Financiamiento Express de la Semana | 19 proyectos recibieron inversión, con un monto total de financiamiento revelado de aproximadamente

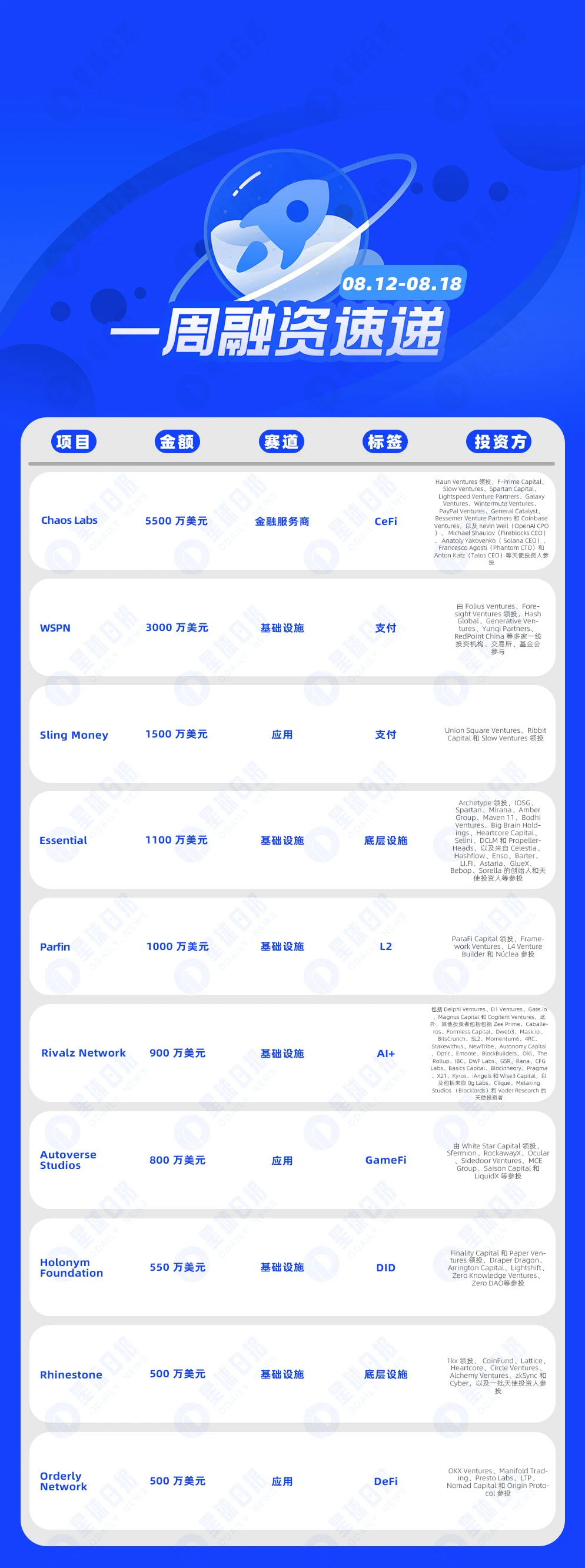

According to incomplete statistics from Odaily Planet Daily, there were 19 blockchain financing events at home and abroad announced from August 12 to August 18, an increase from last weeks data (14). The total amount of financing disclosed was approximately US$170 million, a significant increase from last weeks data (US$61.9 million).

Last week, the project that received the most investment was financial services provider Chaos Labs ($55 million); followed closely by stablecoin 2.0 infrastructure company WSPN ($30 million).

Los siguientes son eventos financieros específicos (Nota: 1. Ordenar por la cantidad de dinero anunciada; 2. Excluye eventos de recaudación de fondos y MA; 3. * indica una empresa tradicional cuyo negocio involucra blockchain):

Chaos Labs Completes $55 Million Series A Funding, Led by Haun Ventures

On August 15, Chaos Labs announced the completion of a $55 million Series A financing round, led by Haun Ventures, with well-known new investors including F-Prime Capital, Slow Ventures, Spartan Capital, etc. They joined Lightspeed Venture Partners, Galaxy Ventures, Wintermute Ventures, PayPal Ventures, General Catalyst, Bessemer Venture Partners and Coinbase Ventures, as well as angel investors such as Kevin Weil (OpenAI CPO), Michael Shaulov (Fireblocks CEO), Anatoly Yakovenko (Solana CEO), Francesco Agosti (Phantom CTO) and Anton Katz (Talos CEO). The new funds will accelerate its product development and expand its cutting-edge risk management platform.

