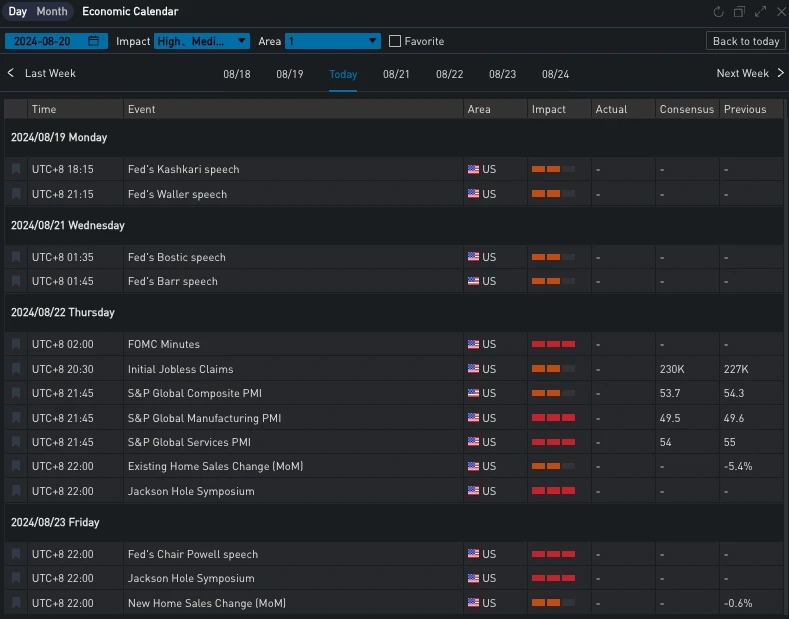

According to the New York Feds July survey on labor market expectations, the proportion of respondents who are worried about losing their jobs in the next four months has increased from 3.9% last year to 4.4%, the proportion of people who expect to change jobs has increased to 11.6%, and the proportion of workers who have been looking for jobs in the past four weeks has increased to 28.4%… A series of indicators in the report have shown cracks in the labor market! This is undoubtedly a worrying phenomenon. Although the number of people applying for unemployment benefits is still relatively low and last weeks retail data performed well, economists continue to issue warnings, pointing out that when the economy is at a turning point, the slowdown in the labor market tends to be relatively early, and the economic growth data cools down later. The focus of the market this week is on Federal Reserve Chairman Powell, who will face a completely different dilemma at the Jackson Hole meeting than the previous year. Considering the recent reassuring inflation data, Powell may remind everyone to pay more attention to employment issues than predicting how much interest rates will be cut in September. The Federal Reserve will receive a revised job growth data on Wednesday, which may show that job growth from last year to the beginning of this year is weaker than before. In addition, the non-farm data at the beginning of next month will inevitably be the focus of attention in determining market sentiment and trends.