On August 16, the stablecoin 2.0 infrastructure company WSPN completed a $30 million seed round of financing. This round of financing was led by Folius Ventures and Foresight Ventures, and participated by many first-line investment institutions, exchanges, and foundations such as Hash Global, Generative Ventures, Yunqi Partners, and RedPoint China.

Stablecoin payment app Sling Money completes $15 million Series A financing, led by USV and others

On August 15, the stablecoin payment application Sling Money completed a $15 million Series A financing, led by Union Square Ventures, Ribbit Capital and Slow Ventures. Previously, Sling Money also completed a $5 million seed round of financing, led by Ribbit Capital and participated by Slow Ventures. Transfers on Sling Money support the use of Pax Dollar (USDP), which is a dollar-backed stablecoin issued by Paxos Trust Company.

Essential Completes $11 Million Series A Funding Led by Archetype and Launches Pre-Alpha Devnet

On August 13, the intent-based blockchain infrastructure project Essential announced the completion of a US$11 million Series A financing round, led by Archetype, with participation from IOSG, Spartan, Mirana, Amber Group, Maven 11, Bodhi Ventures, Big Brain Holdings, Heartcore Capital, Selini, DCLM and PropellerHeads, as well as founders and angel investors from Celestia, Hashflow, Enso, Barter, LI.FI, Astaria, GlueX, Bebop, Sorella and others.

On August 14, Ethereum Layer 2 development company Parfin completed a $10 million Series A financing, led by ParaFi Capital, with participation from Framework Ventures, L 4 Venture Builder and N煤clea. It is reported that the company will continue with its second Series A financing, with a total fundraising amount expected to reach $16 million. The new funds will be used to develop its Rayls network and expand its global business.

Decentralized AI infrastructure project Rivalz Network raises $9 million in recent funding rounds

On August 14, the decentralized AI infrastructure project Rivalz Network raised $9 million in recent rounds of financing. Major investors include Delphi Ventures, D 1 Ventures, Gate.io, Magnus Capital and Cogitent Ventures. In addition, other investors include Zee Prime, Caballeros, Formless Capital, D web3, Mask.io, BitsCrunch, S L2, Momentum 6, 4 RC, Stakewithus, NewTribe, Autonomy Capital, Optic, Emoote, BlockBuilders, OIG, The Rollup, IBC, DWF Labs, GSR, Rana, CFG Labs, Basics Capital, Blocktheory, Pragma, X 21, Kyros, iAngels and Wise 3 Capital, as well as angel investors from 0 g Labs, Clique, Metaking Studios (Blocklords) and Vader Research. According to reports, Rivalz is solving a key bottleneck in AI development – the need for AI-ready, verified, validated and private data. Rivalzs DePIN dual-chain infrastructure is built on Dymension and Arbitrum and will completely change the AI landscape.

Web3 game development studio Autoverse Studios completes $8 million round led by White Star Capital

On August 14, Web3 game development studio Autoverse Studios announced that it had completed an $8 million round of financing led by White Star Capital, with participation from Sfermion, RockawayX, Ocular, Sidedoor Ventures, MCE Group, Saison Capital and LiquidX.

The new funds will be used to develop its social racing Web3 game Auto Legends, with the goal of building a game that brings Web3 ownership and trading mechanisms to traditional players and attract more Web2 users.

On August 17, Holonym Foundation, a decentralized network digital identity security development organization, announced the completion of a $5.5 million seed round of financing, led by Finality Capital and Paper Ventures, with participation from Draper Dragon, Arrington Capital, Lightshift, Zero Knowledge Ventures, Zero DAO and others.

The Holonym Foundation is building critical middleware and applications that advance every citizen鈥檚 digital identity by empowering Web3 users to own, manage, and selectively share their data with privacy and security guarantees.

On August 14, Rhinestone, a modular smart account infrastructure developer, announced the completion of a $5 million seed round of financing, led by 1kx, with participation from CoinFund, Lattice, Heartcore, Circle Ventures, Alchemy Ventures, zkSync and Cyber, as well as a group of angel investors. Rhinestone builds infrastructure for smart accounts, and the company鈥檚 total financing has reached $5.42 million to date.

On August 16, Orderly Network announced the completion of a US$5 million strategic round of financing, with participation from OKX Ventures, Manifold Trading, Presto Labs, LTP, Nomad Capital and Origin Protocol. The new funds will be used to develop new products and enhance its on-chain liquidity.

KIP Protocol Completes $5 Million Private Funding Round Led by Animoca Ventures and Tribe Capital

On August 16, according to official news, KIP Protocol, a decentralized underlying protocol focusing on AI, announced the completion of a $5 million private equity financing, led by Animoca Ventures and Tribe Capital, with participation from GBV Capital, DWF Ventures, Morningstar Ventures, etc. As of now, KIP Protocol has raised a total of $10 million. This round of financing will further promote the development of KIP Protocols decentralized AI by creating a secure decentralized AI solution.

On August 12, Ion Protocol, a liquidity protocol for pledged and re-pledged assets, completed a $4.8 million financing round, with participation from Gumi Capital Cryptos, Robot Ventures, BanklessVC, NGC Ventures, Finality Capital and SevenX Ventures. As of now, its total financing amount has reached $7 million. The new funds will be used to support and develop its native yield platform called Nucleus.

Crunch Lab Completes $3.5 Million Seed Round, Led by Multicoin Capital

On August 15, Crunch Lab announced the completion of a $3.5 million seed round of financing, led by crypto investment company Multicoin Capital, with participation from Factor Capital, Fabric VC and Elixir Capital. As of now, the companys total financing amount has reached $5.3 million.

Investment platform BasedVC completes $2 million seed round with $15 million post-money valuation

On August 12, decentralized proprietary investment platform BasedVC completed a $2 million seed round of financing with a post-investment valuation of $15 million. Neo Tokyo, Kongz Capital, and angel investors such as Mario Nawfal, Crypto Banter, Ashcrypto, and Kmanu participated in the investment.

Goldilocks DAO Completes $1.5 Million Strategic Round of Financing, Led by Shima Capital and Hack VC

On August 16, Berachain ecosystem Goldilocks DAO announced the completion of a US$1.5 million strategic round of financing. This round of financing was jointly led by Shima Capital and Hack VC, and participated by Public Works, Iberia Capital, Rana DAO, Atka Incubator and several angel investors.

Ethereum L2 network Reddio completes seed round financing, led by Paradigm and Arena

On August 13, Ethereum Layer 2 network Reddio announced the completion of its seed round of financing, led by Paradigm and Arena Holdings. It is reported that the project has launched the pledge and task system. The project was founded by Neil, who graduated from Stanford Business School and the National University of Singapore. He was the No. 003 employee of Twilio Asia Pacific, the general manager of PingCAP Eurasia, and a lecturer at Nanyang Technological University. He is an early evangelist of zk expansion technology and has provided open source expansion solutions for Starknet and others.

Binance Labs and others invest in decentralized AI blockchain platform Sahara AI

On August 14, the decentralized AI blockchain platform Sahara AI announced the completion of a new round of financing, led by Binance Labs, Pantera Capital and Polychain Capital, with participation from Samsung, Matrix Partners, Siam Commercial Bank, dao 5, Alumni Ventures, Geekcartel, Nomad Capital, Mirana Ventures and others. The new funds will be used to further expand its global team, improve the performance of its AI blockchain, and accelerate the construction of its developer ecosystem.

It is reported that this is Sahara AIs Series A financing, with a total financing amount of approximately US$43 million.

Web3 gaming platform GAMEE completes new round of financing, TON Ventures participates

On August 16, Web3 gaming platform and Animoca Brands subsidiary GAMEE announced the completion of a new round of financing, with TON Ventures participating. The new funds will support GAMEEs WATCoin ecosystem (including the WatBird Mini App project). It is reported that GAMEE will further integrate TON-based digital assets (such as TON-supported tokens and NFTs) into GAMEEs Telegram Mini App to enhance user engagement.

On August 16, SDM Education Group, a Hong Kong-listed company, issued a voluntary announcement, announcing that it had signed a Series A strategic investment agreement with digital asset trading platform BiFinance. The two parties will carry out long-term cooperation in the fields of blockchain technology, real-world assets, digital assets, etc.

This article is sourced from the internet: Financing Express of the Week | 19 projects received investment, with a total disclosed financing amount of approximately US$170 million (August 12-August 18)

Original | Odaily Planet Daily ( @OdailyChina ) Author|Nan Zhi ( @Assassin_Malvo ) Last night, the Ethereum spot ETF began its first day of trading after listing. The cumulative trading volume of 9 ETFs on the first day exceeded US$1 billion, which is about 23% of the US$4.6 billion trading volume of the Bitcoin spot ETF on the first day of listing in January this year, with a net inflow of US$106 million. What are the specific data of Ethereum spot ETF and whether it can follow the trend of Bitcoin spot ETF ? Odaily will summarize the data and market views in this article for analysis. Ethereum Spot ETF Data According to data released by Bloomberg ETF analyst Eric Balchunas, the first-day trading volume of the nine ETFs was…