Source: Economic Calendar

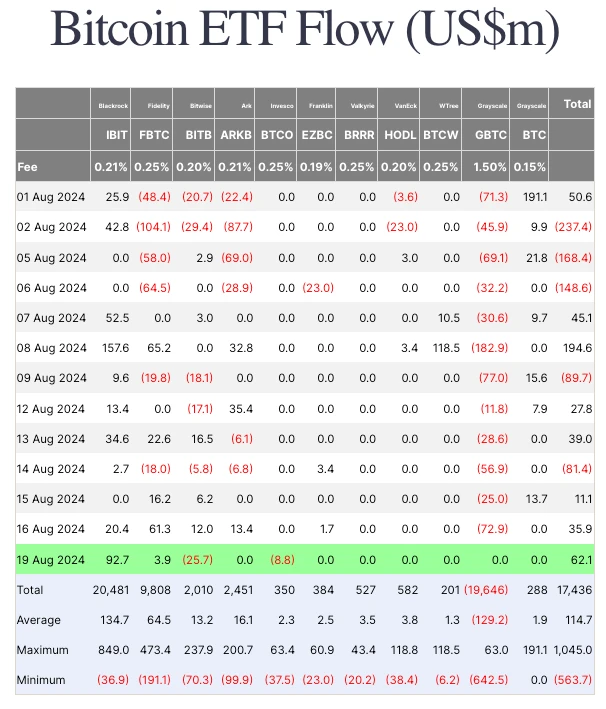

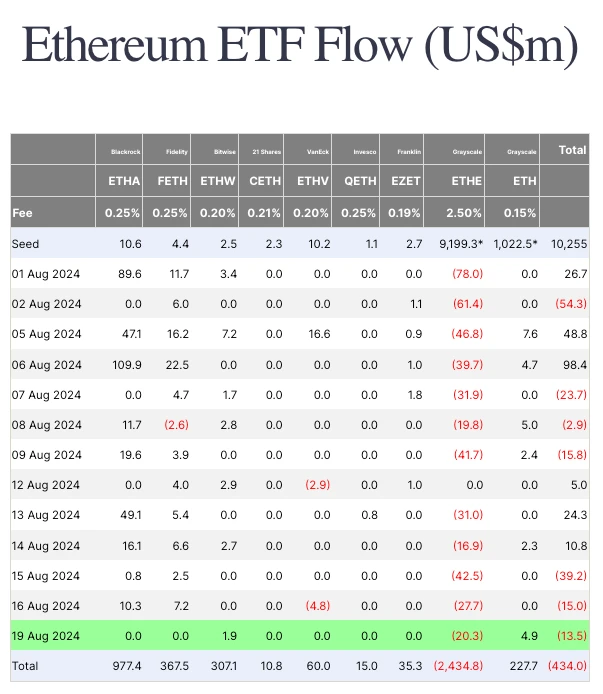

Back to the digital currency, the price of the currency has been rising from the bottom in the past 24 hours. ETH completed delivery at 2674.87 (+ 2.2%), recovering all the lost ground yesterday. BTC is more favored by the market, breaking through the pivot point of 60,000 US dollars and challenging the 61,000 mark, closing at 60901.71, with a daily increase of up to + 3.95%. In addition to the comparison of currency prices, we can see that in the past few days, BTC ETF has continued to have positive capital inflows, while ETH is still losing funds under the shadow of Grayscale ETHEs selling pressure.

Fuente: Inversores de Farside

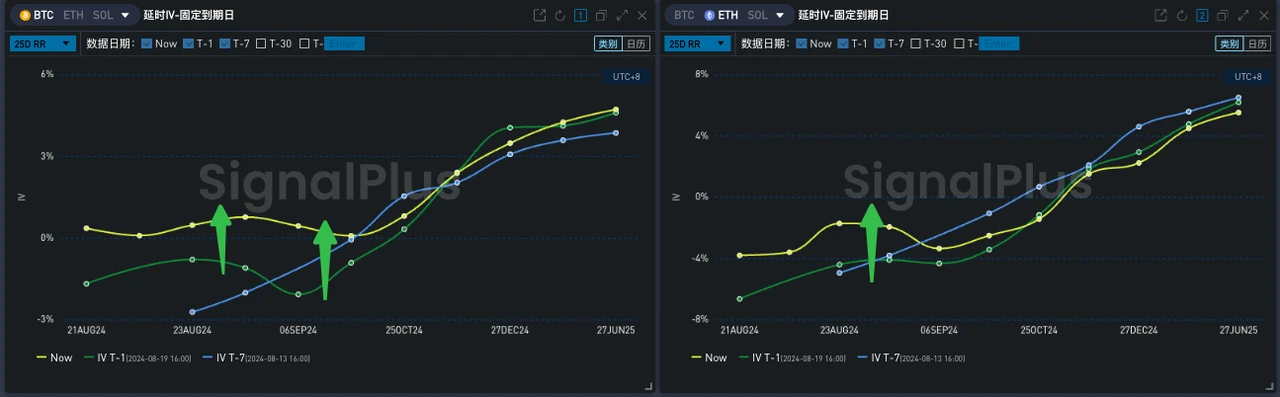

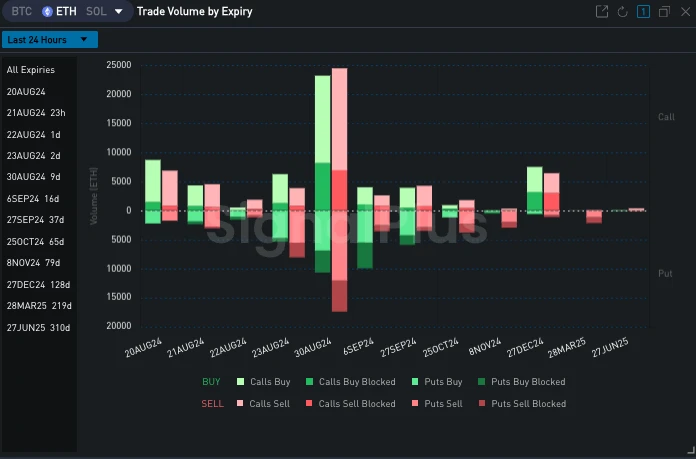

Such market sentiment is also reflected in the options market. From the changes in Vol Skew, we can see that the RR at the front end of BTC has risen sharply back to the positive range, while the curve at the front end of ETH is still tilted towards put options.

Source: SignalPlus, Vol Skew

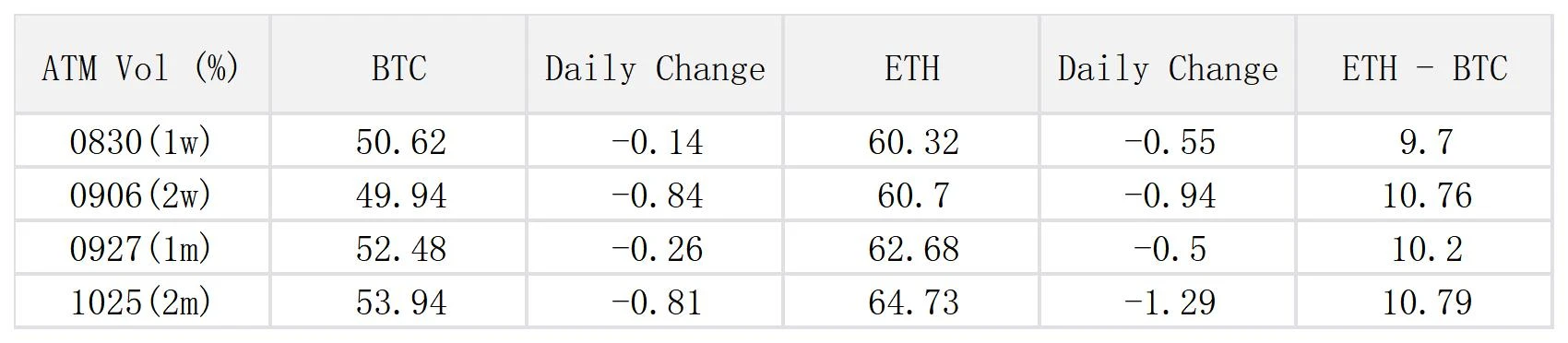

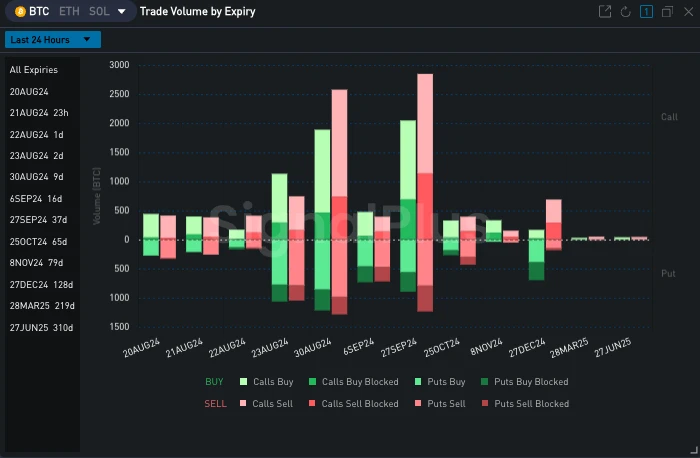

From the overall level of implied volatility, the price increase has led to a slight decline in IV over the past day. BTCs intraday Realized Vol of ~48% is basically the same as the front-end IV, and ETHs RV is about 49%, which is slightly lower than the front-end IV by about 5%-7%. From the transaction, we can see that the sharp rise in BTC price and the return of Skew have attracted traders to sell call options, represented by 29 SEP-70000-C. In the past 24 hours, Deribit sold 800 contracts in bulk, and 938.8 contracts were sold on the option chain, making 25 dRR form a local low on this expiration date; at the same time, 30 aug also showed obvious Sell Risky Flow, with most transactions concentrated on selling 64,000 67,000 Calls vs buying 55,000 Puts.

Source: Deribit (as of 20 AUG 16: 00 UTC+ 8)

Fuente: SignalPlus

Data Source: SignalPlus, Deribit, BTC ETH overall transaction distribution

Puede utilizar la función de ventanilla de negociación de SignalPlus en t.signalplus.com para obtener más información sobre criptomonedas en tiempo real. Si desea recibir nuestras actualizaciones de inmediato, siga nuestra cuenta de Twitter @SignalPlusCN o únase a nuestro grupo de WeChat (agregue el asistente de WeChat: SignalPlus 123), grupo de Telegram y comunidad de Discord para comunicarse e interactuar con más amigos. Sitio web oficial de SignalPlus: https://www.signalplus.com

This article is sourced from the internet: SignalPlus Volatility Column (20240820): BTC! BTC!

Titulares La probabilidad de que la Reserva Federal recorte las tasas de interés en 25 puntos básicos en septiembre es de 89,6%. Los datos de CME Fed Watch muestran: La probabilidad de que la Reserva Federal mantenga las tasas de interés sin cambios en agosto es de 93,3%, y la probabilidad de un recorte de tasas de 25 puntos básicos es de 6,7%. La probabilidad de que la Reserva Federal mantenga las tasas de interés sin cambios para septiembre es de 0%, la probabilidad de un recorte de tasas acumulado de 25 puntos básicos es de 89,6%, la probabilidad de un recorte de tasas acumulado de 50 puntos básicos es de 10,2%, y la probabilidad de un recorte de tasas acumulado de 75 puntos básicos es de 0,3%. El volumen de operaciones del ETF spot de Ethereum alcanza los $951 millones en el segundo día En el segundo día de operaciones en el mercado estadounidense, el volumen de operaciones acumulado de los ETF de Ethereum…